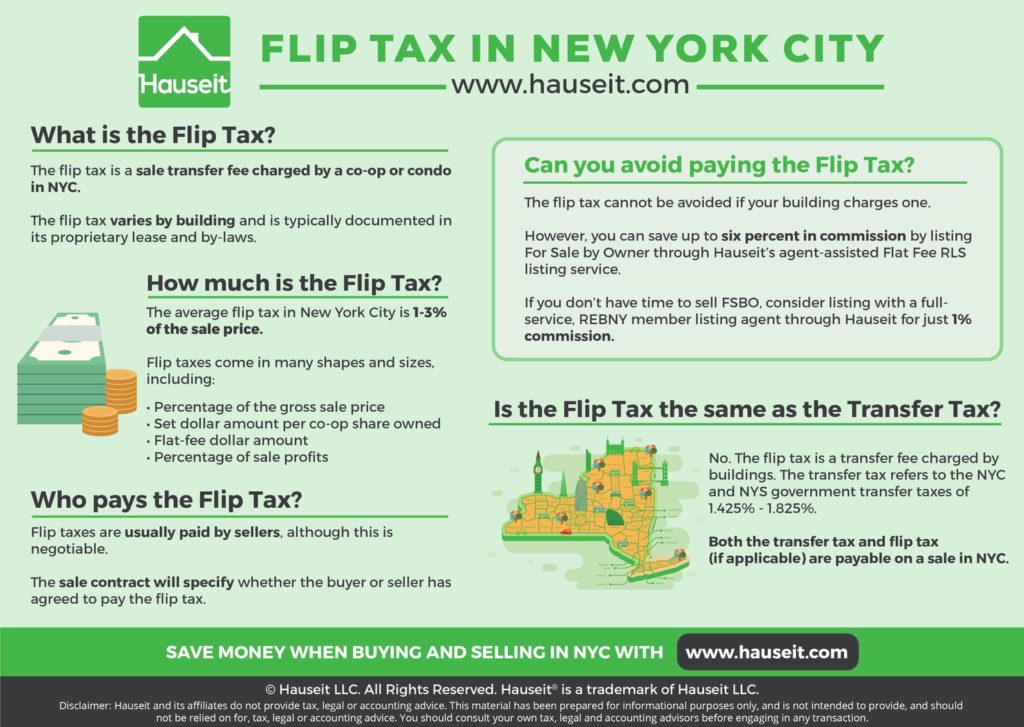

The average co-op apartment flip tax in NYC is 1% to 3% of the sale price, and it’s customarily paid by the seller. The flip tax varies by building, and in rare instances you may even encounter a condo which charges a flip tax in New York City.

A flip tax in NYC can be structured as a percentage of the sale price, a flat fee, a per-share amount or some combination of the methods above.

The flip tax is payable in addition to all other seller closing costs, such as broker commissions and the NYC & NYS Transfer Taxes.

Calculate your co-op flip tax using Hauseit’s Interactive Co-op Flip Tax Calculator. Estimate your seller closing costs in NYC using Hauseit’s Interactive Closing Cost Calculator for Sellers.

Table of Contents:

A flip tax is a transfer fee charged by a co-op (or condo) on the sale or transfer of an apartment. The amount of the flip tax varies by building in NYC, and the flip tax is usually paid by the seller.

The flip tax charged by a building is typically documented in its proprietary lease and by-laws. It’s important to note that any flip tax payable on your sale is an additional closing costs on top of the standard NYC and NYS transfer taxes paid by sellers.

Flip taxes in NYC come in many shapes and sizes, and the most common flip tax is a small percentage of the gross sale price.

Although you cannot avoid paying a flip tax if your building charges one, there are ways for you to significantly reduce or fully eliminate the average 6% NYC real estate commission when selling.

Flip taxes came about as a solution for the 1970s housing crisis in NYC. During this time, there was a wave of co-op conversions throughout the city as buildings were privatized.

The buildings being privatized were often run down and in dire need of major capital investment. At the same time, many of the rent-stabilized tenants who resided in these buildings were offered substantially discounted, ‘insider’ prices to purchase.

To prevent flipping and address the major capital investment needs of the buildings, many co-ops implemented flip taxes on resales. Revenues from flip taxes help strengthen a building’s financial statement.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The average flip tax in NYC is a few percentage points (1 to 3%) of the sale price. However, flip taxes in NYC come in many shapes and sizes.

Flip taxes in NYC can be structured in any of the following ways:

-

Percentage of the Gross Sale Price: i.e. 1.5% of the purchase price

-

Set Dollar Amount per Co-op Share Owned: i.e. $50 per share

-

Flat-Fee Flip Tax: i.e. $2,500

-

Percentage of Sale Profits: i.e. 15% of profits

-

Hybrid Format: i.e. $2,000 plus $25 per share

Flip taxes in NYC are typically paid by sellers, however virtually everything in a NYC real estate deal is negotiable. Asking a buyer to pay the flip tax has to make sense in the context of the demand you are seeing for your listing. If there’s a multiple offer situation, you may have sufficient leverage to ask a buyer to pay the flip tax.

If you are selling an expensive apartment which has been on the market for more than 4 months, it would be unreasonable to even raise the possibility of the buyer paying the flip tax.

The sale contract will specify whether the buyer or the seller is ultimately responsible for paying any flip tax imposed by the co-op (or condo) building.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The flip tax in NYC is usually paid by sellers, however everything is negotiable. In rare instances, the co-op may specify that the flip tax is paid by buyers.

Your real estate purchase contract will specify whether the buyer or seller has agreed to pay the flip tax.

Flip taxes charged to buyers are often phrased as ‘capital contribution fees.’

If you are buying a condo in NYC, there’s a chance that you will be asked to make an initial capital contribution to the building’s reserve fund.

A typical capital contribution is usually a few months’ worth of common charges (or some fixed contribution amount). We discuss capital contribution fees in greater detail below.

The typical NYC co-op flip tax is 1-3% of the gross sale price. However, each co-op’s flip tax policy is unique and there is simply no way to generalize.

To confirm your co-op’s flip tax amount, you can contact the managing agent or ask your buyer’s agent to find out on your behalf. The flip tax amount may also be listed on the co-op’s purchase application.

Flip taxes for co-ops (or condos) in NYC can be structured as a flat fee, a flat fee per share, a percentage of sale profits, a percentage of the sale price or a hybrid formula.

If the co-op has a per-share flip tax, you simply take the number of shares assigned to your unit and multiply that by the per-share flip tax amount.

For example, if your apartment has 100 shares and the flip tax is $25/share, the flip tax is: 100 x $25 = $2,500.

If your co-op charges a flip tax on your profits, you should confirm how the co-op calculates your cost basis. Do they allow you to include improvements in your cost basis

Here is an example of how a NYC co-op flip tax on sale profits is calculated:

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Yes, a co-op or condo in NYC can change its flip tax by amending the proprietary-lease and by-laws by receiving approval from a majority of the shareholders.

Flip taxes cannot be unilaterally imposed by the board without a shareholder vote.

Here is an example of an amendment to a NYC co-op proprietary lease and coop By-laws which calls for the implementation of a flip tax (percentage of sale proceeds):

You can usually reduce your taxable capital gains as a seller by subtracting the flip tax as an additional cost of the sale (alongside broker commissions, for example).

With that said, we suggest you consult your real estate attorney and tax professional for specific advice.

If you are conducting a 1031 exchange, you may wish to read Hauseit’s overview of How to Do a 1031 Exchange in NYC.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Most co-ops will waive the flip tax if you are simply transferring your co-op to a spouse, permanent companion, children, or immediate family.

However, each building has its own language and exceptions for the flip tax. The only way to confirm whether family transfers are exempt from a co-op’s flip tax is to check in the proprietary lease and By-laws.

Here is an example of language which specifically excludes a number of family transfers from having to pay the flip tax:

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

All sales in New York City are subject to both NYS and NYC government transfer taxes, which are between 1.425% and 1.825%.

While a co-op (or condo) flip tax is often called a ‘transfer tax,’ it is not technically a tax but rather a fee because it is not being collected by a government entity.

Co-op Seller Closing Costs in NYC Include:

6%: Broker Commissions

1.425% to 1.825%: NYS & NYC transfer taxes

1 to 2%: Flip Tax (varies by building)

$2k to $3k: Attorney Fees

You can review the full list of seller closing costs in NYC by reading Hauseit’s comprehensive NYC closing cost guide.

The easiest way to reduce your seller closing costs is to list FSBO or list with a full-service agent for just 1% commission.

If you’ve looked at condos or have considered buying a new development, chances are that you’ve seen a capital contribution fee listed as one of your buyer closing costs.

Many condos and new developments charge buyers a capital contribution fee. The capital contribution fee is typically a few months’ worth of the apartment’s common charges.

Often times a new development will charge buyers two separate capital contribution fees.

The first capital contribution fee, usually a few months’ worth of your apartment’s common charges, is the traditional way the building builds up is capital reserve fund.

The second capital contribution fee may be a per-unit charge to help fund and pay for the live-in super’s apartment.

Buyer Closing Costs in NYC Include:

-

2.05 to 2.80%: NYC/NYS Mortgage Recording Tax

-

1%: Mansion Tax (purchases at or above $1m)

-

1.425% to 1.825%: NYC/NYS Transfer Tax (for new construction or sponsor sales)

You can save $20,000 or more and reduce your buyer closing costs by requesting a safe and discreet Hauseit Buyer Closing Credit through an one of our brand name partner brokers.

Buyer broker closing credits in NYC are completely legal and non-taxable.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Never realized how high closing costs are in NYC! So informative 🙂 paying a flip tax of 1-3% on top of a 6% commission bill can wipe out 10% of my profit.

Well said, Violet! It’s true that closing costs in NYC are unreasonably high for sellers! Here is a complete list of seller closing costs in NYC: https://www.hauseit.com/closing-costs-nyc/

That was informative! It’s interesting it’s referred to as a “tax”, even though it’s technically a fee. The whole time I was reading that I was wondering why it’s referred to as a tax, but later on you clarified. That, on top of the standard taxes and commission really add to the closing costs!

Hi Andrew – it sounds like you are a well educated and informed reader! We’d love for you to join the broader discussion about NYC real estate in our forum: https://www.hauseit.com/forum/

I am evaluating a HDFC coop in NYC to make an offer on. This is their flip tax policy. I know HDFC coops are harder to resell, but I didn’t realize their flip taxes are so much higher? Is this the norm? I have included the HDFC coop flip tax policies below.

The current Corporation flip tax and capital improvement policy for shareholders residing in the building for more than five (5) years is that the selling shareholder can recoup his/her original purchase price, $65,000 in capital improvements, the realtor’s fee, and an 85/15% split of the difference: with 85% going to the selling shareholder and 15% to the Corporation. Below are the calculations for ______________’s sale:

1. _________________ purchased the shares for apartment # __ on __________ for ____________.

2. _________________ is selling his shares for ____________.

3. As _______________________has resided in the building for more than five (5) years, he is entitled to $65,000 in capital improvements.

4. The seller’s realtor is due 6% of the selling price, __________________.

5. When the original purchase price of ___________, the capital improvement of __________________, and the realtor fee of $___________________ are deducted from the selling price of $_____________________, the balance is $_________________.

6. 85% of $______________________ is $___________________ and is due _________________

15% of $______________________ is $____________________ and is due the Corporation.

The seller and purchaser will be responsible for the Corporation’s attorney fees.

I have something to add to your Who Pays The Flip Tax section. To my understanding, the coop proprietary lease actually is silent and usually does not specify who actually pays the flip tax. Therefore it is simply custom that the seller pays the flip tax.

This custom is reversed in some neighborhoods like Sutton Place where buildings usually expect and ask the buyer to pay the flip tax!

Is there a law prohibiting sponsors from being levied the same flip tax as other coop owners?

Carol, don’t think there’s a law per se as much as what sponsors have written in the original offering plan. Pretty much the original condo or coop offering plan allows special rights and privileges to the sponsor and sponsor units. These include the ability to rent out sponsor units indefinitely, no need for board approval and not needing to pay flip tax!

What is general initial number of years when a net profit flip tax has a reduction after so many years of ownership?

Is it usually more than 10 years or closer to 5

For HDFC coops the flip tax is often 30% of the profit from the sale. Usually profit is defined as profit less deductions for broker’s fees which is most customary, though some buildings may allow renovation costs and attorney’s fees to be deducted as well.

With that said, it varies by building and I’ve once seen a HDFC coop levy a 70% of the sale price flip tax. Yes that’s right, 70% of the sale price, not of net profit!