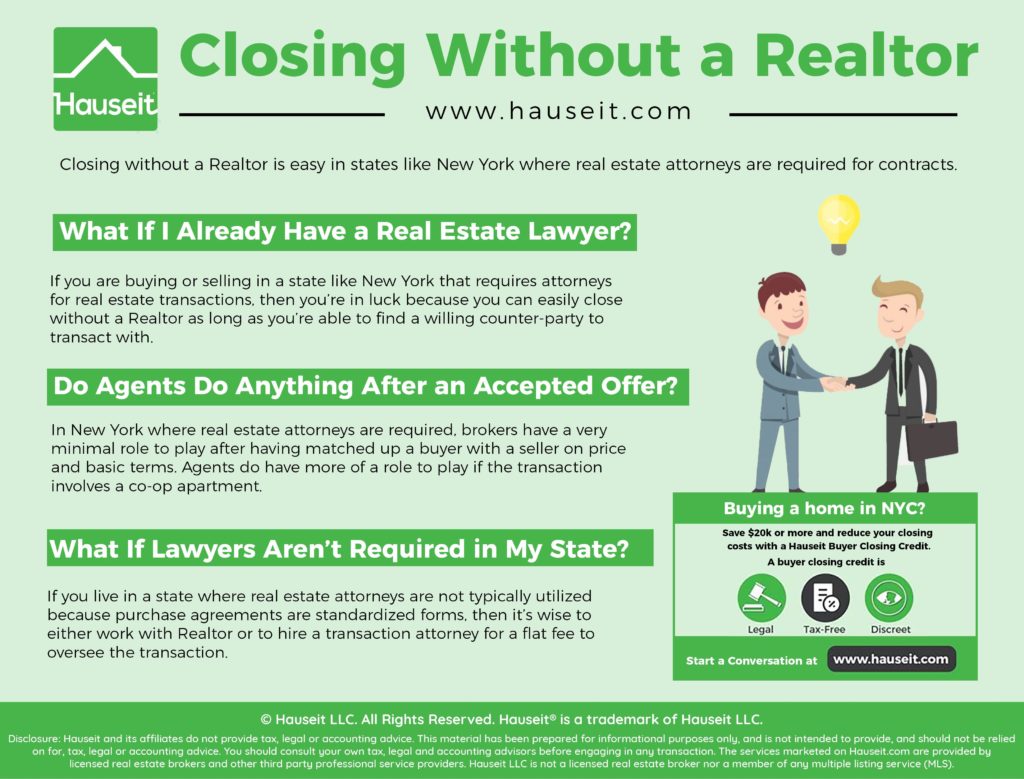

Closing without a Realtor is easy in states like New York where real estate attorneys are required for contracts. Closing without a Realtor is more difficult in states like California where real estate attorneys are not commonly utilized, and where Realtors help customers fill out standardized purchase agreements instead of customized contracts.

Table of Contents:

If you are buying or selling in a state like New York that requires attorneys for real estate transactions, then you’re in luck because you can easily close without a Realtor as long as you’re able to find a willing counter-party to transact with.

In states like New York where both the seller and the buyer have their own attorney, real estate agents’ roles are confined largely to matching up buyers and sellers. Once a real estate agent has secured a non-binding, accepted offer on behalf of their client, the real estate attorneys take over and quarterback the rest of the transaction.

For example, once the listing agent has secured an accepted offer, he or she will circulate a deal sheet (i.e. transaction summary) to the lawyers and brokers representing both parties.

The deal sheet will have some basic agreed upon terms such as the price, any contingencies and perhaps a tentative amount of down payment by the buyer.

The deal sheet may also include any inclusions or exclusions, although this part is often overlooked by the busy agents in NYC.

The main point of the deal sheet is to put the buyer’s attorney in touch with the seller’s attorney so they can take it from there. The seller’s attorney will send a draft contract to the buyer’s attorney, and they’ll begin the contract review and negotiation process.

The buyer’s attorney will also be responsible for legal and financial due diligence on behalf of the buyer.

In big cities like NYC where condos and coops exist, this will be a very important role because there will be board meeting minutes, original condo or coop offering plans, amendments to the offering plan, operating budgets and annual building financial statements for the attorney to review.

This is in addition to ordering and reviewing a title search or a coop lien search and checking for judgments, liens or city violations.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

In states like New York where real estate attorneys are required, brokers have a very minimal role to play after having matched up a buyer with a seller on price and basic terms.

Keep in mind that an accepted offer is not binding until contracts are signed, so sometimes additional negotiation does happen before a buyer agrees to sign a contract. In fact, negotiating after inspection is a common tactic used by some savvy buyers to try to renegotiate the price or to get concessions from a seller after they’ve led the seller on with an accepted offer.

However, negotiating after an accepted offer is an infrequent occurrence, and often times the lawyers will negotiate even the price after an accepted offer without needing assistance from the brokers.

Agents do have more of a role to play if the transaction involves a co-op apartment. That’s because co-ops require purchasers to complete a coop board package and pass a co-op board interview.

The board package is legitimately challenging and can be quite a pain to put together.

Even though some coops are becoming more reasonable these days by accepting electronic submissions, many coops for example in NYC still require 10 physical copies or more of the board package. Keep in mind that even one copy of a board package can be hundreds of pages in length. As a result, it’s sometimes not even possible for a bike messenger to transport 10 copies of a co-op board package across the city.

The buyer’s agent plays a key role in guiding the buyer through the co-op board approval and application process, and in reviewing and helping organize the buyer’s documentation. However, it is still the buyer who ultimately fills out the forms and applications, and who retrieves the required personal and professional reference letters and backup documentation.

The listing agent also plays an important role in double checking the buyer’s board package before it is submitted to the managing agent. This is typically helpful because the listing agent usually will have experience with the coop board and managing agent, and will know what they will and won’t accept. Plus, it’s helpful to have a second set of eyes to make sure you don’t have any mistakes in this application.

Lastly, remember that the agents will schedule and conduct the final walk-through before closing. And if you’re buying a new construction home, there will actually be two walk-throughs that your agent will do with you. The first one to develop a punch-list of items for the sponsor to fix, and a second walk-through to make sure that everything on the punch list has been completed right before closing.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

If you live in a state where real estate attorneys are not typically utilized because purchase agreements are standardized forms, then it’s wise to either work with a Realtor or to hire a transaction attorney for a flat fee to oversee the transaction.

Even though forms may be standardized and quite simple for Realtors to guide buyers and sellers through them without an attorney, you will still be new to these forms. As a result, it’s a good idea to not do this completely unsupervised.

You should easily be able to find a flat fee transaction attorney for under $1,000 to oversee the transaction, perhaps on behalf of both parties. Additionally, this transaction attorney can help the buyer order a title search, and can help hold the buyer’s earnest money check in escrow. Very helpful considering both of those things would be harder for customers to do by themselves!

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.