Most renters in NYC end up working with a broker out of necessity rather than by choice. What do we mean by this? Since most rental apartments have a listing broker representing the landlord, it’s impossible to avoid working with that agent and paying the broker fee if you want to rent the apartment.

With that said, many busy professionals in NYC hire their own dedicated agent to assist them throughout the entire rental process. An agent who works for a tenant is called a tenant’s agent. In most cases, a tenant’s agent is compensated by splitting (also known as co-broking) the total rental broker fee you pay on an apartment between him or her and the landlord’s agent.

Table of Contents:

[su_rental_cta]

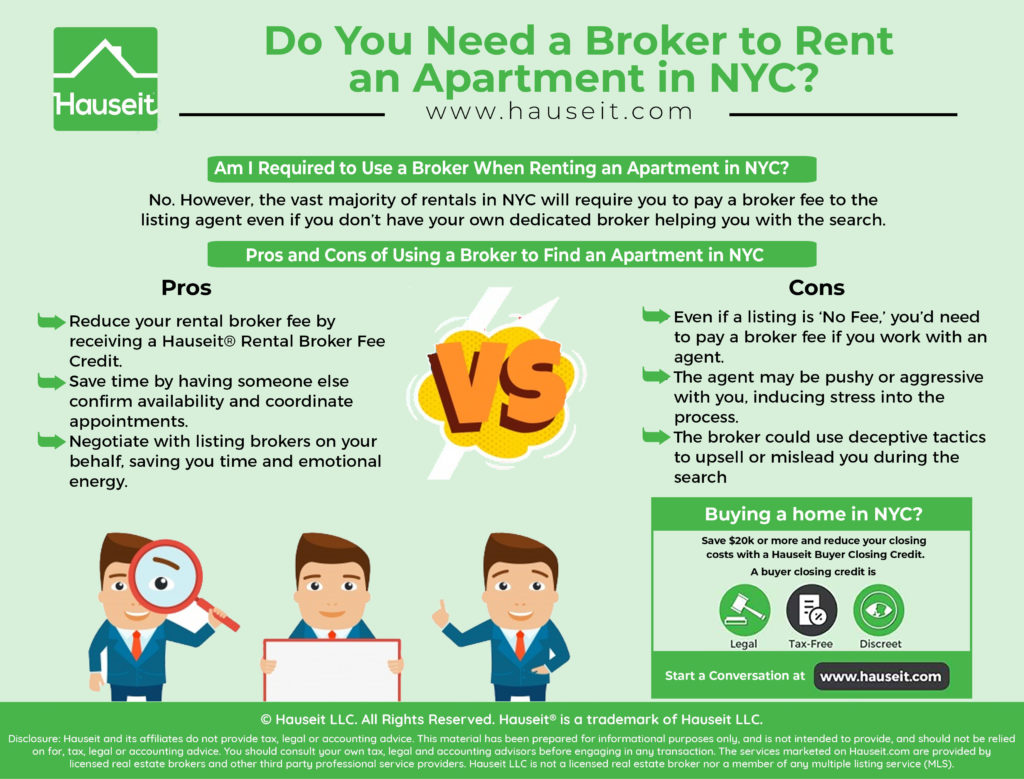

No. However, the vast majority of rentals in NYC will require you to pay a broker fee to the listing agent even if you don’t have your own dedicated broker helping you with the search. The typical rental broker fee in NYC ranges from 1 month’s rent up to 15% of the annual rent.

If you have your own rental broker, the amount of your total broker fee paid will usually remain the same.

The difference is that it will be ‘split’ between the agent representing the landlord and the agent who is helping you on the search.

If a broker fee is 15% of annual rent, it would be split 7.5% / 7.5% between both agents. The act of two agents splitting commission is called cobroking (often referred to as co-broking, cobrokering, co-brokerage, etc.).

If you’ve fallen love with an apartment with a high broker fee, you can reduce the size of the broker fee you’ll pay by requesting a Hauseit® Rental Broker Fee Credit.

Here’s how it works: you are paired with a seasoned tentant’s agent who assists you throughout the search.

When it comes time to pay the rental broker fee, it will be split equally between the landlord’s agent and your agent as opposed to 100% of the fee being paid to the listing agent.

Your agent has already agreed in advance to credit you back a portion of the broker fee she or he receives on the deal.

Since most broker fees in NYC are non-negotiable, the only way to reduce how much commission you pay is to work with a tenant’s agent who has agreed to credit you back some of the rental broker commission on the deal.

Unlike in sales where virtually all listing agents are willing to split commissions, the rental industry is more hit or miss. This means that not all rental listing agents are willing to split the broker fee with your agent.

In this case, you may need to agree in advance to compensate your tenant’s agent if you go with a no fee apartment and your agent receives no compensation whatsoever.

Keep in mind that sometimes apartments listed as no fee will actually offer a fee from the owner (i.e. Owner Pays or OP in industry parlance) which only brokers will see in the broker database. OPs are typically 1 month’s rent.

Pros of using a broker

-

Reduce your rental broker fee by receiving a Hauseit® Rental Broker Fee Credit.

-

Save time by having someone else confirm availability and coordinate appointments.

-

Negotiate with listing brokers on your behalf, saving you time and emotional energy.

Cons of using a broker

-

Even if a listing is ‘No Fee,’ you’d need to pay a broker fee if you work with an agent.

-

The agent may be pushy or aggressive with you, inducing stress into the process.

-

The broker could use deceptive tactics to upsell or mislead you during the search.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

It depends. The ‘no fee’ marketing tactic is often designed to mask the true cost of more expensive apartments. There are a few ways this can be accomplished.

For example, a landlord who has recently renovated an apartment building may drastically increase the rent but list the units as ‘no fee’ with an artificially low monthly rent by offering a specified number of free months contingent on signing an 18 month or 2 year lease.

Here’s an example:

Rent Prior to Renovation: $3,000

New Proposed Rent: $3,500

Free Months: 0.5 per 6 month lease term, minimum 18 month lease

Advertised Rent: ($3,500*16.5) / 18 = $3,208/month

In the example above, it’s easy to see that the optics of a $3,200 ‘No Fee’ apartment will be more attractive to renters compared to fee apartments asking up to ~$3,500.

Although the landlord is offering free rent credits, you’d still have to pay the full $3,500/month figure for every month with the exception of those that the landlord is paying on your behalf.

In other cases, a landlord will list a unit as ‘no fee’ and jack up the monthly rent in hopes that a prospective renter will still assume it’s a good value since there is no broker fee.

If an apartment is asking $3,400 a month with a 15% broker fee, the true monthly cost factoring in the broker fee is $3,910/month.

In this example, the landlord may list their apartments at $4,000/month with no fee in the hopes that prospective tenants who are looking to avoid paying a broker fee at all costs will reach out to the leasing office directly and pay the higher rent.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Posted: 9/27/18 | Last Updated: January 30th, 2020

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.