Buying your first investment property in NYC? We’ll go over the pros and cons of investing in real estate vs the stock market, the tax benefits of real estate investing, how to calculate returns from rental properties and challenge some commonly accepted advice such as buying investment property in a LLC.

Table of Contents:

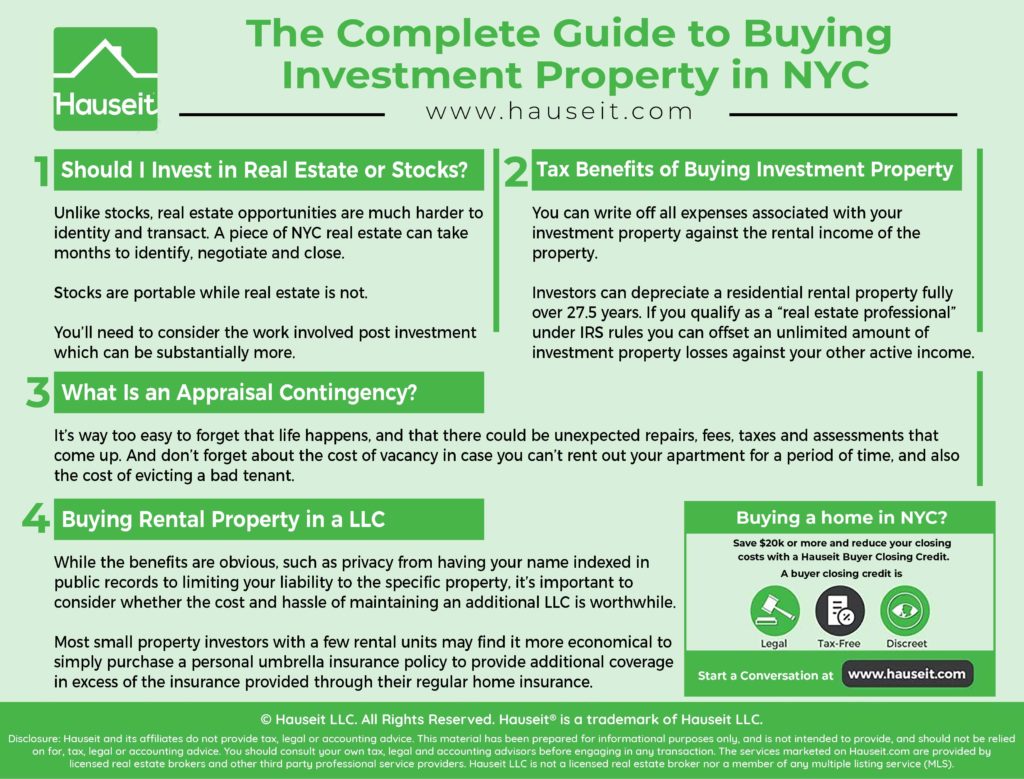

Should I Invest in Real Estate or Stocks?

Before buying your first investment property, you need to carefully consider whether it makes sense for you to invest in real estate vs stocks, and more specifically whether it makes sense to buy rental property in pricey metropolitan centers like New York City.

You’ll need to understand that unlike stocks, real estate opportunities are much harder to identity and transact.

Unlike stocks where you can deploy capital instantly without moving the market, a piece of NYC real estate can take months to identify, negotiate and close.

Furthermore, there’s no certainty of execution until the deal closes, and neither party is even bound to transact until a purchase contract has been fully executed.

Real Estate Is Illiquid

You’ll also need to consider timing and your expected holding period when deciding between NYC real estate and the stock market.

Stocks and bonds are relatively liquid and you can usually exit your investment within the same day if you need to.

However, real estate is one of the most illiquid asset classes. Real estate may sit on the market for months without producing a buyer. As a result, if you do decide to buy real estate, you should be prepared to wait for months before being able to sell your property.

You should also think about lifestyle considerations when it comes to real estate vs stocks.

Stocks are portable while real estate is not.

That means you can live anywhere in the world and access your stock portfolio through the internet, whereas you may have to stick around in NYC to maintain your rental property.

This of course can be mitigated with scale. If you have enough investment properties in a concentrated area, it may make sense for you to form a property management company or at least hire your own janitors and superintendents to maintain your properties.

Consider the work involved post investment.

With stocks, the work involved is effectively zero unless you count voluntary analysis of company filings and economic data. If you simply buy and hold the stock market index in a low cost mutual fund or ETF as Warren Buffett suggests, then you may be free to skip any extra work whatsoever.

The work involved post-closing with rental property can be substantially more.

As a landlord, you’ll need to find and screen tenants, sometimes with the assistance of a real estate listing agent and/or a property manager if you have one.

You may need the assistance of a real estate attorney to draft a lease agreement. You’ll need to run credit, background and perhaps housing court checks. If all goes well and you find a great tenant, you or your property manager will need to collect rent checks and maintain books and records.

Most importantly, you’ll be responsible for following all local rules and regulations, such as ensuring that window guards are installed if applicable, smoke and carbon monoxide detectors are properly installed and proper notices are posted. Lastly, you’ll need to organize any repairs of broken appliances and you may need to call in plumbers and other contractors to deal with things like broken pipes or other issues that may arise.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Tax Benefits of Buying Investment Property

The best thing about buying investment property in NYC are the tax benefits for landlords.

As an investor, you can write off all expenses associated with your investment property against the rental income of the property.

That means your property taxes, your common charges or maintenance, your mortgage interest, depreciation and any miscellaneous costs associated with repairing or maintaining your property.

The biggest kicker here is depreciation, which is a non-cash expense. According to the IRS, investors can depreciate a residential rental property fully over 27.5 years.1

That means you can depreciate just over 3.6% of the property’s cost basis every year! This is huge in the context of low cap rates in places like Manhattan and Brooklyn.

Most gross rental yields on investment properties in Manhattan are under 3%, which means you are almost guaranteed to carry a paper loss on any rental property in the city.

Real estate professional classification means additional tax advantages.

Furthermore, if you qualify as a “real estate professional” under IRS rules you can offset an unlimited amount of investment property losses against your other active income.

To qualify as a “real estate professional” according to the IRS, you need to prove that you had material participation in the trade per the following two quantitative tests of Section 469(c)(7)(B):

(a) More than one-half of the personal services performed in trades or businesses by the taxpayer during the tax year are performed in real property trades or businesses in which the taxpayer materially participates, and

(b) The taxpayer performs more than 750 hours of services during the tax year in real property trades or businesses in which the taxpayer materially participates.

Once you qualify as a real estate professional, you’ll still need to demonstrate material participation in each rental activity, or all of the rental and real estate activities combined. The IRS offers seven tests for material participation:

(1) The taxpayer spends more than 500 hours on the activity in the tax year.

(2) The taxpayer’s participation in the activity constitutes substantially all of the participation of all individuals, including those who are not owners.

(3) The taxpayer spends more than 100 hours on the activity in the tax year, and this amount is not less than the participation of any other individual in the activity, including non-owners.

(4) The taxpayer’s total participation in all significant participation activities combined exceeds 500 hours.

(5) The taxpayer materially participated in the activity during any five of the past ten tax years.

(6) The activity is a personal service activity, and the taxpayer participated for any three years preceding the tax year.

(7) Based on all reasonable facts and circumstances, the taxpayer materially participated on a continuous, consistent and substantial basis in the tax year.

Even if you don’t qualify as a real estate professional per IRS rules, you can still offset a portion of your investment property losses against your active income.2 And because rental property losses are considered passive losses if you don’t qualify as a real estate professional, you can also offset these losses against any passive income such as dividends and capital gains from stocks.

1This is in reference to the building but not the land, which does not depreciate in value. However, since an individual condo or coop unit owns very little of the underlying land that their building sits on, for all intents and purposes a single condo or coop unit is fully depreciable.

2As of 2018, non-real estate professionals can still deduct up to $25,000 of rental property losses against their active income.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Calculating Returns on Buying Investment Property

Calculating your returns, yields or cap rates when buying investment property in NYC is quite simple. You’ll first need to figure out how much you can rent out your investment property for. You can do this in various ways, from inspecting actual signed leases for the unit to looking at rental listings for comparable properties online.

Just be careful however as the last list price for a rental listing online doesn’t necessarily reflect the actual signed lease which is private. Often times rental rates are negotiated, and once a rental listing is closed out or de-listed, only the last listing price is shown. The last listing price is just that, the last price reflected on the listing, and does not mean that the unit was actually rented out at that level.

What’s Your Cost Basis?

The next step is to determine your cost basis.

Some folks choose to take a simplistic approach and will ignore their NYC closing costs and simply use the purchase price.

However, if you choose to incorporate your closing costs into your cost basis, you can estimate them with Hauseit’s Closing Cost Calculator for Buyer in NYC. To be even more conservative, you can include your closing costs for selling as well. You can estimate your seller closing costs with Hauseit’s Closing Cost Estimator for Seller in NYC.

If you’ve decided to renovate your rental unit, you’ll want to add your cost of renovation to your cost basis as well. Often times an investment property may not be in marketable or even habitable condition, and renovations will be a prerequisite for renting it out.

Let’s assume for the sake of example that you are buying a condo in NYC for $1 million. This condo rents for $4,000 a month, so you’ll be receiving $48,000 per year. Let’s assume you haven’t done any renovations and you aren’t including closing costs for simplicity. In this case, your gross or asset yield on the investment property is 4.8%! Not so bad for New York City.

Next, you’ll want to figure out your net investment yield after factoring in mandatory expenses such as common charges or maintenance. Let’s assume that property taxes are 0.72% per year, or $7,200 per year according to average NYC property tax rates discussed in our article on NYC real estate taxes. Next, let’s assume this property has $1.25 per square foot in common charges1, and that the property is 700 square feet.

That equates to $875 per month in common charges, or $10,500 per year which sounds about right. You’ll also have to include the cost of home insurance, which let’s assume is $2,000 per year. Assuming you didn’t finance the purchase with a mortgage, your housing expenses now add up to $19,700 per year.

This means your net income after mandatory housing expenses comes to $28,300 or 2.83% on a $1 million cost basis.

Now the fun part. Remember you’ll have a paper loss from depreciation worth $36,363.64 per year for 27.5 years after which your $1 million property will become fully depreciated to zero.

Assuming you don’t have mortgage interest to deduct and any other expenses, repairs or maintenance costs, you already have a negative income liability. After taking depreciation into account, your income will be negative $8,063.64, or -0.81%.

The return calculations for buying an investment property in NYC become more complex if you are financing with a mortgage. The mortgage can be either positive leverage or negative leverage depending on whether the mortgage interest rate is higher or lower than your net investment yield.

Let’s assume in this example that you take out an $800,000 loan at a 4% interest rate. We’ll ignore principal payments for the sake of simplicity, which means you’ll owe $32,000 of mortgage interest per year. Added together, your mandatory housing expenses now total $51,700 per year. Excluding the tax benefits from depreciation, you’ll have negative cash flow of $3,700 per year.

If you include depreciation however, you’ll have total expenses of $88,063.64 per year, which results in a largely paper loss of $40,063.64 per year. Depending on your tax rate in NYC, the benefit of this tax loss can easily over-weigh the slightly negative cash flow in our example.

1According to a Hauseit survey of real estate industry professionals on average coop maintenance fees in NYC in 2018. We’ve assumed that condo common charges will be half of this amount since coop maintenance charges include real estate taxes.

Unexpected Costs with Buying Investment Property

It’s easy to get caught up with static return calculations when buying your first investment property.

It’s way too easy to forget that life happens, and that there could be unexpected repairs, fees, taxes and assessments that come up.

As a landlord, you face downside risk if anything breaks in the apartment and you or your handyman will need to go in and fix it. You can mitigate this risk by including language in your lease agreement whereby the tenant will take care of all repairs and maintenance under $50, for example installing a new light bulb.

What If Something Breaks?

However, there can be much larger downside risk if a major appliance breaks or leaks.

For example, what if your unit has a self-contained boiler or washer and dryer machine that starts leaking?

Not only might your insurance not cover all of the damages, but you might have to spend lots of time and money on plumbers who might or might not do a good job fixing the situation. For context, a new boiler can cost upwards of $10,000 with an equivalent amount in labor costs.

What if you live in a small building with only 6 or 7 units and the building needs to do major façade repairs after failing a Local Law 11 inspection? Depending on the scale of the work, façade repairs can cost six figures or more! All of these are costs that are hard to estimate in advance, but are real cash outflows which will impact your returns.

Cost of vacancy

Lastly, don’t forget about the cost of vacancy in case you can’t rent out your apartment for a period of time, and also the cost of a bad tenant.

NYC is notorious for making it difficult for landlords to evict tenants. You certainly can’t self-evict a tenant, and your case may be stuck in housing court for months before a Sheriff can come and execute the eviction.

The best way to mitigate this risk is to screen prospective tenants extremely carefully, and to conduct housing court checks to see if they’ve ever litigated against landlords before, and whether they’ve been evicted before.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Buying Rental Property in a LLC

Should you follow the commonly accepted wisdom of buying property in a LLC as an investor? While the benefits are obvious, such as privacy from having your name indexed in public records to limiting your liability to the specific property, it’s important to consider whether the cost and hassle of maintaining an additional LLC is worthwhile.

Personal umbrella insurance vs LLC

For starters, most small property investors with a few rental units may find it more economical to simply purchase a personal umbrella insurance policy to provide additional coverage in excess of the insurance provided through their regular home insurance.

This provides a similar benefit to the limited liability from a LLC structure and mitigates the amount of additional fees and paperwork associated with having a LLC for each property.

Remember that each additional LLC will also warrant additional fees from your tax accountant every year, not to mention the annual cost of registered agents and other filing fees and LLC publication requirements.

Furthermore, if a tenant decides to sue you, they can always name you in the lawsuit along with the LLC if they’ve discovered your real name. As a result, unless you intend to have layers of managers and authorized signatories between you and any tenants, the LLC may not protect you from being named in a lawsuit anyway.

As a result, you should carefully consider the pros and cons of buying a property in a LLC or in your own name. Do you care that much about having your name indexed as the property owner? Do you have significant other assets to protect? What is the cost of personal umbrella insurance vs the cost of an additional LLC? Do your research before deciding automatically that buying investment property in a LLC is the best approach!

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

Guys, what about this RPIE form you’re supposed to fill out if you’ve just converted your home into a rental property? This is a complete surprise to me, and I would have missed it had I not decided to glance at my property tax bill today … unbelievable.

“If you own income-producing property, you must file a Real Property Income and Expense (RPIE) statement or a claim of exclusion unless you are exempt by law. You must also file information about any ground or second floor storefront units on the premises, even if you are exempt from filing an RPIE statement. RPIE filers whose properties have an actual assessed value of $750,000 or greater will be required to file rent roll information. The deadline to file is June 1, 2021. Failure to file will result in penalties and interest, which will become a lien on your property if they go unpaid. Visit http://www.nyc.gov/rpie for more information.”

I’ve been Googling all over trying to figure out this Real Property Income and Expense (RPIE) form and whether an individual condo unit owner needs to file it. A bit frustrating as it was incredibly hard to find info online about this.

For context, I moved out of New York late last year and started renting out my condo apartment (small building, 20 units or so, condo apartments only).

The answer only became clear after starting the online RPIE application, and seeing an option for being excluded from having to file: “I am not required to file an RPIE for this year because my property: … e. is a residential unit that was sold and is not owned by the sponsor.”

And upon further research, finally came upon this gem: https://www1.nyc.gov/assets/finance/downloads/pdf/rpie/2015_forms/rpie-2015_nursing_home.pdf which further explained part e:

“Individual residential units in a condominium building/development. For a residential condominium that has commercial space, professional space, and/or has 10% or more unsold sponsor-owned units, an RPIE must be filed for the commercial space, professional space or the unsold sponsor-owned units. An RPIE must also be filed for residential units that are rentals and not intended to be individually owned.”

So voila, filed, checked part e, and didn’t give them any more info. However, they still ask you to voluntarily provide rent roll info if you want, as it helps them with tax assessment valuations.