Save Our Homes (SOH) is a property tax exemption for qualifying Homestead Property homeowners in Florida which lowers your property taxes. SOH works by capping the annual increase in assessed value for tax purposes.

After the first year a homeowner receives a Homestead Exemption, SOH limits the annual increase in the assessed value to either 3% or the percentage change in the Consumer Price Index (CPI), whichever is lower.

This means that even if the market value of a homestead property increases significantly in any given year, the assessed value may not increase by more than the cap.

Ad valorem property taxes are calculated by multiplying market (assessed) value by the tax rate, so a cap on assessed value increases mitigates annual property tax increases.

Over time, the SOH assessment limitation can result in huge disparities between market value and assessed value for tax purposes. The accumulated difference is called the SOH benefit.

You can port your accumulated SOH benefit to a new homestead property in Florida up to a maximum of $500,000. However, the SOH benefit does not transfer to the new owner of a property.

If you’re buying a home in Florida, chances are that many of the homes you’re looking at are Homestead Properties with an accumulated SOH benefit. This means that listed property tax figures might not represent what you’ll pay.

FAQ on Save Our Homes:

How does the Save Our Homes Cap work in Florida?

What is the purpose of the Save Our Homes amendment?

How to apply for the Florida Save Our Homes Cap

Does the accumulated Save Our Homes benefit transfer to a new owner?

Can I transfer my Save Our Homes benefit to a new property?

How to port a Homestead Exemption in Florida

How do I calculate portability in Florida?

How many times can I port my SOH benefit in Florida?

Will I receive the accrued Save Our Homes Benefit when inheriting a property?

How does the Save Our Homes Cap work in Florida?

The Save Our Homes Cap works by limiting annual increases in a property’s assessed value. This mitigates yearly tax increases because property taxes are calculated by multiplying assessed value by the applicable property tax rate.

Here is an example of how a Florida home buyer who receives Homestead Exemption will save money on property taxes over time through the Save Our Homes (SOH) program:

As you can see, both the annual and cumulative property tax savings increase considerably over time.

What is the purpose of the Save Our Homes amendment?

The purpose of the Save Our Homes (SOH) amendment is to shield property owners from drastic and potentially destabilizing increases in annual property taxes.

While the SOH cap does’t stop property taxes from going up over time, it makes yearly increases more manageable for homeowners.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How to apply for the Florida Save Our Homes Cap

You automatically qualify for the Save Our Homes Cap once you receive a Homestead Exemption. Therefore, the only way to qualify for the Save Our Homes Cap is by applying for a Homestead Exemption.

The annual application deadline for a Homestead Exemption is March 1st. Each county’s property appraiser has its own Homestead Exemption application. Many counties such as Miami-Dade offer an online application.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Does the accumulated Save Our Homes benefit transfer to a new owner?

With few exceptions, the accumulated Save Our Homes benefit does not transfer to a new owner. A property is re-assessed at market value as of January 1 of the year following a change of ownership.

A handful of transfers do not result in the loss of an accumulated SOH benefit. These include, but are not limited to:

-

Certain transfers upon death

-

A change or transfer between spouses

-

Certain transfers when the same persons are entitled to a Homestead Exemption both before and after the transfer

How to port a Homestead Exemption in Florida

To port your Homestead Exemption in Florida, first apply for Homestead on your new home using form DR-501. Thereafter, complete Form DR-501T (TRANSFER OF HOMESTEAD ASSESSMENT DIFFERENCE) and file it with your property appraiser by March 1.

All owners of a jointly owned prior homestead must abandon that homestead to be eligible for portability.

Note that you and your spouse (or former spouse) can apportion the SOH benefit by filing a DESIGNATION OF OWNERSHIP SHARES OF ABANDONED HOMESTEAD. This must be done before either of you complete Form DR-501T.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How do I calculate portability in Florida?

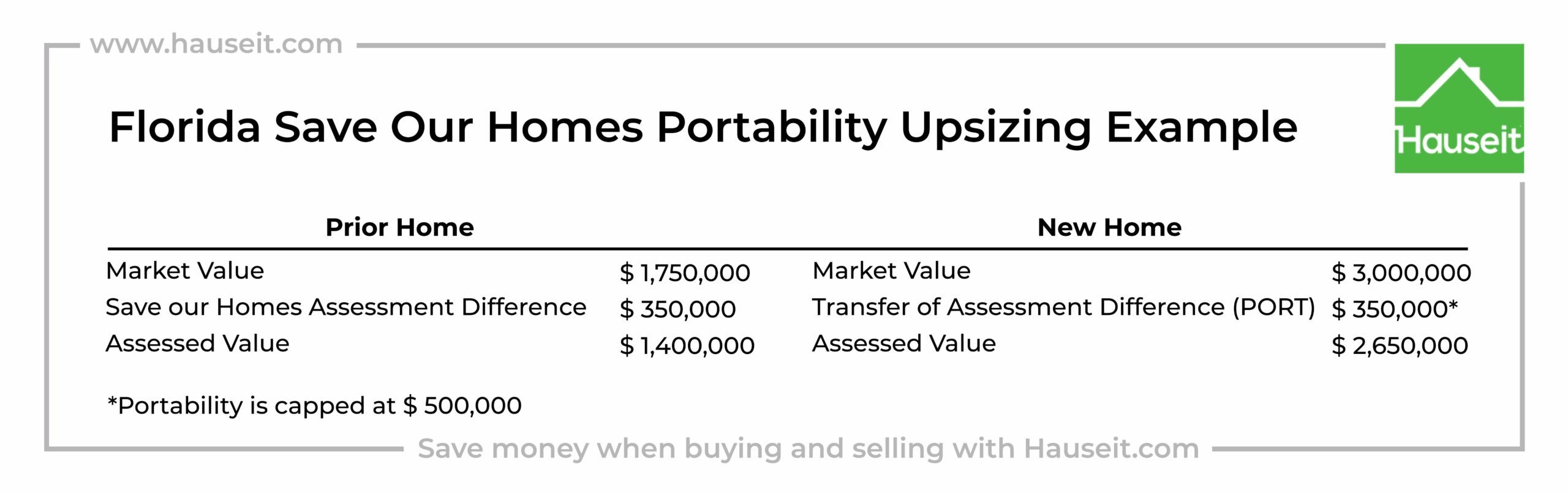

If you are buying a more expensive property, you may port your accumulated SOH benefit up to a maximum of $500,000. Simply subtract the lesser of $500,000 and your prior home’s accumulated SOH benefit from the market value of your new home to calculate assessed value.

Here is an example of how to calculate SOH Portability when upsizing:

If you purchase a new homestead property which is less expensive than your old one, divide your new home’s purchase price by the market value of your old home and multiply that by your accumulated SOH benefit to calculate your PORT.

Note that the maximum Portability is $500,000. The Portability benefit may need to be divided when there is a divorce or when an applicant has partial ownership interest in the new home, had partial ownership interest in the old home, or had/has an ownership interest in both properties.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Will I receive the accrued Save Our Homes Benefit when inheriting a property?

With few exemptions, you typically will not receive the accumulated SOH benefit when inheriting a property. There are two exceptions which may allow you to inherit the accumulated SOH benefit from the decedent:

-

You are a surviving spouse

-

You are a legal dependent who was permanently residing in the property at the time of the decedent’s death

So there seems to be a gaping lack of coverage for homeowners who apply for the homestead exemption, because the Save Our Homes cap only comes into play it seems the year after the exemption is live. Meaning in that one year gap the assessed value can go up dramatically!

This seems totally unfair because if the home owner did nothing, they would automatically qualify for the Non-Homestead Cap which limits the increase to 10%. This would be at least better than say a 50% increase in the assessed value! How is this allowed?

Non-Homestead Cap (10%)

Constitutional Amendment 1, approved by Florida voters on January 29, 2008, was a provision to limit increases in the annual assessment of Non-Homestead properties to ten percent (10%). The base-year for implementing this change was 2008 and assessments were capped beginning in 2009. It was set to expire on January 1, 2019, but was approved by more than 60% of Florida voters on November 6, 2018.

There is no application for the Non-Homestead Cap as it applies automatically.

Changes in ownership and use resets the Non-Homestead Cap base year following the change. For example, filing a homestead exemption application removes the Non-Homestead Cap.

The Non-Homestead Cap limits increases in the assessed value to 10%, excluding School Board assessments.