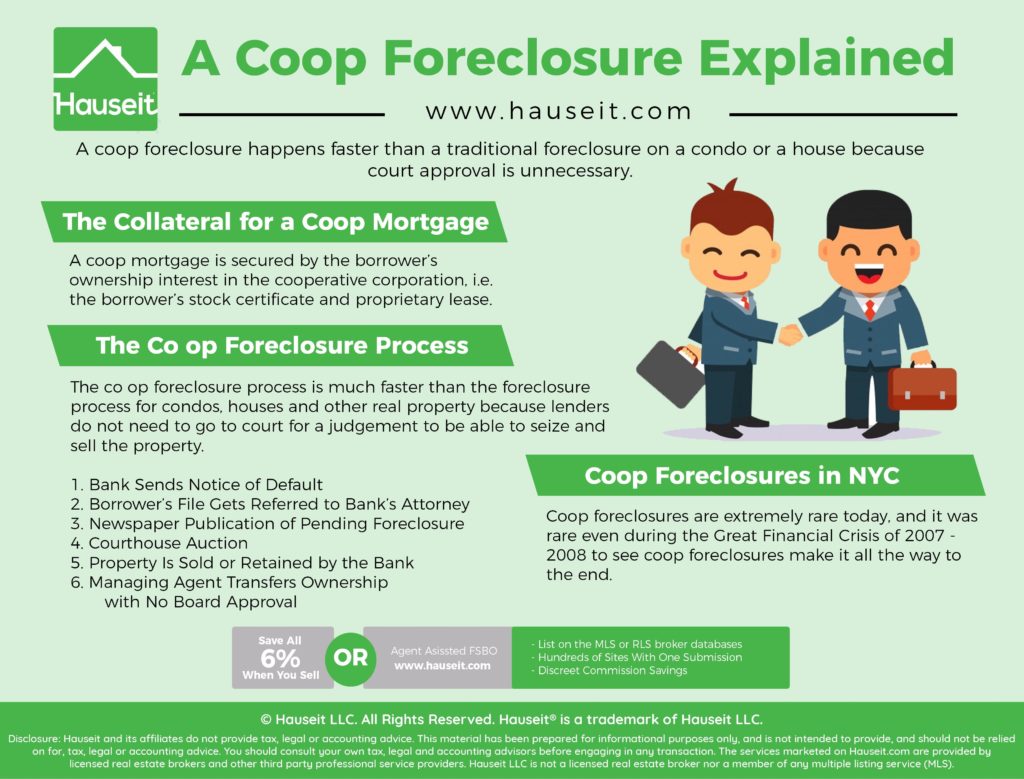

A coop foreclosure happens faster than a traditional foreclosure on a condo or a house because court approval is unnecessary. Furthermore, coop board approval is not necessary for a coop foreclosure which can save months of time.

Table of Contents:

A coop mortgage is secured by the borrower’s ownership interest in the cooperative corporation, i.e. the borrower’s stock certificate and proprietary lease.

A coop mortgage consists of a promissory note and a cooperative loan security agreement.

The promissory note is essentially a written promise to pay a debt, and the cooperative loan security agreement establishes the stock certificate and the proprietary lease as collateral which will secure the lender’s debt.

After a coop mortgage is finalized, the bank will file a UCC Financing Statement and take the physical coop stock certificate and proprietary lease as collateral until the debt is cleared.

Remember that coop apartments aren’t considered to be real property, and thus a coop mortgage is not technically a mortgage since mortgages are only for real property such as condos and houses.

As a result, banks have to rely on the Uniform Commercial Code (UCC) to be able to extend secured loans on co-op apartments.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The coop foreclosure process is much faster than the foreclosure process for condos, houses and other real property because lenders do not need to go to court for a judgement to be able to seize and sell the property.

Since a loan on a co-op apartment is not technically a mortgage, a bank can conduct a foreclosure sale under Article 9 of the Uniform Commercial Code without needing a judge’s approval. This is great for lenders because they can maximize their recovery by avoiding a costly and lengthy judicial foreclosure sale.

1. Bank Sends Notice of Default

The lender will send an official notice of default typically between five to fifteen days after a borrower has missed a loan payment. Remember that the UCC does not define what a default is, so you’ll have to read the fine print in the loan or security agreement.

2. Borrower’s File Gets Referred to Bank’s Attorney

If the borrower does not cure the default, the borrower’s case will get referred to the bank’s attorney. The bank’s attorney will typically send some additional notices and make some additional demands to the borrower to cure the default.

3. Newspaper Publication of Pending Foreclosure

Assuming the borrower still has not cured the default, the bank’s attorney will publish a notice of the pending foreclosure for the co-op apartment in a local newspaper for three successive weeks. Foreclosure attorneys have told us that it doesn’t matter which newspaper is used to fulfill this requirement, and banks’ attorneys will often just choose the cheapest local paper for this publication requirement.

4. Courthouse Auction

If the borrower still hasn’t bothered to reach out to negotiate, pay off the loan, refinance the loan or sell the property perhaps through a short sale, then an auction will be held at the local county courthouse.

5. Property Is Sold or Retained by the Bank

The bank will have a reserve price, commonly known as a “knockdown price,” which is the minimum price that the bank will accept from a bidder. The knockdown price is determined by the bank on a case by case basis, dependent on a number of internal factors. In most situations, the knockdown price will be meaningfully less than the loan amount, let’s say by 10% to 20%.

If a bidder offers even $1 more than the knockdown price, the coop apartment will be sold to that bidder. If however no one bids more than the bank’s reserve price, the bank will take the property onto its books and the home will be classified as a real estate owned (REO) property.

6. Managing Agent Transfers Ownership

No board approval is needed in a coop foreclosure. The bank will bring the physical stock certificate and proprietary lease to the managing agent’s office, and the managing agent will issue a new stock and lease to the buyer of the foreclosed coop apartment. Remember that you’ll need to do a coop lien search beforehand.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Coop foreclosures are extremely rare today, and it was rare even during the Great Financial Crisis of 2007-2008 to see coop foreclosures make it all the way to the end.

That’s because coop boards generally do a pretty good job of vetting and qualifying potential buyers, vs condo boards which don’t really have a say vetting or approving buyers.

Furthermore, because the NYC real estate market is very liquid with a strong demand base from all over the world, it’s relatively easy to find a buyer through a short sale if a coop shareholder falls behind on monthly payments.

At the right price, it’s almost a certainty in today’s market that a buyer for a co-op apartment can be found.

However, potential short sellers should be warned that banks’ short sale applications will require all sorts of personal and financial information in order to demonstrate why you can’t pay. You’ll have to provide the bank with your social security number, bank account statements, retirement and brokerage account statements and W-2 forms etc.

Furthermore, your lender can technically sue you for the deficiency in a coop short sale, especially if they think you have other assets which can help pay for their loss. However, this rarely happens in practice because it’s usually not worth the effort for a bank to sue and go after a borrower for a deficiency.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.