The typical home buying checklist you’ll find online will be written by journalists without real estate experience and irrelevant to the one-of-a-kind NYC real estate market.

We’ll explain in the following home buying checklist for NYC the exact steps you’ll need to take before, during and after the home buying process in New York City. All of our articles are written by experienced real estate professionals with in depth knowledge of the world’s greatest real estate market.

Table of Contents:

How Much Mortgage Can I Get?

How Much Home Can I Afford?

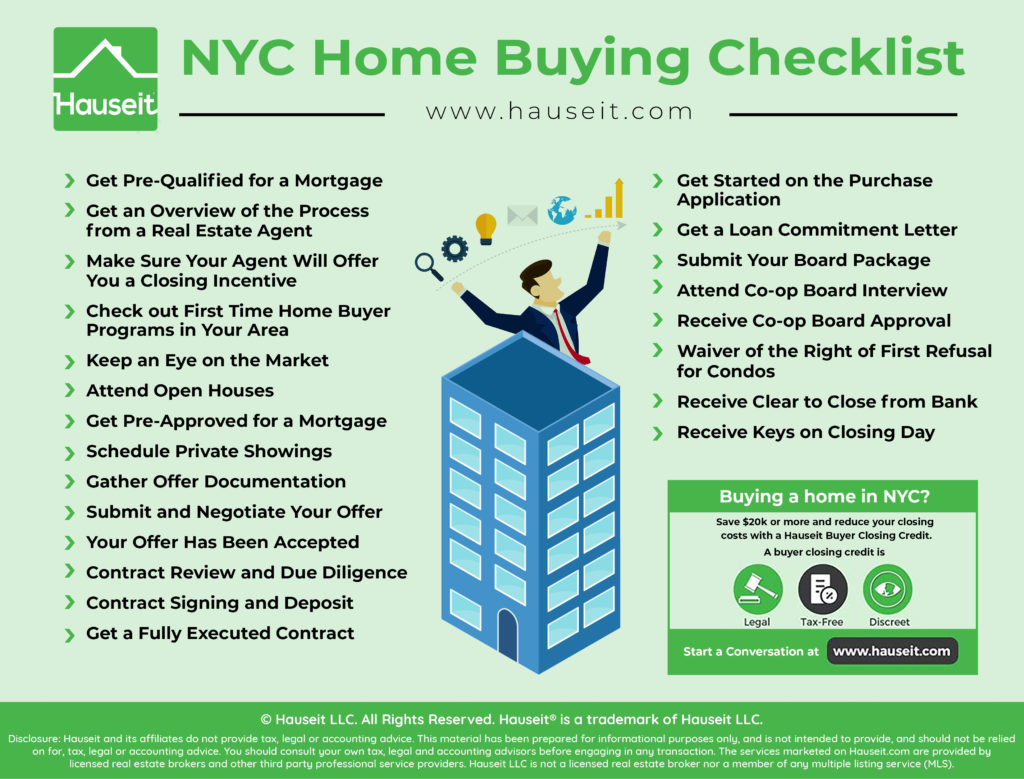

Get Pre-Qualified for a Mortgage

Get an Overview of the Process from a Real Estate Agent

Make Sure Your Agent Will Offer You a Closing Incentive

Check out First Time Home Buyer Programs in Your Area

Keep an Eye on the Market

Attend Open Houses

Get Pre-Approved for a Mortgage

Schedule Private Showings

Gather Offer Documentation

Submit and Negotiate Your Offer

Your Offer Has Been Accepted

Contract Review and Due Diligence

Contract Signing and Deposit

Get a Fully Executed Contract

Get Started on the Purchase Application

Get a Loan Commitment Letter

Submit Your Board Package

Co-op Board Interview

Receive Board Approval

The Right of First Refusal

Receive Keys on Closing Day

The first step is to figure out how much money you can borrow based on your income, liabilities and other variables.

Check out our handy Mortgage Affordability Calculator to figure out the maximum amount you can borrow.

The next step is to figure out how big of a house you can buy, and how much you’ll need to have saved in order to buy it.

Remember that you’ll need cash to cover not just the down payment, but also closing costs as well as any post-closing liquidity requirements imposed by banks or co-op and condo boards.

Use our interactive Home Affordability Calculator to figure all of this out.

Speak with a mortgage broker or bank and tell them about your financial situation. You don’t have to hand over any documentation at this stage.

The mortgage pre-qualification letter you’ll receive after a ten minute phone call is primarily for your own benefit because real estate agents won’t give much credence to it.

However, it will be useful for you to know whether the loan amount you had in mind is realistic or not according to the bank.

It is free for buyers to work with a real estate agent. The buyer never pays commission because it’s the seller who pays a fixed commission that is typically split equally between the seller’s agent and the buyer’s agent.

So take this opportunity to find a real estate agent in NYC and get a no strings attached overview of the home buying process. You can always switch agents as it’s almost unheard of for buyers to agree to work with an exclusive buyer’s agent.

Some agents may offer you a closing gift as a token of appreciation for choosing them vs the next agent. The typical closing gift will be a bottle of sparkling wine or a box of chocolates.

You can do better with a discreet buyer closing credit worth $20,000 or more on your typical home through one of Hauseit’s traditional partner brokers.

It’s important that the buyer’s broker you choose is not a discount real estate broker in NYC, but rather a traditional broker who is discreetly giving you a gift at close.

The last thing you’ll want is for your closing gift to disrupt your home purchase.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

There are many local and national first time buyers programs available for New Yorkers.

Some programs may offer special loans and rates, and some may offer outright assistance with your down payment such as SONYMA’s DPAL program or the Hauseit Buyer Closing Credit program.

Your local bank may also offer closing credits for first time home buyers.

Tell your buyer’s agent exactly what you’re looking for and have him or her send you ideas that match. If you want to be thorough, you can also set up a search alert yourself on any number of popular real estate search websites.

This way, you’ll get an email notification anytime a new listing comes on the market that matches the criteria you specified.

It’s important to stop by as many open houses as you possibly can. This will give you an idea of the range of possibilities in your price range that’s on the market. Seeing more places also enables you to compare options and even measure square footage more easily.

Furthermore, open houses don’t require an appointment which means there’s no scheduling and you can show up anytime you like during a typical two hour window, if you even make it at all. Try to line up multiple options which are close to each other to see all at once on any given Sunday.

Once you’ve seen enough places and have concluded that buying a place at current prices is a real possibility for you, it’s time to get pre-approved for a mortgage. Getting mortgage pre-approval in NYC is much more serious than simply getting pre-qualified.

That’s because you’ll need to submit documentation so the bank can verify your income, assets and liabilities. A mortgage pre-approval letter means the bank has partially underwritten your file, and is a vote of confidence from a lending institution that you can actually get a loan.

It’s time to schedule a private showing if you’ve seen something you really liked during your open house tour. Though it’s perfectly acceptable to make an offer after only seeing a place once, some buyers may wish to see a property again with their family or even just to take some measurements.

If you’re serious about putting an offer in on a place, then ask your buyer’s agent to schedule a second showing for you.

It’s important to have a pre-approval letter at this stage so your buyer’s agent can demonstrate that you’re a serious buyer when making appointment requests.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

In order to submit an offer on your behalf, your buyer’s agent will need a completed REBNY Financial Statement and a mortgage pre-approval letter from you.

It’s also nice to include a short biography along with your lawyer’s contact information to demonstrate the level of your seriousness.

You’ll of course also need to agree on the offer price, what percent you are putting down, any closing date preferences and whether you want a mortgage contingency or not.

Your buyer’s agent will gather all of the above documentation into a single email and send it to the listing agent. Please keep in mind that offers are not binding until contracts are signed.

This means negotiation and changes to the terms of the deal can occur even after you have an accepted offer. Rely on your buyer’s agent at this stage to negotiate on your behalf.

It’s best to keep your options open by putting offers in on multiple properties. You can even negotiate contracts on multiple accepted offers.

Don’t celebrate yet as deals fall apart all of the time. The real estate agents on the deal will circulate a transaction summary, often called a deal sheet, to all lawyers and brokers on the transaction shortly after an offer has been accepted.

The point of the deal sheet is to put the lawyers representing the buyer and the seller in touch with each other and to give them the basic terms that have been agreed to. Buyers and sellers are each required to have their own real estate attorney for contract review and negotiation in New York.

Your lawyer will review and negotiate the purchase contract plus perform legal and financial due diligence on your behalf.

Your lawyer will review the building’s original offering plan and the building financial statements, and your lawyer will schedule time to review the condo or co-op board meeting minutes at the managing agent’s office.

Once your attorney has reviewed and negotiated everything on your behalf, you’ll meet to get a final summary before signing the purchase contract.

You’ll also need to bring a personal check for typically 10% of the purchase price. Your lawyer will messenger your signed contract along with your good faith contract deposit to the seller’s attorney.

At this stage, your offer becomes binding because the seller can counter-sign the contract and deposit your check in the seller attorney’s escrow account at any time.

Even though the contract is binding for you as the buyer once you’ve signed, the contract is not binding on the seller until he or she counter-signs the contract and returns it.

Because the seller is last to act, he or she holds tremendous leverage over you at this point. It’s possible for the seller to back out of your accepted offer and sell to someone else at any time before counter-signing the contract.

Fortunately, most lawyers will be professional enough to get their client to counter-sign within a business day or two.

Get a head start on your purchase application as soon as you have a fully executed contract.

You’ll need the lead time to gather documentation and reference letters especially if you have a co-op board package to complete.

Check out our guide on how to put together a professional co-op board purchase application.

Provide your mortgage banker with anything else he or she needs to finish the mortgage underwriting process.

Once your loan has been approved, you’ll get a mortgage commitment letter which is as close to a promise as you’ll be able to get from a bank that they’ll fund your loan.

Mind the fine print as there will be lots of contingencies for the bank to not fund your loan on closing day.

Once you’ve gathered everything and diligently completed the purchase application exactly to specifications, then it’s time to print it all out and submit it to the managing agent.

Some co-op and condo boards allow electronic submissions these days, but the vast majority still require you to print out multiple copies of the entire board package for a physical submission.

Please keep in mind that condos will still typically have some sort of registration form or simple condo purchase application; however, they will pale in comparison to the monstrosities that are your typical co-op board applications.

Co-ops will generally require you to meet the board for an interview after reviewing and conditionally approving your purchase application.

They’ll want to make sure that you aren’t a total mess in person and that you will generally be a good neighbor and addition to the community.

Remember that co-ops can reject applicants without needing to provide a reason as to why. Read our tips on how to ace a co-op board interview before you head out.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Co-op board approval can take a day or weeks, depending on how the interview went and the board’s deliberations.

Some applicants may hear informally at the end of the interview that they’ve been approved, with formal notice from the managing agent to come the next business day.

However, the average wait time is usually one to two weeks after the interview to hear the board’s decision.

Condo boards don’t have an interview, but they do have a right of first refusal on any sale in their building.

Condo boards typically have 30 days to either waive their right of first refusal or confirm that they’ll exercise their right to purchase the property on the same terms as the prospective buyer.

This almost never happens given the difficulty of raising funds for such a purpose, but it does protect the condo building from fire sale transactions.

Once you’ve gotten the green light from your condo and co-op board, you’ll simply need to receive a clear to close from your bank lender.

Remember that closing dates have wiggle room, and the date set in the contract has on or about language regarding it. That means the closing date can be 30 days to either side of the contract closing date as a normal course of business.

On closing day, your lawyer will be present to guide you through all of the documents you’ll need to sign, and your lawyer will cut checks on your behalf and make sure all funds are distributed correctly.

You can expect to see the seller, the bank’s attorney, the seller’s attorney, your attorney, the title company representative and possibly the real estate brokers on closing day.

Real estate agents typically do not show up at closing as they do not have a role, and there often aren’t enough seats to accommodate them!

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.