Penthouse buyer closing costs in NYC range from 3% to 6% of the apartment purchase price. Expect to pay between 3% to 4% if you’re paying cash and 5% to 6% if you’re financing. Buyer closing costs are higher for financed purchasers due to the Mortgage Recording Tax.

The largest penthouse buyer closing costs in NYC consist of the Mansion Tax, the Mortgage Recording Tax and title insurance. Other penthouse buyer closing costs include buyer attorney fees, lender fees, condo application and move-in fees as well as recording and title related search fees.

Thinking of buying? Estimate your penthouse closing costs in NYC using Hauseit’s Buyer Closing Cost Calculator, and consider requesting a Hauseit Buyer Closing Credit to save money on your home purchase.

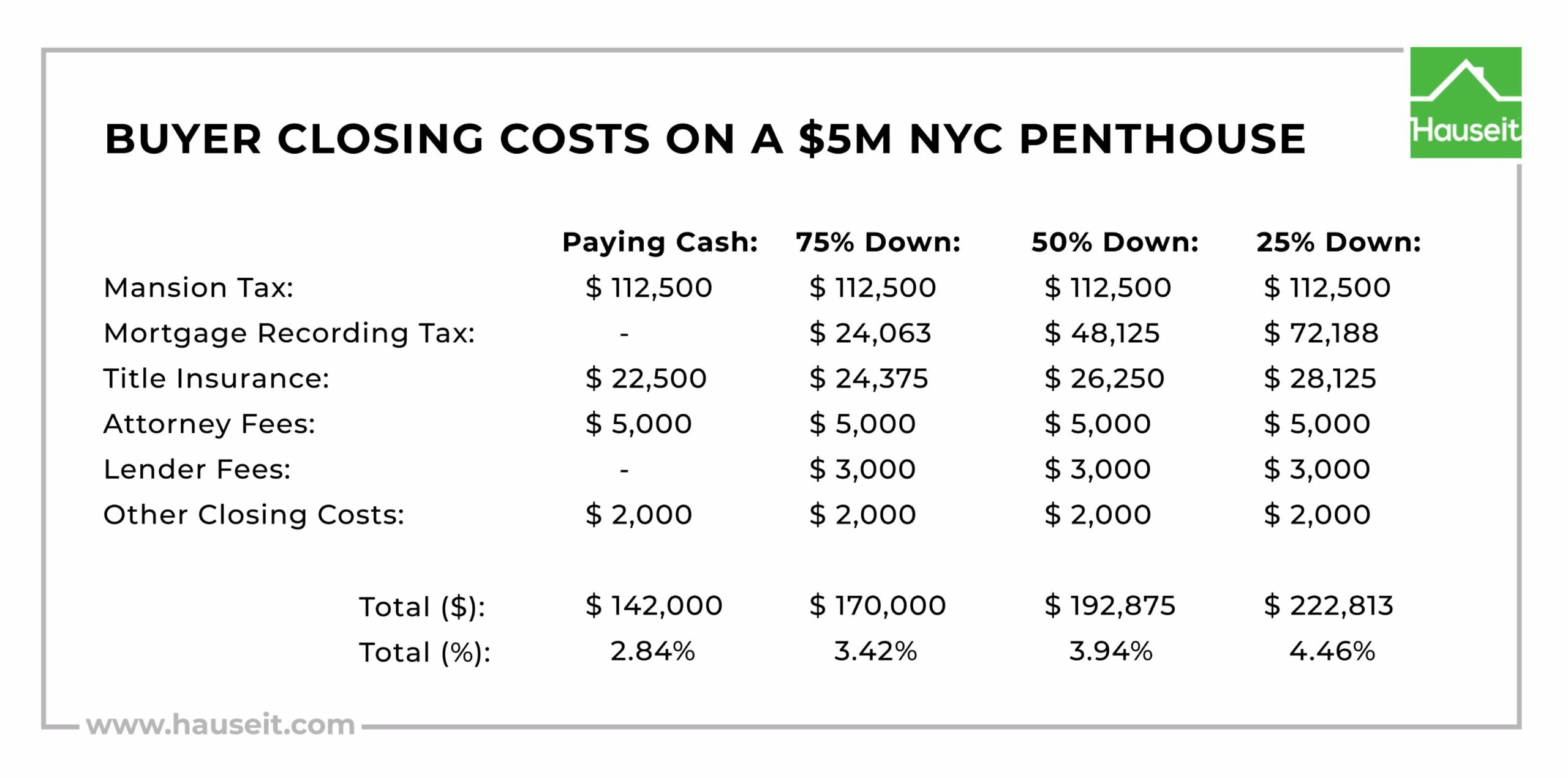

Expect to pay around 4.5% in buyer closing costs when buying a $5m NYC penthouse, assuming you’re financing 75% of the purchase price. If you’re able to swing an all-cash purchase, you’ll pay slightly less than 3% in buyer closing costs:

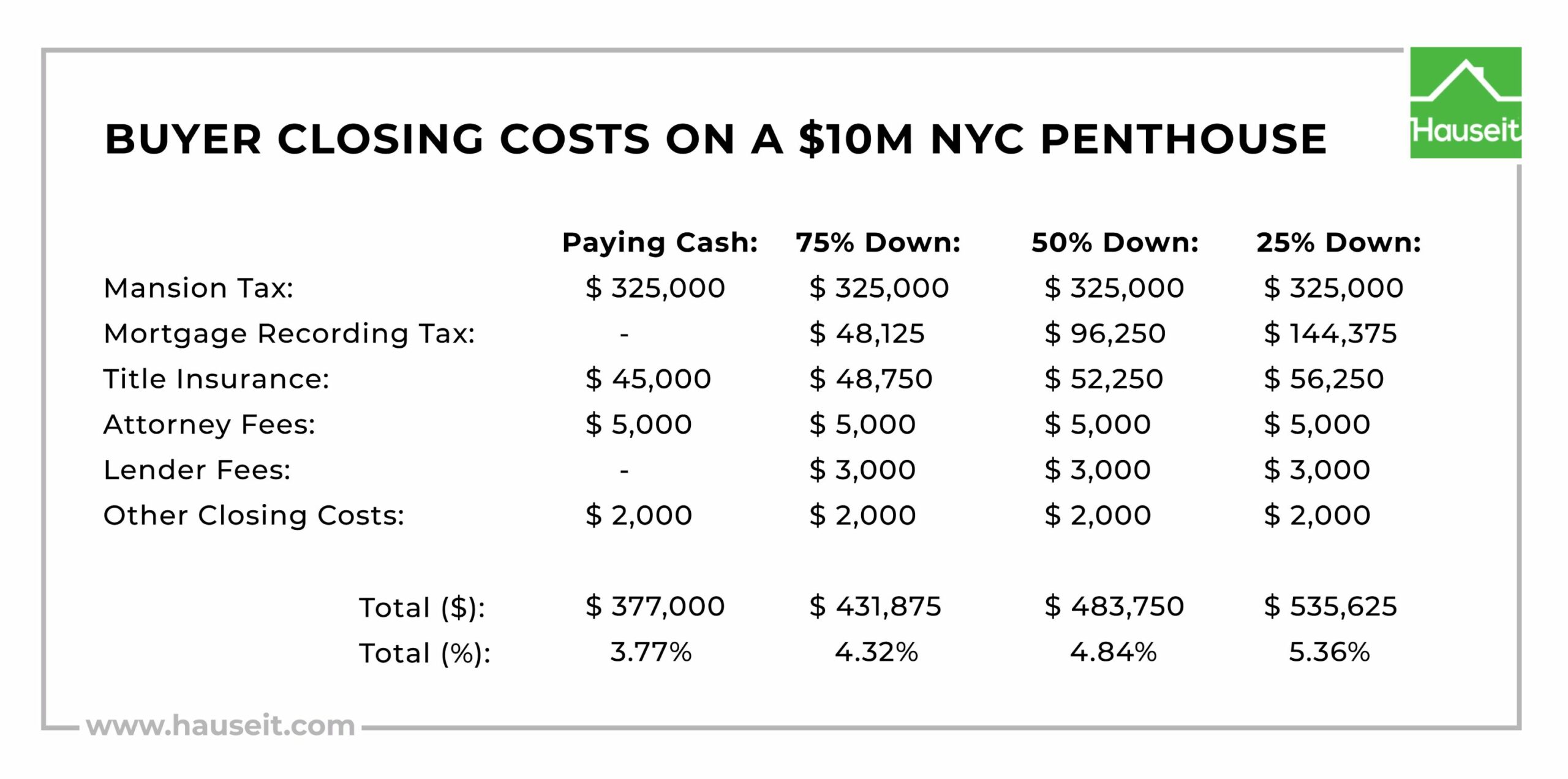

Buyer Closing Costs on a $10m NYC Penthouse

Buyer closing costs on a $10 NYC penthouse are approximately 3.5% for an all cash purchase. If you’re financing, expect to pay progressively more based on the size of your loan.

Buyer closing costs are roughly 5.5% on a $10 NYC penthouse if you finance 75% of the purchase price:

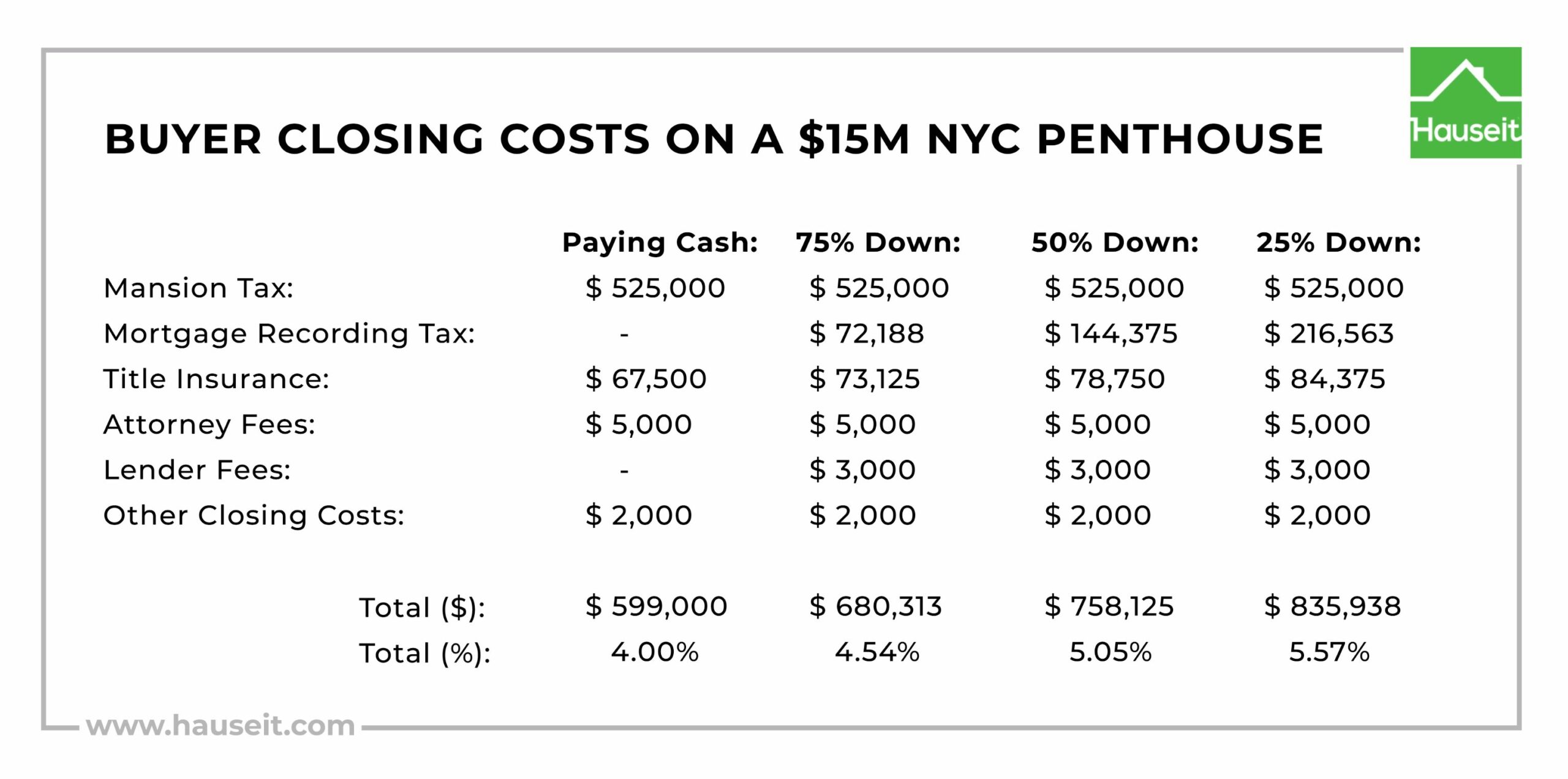

Buyer Closing Costs on a $15m NYC Penthouse

Buyer closing costs on a $15m NYC penthouse are roughly 4% if paying all cash. You’ll pay closer to 5.5% in total closing costs if you finance 75% of the purchase price:

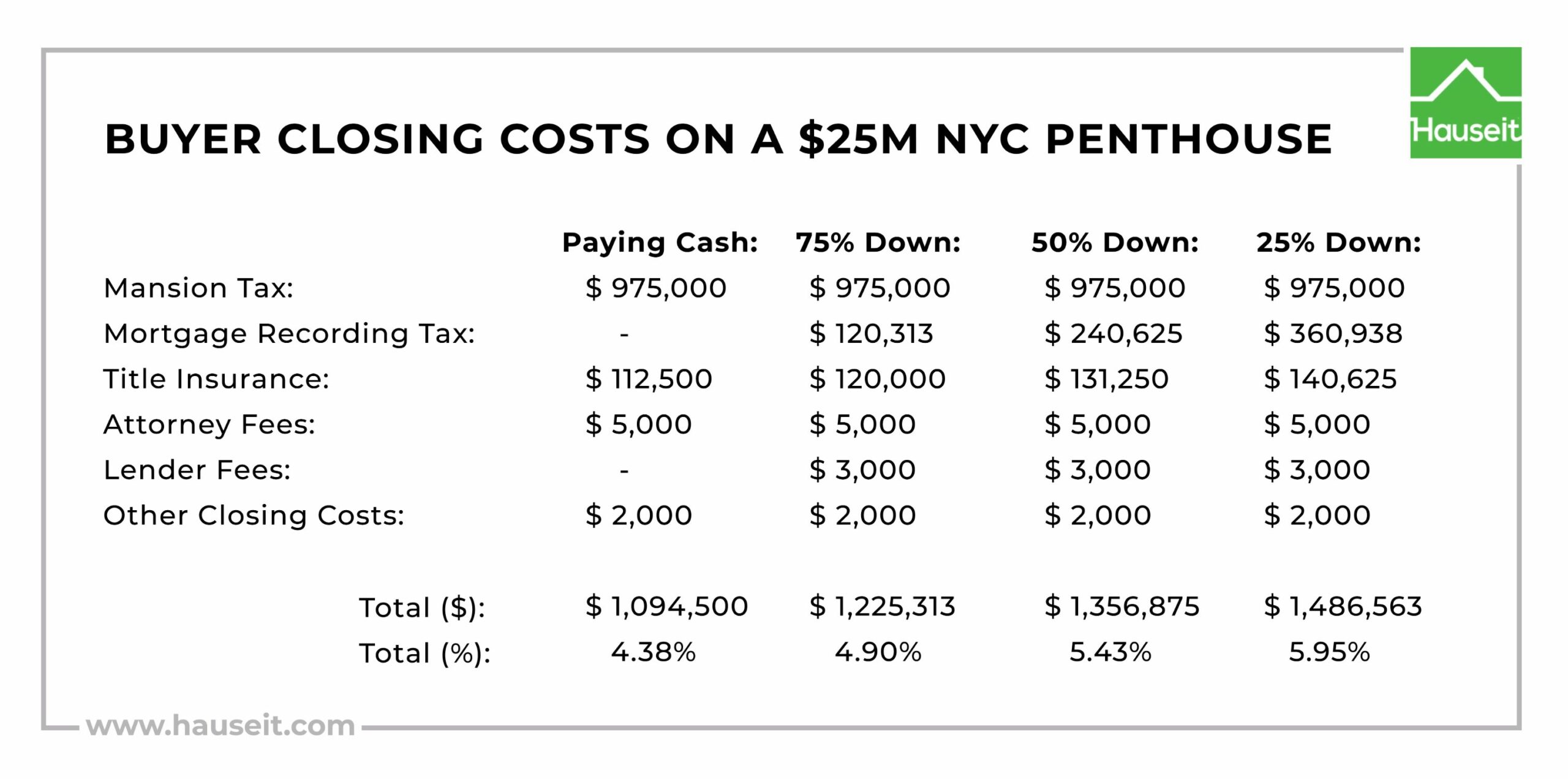

Buyer Closing Costs on a $25m NYC Penthouse

Buyer closing costs on a $25 NYC penthouse are approximately 4.4% for an all cash purchase. You’ll pay closer to 6% in total closing costs if you finance 75% of the purchase price:

Buyer closing costs for a NYC penthouse include the Mansion Tax, the Mortgage Recording Tax, title insurance, attorney fees, lender fees (if financing) as well as miscellaneous expenses such as building application, deed recording and title search fees.

The largest buyer closing cost for a NYC penthouse is the Mansion Tax. This closing cost ranges from 1% to 3.9% of the purchase price.

The NYC Mansion Tax

There are eight separate Mansion Tax brackets in NYC:

-

1% for purchases of $1,000,000 to $1,999,999

-

1.25% for purchase of $2,000,000 to $2,999,999

-

1.5% for purchases of $3,000,000 to $4,999,999

-

2.25% for purchases of $5,000,000 to $9,999,999

-

3.25% for purchases of $10,000,000 to $14,999,999

-

3.5% for purchases of $15,000,000 to $19,999,999

-

3.75% for purchases of $20,000,000 to $24,999,999

-

3.90% for purchases of $25,000,000 and above

The applicable tax bracket based on your purchase price applies to the entire purchase price. If you’re buying a $12,000,000 penthouse, the 3.25% rate applies to the entire purchase price of $12,000,000.

Extra prudence is warranted if you’re buying a new construction penthouse in NYC. Here’s why:

If you agree to pay any sponsor closing costs (such as NYC & NYS Transfer Taxes), they will be added to the purchase price for the purpose of determining the applicable Mansion Tax rate for your purchase. This can inadvertently bump you into a higher Mansion Tax bracket.

Estimate your Mansion Tax bill in NYC with Hauseit’s Interactive Mansion Tax Calculator.

The Mortgage Recording Tax

The Mortgage Recording Tax for a NYC penthouse is 1.925% of your loan size. While there is a lower tax rate of 1.8%, it only applies to loans less than $500k.

The Mortgage Recording Tax can be completely avoided by making an all-cash purchase. If that’s not possible, consider putting slightly more down in order to reduce your Mortgage Recording Tax bill.

Estimate your Mortgage Recording Tax bill in NYC with Hauseit’s Interactive Mortgage Recording Tax Calculator.

Title Insurance

Title insurance premiums for a NYC penthouse are approximately 0.4% to 0.5% of the purchase price. You’ll pay slightly more for title insurance if you’re financing, as you’ll also have to purchase a lender’s title insurance policy in addition to an owner’s policy.

The lender’s policy covers the principal amount lent to you and protects the lender. The policy coverage amount decreases as you pay down the mortgage. The owner’s policy protects you against the full purchase price.

If you’re buying a penthouse in NYC, we recommend purchasing a market value rider from your title insurance company. This add-on increases your title insurance coverage over time to match appreciation in the value of your apartment over time.

Attorney Fees

Buyer attorney fees are fairly small and insignificant relative to the typical purchase price of a NYC penthouse. Most NYC real estate attorneys charge a flat fee of a few thousand dollars to handle the entire process including contract negotiation, buyer due diligence and the closing.

Note that the attorney fee you’re quoted may be slightly higher for a penthouse compared to a traditional apartment due to the added complexity of due diligence because of the apartment size and other factors like private outdoor space.

Lender Fees

If you’re financing, mortgage related fees include the loan application fee ($700 – $1,000), appraisal fee ($700 – 1,000), bank attorney fee (~$1,000) and mortgage recording fees (~$250).

Depending on your loan size and the policy of your lender, you may have to pay for two appraisals.

Miscellaneous Expenses

Other miscellaneous penthouse buyer closing costs in NYC include condo board application and move-in fees, recording fees as well as various title related search fees.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

What Are the Largest Buyer Closing Costs for a NYC Penthouse?

The largest penthouse buyer closing costs in NYC consist of the Mansion Tax, the Mortgage Recording Tax and title insurance. These three closing costs comprise over 95% of the total buyer closing costs for a penthouse apartment in NYC.

Aside from the Mansion Tax, the Mortgage Recording Tax and title insurance, penthouse buyer closing costs include buyer attorney fees, condo board application and move-in fees, recording fees as well as various title related search fees.

How Can I Reduce My Closing Costs When Buying a NYC Penthouse?

The easiest way to reduce your penthouse buyer closing costs in NYC is to request a Hauseit Buyer Closing Credit. We pair you with a traditional, full-service buyer’s agent who has agreed to rebate you a portion of the buyer agent commission paid by the seller upon closing.

On a $10,000,000 purchase, expect to save up to $200,000 (approximately 2%) by requesting a Hauseit Buyer Closing Credit. The exact size of the discount depends on the buyer agent commission (%) being paid on the particular listing you’re interested in.

Buyer agent commission rebates are legal in New York and generally considered to be non-taxable.

Other methods of lowering your buyer closing costs in NYC include:

-

Avoiding the Mortgage Recording Tax by paying all-cash

-

Lowering your budget to fall into a lower Mansion Tax bracket

-

Negotiating a Purchase CEMA with the seller, assuming they have an existing loan balance of sufficient size