There are many different reasons to get a reverse mortgage in New York. You may want a more comfortable retirement, the money to buy a second home, or to make home improvements. New York is an expensive place to live, especially on the fixed income of a senior.

A reverse mortgage could be the solution to many of your debt problems or financial issues. While a reverse mortgage has many benefits, you will need to decide if it’s the best option for you. It’s important that you understand what a reverse mortgage is and to understand if it’s right for you.

A reverse mortgage is a home equity loan that allows you to convert some of your home’s equity into cash while you maintain ownership. A reverse mortgage can be great for many seniors who have money in their homes and not enough in their banks.

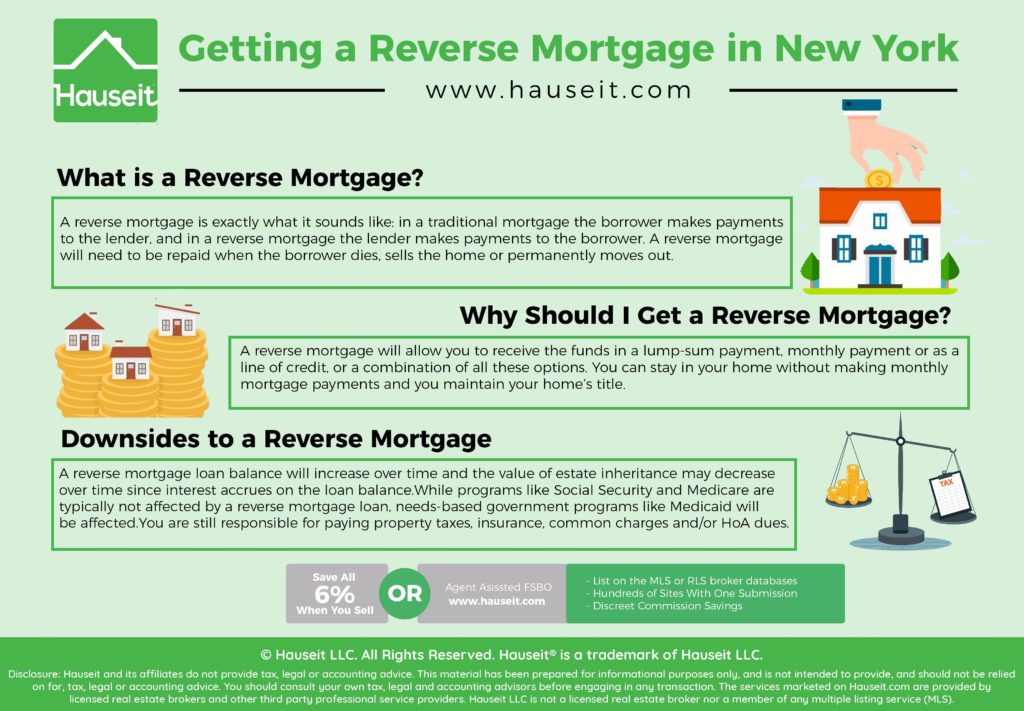

A reverse mortgage is exactly what it sounds like: in a traditional mortgage the borrower makes payments to the lender, and in a reverse mortgage the lender makes payments to the borrower.

A reverse mortgage will need to be repaid when the borrower dies, sells the home or permanently moves out.

There is a credit check and lenders will evaluate your income, assets and monthly living expenses. It’s mandatory that you be current on your property taxes and home insurance premiums.

It is important to understand that a reverse mortgage is not for everyone and consulting a lawyer before you make a final decision is highly recommended.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

If you want to get a reverse mortgage you will need to meet eligibility requirements. It is important that you own your home and you live in your home for more than half of the year.

If you have debt or don’t own your home, then you will need to pay it off or use a cash advance from your reverse mortgage to pay it off.

If you don’t qualify for a large enough amount, you won’t be able to get a reverse mortgage unless you can afford to pay off the debt first.

If your home needs improvements to qualify for a reverse mortgage, then money from the reverse mortgage should be set aside for those expenses.

Homes must meet FHA property standards and all flood requirements.

Reverse mortgage qualification standards can be different depending on the type of home loan you have and the company you are getting the reverse mortgage through.

For example, with some types of reverse mortgages you only need to be 60 years of age and for others you need to be a minimum of 70 years old and have a low income.

If you have an FHA reverse mortgage (HECM), you will need to be at least 62 years old. Talking to a loan officer can help you understand what type of reverse mortgage is best for you.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

A reverse mortgage will allow you to receive the funds in a lump-sum payment, monthly payment or as a line of credit, or a combination of all these options. You can stay in your home without making monthly mortgage payments and you maintain your home’s title.

In a reverse mortgage you heirs won’t be personally liable if the loan balance exceeds the value of the home. Also, your heirs will inherit any remaining equity after paying off the reverse mortgage.

The money you receive from a reverse mortgage can be used for any reason. Many seniors use the cash to supplement income, afford proper health care, pay off debt or to finance home improvements.

There is no financial penalty if you decide to prepay the loan, you won’t need to make payments on the loan if you live in your home and you will have a guaranteed monthly income or a guaranteed line of credit.

Like many good things, there is a downside. A reverse mortgage loan balance will increase over time and the value of estate inheritance may decrease over time since interest accrues on the loan balance.

Another important factor is Medicaid eligibility. While programs like Social Security and Medicare are typically not affected by a reverse mortgage loan, needs-based government programs like Medicaid will be affected.

We spoke to Christopher Chiccino over at Sugar Sand Homes, he shared his professional opinion on the pros and cons of reverse mortgages:

“When we’re talking about reverse mortgages we’re talking about something, that in my opinion, is very risky but does have purpose. They’re only approved if the home is fully paid off and the title stays in your name, they are designed for those that have no other source of income. Compared to a standard mortgage, there isn’t a monthly payment. The reverse mortgage takes from the equity of your home, plus monthly interest, and you are to still pay your regular property taxes and maintain insurance as well as keep the property in livable conditions. The loan plus interest is due after the property is no longer your primary residence.”

Chiccino shared 3 main risks:

1) Getting approved for more money than you need. Don’t feel like you are ever required to do this, this is a predatory lending tactic.

2) Believing that if you get a reverse mortgage, you will not need to pay anything for the rest of your life. All mortgages require properties taxes and insurance to be charged, sometimes monthly.

3) Being convinced to take the spouse off the title. This is often because they are too young, and the older owner does not qualify for the reverse mortgage. This will give the bank rights to the property and leave the spouse homeless when the loan balance is due.

“In the end, I don’t believe a reverse mortgage is necessarily a bad thing. However, it’s important to identify these risks and make the right decision for your situation.”

Application for a Reverse Mortgage

If you meet the age and other requirements needed to apply for a reverse mortgage there could still be some final steps you need to take.

Counseling

A lender can only begin processing a reverse mortgage loan application when the homeowner has completed the Housing and Urban Development (HUD) required counseling and submitted a signed Home Equity Conversion Mortgage (HECM) Counseling Certificate.

This counseling is accessible via phone from national and region agencies. Regional agencies will even do counseling face to face.

Application

Just because you applied doesn’t mean you are approved. The application is not binding and can be canceled anytime during the process. This step legally authorizes the lender to begin the process of applying, the lender can’t incur any costs on your behalf until counseling is completed.

Appraisal

A reverse mortgage loan appraisal needs to be done by the Federal Housing Administration (FHA) approved appraiser and it must comply with FHA guidelines. An appraisal will determine the current market value of your home.

Underwriting

Once the previous steps are complete, all the documents and paperwork will go to the underwriter for review. If no items are missing and conditions are met, the final closing date can be set.

Closing

When the closing date arrives, you will meet with an attorney or a notary to sign the final closing documents. You need to check and make sure that the interest rates, fees, and proceeds have not changed.

Canceling a Reverse Mortgage

After closing on a reverse mortgage, you have the “right of rescission” period; this means you’ll have three business days to change your mind and cancel the contract. Business days include Saturdays, but never Sundays or legal public holidays.

Should you choose to cancel, you will need to do it in writing, using a form provided by the lender or by fax, letter or telegram that must be hand delivered, mailed, faxed, or sent before midnight on the third business day.

There is no way to cancel via telephone or in person. Following the right of rescission period, the reverse mortgage company will issue a check or wire funds to your account.

Most Importantly

Research reverse mortgages and become as well informed as possible. The more you know, the more confident you will be in your decision. Only you can determine if the benefits outweigh the risks.

Depending on your situation, there may be better options for you. A financial planner or a loan officer may be able to discuss different options with you.

For some selling their home and purchasing a smaller home may be in their best interest. Others may find an alternative such as a refinancing more appealing.

Whatever you choose, choose confidently. It’s important to know and understand your options. There are plenty of benefits that accompany a reverse mortgage, talking with a loan officer can help you decide if these are the benefits best suitable for your lifestyle and future plans.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.