Dividing real estate in a divorce can be easy or messy, depending on how amicable the divorcing couple is towards each other. Often times, the parties will have a general agreement about who keeps the house or how it’s to be split, and a matrimonial attorney simply needs to paper the agreement.

If however the parties can’t agree on who gets to keep the property, or how the proceeds are to be split if it’s to be sold, then one needs to file a motion in court and have a judge decide on what’s fair. We’ll explain how a judge determines what’s fair and much more in the following article.

The home is usually the primary marital asset, and as a result it is usually the most contentious one in divorce proceedings.

In more amicable divorce proceedings, the parties will mutually agree on a divorce settlement which decides who keeps the house or how the proceeds are split if it’s to be sold.

However, in the case of a disagreement, a hearing or trial will need to take place and the court will decide based on a whole host of statutory factors.

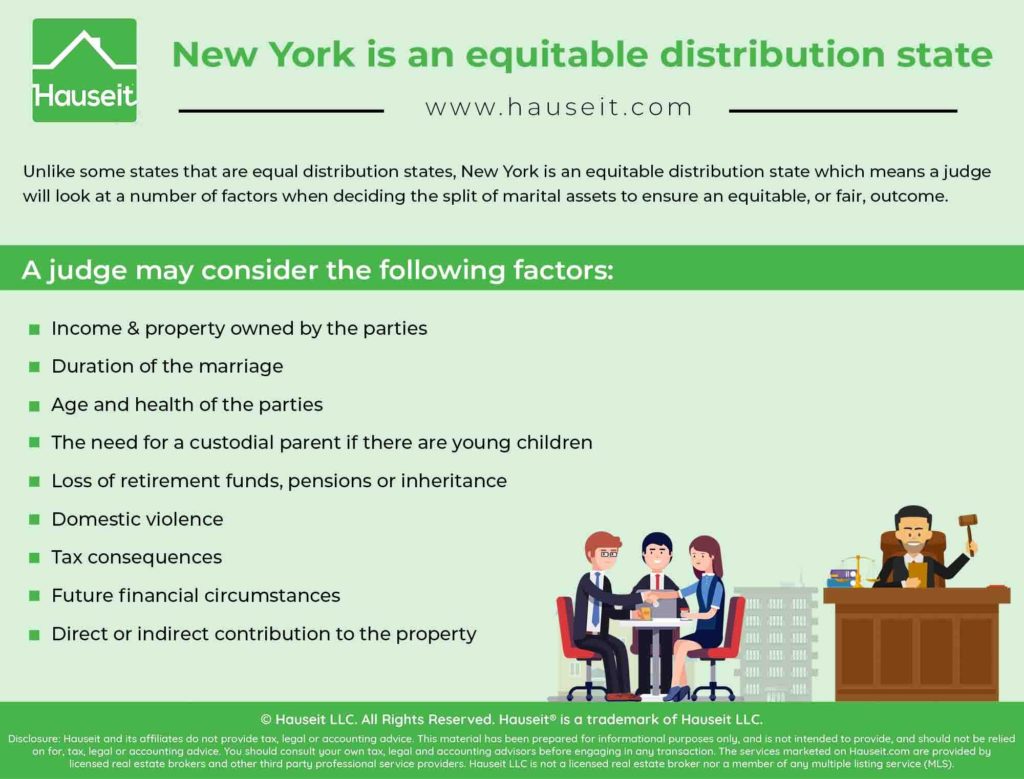

New York is an equitable distribution state

Unlike some states that are equal distribution states, New York is an equitable distribution state which means a judge will look at a number of factors when deciding the split of marital assets to ensure an equitable, or fair, outcome.

A judge may consider the following factors:

-

Income & property owned by the parties

-

Duration of the marriage

-

Age and health of the parties

-

The need for a custodial parent if there are young children

-

Loss of retirement funds, pensions or inheritance

-

Domestic violence

-

Tax consequences

-

Future financial circumstances

-

Direct or indirect contribution to the property

Indirect efforts could include joint efforts in building or maintaining the property, household services, being the primary caretaker of the children, contributing to the career of the other party, etc.

Marital vs separate property

Marital property is property that is owned together or acquired during the marriage whereas separate property is property that was acquired by either party prior to the marriage.

Keep in mind that there are exceptions to what is considered marital property. For example, inheritances received by either party during the marriage is still considered to be separate property, as are personal injury awards.

Pro tip: If you don’t have a pre-nup, then it’s important to deposit your inheritance into a separate bank account with just your name. Furthermore, you shouldn’t use your inheritance money to support the marriage, otherwise that money could be argued to be marital property vs separate property unless you have a solid pre-nup.

This means that condo you purchased before getting married is considered separate property, and will still be yours in the case of a divorce.

The appreciation in value of separate property can be claimed

It’s important to understand that the appreciation in value of any separate property is added to the marital pot of assets in a divorce proceeding.

For example, the spouse that isn’t on the title can make a claim that he or she made contributions or exerted effort in some way in order to lay claim to the appreciation in value of the separate property.

For example, the non-title spouse can claim that he or she spent lots of time with architects or contractors, or spent a lot of time cleaning the separate property, and thus claim the appreciation in value of the separate property.

Whether children are involved makes a difference

It’s often easier and more straightforward for a judge to decide the split on a marital home if there are no children involved. If however there are still young children living in the marital home, then one party may have to pay the other party to live in that house with the children for continuity purposes.

For example, let’s say one spouse is the primary custodial parent and this spouse can’t afford to maintain the home by him or herself, but wants to stay in the home so the kids can continue at the same school. Then the court might order both parties to co-own and maintain the marital home until the kids finish high school.

What is the earnings capacity of each spouse?

The court will look at each party’s earning capacity and history over the past few years. If one party doesn’t have much earnings capacity while the other party does, then the judge may order the earning spouse to pay a spousal support package which may include the housing expenses for the non-earning spouse (i.e. cost of a rental, buying another property for the non-earning spouse, etc.).

Remember that child support and spousal support can play off of each other, and that child support generally ends at age 21.

Pro Tip: It’s rare to see judges award lifetime spousal support these days. Courts are much less forgiving these days when it comes to earnings capacity.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

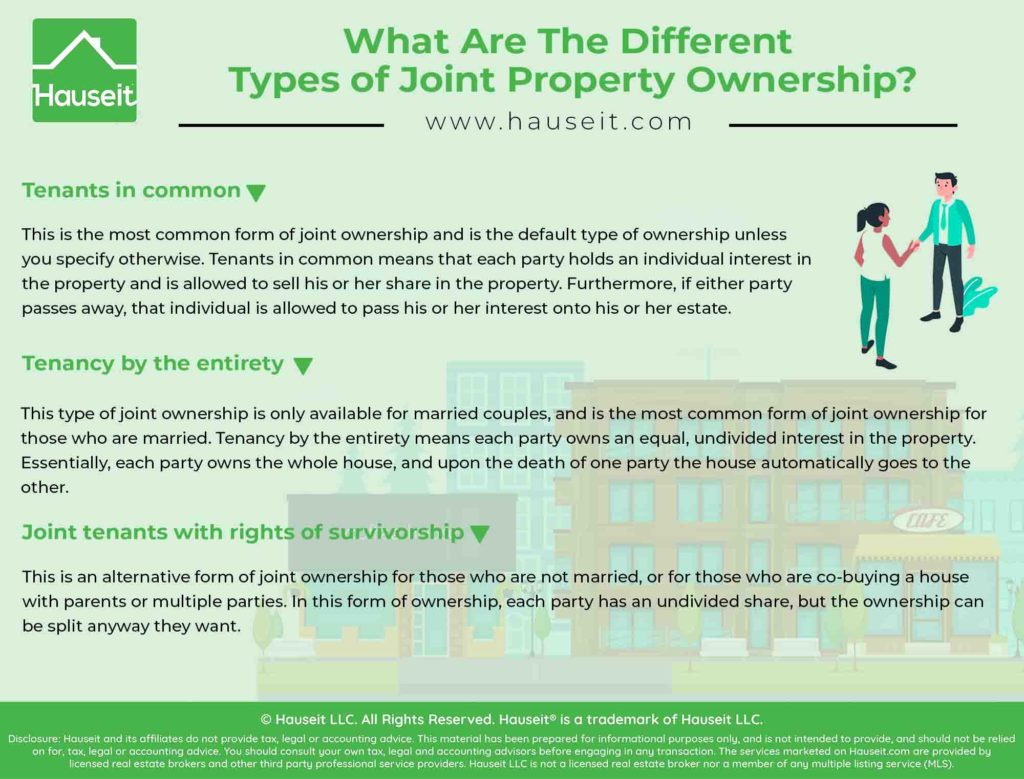

Tenants in common

This is the most common form of joint ownership and is the default type of ownership unless you specify otherwise. Tenants in common means that each party holds an individual interest in the property and is allowed to sell his or her share in the property. Furthermore, if either party passes away, that individual is allowed to pass his or her interest onto his or her estate.

Tenancy by the entirety

This type of joint ownership is only available for married couples, and is the most common form of joint ownership for those who are married. Tenancy by the entirety means each party owns an equal, undivided interest in the property. Essentially, each party owns the whole house, and upon the death of one party the house automatically goes to the other.

Joint tenants with rights of survivorship

This is an alternative form of joint ownership for those who are not married, or for those who are co-buying a house with parents or multiple parties. In this form of ownership, each party has an undivided share, but the ownership can be split anyway they want.

Title doesn’t control in New York. If a property was purchased during the marriage, it doesn’t matter whose name it’s in. It will be considered marital property unless a pre-nup says otherwise.

If you’re concerned about having any property you buy during your marriage be classified as tenancy by the entirety, a well structured pre-nuptial agreement can specify that any property purchased together is structured as tenancy in common.

We’ll discuss later in this article why it’s so important to get a pre-nup before you get hitched. After all, if it’s not about the money and just about the love, then a pre-nup shouldn’t matter right?

What if parents contributed to the marital home?

If one party’s parents contributed (i.e. down payment assistance) by transferring money to that party’s separate bank account, then this contribution can be considered separate property.

If however the contribution appears to be a gift to the married couple, jointly, then that contribution may not be considered to be separate property. As usual, this potential issue can be addressed in a pre-nup.

What about marital debt like the mortgage?

Marital debt is split equitably vs equally just like assets in New York. This is something to watch out for especially when it comes to debt that may not be obvious to the other party, such as student loans. Marital debt can be addressed and protected against in a well written pre-nup.

What if one person contributed separate property for the purchase?

If one party used their separate property to pay for part of the purchase of the marital property, then that person is entitled to a credit when the property is sold and the profits divided.

In the same vein, if one party is paying for the other party’s share of carrying costs for the home, then they’re entitled to be reimbursed.

Of course, if the other party can’t afford it, then it’s a different story since New York is an equitable distribution state.

This is why it’s important to keep records. If you can prove and trace the flow of funds, then you can usually get a credit back during divorce proceedings.

What happens if one spouse wants to buy out the other spouse’s share? How is valuation determined?

In this scenario, the fair market value is agreed upon by the parties either amicably, or via a neutral appraisal done by an independent, third party licensed property appraiser.

Any potential buyout of the other spouse’s share will of course depend on the buyer’s ability to maintain the property. If this is not possible, some agreements will specify that the property then needs to be sold, and the proceeds divided.

Remember that in a buyout, the mortgage needs to be taken care of as well, usually through a refinancing.

This is a great article on divorce and real estate, but you didn’t address the topic of co-hab agreements, which can also be turned into a pre-nup; however, it’s better to have two separate agreements. Remember that New York doesn’t recognize common law marriage.

A co-hab agreement can also cover the distribution of property, and can cover who lives in the residence after a break-up.

And of course, some married couples might even want a post-nup agreement, to provide some sort of safety net.

Oh a few other tips that I forgot to mention:

– Negotiate with your spouse for a cut-off date.

– If you didn’t serve your spouse in 120 days, then you need to re-file.

– Every divorce agreement has a reconciliation clause, or should.

– Automatic stays that happen upon a divorce filing doesn’t apply to wills.

– Any transfer of property from spouse to spouse is non-taxable.

– You are legally separated when you enter into a settlement agreement.

– The separation agreement is a separately enforceable document.