The US housing market faces significant headwinds in 2023 due to a confluence of factors ranging from mortgage rates above 7%, increasing layoffs as we see more than just a technical recession, a run-up in home equity over the past several years on an unprecedented scale and increasing inflationary pressures on home owners and landlords.

Given the size of the housing market and its outsized percentage of household net worth, we believe these factors will lead to a deep decline in the housing market in 2023 to 2024. Furthermore, we believe the upcoming crash in the housing market will cause the economy to go into a deep recession starting in 2023, with the prospect of a Fed-managed soft-landing becoming increasingly unlikely.

Despite repeated bear market rallies in the hopes of a Fed pivot, peak hawkishness and peak inflation, investors seem to ignore the elephant in the room of higher mortgage interest rates on the gigantic US housing market.

With 30 year fixed mortgage rates well above 7% as of late 2022, mortgage payments for prospective buyers have gone stratospheric.

Consider the case of a buyer needing a $500,000 mortgage in order to buy. When rates were 2.5%, the monthly payment was $1,976. But with rates at 7.5%, the monthly payment has gone up to $3,496. That is an approximately 77% increase in the monthly payment!

While the cost of buying a home has dramatically increased, Americans’ incomes have actually been decreasing on a real basis, adjusted for inflation.

For example, the U.S. Bureau of Labor Statistics says that “real average hourly earnings decreased 2.8 percent, seasonally adjusted, from October 2021 to October 2022. The change in real average hourly earnings combined with a decrease of 0.9 percent in the average workweek resulted in a 3.7 percent decrease in real average weekly earnings over this period.”

This massive decrease in buyer affordability for the majority of buyers who would need a mortgage, means that the buyer universe is more and more dependent on cash buyers. However, with interest rates significantly higher and valuations of all assets lower, cash is more valuable than ever due to high opportunity costs.

As a result, in 2023 and into 2024 it’s inevitable that we will see a major slump in the housing market. With the majority of buyers priced out of the market and sellers largely unwilling to cave to the discounts demanded by cash buyers, we expect to see thin liquidity marked by transactions between truly desperate sellers and opportunistic buyers.

Pro Tip: The only positive news here is that banks have maintained their discipline after the Great Financial Crisis of 2007-2008, and lending standards have remained tight in the years since. As a result, we don’t expect as many banks to be in trouble this time around due to the absence of aberrations like NINJA (no income, no job, no assets) loans.

With new job cuts being announced almost daily by large employers, first in the bloated technology sector and now spreading out to banks and the broader economy, we will finally have an end to the debate on whether we’re technically in a recession or not.

Unfortunately for the housing market, these job losses could not have come at a worse time. According to the Federal Reserve Bank of New York, Americans are more indebted than ever with household debt rising to $16.15 trillion, of which $11.71 trillion was housing related debt as of Q2 2022.

This tremendous rise in mortgage debt can partly be accounted for by the rapid increases in home prices in recent years, due to the massive increase in the money supply and the Fed’s zero interest rate policies.

People still needed a place to live, and had to borrow more to get in on the housing market. Plus, with the prospect of the Fed distorting the market and interest rates forever, people felt that it was relatively risk-less to pay up for ever pricier homes.

Unfortunately for the housing market, the rapid rise in mortgage rates combined with the coming increase in the unemployment rate spells disaster.

What do you think will happen when that highly paid tech worker who just got laid off, with negligible savings after all the revenge travel he or she did post-COVID, will do when his or her adjustable rate mortgage resets 2-3x higher?

Keep in mind there were plenty of smart people who opted for the lower interest rates that came with a 3, 5, 7 or 10 year ARM, or even IO ARMs, vs a higher rate but more conservative 30 year fixed mortgage.

They counted on being able to refinance when their fixed interest rate period became floating, or anticipated being able to sell prior to their rate becoming free floating.

However, all of these people will be in a tough situation when they realize that the housing market is frozen, they’re unable to sell, they’re unable to afford to refinance at 7% or 8%, and that they just lost their job. How will they able to avoid defaulting on their mortgage when their interest only (IO) adjustable rate mortgage (ARM) resets to 7.5%?

Keep in mind that in a recession, many companies are also announcing hiring freezes, especially in the tech sector which simply grew too much, too fast in recent years. As a result, while a superstar software engineer might be safe, all the recent hires in DEI, ESG, HR or other non-core roles may truly find it difficult to find a replacement job.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

One of the major reasons that the US housing market is in deep trouble is how fast and how much home prices have risen in recent years. Per the St. Louis Fed, the average sales price has increased from $374,500 in Q2 2020 to $542,900 in Q3 2022. This is a hyperbolic increase of approximately 45% in home prices over the last 2 years!

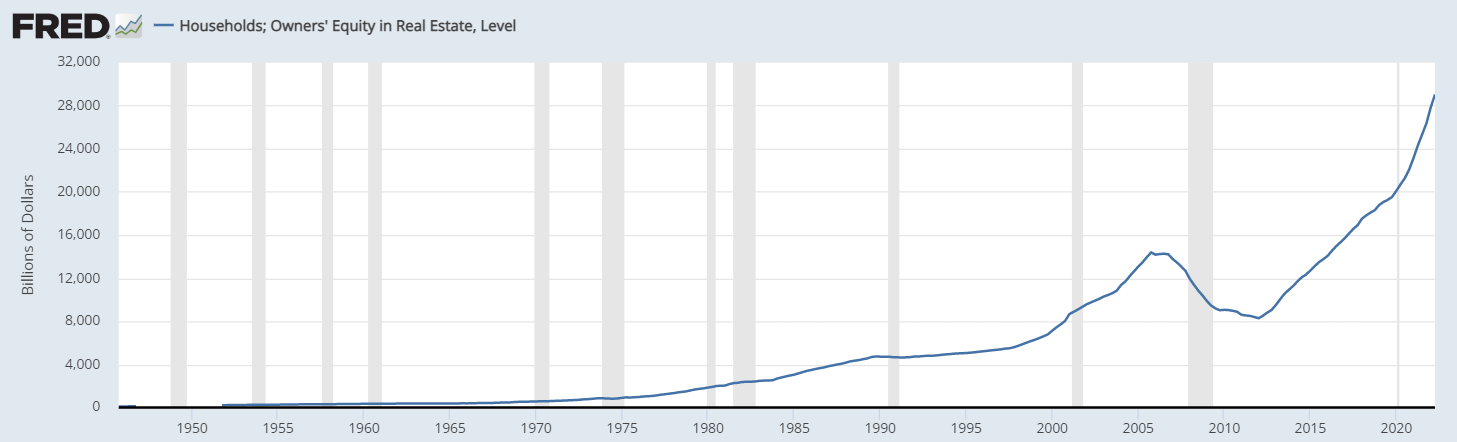

According to St. Louis Fed data, households’ home equity has increased to $29.04 trillion, out of a total net worth of $135.75 trillion as of Q2 2022. This equates to 21.4% of US households’ net worth being tied up in their home equity.

This is bad news for not just the housing market, but the wider economy due to the negative wealth effect from declining asset values.

As people’s stock, bond and real estate portfolios go down in value, they feel “poorer” and as a result rein in their spending, further contracting the economy and asset prices.

However, what’s especially troubling this time around is just how big a percentage of households’ net worth is tied up in inflated home equity, due to the massive run-up in housing prices.

Per the chart from the St. Louis Fed below, you can see the run-up in households’ home equity far exceeds that of the mid-2000’s housing bubble: