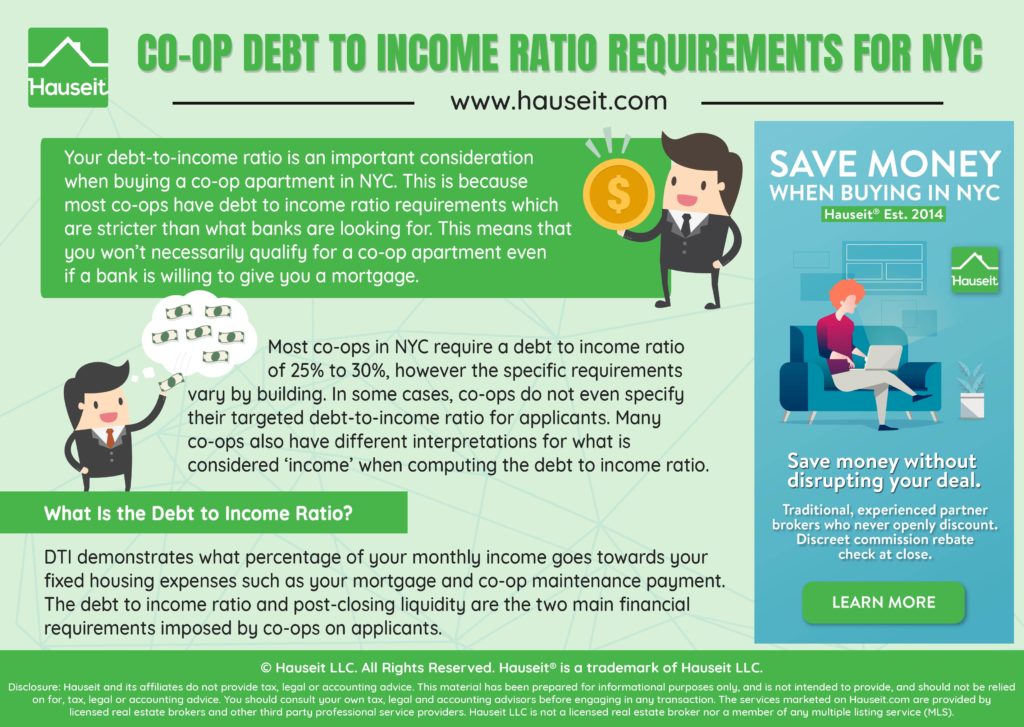

Your debt-to-income ratio (DTI) is an important consideration when figuring out how much home you can afford in NYC. The DTI is especially important if you’re buying a co-op apartment, as most co-ops have deb to income ratio requirements which are stricter than what banks are looking for. This means that you won’t necessarily qualify for a co-op apartment even if a bank is willing to give you a mortgage.

Most co-ops in NYC are looking for a DTI of 25% to 30%, however the specific requirements vary by building. In some cases, co-ops do not even specify their targeted debt-to-income ratio for applicants. Furthermore, many co-ops have different interpretations for what is considered ‘income’ when computing the debt to income ratio.

Table of Contents:

The Debt-to-Income Ratio demonstrates what percentage of your monthly income goes towards your fixed housing expenses such as your mortgage and co-op maintenance payment. The debt to income ratio and post-closing liquidity are the two main financial requirements imposed by co-ops on applicants.

Let’s say you make $15,000 a month. If your debt-to-income ratio is 25%, it means that you spend 25% of your monthly salary on housing expenses.

This means that the total amount of money you spend on your monthly mortgage and co-op maintenance (plus special assessments) is 25% x $15,000 = $3,750.

If you have other fixed debt payments such as student loans, another mortgage or a car payment, co-ops may also ask you to include these when computing your debt to income ratio.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

A typical co-op calculates your debt-to-income ratio by dividing your monthly income by the sum of your monthly liability payments. Here’s an example:

What’s interesting about co-ops is that each one has its own particular rules about how to calculate DTI. For example, many co-ops exclude ‘passive’ income for the purposes of computing your monthly income. Other co-ops will have rules for how you calculate the monthly mortgage payment used in the DTI calculation.

Here are the requirements for a co-op building in Lower Manhattan, as stated on the building’s co-op purchase application:

Before submitting an offer on a co-op apartment, it’s essential that you discuss the building with your buyer’s agent to make sure that you qualify financially. This is especially important if you have other fixed liabilities, such as the mortgage and/or monthly maintenance for another home.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The average debt-to-income ratio for co-op apartments in NYC is between 25% to 30%. It’s also fairly common to encounter coops which permit debt to income ratio in the low 30% area: 31%, 32% and 33%.

Co-ops often take a holistic approach to evaluating a buyer’s financials, which means that many buildings do not specify an exact requirement for debt-to-income ratio.

If the co-op you are considering does not have stated financial requirements, it’s a good idea to leverage the expertise of a seasoned buyer’s broker in order to help assess whether you’d qualify financially for the building.

Here’s a good example: let’s say you are retired and have a net worth of $5,000,000. Your monthly income is a relatively humble $5,000 due to the fact that you are no longer working. The co-op you are interested in is asking $750,000, and you still want to finance the purchase Looking holistically at your financials, any co-op building will see that you are a highly qualified individual.

However, there’s a chance that your debt-to-income ratio may be slightly higher than 30%. If the co-op is looking for something around ~30% or the building does not specify, it’s a good idea to speak with the co-op transfer agent to see if he or she can offer any further insight as to how the board would interpret your financial situation.

If a co-op has financial requirements for applicants, they will usually be stated on the co-op’s purchase application (board application).

Your buyer’s broker will usually request the board package from the listing agent for review early on in the process.

If the listing agent is unprepared and is not familiar with the co-op’s financial requirements, your buyer’s agent can reach out directly to the building’s managing agent in order to learn about any DTI (and/or post-closing liquidity) requirements maintained by the co-op board.

Larger co-op buildings typically have the means to hire larger managing agents, and many of these companies now have an online database where you can download a co-op’s board package, house rules, sublet application and various other documents (possibly including the building’s financials).

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.