If you’re buying a co-op in NYC and preparing a board application, you may be asked to submit a post-closing cash flow statement alongside your financial statement. The post-close statement of cash flows is actually rather simple and nothing to be concerned about.

Truth be told, it’s quite rare for a co-op to request a post-close statement of cash flows as part of the board application. If they do request one, simply download one of our templates below and follow the instructions in this article for completing it!

Table of Contents:

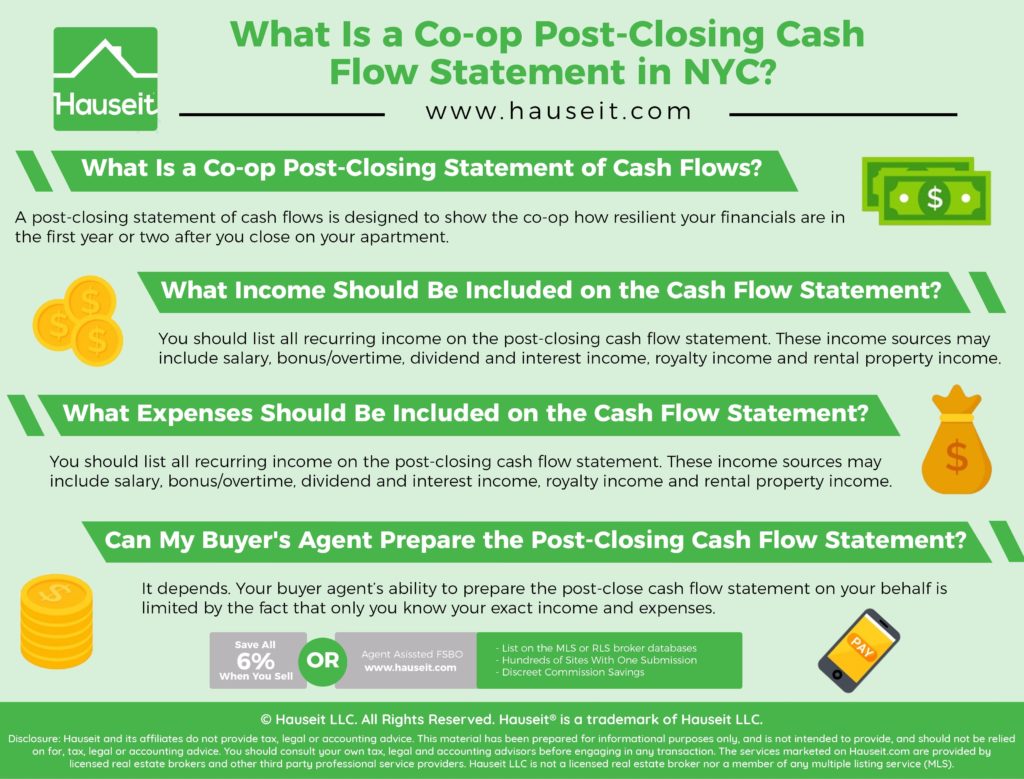

A post-closing statement of cash flows is designed to show the co-op how resilient your financials are in the first year or two after you close on your apartment.

The basis for this request is an extension of the co-ops standard assessment of your post-closing liquidity.

In short, a co-op wants to make sure that you can have sufficient cash reserves which will allow you to continue paying the monthly maintenance bill for some time even if you suffer a job loss or other transient dip in income.

The post-closing cash flow statement itself shows your starting cash balance each month and computes an ending monthly cash balance by adding your income and deducting your living expenses.

The starting cash balance for the next month is simply the ending cash balance from the month prior.

Since most co-ops have a debt-to-income target for applicants of 25% to 30%, this means that by default you should build net worth each month because your fixed housing expenses are a small fraction of your total income.

Therefore, a post-closing statement of cash flows should always show your cash balance to be increasing over time.

Because the cash flow statement should always show a net worth gain over time, one could make the argument that it’s a superfluous request.

The truth is that co-ops may request it in order to test you and see what sorts of living expenses you have and may reveal to them.

The entire co-op board approval process in NYC is as much a test of your ability to follow instructions and keep your head down as it is an evaluation of your overall financial qualifications.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

You should list all recurring income on the post-closing cash flow statement. These income sources may include salary, bonus/overtime, dividend and interest income, royalty income and rental property income.

If you occasionally receive supplemental or side income, it’s best not to include this since it’s not recurring and impossible to precisely predict (as is the case with recurring income).

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

It’s a good idea to group your large recurring living expenses into digestible categories, such as co-op mortgage, co-op maintenance, student loan payment and school fees.

When it comes to living expenses, the level of detail depends on the expectations of the co-op board.

If the building is more flexible, you can simply group all other variable expenses into a ‘living expenses’ category.

Alternatively, you can subdivide this into a handful of categories such as food, utilities and entertainment.

Unless you are told otherwise, it’s usually overkill to go into any further detail with the categorization. Examples of going too far include specific categorization such as ‘movie tickets’, ‘vacations’, or ‘gym fees’.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

It depends. Your buyer agent’s ability to prepare the post-close cash flow statement on your behalf is limited by the fact that only you know your exact income and expenses.

If you’re able to share the inputs to the cash flow statement with your buyer’s agent, they may be able to generate the completed statement on your behalf.

However, completing a post-closing cash flow statement is quite easy because all of the income and expense inputs are consistent each month.

This means that the post-closing cash flow statement generates automatically in Excel once you enter the starting cash, income and expense information into the first month.

A post-closing financial statement is simply your standard financial statement with the following adjustments:

-

Add loan balance to ‘liabilities’

-

Add purchase price to real estate under ‘assets’

-

Remove ‘contract deposit’ from assets

It’s unclear to what extent co-op boards expect you to also reduce your post-closing cash balance by the amount of your buyer closing costs.

This is because co-op buyer closing costs are just 1% to 2% of the purchase price, which is fairly low for an average co-op apartment.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

To download a co-op post-closing cash flow statement Excel template, click here.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.