Let’s face it, millennials these days are much less likely than their parent’s generation to be able to afford to buy a home by themselves. In fact, less than 50% of millennials earn more money than their parents by age 30 on an inflation adjusted basis.

This is in stark contrast to baby boomers, where 90% of their generation earned more than their parents by age 30. Plus, don’t forget that baby boomers got to buy when property, stocks and other assets were dirt cheap. Here’s some advice for co buying a house or apartment you can use, and what to know before signing up to be a co-borrower on a mortgage.

Table of Contents:

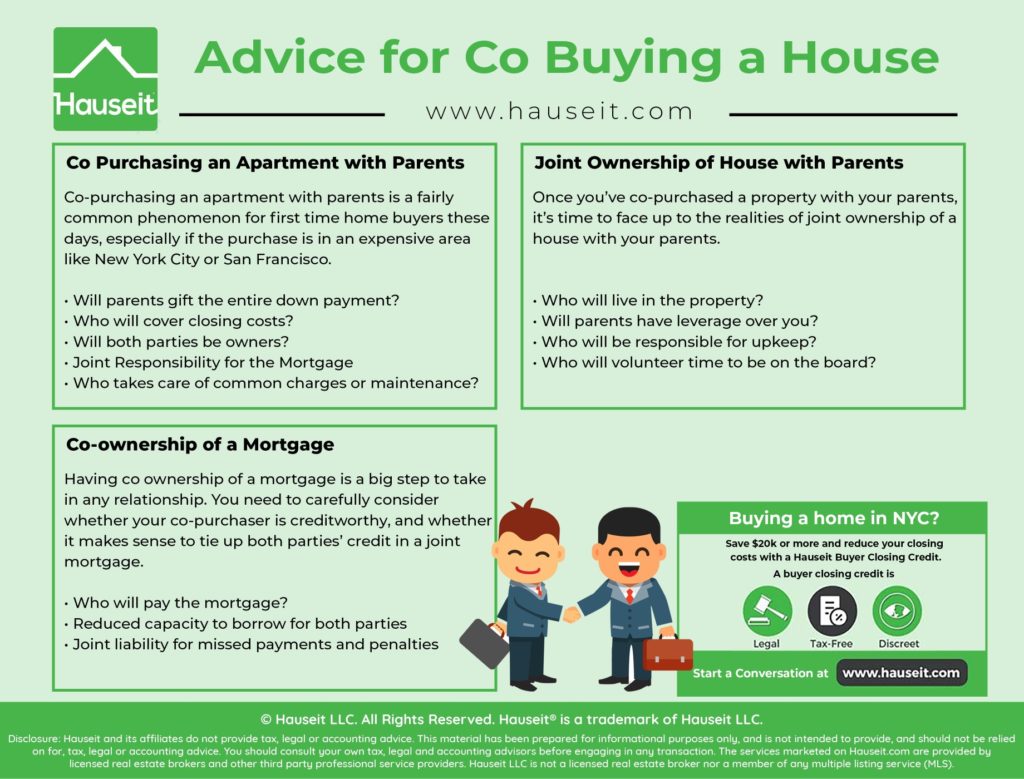

Co-purchasing an apartment with parents is a fairly common phenomenon for first time home buyers these days, especially if the purchase is in an expensive area like New York City or San Francisco.

Here are a few things to keep in mind when co buying a house or apartment with parents:

Gifting the down payment

Will parents be gifting the entire down payment to the child? Or will the child be responsible for putting up part of the down payment?

Gifts need to be documented. Lenders will require a gift letter for a mortgage and co-op boards will require a co-op gift letter too.

Covering closing costs

Will parents be paying for the child’s closing costs, or will the child be expected to cover closing costs on their own? These expenses are not insignificant, for example NYC closing costs for buyers can range from 1.5% to 6% depending on whether the buyer is financing, buying new construction, and buying a co-op vs condo.

Will both parties be owners?

Will the parents want to be co-owners of the property, or will it be a straight gift and the child will be the sole owner? Unless otherwise specified, ownership is automatically assumed to be split equally between everyone listed on the deed (condos and houses) or stock and lease (co-ops).

Joint Responsibility for the Mortgage

Who will be responsible for paying the mortgage every month? Unless an exception is made, every owner will be a co-borrower on the mortgage. This has ramifications for each co-borrower’s credit score and debt-to-income ratios, which could affect their ability to borrow more in the future.

Who takes care of common charges or maintenance?

Who will be responsible for covering the ongoing carrying costs of the apartment, such as condo common charges or co-op maintenance fees? These can add up to be quite a lot, and sometimes even more than the mortgage payment in an expensive city like NYC.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Joint Ownership of House with Parents

Once you’ve co-purchased a property with your parents, it’s time to face up to the realities of joint ownership of a house with your parents. Here are just a few important things to consider:

Who will live in the property?

The first and most important question is, who will actually get to live in the property?

If the child will be solely occupying the apartment, will he or she owe any sort of rent or non-monetary compensation to the parent?

Will parents have leverage over you?

Will your parents have leverage over you in arguments and disagreements because they own part of your home? Think long and hard about whether you want someone, even a family member, to have this sort of leverage over you.

Who will be responsible for upkeep?

Who will be responsible for maintenance and repairs of the property? What if something major like a boiler tank leaks and breaks? What if the roof needs to be repaired? What if your board levies a massive co-op special assessment because your building needs extensive Local Law 11 façade repairs? Owning a house can involve significant costs in maintenance and repair. Who will be responsible for paying for these?

Who will be on the board?

If you live in a condo or co-op building, you may have an opportunity to serve on the board and help oversee the operations of the building. This is extremely important and can take quite a bit of time and work, especially if you live in a smaller building with fewer people who will volunteer. Will the child or parents be responsible for participating in the board? This responsibility is magnified if you live in a self-managed condo or co-op building where no managing agent exists.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Co-ownership of a Mortgage

Having co ownership of a mortgage is a big step to take in any relationship. You need to carefully consider whether your co-purchaser is creditworthy, and whether it makes sense to tie up both parties’ credit in a joint mortgage.

Who will pay the mortgage?

Mortgage companies will automatically debit each month’s mortgage payment from one bank account, meaning that one person will be responsible for paying the mortgage unless alternative arrangements are specified. Keep in mind that your mortgage payments will likely include money to be set aside in escrow for property insurance and property taxes. Typically, a lender will take responsibility for ensuring that you pay for home insurance and that you pay your property taxes through the money that you have with them in escrow.

Reduced capacity to borrow

Being a co-borrower on a mortgage means both the loan and the monthly required payments will be on your credit report. This reduces the future borrowing capacity of each co-borrower as much as if they had been the sole borrower. This downside should be carefully considered, especially if the mortgage is especially large or if one of the co-borrowers wishes to get additional financing in the future.

Joint Liability

Being co-borrowers on a mortgage means everyone will be on the hook for the loan, and will have their credit scores severely impacted if they miss a mortgage payment or default on the loan. Furthermore, who will be responsible for double checking that mortgage payments are indeed going through each month, and that somehow their auto payments haven’t somehow been disabled. Joint liability also means you’ll both be on the hook for any fines for late payments.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.