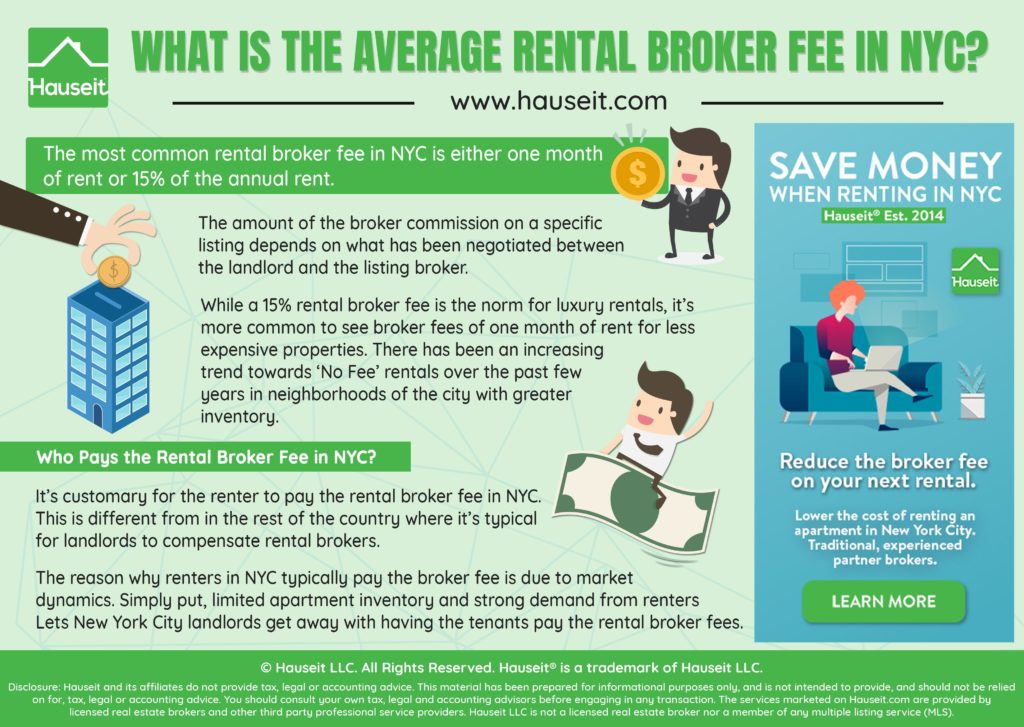

Rental broker fees in NYC are notoriously high. The typical broker fee in New York City is anywhere from one month (equivalent to 8.33% of annual rent) up to 15% of the annual rent. The amount of the rental broker fee and who pays it for a specific listing depends on what has been negotiated between the landlord and the listing broker.

While a 15% rental broker fee is the norm for luxury rentals, it’s more common to see broker fees of one month of rent for less expensive rentals. There has also been an increasing trend towards ‘no fee’ rentals over the past few years, particularly in neighborhoods which have a larger supply of available apartments.

When a rental listing is marketed as ‘no fee’ to prospective tenants, it simply means that the landlord is paying the broker fee instead of the tenant. The trend towards ‘no fee’ rentals was exacerbated by the New York Department of State’s temporary prohibition on tenants paying rental broker fees in NYC which occurred in early 2020.

As we explain in this article, the courts ultimately decided against the Department of State and concluded that it’s legal for tenants to pay a rental broker fees.

The typical rental broker fee in NYC is either one month rent or 15% of the annual rent. Occasionally, you may come across a listing with a 12% broker fee. The exact rental broker fee varies by listing in NYC based on the commission agreement negotiated between the landlord and the rental broker.

The rental broker fee is usually payable on the day you sign the rental agreement, along with the security deposit which is legally capped at 1 month of rent in New York City.

While broker fees are typically non-negotiable for less expensive apartments, it may be possible to negotiate down the fee for more expensive, luxury units.

It’s customary for the renter to pay the realtor broker fee in NYC. This is quite different from in the rest of the country, where it’s fairly typical for the landlord to compensate the rental broker.

The reason why renters in NYC typically pay the broker fee is due to market demand dynamics. Simply put, limited apartment inventory in NYC and robust demand from renters lets New York City landlords get away with having the tenants pay the rental broker fees.

Keep in mind that you do not need your own broker to rent an apartment in NYC. With that said, most listings will have a landlord’s agent who will still charge you a broker fee even if you don’t have your own tenant’s agent helping you with the search.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Rental brokers in NYC have a bad reputation because of the seemingly high broker fees being charged relative to the work it takes for a broker to actually rent an apartment. While not all rentals are easy tasks for brokers, the truth is that some apartments more or less rent themselves.

In the case of a straightforward rental, it’s easy to see why tenants are frustrated at the broker fee being charged.

From the tenant’s perspective, all the broker did was open a front door and show up a week later to collect a broker fee and have the tenant sign the lease.

Regardless of how much work is actually involved for a rental broker, most NYC landlords simply don’t have time to deal with the hassle of finding tenants. Furthermore, most landlords don’t care how much the broker fee is because they do not have to pay it.

Landlords care much more about negotiating down the average 6% broker commission on sales, as this commission is paid directly by sellers.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

In most cases, the listing agent on a rental is a Licensed Real Estate Salesperson or a Licensed Associate Real Estate Broker who is associated with a real estate brokerage firm.

When a listing is rented, the rental broker commission is split between the listing agent and the brokerage form based on a pre-agreed commission split arrangement.

We explain the difference between brokers and agents in this article. Ultimately, how much money a broker makes in NYC depends on his or her deal flow and the commission split arrangement with his or brokerage.

A tenant pays the rental broker fee the vast majority of the time in NYC. If a landlord is willing to pay the broker fee, it means that he or she is having trouble finding a tenant to rent the apartment.

When an apartment is ‘No Fee,’ it either means that the landlord has agreed to pay the fee or the unit is being rented directly from the landlord without the involvement of a third party broker.

If you simply refuse to pay a rental broker fee in NYC, you can narrow your search to focus exclusively on ‘No Fee’ rentals. No Fee rentals are more common in parts of the city with large rental buildings, such as FiDi and Midtown.

It’s less realistic to demand a No Fee rental in neighborhoods with less inventory and stronger demand, such as the West Village. This is because tenants have no trouble finding tenants and there are plenty of other tenants who are willing to pay the going rate broker fee.

From the perspective of a landlord, rental broker fees are just as negotiable as broker commissions on sales in NYC.

A savvy landlord who understands the risks of vacancy will want to make sure that the all-in cost of the rental from the perspective of a tenant (factoring in broker fees) is in line with comparable units.

In this situation, the landlord will try to negotiate down the rental broker fee even though the tenant is the one who will ultimately be footing the bill.

From the perspective of a tenant, rental broker fees are less negotiable.

This is because for most rentals there is a line of qualified candidates. Why would a rental broker rent an apartment to you for a lower fee if he or she has numerous other candidates who are willing to pay the full broker fee?

In other words, rental broker fees are the most negotiable for tenants in the case of luxury rentals or a rental where there is less demand with a longer anticipated vacancy period.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

How do I negotiate to reduce a broker fee!!

Hi Augustine – great question! Can you to ask this in our forum so that others can chime in? https://www.hauseit.com/forum/forum/main-forum

Good luck out there!

Is it unscrupulous for the landlord to change the date of the lease to 4 days earlier than you agreed upon and then charge the tenant a pro-rated fee/day? In addition to the 15% broker fee. Broker is saying the landlord won’t budge on this.

Hi Barb, we’re so sorry the hear that! That doesn’t seem like a nice thing to do. Like all things in NYC real estate, it’s negotiable. Assuming you haven’t signed the lease etc., you can negotiate this, and if the landlord truly won’t budge, you are free to walk away and pick a nicer apartment and landlord! We recommend having an experienced tenant’s agent guiding you through this process. Please contact us if you’d like a referral!