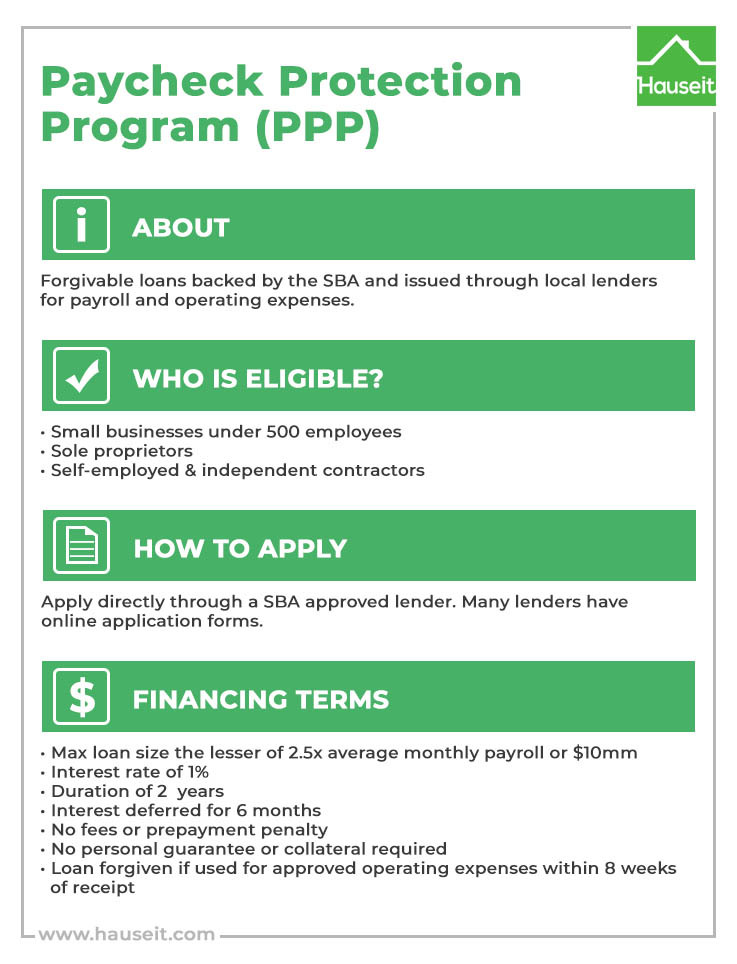

When the CARES act was signed by President Trump on March 27th, 2020, we were hopeful that condo and co-op corporations would be able to take advantage of the PPP Loan Program to ensure that all building management staff continued to get paid.

Many management companies even went ahead and started filling out loan applications and asking for board signatures. However, after a long week of consultations with banks and attorneys, we’ve been advised that cooperatives and condominiums do not qualify for the PPP loan.

The SBA changed the application the night before the process opened, and the following amended language was added to the program which we believe precludes cooperative and condominium corporations from applying for the PPP Loan Program:

-

“Businesses that are primarily engaged in owning or purchasing real estate and leasing it for any purpose are not eligible”

-

“Apartment buildings and mobile home parks are not eligible”

-

“Residential facilities that do not provide healthcare and/or medical services are not eligible.”

Several prominent legal firms in NYC and several banks have officially stated that co-ops and condos are not eligible for the program.

Some banks have now said that they will not even process PPP Loan Program applications from condos and co-ops due to ineligibility per the amended qualifications of the program.

Therefore, unless the law is amended or the SBA changes its terms for eligibility, condos and co-op boards should not expect their buildings to qualify for the PPP Loan Program.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Yes, though we strongly advise against doing so until there is more clarity from the SBA or Congress.

Based on the Interim Final Rules and the new application form the SBA released on April 2, 2020, there is a conflict between what the SBA says and what the CARES Act says.

For example, the SBA states in the Interim Final Rules that in order to be eligible for a PPP loan, the applicant must be “a small business concern as defined in section 3 of the Small Business Act (15 USC 632), and subject to SBA’s affiliation rules under 13 CFR 121.301(f) unless specifically waived in the Act.”

Meanwhile, the CARES Act itself states that “in addition to small business concerns, any business concern … shall be eligible …”

If you dig deeper, the SBA discusses ineligible borrowers in the SBA’s Standard Operating Procedure 50 10, Subpart B, Chapter 2. On page 105 the SBA states that “apartment buildings and mobile home parks are not eligible.”

Is the SBA going too far against the intent of the CARES Act?

Several prominent law firms that have said that co-op and condo boards who are comfortable executing the application and related certification can do so if they wish, after consulting individual counsel and the building’s accountant.

Their argument is that the new SBA rules go too far and contradict the CARES Act, which expressly seeks to expand eligibility beyond traditional SBA eligibility requirements.

In the absence of further clarification from Congress or the SBA, we should respect the SBA’s rule making authority.

What are the consequences of applying anyway?

Board members will have to sign the loan application, and the new loan application requires the signer to certify that:

“The Applicant is eligible to receive a loan under the rules in effect at the time this application is submitted that have been issued by the Small Business Administration (SBA) implementing the Paycheck Protection Program under Division A, Title I of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) (the Paycheck Protection Program Rule).”

As a result, any board member who signs the application could be subjected to criminal penalties for false certification of a federal loan application, and would not be protected under a typical directors and officers liability insurance policy.

No, the Interim Final Rule released by the SBA references 13 CFR 120.110 which states that “passive businesses owned by developers and landlords that do not actively use or occupy the assets acquired or improved with the loan proceeds” are ineligible for certain SBA loans.

Furthermore, additional SBA guidance from Standard Operating Procedure 50 10, Subpart B, Chapter 2 which we referenced earlier provides further clarification on ineligible businesses:

-

Businesses that are primarily engaged in owning or purchasing real estate and leasing it for any purpose

-

Apartment buildings

-

Residential facilities that do not provide healthcare and/or medical services

As a result, landlords and real estate investors appear to be excluded from the PPP Loan Program and possibly other SBA programs as well.