Buyers of HDFC co-ops are not subject to an asset limit. There are no net worth restrictions for purchasers of HDFC apartments in NYC. However, prospective HDFC purchasers are subject to income restrictions at the time of purchase. HDFC income limits vary by building.

NYC considered implementing an asset limit for HDFC purchasers as part of a regulatory overhaul in 2017, but the plan was ultimately withdrawn.

Although the goal of the HDFC program is to promote affordable housing, it’s become increasingly common for purchasers of HDFCs to be wealthy. As we’ll explain, high asset, low income purchasers are frequently the only viable prospects who can make the math work for HDFCs.

If an HDFC’s income limit is too low relative to the market value of an apartment, it’s effectively impossible for a prospective purchaser to obtain financing without making a very large down payment.

This is because lenders typically underwrite loans based on a maximum debt-to-income (DTI) ratio of 43%.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

As an example, let’s say that an HDFC you’re considering has an income limit of $50,160 for a one-person household. This works out to $4,180/month.

Only 43% of the purchaser’s $4,180 monthly income can go towards the monthly payment, which includes both the mortgage and co-op monthly maintenance payment.

This works out to $1,797.50. Reducing this by $579 to account for monthly maintenance leaves you with a maximum of $1,297.50 to go towards your mortgage payment. Your maximum loan size is roughly $200,000.

If the purchase price in this example is $700,000, you’ll need to make a down payment of $500,000.

Using this same example, let’s say you want to put down 20% ($140,000). Your loan size is $560,000. The mortgage payment on a 30-year fixed loan at 6% interest is $3,357.

Your total monthly payment consists of $3,357 in mortgage payment plus $579 in maintenance, which amounts to $3,936.

Based on the 43% max lender DTI requirement, you’ll need to earn $9,153/month (or $109,841/year) to qualify for an 80% mortgage. However, $109,841 is more than double the building’s income limit of $50,168.

Moreover, this calculation assumes you have no other recurring debt payments such as a car lease or student loans.

If you happen to have a $500 monthly student loan or car payment, you’ll need to earn $123,795.35/month to qualify for a mortgage. This is nearly 2.5 times the HDFC building income limit for purchasers.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

In practice, the combination of low HDFC income limits and high purchase prices results in buyers of HDFC co-ops often being high-asset, low-income individuals.

Students with wealthy parents fit the bill perfectly. A student will qualify based on low income, and a parent may provide a large gift to cover the down payment.

There’s always a possibility that future regulatory changes could result in an asset limit for prospective HDFC purchasers.

In 2017, the De Blasio administration sought to increase the number of HDFCs subject to HPD oversight by luring HDFCs into signing a new Regulatory Agreement in exchange for a more generous tax break. Only 207 out of 1,048 HDFC co-ops had a Regulatory Agreement (RA) with HPD (Housing Preservation & Development) at the time.

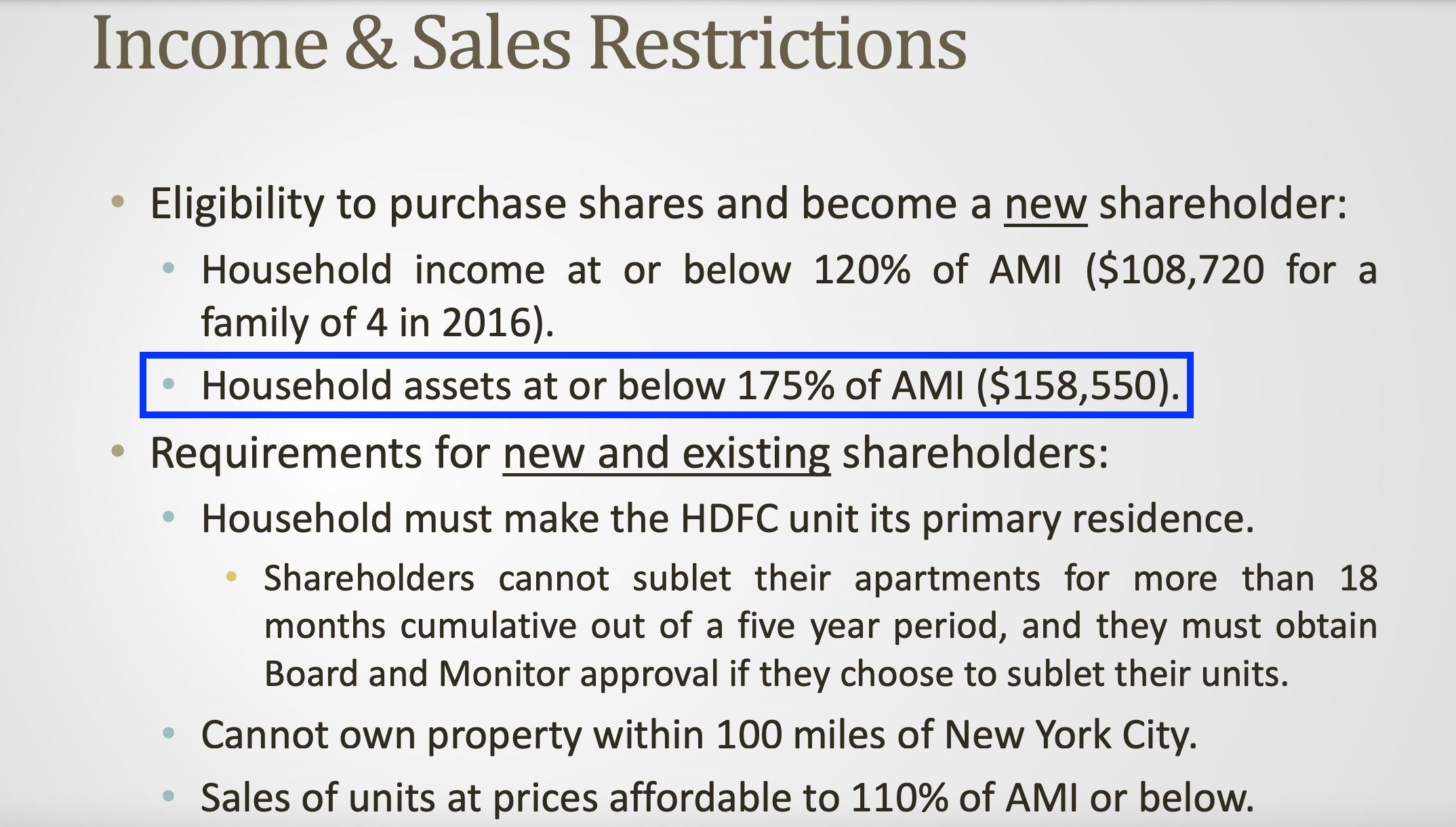

HPD’s proposed Regulatory Agreement included an asset limitation for prospective purchasers along with other controversial provisions which applied to current HDFC owners:

HPD’s proposed Regulatory Agreement overhaul faced strong opposition from HDFCs and the plan was ultimately abandoned.

HDFC FAQ:

How do income limits work for HDFCs?

HDFC co-ops typically have a maximum statutory income limit of 165% of the Area Median Income (AMI) for potential purchasers. However, many HDFCs may set their income limits lower than this maximum threshold. For instance, HDFC co-ops sold with a 30-year Regulatory Agreement often impose a stricter income limit of 120% of the AMI for prospective buyers. In some cases, HDFCs determine purchaser income limits using a formula as outlined in Section 576 of the Private Housing Finance Law in New York. This formula considers household size, monthly maintenance and utility costs specific to the apartment being purchased as well as the seller’s original purchase price.

How much are buyer closing costs for HDFCs?

HDFC buyer closing costs range from 1% to 2% of the purchase price. You can reduce your closing costs by requesting a commission rebate from Hauseit. Estimate your closing costs using Hauseit’s interactive calculator. HDFC buyer closing costs include attorney fees, building application & move-in related fees as well as the cost of a lien search. If you’re financing, you’ll also be responsible for a lender application fee, appraisal fee, bank attorney fee, recognition agreement fee and a UCC-1 filing fee. Buyer closing costs are comparable for traditional co-ops and HDFCs.