How much can I save with a Hauseit® Buyer Closing Credit?

You receive 2/3 (two-thirds) of the buyer agent commission, subject to the terms of your agreement. Buyer agent commissions are 3% on average, but may vary depending on the listing. For example, new construction condos in Miami can offer up to 7% in commission, meaning the size of your rebate could significantly exceed 2% of the purchase price.

What properties qualify for getting a rebate?

You can receive a Hauseit Buyer Closing Credit on all types of apartments and houses, including new construction buildings, condos, co-ops, condops, brownstones, multi-family houses, single-family homes or any other building or land that is listed for sale.

It’s important to clarify that our brokers can offer you this incentive on any listing in New York or Florida, even if it is listed by another broker. Many buyers think that this sort of incentive could only be offered on a broker’s own listings but that is simply not the case.

What areas of New York do you cover?

Hauseit offers buyer agent commission rebates in NYC and nearby New Jersey areas (Hudson, Essex, and Union Counties), in addition to Long Island, Westchester and the Hudson Valley, the Hamptons, and South Florida.

All home types qualify for a commission rebate, including condos, co-ops, condops, brownstones (townhouses), multi-family houses, single-family homes or any other building or land that is listed for sale.

Hauseit’s buyer broker commission rebate program for home buyers is available in all of the following areas:

-

NYC: Manhattan, Brooklyn, Queens, the Bronx and Staten Island

-

NJ: Hudson, Essex, and Union Counties

-

Long Island: Nassau County & Suffolk County (including the Hamptons)

-

Hudson Valley: Westchester County & adjacent areas

-

South Florida: Miami-Dade, Broward, Palm Beach, Martin and Saint Lucie counties

What areas of New Jersey do you cover?

Hauseit offers buyer agent commission rebates in nearby areas of New Jersey that are close to NYC, including Hudson, Essex, and Union counties. Hudson County is covered by the Hudson County Multiple Listing Service (HCMLS), and Essex & Union counties are covered by the Garden State Multiple Listing Service (GSMLS).

All property types qualify for a commission rebate, including condos, co-ops, condops, brownstones (townhouses), multi-family houses, single-family homes or any other building or land that is listed for sale.

For the Hudson County Multiple Listing Service (HCMLS), we cover all of Hudson County, including Jersey City, Hoboken, Bayonne, Union City, North Bergen, West New York, Secaucus, Weehawken, Guttenberg, Kearny, Harrison, and East Newark.

For the Garden State Multiple Listing Service (GSMLS), we focus on Essex and Union counties, including areas like Short Hills, Summit, Maplewood, Montclair, and Millburn Township.

What areas of Florida do you cover?

Hauseit offers buyer agent commission rebates on properties in the South Florida counties of Miami-Dade, Broward, Palm Beach, Martin and Saint Lucie. All property types qualify, including condos, freestanding homes, new construction or any other building or land that is listed for sale.

Does Hauseit offer rebates on luxury listings above $5 million?

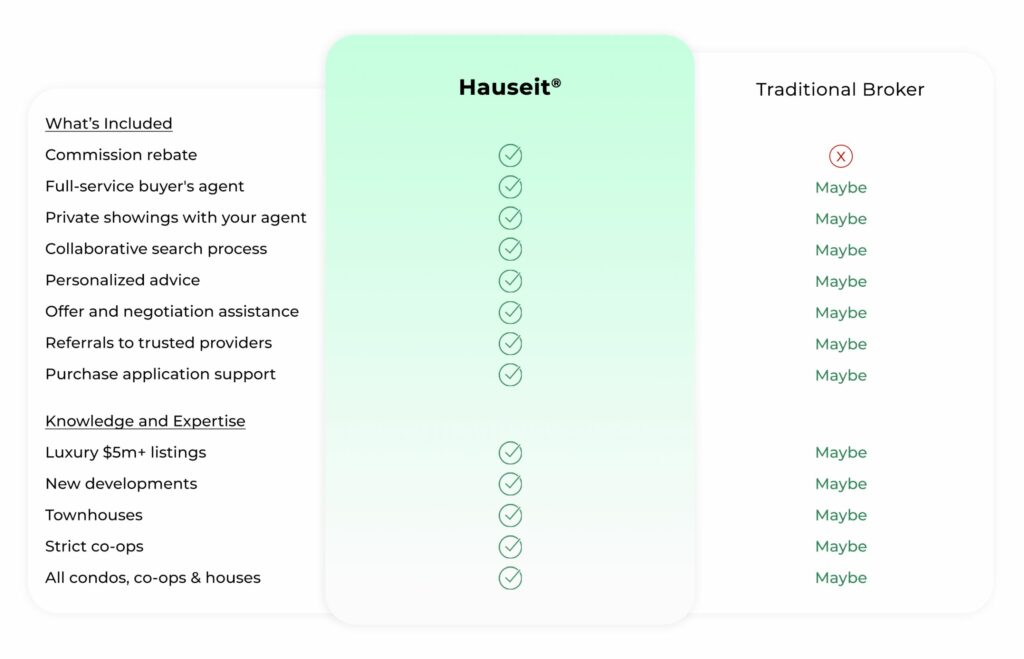

We regularly represent discerning buyers with budgets of $5 million or more. In addition to traditional apartment resales, our experience and expertise in the luxury segment extends to high value new development condos, townhouses as well as prestigious (and strict) New York City co-op buildings.

Is Hauseit experienced with new developments?

Yes. All our brokers have extensive track records representing buyers on new construction projects. Our partner brokers are intimately familiar with the additional nuances of negotiating the purchase of a new construction home in addition to the special risks and procedural aspects of buying into a new development compared to a traditional purchase.

In some markets like New York, new development buyer closing costs are considerably higher than for a traditional resale, but many of the additional buyer closing costs, such as NYC & NYS Transfer Taxes and sponsor attorney fees, can be adeptly negotiated by working with an experienced buyer’s broker.

Additional closing costs which may negotiable in the case of a new development purchase include the Mansion Tax, the Mortgage Recording Tax, common charge and/or property tax credits, parking, storage, unit improvements, residential manager apartment contribution or even gym memberships!

Can Hauseit assist with townhouses?

Yes. All our brokers have extensive track records representing buyers on townhouses throughout NYC, including both single-family and multi-family homes. Our partner brokers are intimately familiar with the additional nuances of buying a townhouse including the potential renegotiation of deal terms based on the findings of a pre-contract home inspection.

Is it legal to receive part of the commission?

Yes, closing credits and incentives to buyers are legal in 40 states including New York and Florida. It’s legal for a buyer’s agent to offer a portion of their commission as an incentive, and it’s legal for buyers to receive such an incentive. In fact, former New York State Attorney General Eric T. Schneiderman released an open letter to the real estate community on April 20th, 2015 urging all parties to take advantage of such home buyer closing credit programs and incentives.

In addition to the letter referenced above, The New York Department of State, Division of Licensing Services also speaks to the legality of rebates on this page, a excerpt of which is reproduced below:

Can brokers pay rebates to customers and offer other incentives?

The payment of cash or offering an incentive to encourage a consumer to do business with a broker is permitted. The Real Property Law prohibits brokers from sharing commissions with unlicensed individuals. It is often misinterpreted as prohibiting the payment of cash or offering another business generating incentive to a consumer. This law prohibits a broker from sharing a commission as compensation for activity that would require a real estate license.

Ten states currently ban commission incentives offered by the buyer’s agent. Nine of these states have a full ban in effect due to strong real estate broker lobbying efforts: Alabama, Alaska, Kansas, Louisiana, Mississippi, Missouri, Oklahoma, Oregon, and Tennessee. The tenth state, Iowa, prohibits any such incentives when there are two or more real estate brokers on a transaction.

Are commission rebates permitted under the NAR settlement?

The NAR commission lawsuit settlement does not restrict sellers from paying commission to a buyer’s agent, nor does it prohibit buyer agent commission rebates. Sellers continue to overwhelmingly pay buyer agent commissions. This means that requesting a buyer agent commission rebate is still the most effective way for you to save money and lower your closing costs when purchasing a home. For more detailed thoughts on how the NAR settlement impacts the buyer agent commission rebate landscape in NYC specifically, refer to this article.

Will my buyer closing credit be taxed as income?

The IRS has issued an opinion letter stating that closing credits and commission incentives provided by real estate brokers are generally not taxable. As a result, you should not expect a 1099 to be issued to you as your closing gift will generally be treated as a concession on price, and thus a reduction of your cost basis. Please consult your tax adviser for more information. You can also view the specific IRS rule we referenced here.

Who will be my agent?

After your introductory call with our team, we will assign you an agent who will be your main point of contact throughout the process. We assign agents based on best fit and proximity to where you’re likely to transact.

We are confident that you will be happy with the agent we assign; however, if for whatever reason you wish to be assigned a different agent, please contact us right away so we can assign you another agent.

In select markets like New York, we may assign you to one of our partner brokers operating under a different brand. In all other markets, you will be assigned an agent working under the Hauseit® brand.

Will I have a full-service buyer's agent?

Yes. Our experienced brokers will be there for you throughout your search, offer, contract and closing process. If you’re busy, our partner brokers can search for listings and schedule viewings on behalf, and even put together showing tours for you when you’re free for a day.

Do I need to sign an agreement?

In markets like New York and Florida, buyers are not typically expected to sign an exclusivity agreement. As a result, you can expect only a simple agreement to be sent to you for e-signature detailing the terms of your commission rebate. This agreement is non-exclusive in nature, and serves to protect you by clarifying the terms of your payment.

Brokers are also required to send you various state mandated disclosure forms such as the NY Agency Disclosure Form, the NY Fair Housing Disclosure Form and the Lead-Based Paint Disclosure Form. These government mandated disclosure forms are not contracts and you are not required to sign many of them.

Are there any hidden fees?

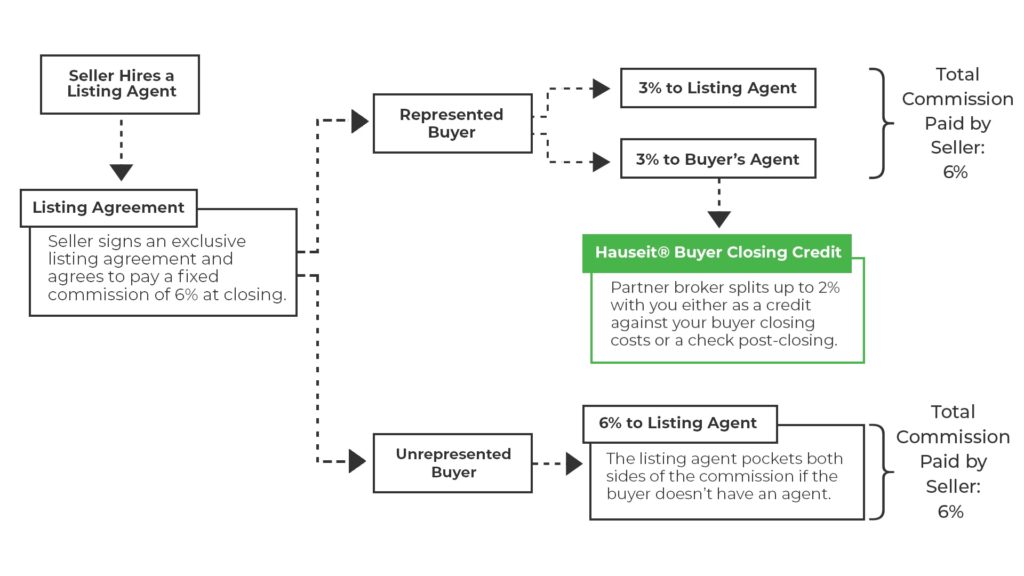

There are no hidden fees. In fact, you don’t owe us or our partner brokers anything at all because buyer’s agents typically get paid from a split of the total listing commission, which is covered by the seller. This means the seller pays both the listing and buyer’s agent commissions. If you forgo working with a buyer’s agent, the listing agent usually keeps the entire commission, so neither you nor the seller save any money.

If the seller isn’t paying a buyer agent commission, we won’t be able to provide you with a commission rebate. You can either submit an offer directly to the listing agent, or if you’d still like us to represent you as your buyer’s agent, we can work out a reasonable fee that you would pay for our services.

Keep in mind that the buyer agent commission varies by listing, and commissions are not set by law or any Realtor® association or MLS and are fully negotiable.

Can I sign up if I already have a buyer's agent?

Yes. As long as you haven’t signed an Exclusive Right to Represent Agreement, you’re free to switch representation at any time. In fact, if you’re ever asked to sign an exclusivity agreement, you should run! It’s very rare for anyone but the occasional foreign buyer who is heavily dependent on their local representative to have an exclusive buyer’s agent.

What if I've already contacted the listing agent?

No problem. You have the right to choose to work with the agent of your choice at any time. However, it’s important to loop in your buyer’s agent prior to making an offer, and certainly before you have an accepted offer. If you decide to enlist a buyer’s agent after you already have an accepted offer, then it’s usually too late for your buyer’s agent to be the procuring cause of the transaction and eligible for commission.

To get started, simply copy your buyer’s agent on an email to the listing agent explaining that you’ve decided to enlist the services of a buyer’s agent for your purchase. You can explain that you’ve done a lot of research and realized that you needed someone to guide you through the process who only works for you.

What if I've already submitted an offer?

It depends. If you’ve already submitted an offer directly with the listing agent or through another buyer’s agent, then it may be too late. It will be hard for our partner broker to be the procuring cause of the sale, and thus eligible for commission, if your offer has already been accepted.

However, it’s not too late if your offer was rejected or if you plan on making a new offer with different terms, whether it be on the same property or a different property.

If you’re intent on purchasing a specific property that you’ve already submitted an offer on, sometimes the best bet is to not counter back or withdraw, and come back some time later with your buyer’s agent to submit a new offer.

What if the seller isn't paying a buyer agent commission?

If the seller isn’t paying a buyer agent commission, we won’t be able to provide you with a commission rebate. You can either submit an offer directly to the listing agent, or if you’d still like us to represent you as your buyer’s agent, we can work out a reasonable fee that you would pay for our services.

Can I still search on my own?

Yes. Customers who prefer to be more independent are free to continue searching for listings online and attending open houses on their own. In fact, we encourage this for buyers who are earlier in their search.

Please list your buyer agent’s contact information on open house sign-in sheets so listing agents know you’re represented. A further benefit of doing so is you won’t be added to newsletters and mailing lists.

Once you’ve found a few places you’re serious about, please let your buyer’s agent know so they can schedule any follow-up showings and submit any offers on your behalf.

How long has Hauseit been around?

We’ve helped thousands of customers save millions on their home sales and purchases since we first opened our doors in New York in 2014. Since then we’ve established a number of traditional brokerage brands in select markets like New York to work with buyers and sellers who sign up for our full-service product.

While we started with New York City, we quickly expanded service to cover Long Island and the Hudson Valley. As members of the Long Island Board of Realtors with access to the OneKey MLS, we’ve been providing our services to buyers and sellers in Nassau, Suffolk, Westchester, Rockland, Putnam, Orange, Dutchess, Ulster and Sullivan Counties.

In 2021, we opened up for business in Florida with a focus on the southeastern Florida counties of Miami-Dade, Broward, Palm Beach, Martin and Saint Lucie. Our business is headquartered today in Miami, Florida.

Does Hauseit collect referral fees from its partner brokers?

No, there are no referral fees between external parties to worry about because Hauseit and the partner brokerages we work with are under common ownership.