Cap rate is an important metric used by real estate investors to compare investment returns between different rental properties, before income taxes and any potential financing.

Essentially, cap rate can be calculated by dividing the net operating income of a property by the investor’s cost basis in the property, where net operating income is gross rent less expenses and the cost basis of the property is the purchase price plus closing costs and any renovation costs.

Cap rate definition

Cap rate, short for capitalization rate, is a measure used in real estate to evaluate the potential return on an investment property. Simply put, cap rate is the percentage of the property’s value that is expected to be generated in income in a given year.

To calculate cap rate, you divide the property’s net operating income (NOI) by its current market value or cost basis. The NOI is the income the property generates from rental payments or other sources, minus any operating expenses such as property taxes, HoA dues or condo common charges, maintenance costs and insurance.

For example, let’s say you are considering purchasing a rental property for $500,000 that generates an NOI of $50,000 per year. The cap rate for this property would be 10% ($50,000 / $500,000). This means that the property is expected to generate a 10% return on your investment each year.

The above example is of course a simplification, as the NOI will technically be divided by an investor’s cost basis, which would consist of the $500,000 purchase price plus closing costs plus any renovations done post-closing.

Cap rate is an important tool for real estate investors because it helps them compare the potential returns of different investment properties.

A higher cap rate indicates a higher potential return, while a lower cap rate suggests a lower return. However, it’s important to keep in mind that cap rate is just one factor to consider when evaluating an investment property, and other factors such as location, market trends, and potential for appreciation should also be taken into account.

Cap rate formula

The capitalization rate, or “cap rate” for short, is a commonly used metric in real estate investment analysis. The cap rate formula is a simple way to determine the value of an income-generating property by calculating the rate of return that an investor can expect to earn on their investment. The cap rate is calculated by dividing the net operating income (NOI) of the property by its current market value or cost basis.

The formula for cap rate is: Cap Rate = Net Operating Income / Cost Basis

Net Operating Income (NOI) is calculated by subtracting all operating expenses from the gross income generated by the property. Operating expenses include property taxes, insurance, utilities, maintenance, repairs, and property management fees. Gross income is the total income generated by the property, including rental income and any other revenue streams.

The cost basis is calculated by adding the purchase price (or prospective purchase price) to the buyer’s or potential buyer’s closing costs and the cost of any renovations done or to be done post-closing. Sometimes instead of cost basis, people will replace the denominator with current market value. This simply changes the calculation from the original cap rate at the buyer’s purchase price, to the current cap rate a prospective buyer today might encounter.

For example, if a property generates $100,000 in gross income and has $30,000 in operating expenses, the NOI would be $70,000.

If the property is currently valued at $1,000,000 (or its original cost basis is $1,000,000), the cap rate would be 7% ($70,000 / $1,000,000 = 0.07 or 7%).

The cap rate is an important tool for real estate investors to evaluate the profitability of a potential investment. A higher cap rate indicates a higher rate of return on investment, while a lower cap rate indicates a lower rate of return. It is important to keep in mind that the cap rate is just one factor to consider when evaluating an investment opportunity, and other factors such as location, market trends, and potential for appreciation should also be taken into account.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

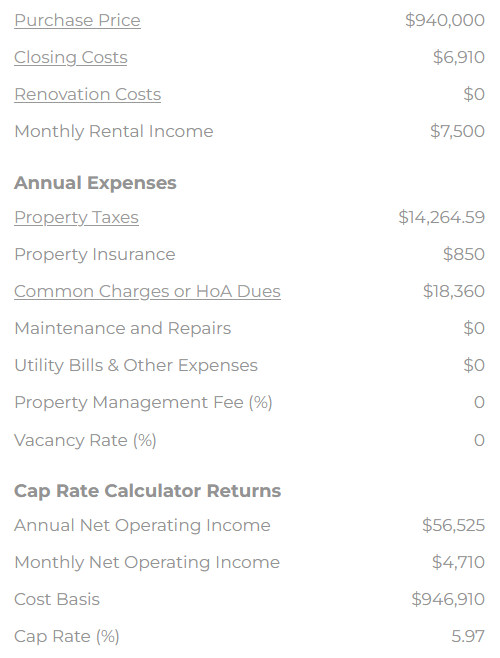

Purchase Price

Closing Costs

Renovation Costs

Monthly Rental Income

Annual Expenses

Property Taxes

Property Insurance

Common Charges or HoA Fees

Maintenance and Repairs

Utility Bills & Other Expenses

Property Management Fee (%)

Vacancy Rate (%)

Monthly Rental Income

Annual Expenses

Property Insurance

Maintenance and Repairs

Utility Bills & Other Expenses

Property Management Fee (%)

Vacancy Rate (%)

Cap Rate Calculator Returns

Annual Net Operating Income

Monthly Net Operating Income

Cost Basis

Cap Rate (%)

My friend is a subcontractor who hasn’t been paid for his services with the recent project he handled, so he wants to get a mechanical lien soon. Thank you for informing us that most liens expire after a certain amount of time, with a one-year time limit in some states and unlimited for property tax and common charge liens until the balance has been paid off.