What are the main steps for buying a home in NYC? What do you need to know before embarking on the home buying process in New York City?

The following Home Buying 101 course is free of charge and written by seasoned real estate professionals with years of experience in the field. Please leave a comment if you have more questions!

Table of Contents:

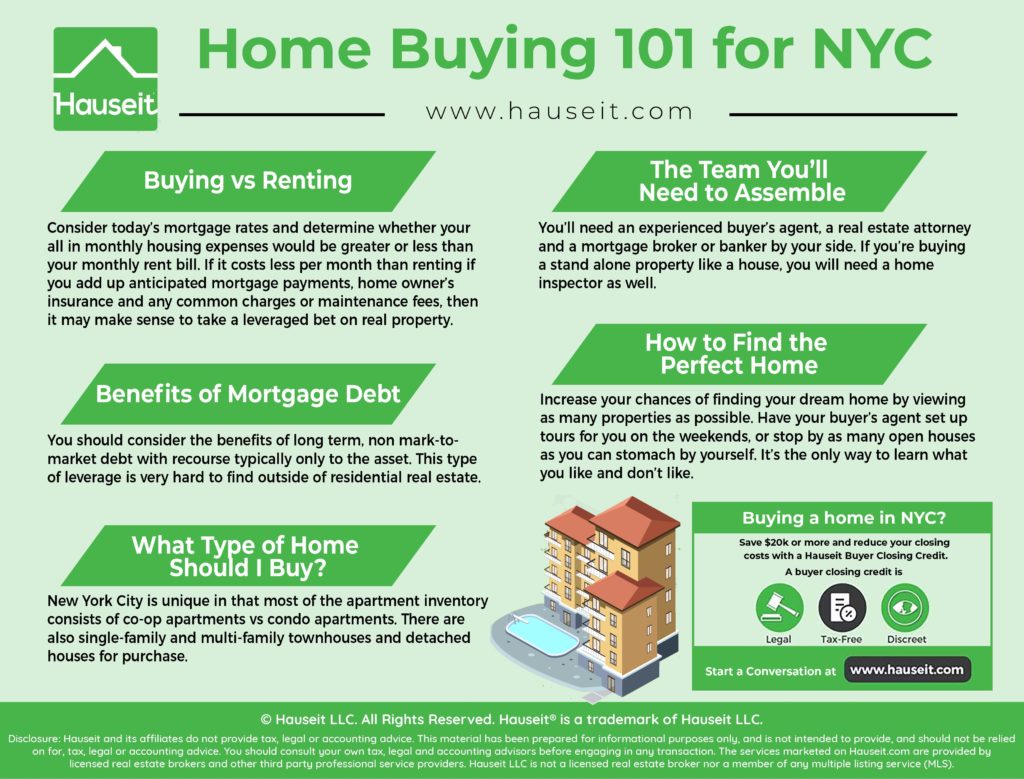

The basics of home buying 101 don’t start with how to go about purchasing a property in NYC. It starts much earlier in the critical preparation phase. The first step involves crunching some numbers and analyzing whether it even makes sense in the first place to buy vs rent.

You should consider today’s mortgage rates and determine whether your all in monthly housing expenses would be greater or less than your monthly rent bill.

If it costs less per month than renting if you add up anticipated mortgage payments1, home owner’s insurance and any common charges or maintenance fees, then it may make sense to take a leveraged bet on real property.

Assuming that your monthly outlay is equivalent whether buying vs renting, then the decision is purely one of whether you wish to take a leveraged bet on home prices. In this situation, you should compare the potential returns on your down payment if it were invested in alternatives like stocks or bonds vs real estate.

1This is a simplistic but powerful way of comparing the choice between buying vs renting. Keep in mind that if you include mortgage principal payments, you are automatically creating equity by paying down your loan each month. If you wanted to be nitpicky, you could assume an interest only loan in which case you could have a more accurate comparison of monthly costs of renting vs buying. However, interest only loans longer than 7 or 10 years are exceedingly rare as of today.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

You should consider the benefits of long term, non mark-to-market debt with recourse typically only to the asset.

This type of leverage is very hard to find outside of residential real estate mortgages.

For example, if you get a margin loan on your stock portfolio, your portfolio value and loan-to-value will be evaluated on a daily basis.

This means if your stock portfolio suffers heavy losses one day, you could be forced to liquidate holdings at then market prices to pay off your margin debt.

In contrast, a mortgage lender will never check what your home is worth vs their loan amount. Even if home prices crash and your home is likely worth less than your mortgage loan amount, a lender will never bother you as long as you are current on your mortgage payments.

This is extremely important because the last thing you want during a financial crisis is for the bank to knock on your door looking for you to put more skin in the game.

Another major benefit of mortgage debt is that it is for all intents and purposes non-recourse. What we mean is banks will only have recourse to the asset itself in the event of a default.

In other words, the collateral securing a bank’s mortgage debt is generally the property itself. If you default, they generally won’t be able to go after your personal or other assets.

This is important given that mortgages can be quite large, and the last thing you’ll want is to have to give a personal guarantee on a large amount of debt.

Lastly, it’s important to understand just how rare it is to secure debt that’s as long as 30 years for an individual. Sure, larger corporations or governments might easily be able to secure long term debt, but it’s generally very difficult for individuals to do so outside of residential mortgages.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

There are a variety of types of apartments as well as houses in NYC available for purchase. Do you want to live in a high rise building with many amenities? Or do you wish to live in a low-rise building in a quieter neighborhood, or even a walk-up apartment in a neighborhood like the West Village or SoHo?

Do you mind having neighbors? Or would you prefer to be the master of your own house, in which case you’d be looking to buy a single or multi-family townhouse or brownstone.

Keep in mind that individual townhomes can be quite expensive in New York City, so much so that townhouses are often divided up and sold or rented as individual apartments. Because townhouses can be quite expense and are relatively rare compared to condos or co-ops, it’s much more likely that you’d find an apartment to buy instead.

New York City is unique in that most of the apartment inventory consists of co-op apartments vs condo apartments. The ratio has historically been as high as 75% co-op vs 25% condo, though in recent years with the new development condo boom that ratio has become more equal.

You’ll need a few professionals on your side for the home purchase process in NYC. For starters, find a real estate agent in NYC whom you can trust, who is highly experienced, and who will discreetly offer you a buyer closing credit at the end.

You can speak with one of our seasoned, local partner brokers who can discreetly offer you $20,000 or more through a closing credit paid from their commission.

Because all of our partner brokers are traditional brokerages with great working relationships with the wider real estate community, your closing gift will be our little secret, and you’ll never have to worry about other agents treating you or your agent any differently.

Once you’ve found a great buyer’s agent, the next step is to ask your buyer’s agent for referrals to everyone else you’ll need throughout the process.

The other critical real estate professional in the home buying process is the real estate attorney, and you can count on your buyer’s agent to recommend someone who’s reliable and experienced in real estate transactions.

After all, the last thing you’ll want is an attorney who dabbles in a variety of fields and only has cursory knowledge about NYC’s complex real estate market.

Your buyer’s agent can also refer you to a competent mortgage broker or bank in NYC. Having a local bank that actually does deals in NYC is extremely important. That’s because a local bank will likely have done deals before in the building you’re buying in, and has already approved the building itself for financing. This will be important in keeping the mortgage loan process moving.

Getting a mortgage pre-approval letter is the next step after you’ve been introduced to a mortgage banker by your agent. Get on the phone and get the banker all of the documentation they need.

A mortgage pre-approval letter is a vote of confidence by a serious lending institution that you actually can borrow what you were hoping to borrow.

Other real estate professionals that your buyer’s agent may recommend down the road include a home inspector if you are intent on ordering a home inspection which is often superfluous for large condo or co-op buildings.

Your buyer’s agent can also recommend general contractors and interior designers if you intend to renovate your apartment before you move in.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

The way to find your perfect home is to know what you like. And to know what you like and don’t like involves seeing many, many properties. That’s why our first field trip for Home Buying 101 will involve seeing as many open houses as possible this weekend.

Ask your buyer’s agent to line up an open house and private showing tour for this weekend. Sundays are best because they have the most amount of open houses, although Saturdays often work as well.

Try to see at least 6 properties over the course of the day. This can easily be accomplished by property coordination and planning.

Give your buyer’s agent advance notice and he or she can set up a tour of properties that are in close proximity of each other. Ideally, you’ll be able to walk a short distance from appointment to appointment.

Pay attention and remember to read our apartment viewing tips before you attend your first showing. Try to remember the size of different apartments so you can start getting a sense of how large an apartment is when there isn’t a square footage listed.

Remember that different buildings may measure square feet differently and many co-ops may not even list a square footage at all.

Once you’ve found a property or two that you can picture yourself coming home to, it’s time to work with your buyer’s agent to submit an offer.

Your buyer’s agent will need a mortgage pre-approval letter if you’re financing your purchase, as well as a completed REBNY Financial Statement.

It’s also a good idea to include a short biography with your offer email or some sort of a home buyer offer letter.

Including your real estate attorney’s contact information is a good idea and demonstrates that you’re serious about buying.

Lastly, your offer email should include the basic terms of your purchase: offer price, anticipated down payment, any contingencies and anticipated closing date.

If you’ve discussed specific inclusions or exclusions with the seller, then you can include what’s agreed upon in your offer email as well. Remember that you want to make your offer as digestible and easy to accept as possible, so go easy on the demands and requests at this stage.

Once your buyer’s agent has negotiated an accepted offer on your behalf, the listing agent will circulate a transaction summary, often called a deal sheet, to all lawyers and brokers on the transaction. The point of the deal sheet is to outline basic terms that have been agreed to and to put the lawyers representing both the buyer and the seller in touch with each other.

Once the lawyers are in touch, the seller’s attorney will send a draft purchase contract and a contract rider to the buyer’s attorney. At this point your attorney will review the contract and negotiate it on your behalf.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Besides reviewing and negotiating the contract, your real estate attorney will play a critical role in conducting legal and financial due diligence on your behalf.

Your lawyer will review the building’s financial statements (typically the last two year’s), the building’s board meeting minutes, the building’s original offering plan as well as any amendments to the offering plan.

Your lawyer will order and review the title search to see if there are any liens, encumbrances, judgments or other violations on the property. Your lawyer may also send an attorney questionnaire, similar to a condo or co-op questionnaire ordered by a bank, to the building’s managing agent.

We also recommend speaking with the building’s staff and any residents you run into to get the true story about the building and to learn more about the dynamics of the board. There’s much you can learn from simply speaking with the building’s superintendent or doorman, or even a resident you meet in the elevator.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

If you take anything away from this Home Buying 101 course, it should be the fact that real estate offers are not binding in NYC until a purchase contract has been signed.

This means verbal or written offers don’t mean anything at all. Buyers can back out of an accepted offer as long as they haven’t signed a contract and handed a contract deposit to the seller’s attorney.

In fact, many contracts will have language allowing a buyer’s attorney to cancel a purchase contract with written notice on behalf of the buyer even if the buyer has signed it, as long as the seller hasn’t counter-signed yet. In practice, this is difficult because the seller could theoretically sign at any time after the seller’s attorney has received a signed contract and good faith deposit from the buyer.

Once the seller has counter-signed the contract, the listing is considered to be in-contract and you have a binding deal, subject to any contingencies or outs in the contract. At this stage, your home purchase is beginning to look much more real!

If you’re buying an apartment in NYC, you’ll most likely need to get sign-off from the condo or co-op building’s board of directors. The process can be quite onerous, especially if you’re buying a coop in NYC.

Condos have a relatively easy approval process where the condo board waives its right of first refusal. Technically, condo boards don’t have the right to approve or decline a prospective purchaser.

They simply have a right to purchase the unit at the same terms offered to the prospective purchaser.

As you can imagine, this almost never happens and a condo board will usually waive its right of first refusal within the typical 30-day deadline to make a decision.

Coops on the other hand can have monstrous purchase applications and much lengthier board approval processes. Co-ops will also require an in-person interview with the board after a purchase application has been reviewed and conditionally accepted.

A co-op board is unique in that it does have the power to reject a prospective purchaser without having to disclose a reason. Technically, a co-op board can reject a buyer for any reason except for a discriminatory reason. Discrimination is difficult to prove in practice as co-op boards will never give any reason for the rejection.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

You should reach out to your mortgage broker or bank to finalize your mortgage as soon as your deal is in contract. It’s wise at this stage allow the bank to order their appraisal because it will be paid by you. You may also wish to rate lock your mortgage at some point after you have a fully executed contract. It’s up to you to time it depending on how interest rates are behaving and what your mortgage banker thinks.

Once you’ve handed over all documentation and the lender has reviewed and verified your submission, your file may be approved by the bank’s underwriter in which case you’ll receive a mortgage commitment letter.

This letter is as close to a promise as you’ll be able to get from a bank these days that they will show up with the money at closing. You’ll need a loan commitment letter in order to submit your purchase application if you’re buying a co-op.

After you’ve received board approval, reach out to your attorney to schedule a closing. You may have to wait for your bank to finalize our file and to give you a clear to close.

Congrats on making it to the end of our Home Buying 101 course! The hard work is done and it’s now time for you to relax and collect your keys on closing day. You’ll want to make sure that your attorney and not his paralegal shows up on closing day.

Even though everything should be finalized, you still might encounter some last minute negotiations, and you don’t want your paralegal to get run over by the other side’s attorney.

On closing day, your attorney will guide you through all the documents you’ll need to sign. Your attorney will also make sure funds and checks are properly disbursed.

In fact, your lawyer will give you a closing statement with your exact closing costs shortly before closing so you’ll know exactly where the money is all going.

You can expect to see the buyer’s attorney, the seller’s attorney, the bank’s attorney, the title company’s representative, the buyer, the seller and possibly the buyer’s broker and the seller’s broker on closing day. We say possibly because brokers do not have a role at closing, and often times there aren’t enough seats for them!

As a result, most brokers will simply show up at some later time to collect their commission check, or ask that it be mailed to them.

That’s it! After you have signed and reviewed everything, it’s time to take a photograph with your team for the history books and collect your keys to your new home. Congratulations on finishing our Home Buying 101 course and for now understanding how the home buying process works in NYC!

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

Thanks for sharing this informative information with us. Really got a very useful info from your blog. Keep it up. I really enjoyed reading this blog.