Buying property in New York City as a Foreigner is quite easy as you are treated no differently versus domestic purchasers. With the exception of purchasing a co-op which we’ll discuss below, you’ll face no special taxes or levies in NYC just because you are a foreign purchaser.

However, your tax treatment can be significantly different should you choose to sell or if you were to pass away. As a result, you should learn what FIRPTA is, how the Estate Tax affects you, and what you can expect to pay in Capital Gains Tax when you sell.

Furthermore, it will be wise to team up with a veteran buyer’s broker who can guide you through the process and introduce you to local accountants, lawyers and mortgage lenders who can ensure that your property investment in NYC is a success.

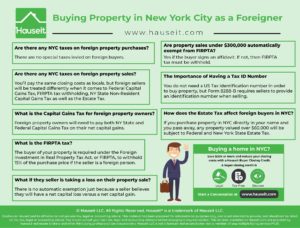

There are no special taxes levied on foreign real estate buyers in NYC. Foreign buyers pay the same closing costs in NYC as domestic home buyers. Although certain Democratic New York City politicians have tried to introduce “pied a terre” taxes aimed at foreign investors, they have so far all been shot down by Republican New York State politicians in Albany. This stands in stark contrast to many major cities across the world which have specifically targeted foreign buyers in an effort to curb property speculation and dramatic price increases. Ironically, some of these cities such as Hong Kong and London also boast dramatically higher average per per square foot property valuations than NYC!

London’s Stamp Duty Land Tax – The notorious “Stamp Tax” is a progressive tax on property purchases that increases as the price increases. Marginal tax rates currently top off at 12% of the purchase price in excess of 1.5 million pounds. The portion of the purchase price below 1.5 million pounds is taxed at progressively lower tax rates. However, foreign buyers will be especially hurt by an additional 3% flat tax on the purchase prices of second properties. Since foreign buyers will typically be buying investment properties, this is a tax that can be viewed as a direct effort to curb property speculation by foreigners.

Hong Kong – Hong Kong introduced a 15% tax in October 2012 on residential property purchases by anyone who is not a permanent resident. In addition, the Hong Kong government raised transaction taxes to as much as 20% of the sale price on any sales that take place within 3 years of purchase. Not surprisingly, the tax had the intended affect and mainland Chinese property investment has slowed dramatically since this tax went into effect.

Singapore – Singapore has a similar 15% tax levied against foreign apartment buyers. In January 2013 the government boosted the tax to 15% from a former level of 10%. This tax was imposed originally in December 2011 in an effort to curb property speculation. Interestingly enough, citizens of Switzerland, Norway, Iceland and Liechtenstein and the USA are exempt from this tax due to special tax treaties.

Vancouver – Vancouver recently imposed a 15% tax on foreign apartment buyers due to rampant property investment by foreign buyers, especially buyers from China. As a result, anyone who is not a citizen or permanent resident will have to pay this tax on their purchase as of April 2017.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Buying property in New York City as a foreigner becomes a little more complicated when it comes time for you to sell. Besides having to pay the same NYC closing costs as the locals, you’ll be treated differently when it comes to Federal Capital Gains Tax, FIRPTA tax withholding, New York State Non-Resident Capital Gains Tax as well as the Estate Tax should you pass away.

Foreign property owners in NYC will need to pay both State and Federal Capital Gains Tax on their net capital gains. Your net capital gains are calculated by taking your original purchase price and adding closing costs for both your purchase and sale, the cost of any capital improvements such as renovations and repairs, and subtracting this cost basis from your sale price. The Federal Capital Gains Tax is currently 20% of your net capital gains. Additionally, New York State charges a non-resident gains tax of 10.9% of your net capital gains.

Even if you lost money on your property investment, the buyer of your property is required under the Foreign Investment in Real Property Tax Act (FIRPTA) to withhold 15% of the purchase price if the seller is a foreign person. Once the IRS determines that you are current on all taxes owed to the US Government, you can receive a refund of the excess FIRPTA tax that was withheld by filing a tax return.

Pro Tip: File an 8288-B Application for Withholding Certificate to request a reduced amount or no withholding well in advance of your closing date. You should file a tax return the following year to obtain any refund due. Furthermore, by filing in advance the attorney can hold the withholding in escrow versus the IRS. Most foreign buyers will be more comfortable with a lawyer holding their withholding in escrow versus the US Government. In recent cases, we’ve had customers who have received a decision from the IRS within 4 to 6 weeks of closing.

No withholding is required if the seller is a US citizen, permanent resident or resident alien. A person can be classified as a resident alien if they meet either the physical presence test of being present in the US for at least 183 days in the current calendar year; or the substantial presence test of being present in the US for a weighted average of 183 days over three years.

Recent changes to FIRPTA

The Protecting Americans from Tax Hikes Act of 2015 (“PATH”) was signed into law by President Barack Obama on December 18, 2015. PATH included modifications to FIRPTA which took effect on sales occurring after February 16, 2016. A key change to FIRPTA included an increase of the withholding tax from 10% to 15% unless an exemption or reduce rate applies as detailed below. The actual tax liability is not increased, only the withholding amount.

Exemptions or reductions in FIRPTA withholding

Withholding is not required if

-

Seller furnishes buyer with a Non Foreign Person Certification

-

A Withholding Certificate is issued to seller stating that withholding is not due

-

Seller is a qualified foreign pension fund, or a subsidiary of a qualified foreign pension fund

-

Sales price is $300,000 or less and the buyer intends to reside in the property

Reduced withholding applies if

-

The sales price is under $1 million and the property is acquired for residential use

-

A Withholding Certificate is issued to the seller saying that a reduced amount is to be withheld

Who is responsible for withholding FIRPTA tax?

According to the IRS, the buyer is responsible for withholding potential taxes owed by a foreign property seller in the amount of 15% of the sale price. The IRS will have the power to seize the property to ensure that they receive the taxes owed to them. If the buyer does not enforce the withholding, the IRS can seize the buyer’s newly acquired property as well as other assets of the buyer.

Pro Tip: The buyer’s attorney can keep the FIRPTA withholding amount in escrow if there is a pending Form 8288-B. This is highly preferable for most foreign sellers vs having to apply for a refund from the IRS. Plus, you will typically receive your FIRTPA withholding back much faster (i.e. 1 month+ vs 1 year+).

What if they seller is taking a loss on their property sale?

There is no automatic exemption just because a seller believes they will have a net capital loss versus a net capital gain. If a foreign property seller believes they should be exempt from FIRPTA withholding because there is no gain on their sale, they should consult with a tax accountant and apply for a withholding certificate from the IRS that will grant them an exemption. They should apply using IRS form 8288-B well before closing.

Are property sales under $300,000 automatically exempt from FIRPTA?

The buyer must agree to sign an affidavit stating that he or she intends to live in the property and that the purchase price is indeed under $300,000. If the buyer chooses not to sign such an affidavit, then FIRPTA tax must be withheld.

The Importance of Having a Tax ID Number

In practice, most foreign sellers are not able to complete Form 8288-B prior to closing because they do not have a US Tax ID number. Remember that you do not need a US Tax Identification number in order to buy property, but Form 8288-B requires sellers to provide an identification number.

Getting a US Tax Identification number can be a difficult and lengthy process. You’ll need to fill out Form W-7 and send in original or supporting identification documents. A foreign passport is the most commonly used supporting document allowed per the instructions accompanying Form W-7; however, we never recommend mailing your original passport to anyone. That means you’ll need to get a certified copy from the original issuing agency who will provide an exact copy plus an official stamped seal. You can typically request this from your local embassy or consulate.

Once you’ve submitted the documents to the IRS, you’ll have to wait for your identification number or try again if the form is rejected. Unfortunately, you should not expect a reason for rejection, you will simply have to keep trying until it is accepted.

Additional Cost of FIRPTA Compliance

The additional costs from complying with FIRPTA can be substantial for foreigner sellers of property in NYC. After you add up the additional legal, accounting and filing fees, you can get a five figure USD bill for all of the additional work required. However, considering that FIRPTA withholding is now 15% of the gross sale price, it’s a small sum to pay to do it right.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

If you purchase property in NYC directly in your name and you pass away, any property valued over $60,000 will be subject to Federal and New York State Estate Tax. The Federal Estate Tax is 40% and the New York State Estate Tax has a maximum rate of 16%. Foreigners do not enjoy any exemptions from the Federal and New York State Estate Tax that US citizens enjoy. For example, US citizens are given an exemption of $5.49 million per person, or $10.98 million per married couple on their Federal Estate Tax.

These limits are periodically adjusted for inflation. Not all states have their own estate taxes, but New York State happens to have one. There is a similar exemption from the New York State Estate Tax of $5.25 million that is in effect until December 31, 2018. In 2019 the New York State Estate Tax exemption is set to match the Federal Exemption amount.

They suggest purchasing the property itself using a New York State Limited Liability Company, and concurrently forming an offshore company (i.e. typically a British Virgin Islands company) to act as the sole member and owner of the LLC. This way, when the foreign owner passes away his or her heirs will be inheriting shares in a foreign corporation and not real property located in the US.

According to these attorneys and estate planners, the IRS will view this form of ownership of the property as an intangible asset and therefore not subject to Estate Tax. While this is certainly clever if it works, we suggest you diligence whether this will change your Capital Gains Tax rate as you may be subjected to a higher corporate tax rate. We cannot endorse this behavior nor can we confirm its effectiveness. We suggest you speak with a tax or legal professional about your specific situation.

As a foreigner, you may have to limit yourself to investing in condominiums because of the strict House Rules around subletting and primary residency imposed on co-op apartment owners. Furthermore, you may not want to invest in free-standing property such as multi-family or townhouses either because of the maintenance work required. Unless you plan on investing on an institutional scale with teams of contractors, superintendents and property managers on the ground, it may be simpler to buy a condo where you’re only responsible for the interior of your unit.

Buying property in New York City as a foreigner is easy precisely because of the low amount of work required in owning a condominium. If you have a mortgage, the bank will automatically take care of your city tax payments by holding a portion of your monthly mortgage payment in escrow. All you’ll need to remember to do is to pay your monthly common charges, which in many cases today can be paid automatically each month online.

In terms of property management, you can quite easily make friends with the building’s superintendent or a local handyman, and have him help out with any minor apartment repairs. Any veteran real estate agent will advise you that most lease agreements will state that any minor repairs (i.e. under $50) is the sole responsibility of the tenant. Therefore, you’ll only need to rely on the superintendent or a local handyman for anything more serious that needs to be repaired.

If you don’t plan on being on call for late night complaints from your tenant about water leaks and other emergencies, it may make sense to hire a property manager to handle everything from collecting rent to handling tenant inquiries.

However, instead of trying to hire a larger, traditional property manager who will not only be more expensive but will typically only manage entire apartment buildings, you could consider teaming up with your local, veteran real estate agent you’re already working with!

Depending on how you negotiate and how sizable the rent roll is, you can usually get your local agent to take on the property management role for anywhere between 4 to 15% of the annual rent roll. It may be simpler and cheaper to deal with one point of contact for everything related to your home!

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

Hello, this is Giuseppi from Bergamo in Italy. My sister is moving to New York City this September. Do you have a good buyer agent who speaks Italiano who can introduce to us? I have provided my Email to you in the form. Hope to hear from you. Ciao.

Hello there, do you have any agents who speak French? This is Louis from Nice in France. I am looking to move by October. My friend Riddhi who is a banker in the city recommended you

This is fantastic information gentlemen. I was looking for info on selling my flat in NYC and came across your research. I think it’s quite tricky really that the US doesn’t tax on the way in, but gets you on the way out if you’re a foreigner. The estate tax is also quite shocking. I believe your President Trump calls it the Death Tax. That’s no good!

How much does it cost to have a local real estate agent manage my property? I don’t want to pay a big property management company some crazy percentage of my monthly rental income.

What’s reasonable and typical? Can they just earn income from renting it for me and having the tenant pay the broker fee?

You should mention that the way to get around FIRPTA withholding is to have your lawyer get you a Certificate of Reduced Withholding. Essentially if you put in paperwork to IRS early before closing, showing proof of what you paid for, invoice from broker, renovation costs etc. Then the FIRPTA withholding money can sit in the attorney’s escrow vs mailing a check to the government. Much better!