The average down payment for an apartment in NYC is 20% of the purchase price. While it’s possible to put down 10% or less on many condos in the city, most co-op apartments have stricter financial requirements which require a minimum of 20% down. Condo buildings in NYC often have minimum financing requirements as well.

How much cash you need to buy an apartment in NYC is actually slightly more than your down payment due to buyer closing costs. To estimate your buyer closing costs in NYC, visit Hauseit’s interactive closing cost calculator for buyers.

Table of Contents:

The typical down payment in NYC is 20%. The vast majority of co-op apartment buildings require at least 20% down, and some buildings require 30% or more. It’s rare but not improbable for a condo building in NYC to have a minimum down payment requirement.

If a condo building in NYC does not have a minimum down payment requirement, how much your down payment is will ultimately depend on what loan-to-value your bank is willing to lend to you at.

10% down is usually the lowest down payment for a condo in NYC, although in rare instances it’s possible to see as little as 5% down.

However, just because a building or bank will permit 10% down does not mean that a seller will have to agree to it.

For obvious reasons, sellers are most attracted to all-cash and/or non-contingent offers because these deals have a higher certainty of actually going through.

If you’re putting down 5% to 10% and have a mortgage contingency, a seller will only agree to do a deal with you as a last resort if there are no other offers.

Furthermore, a seller may demand a higher sale price as compensation for the increased risk of selling to someone with shakier financing terms.

If you’re buying a co-op apartment, the amount of your down payment is a key measure of your financial qualifications which will be reviewed as part of the co-op board application process.

Typical co-op financial requirements in NYC include a minimum down payment, sufficient post-closing liquidity and a minimum debt-to-income ratio.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

It’s customary in NYC for buyers to put down a 10% earnest money deposit upon signing a purchase contract. The deposit is held in an escrow account maintained by the seller’s attorney.

If you’re putting down 20%, this means that you’d put down the remaining 10% down payment balance at closing.

If you’re putting down just 10% and the contract deposit is 10%, this means that you would not need to put down any additional down payment monies upon closing.

We discuss the timeline between offer and closing in this article.

If you have a mortgage contingency, this clause in the contract allows you to back out of a deal and recoup your contract deposit under certain conditions.

While the amount of the contract deposit is technically negotiable, it’s extremely rare for a seller to accept anything less than the customary 10%.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

You need approximately 10% to 20% of the purchase price for a down payment, 2% to 6% of the purchase price for closing costs and approximately 6 months’ worth of housing expenses in post-closing assets when buying a condo in NYC.

This means you need to have approximately 22% to 26% of the purchase price in cash saved up when buying a condo, excluding bank reserve requirements.

Condo buyer closing costs can be as high as 6% for new construction and as low as 2% for an all-cash deal. The average condo closing cost bill for a buyer in NYC who is financing is 4%.

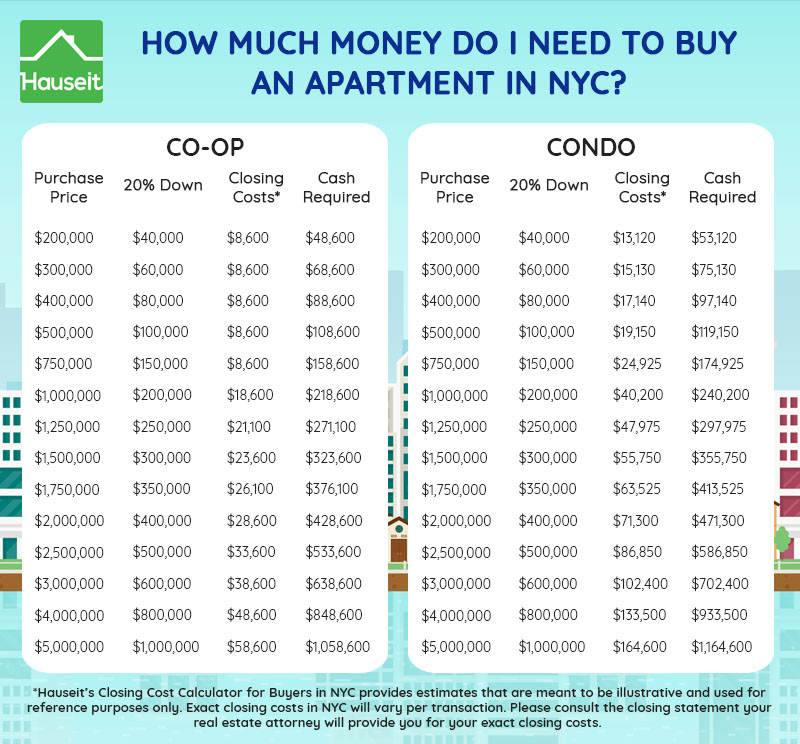

The following table shows approximately how much money you need to buy an apartment in NYC, assuming a 20% down payment. You can click to enlarge the infographic.

Please note that most lenders require you to have at least 6 months of monthly housing payments in reserve assets after you close, including your mortgage payment, common charges, real estate taxes and any other fixed money liabilities you may have.

Therefore, you’d actually need to have total assets which are slightly greater than the figures below in order to afford an apartment in NYC.

You need approximately 20% down, closing costs of 1% to 2% and post-closing liquidity of one to two years’ worth of housing expenses in order to buy a co-op apartment in NYC.

Fortunately, buyer closing costs in New York City are lower for co-ops compared to condos and houses.

Co-ops are actually a great option for buyers in NYC despite their sublet restrictions and the onerous board application process.

This is because co-op apartments are 10% to 40% less expensive compared to condos.

Simply put, this means that you can get more for your money with a co-op versus a condo.

With that said, it’s not a good idea to buy a co-op as an investment property due to the subletting restrictions. Even if a co-op is ‘investor friendly,’ the reality is that this policy is at the discretion of the board and it can change at any time.

We compare condos and co-op apartments in this article.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Buyer closing costs in NYC are substantial and can add up to an extra 2 to 4% on top of your purchase price on average.

Closing costs for buyers who purchase new construction condo units directly from a sponsor are even higher and can range from 5 to 6%.

The most common closing cost figures for condo and co-op apartments in NYC are 4% and 2%, respectively.

Buyer closing costs are lower for co-op vs. condo apartments because co-ops are not considered to be ‘real property,’ and some buyer closing costs only apply to real property.

Posted: 9/13/18 | Last Updated: April 1st, 2020

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.