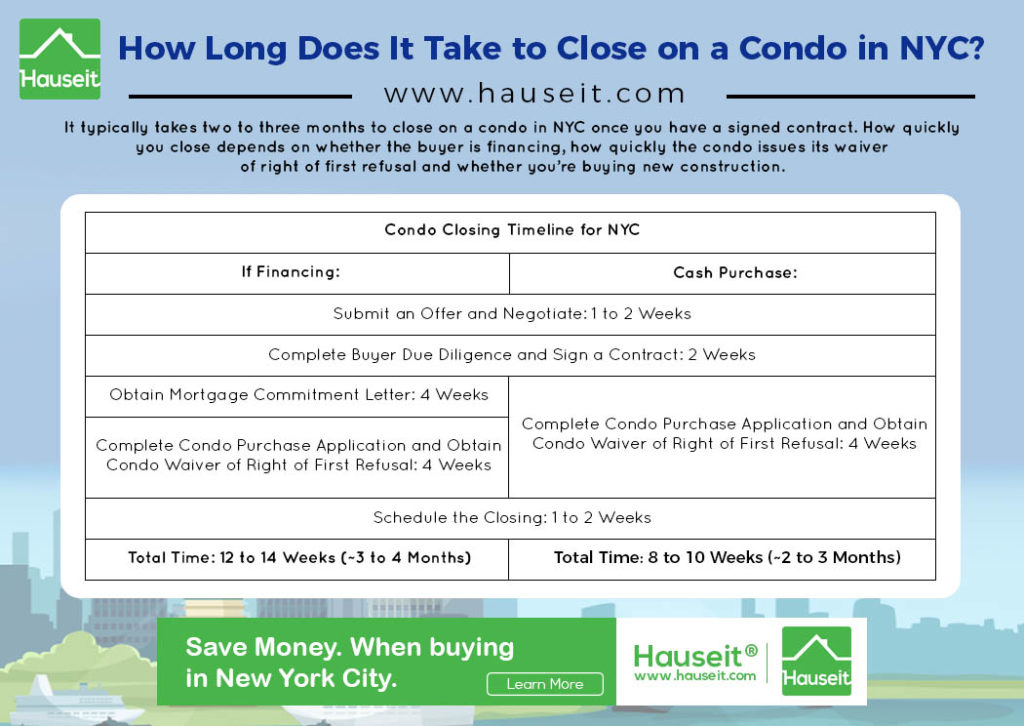

It typically takes two to three months to close on a condo in NYC once you have a signed contract. However, the timeline from accepted offer to closing can be faster or slower depending on a number of factors.

These variables include whether the buyer is financing, how quickly the building reviews the purchase application and issues its waiver of right of first refusal and whether you’re buying new construction.

Table of Contents:

It takes approximately 5 to 8 weeks to close on an all-cash condo deal in NYC. Whether you’re buying a condo or a co-op, a cash transaction will always be approximately one month faster than a comparable financed deal.

Cash deals are quicker because the buyer and seller do not need to wait two to four weeks for the bank to complete its underwriting process and issue a mortgage commitment letter.

The involvement of a bank can introduce a number of delays and risks into any condo transaction.

Here’s a good example: if a bank’s team of underwriters are overloaded on work, it could take them longer than usual to review the buyer’s file in the first place.

If there is a low appraisal, it could take a few weeks for the buyer to complete the dispute process with the bank.

Furthermore, introducing a bank into a condo deal adds another party to the game of complex coordination which is every real estate deal in NYC. Before the closing can be scheduled, all parties including the buyer, seller, both attorneys, building and the lender must all be on the same page and ready to close.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

It takes approximately two to three months to close on a condo in New York City if the buyer is taking out a mortgage.

The speed of the mortgage process depends on a number of factors including how quickly the buyer submits his or her loan documentation and how quickly the bank’s underwriters are able to review the file.

The first possible source of financing related delays can often be caused by the buyer.

To complete a loan application, a buyer needs to provide many months of bank statements and sign a large number of documents.

For a busy NYC home buyer who works around the clock, it may take a week or more to complete this part of the process.

Once the buyer submits all required documentation, the application turnaround time is largely at the discretion of the bank. If the underwriting team determines that there are errors or omissions in the application, the buyer will be asked to submit more documentation. This bank and forth can add weeks to the overall sale closing timeline.

In rare instances, a bank can accidentally issue a commitment letter and subsequently back out of the deal before closing.

Sellers typically prefer cash buyers and often accept lower offers from them because of the reduced risk of deal delays or the cancellation of the deal altogether through the mortgage contingency clause.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The condo closing timeline is 2-3 months for a financed deal and 5-8 weeks for a cash deal. The minimum amount of time between a signed contract and closing is approximately 4 weeks.

The reason for this delay is because buyers are usually required to submit a condo application to the building which must then be reviewed by the board.

The building is entitled to a minimum amount of time which is usually 20 to 30 days to review the application and issue its waiver of right of first refusal.

The right of first refusal is a mechanism which allows a condo building to buy the apartment on the same proposed deal terms of the transaction itself.

The risk of a condo in NYC exercising its right of first refusal is remote, as most buildings simply do not have enough money readily available to make a purchase.

The concept of right of first refusal is intended to protect a building against an owner who tries to sell his or her apartment at a fire sale price.

For example, let’s say a seller with a $1.5 million apartment needs $250k immediately in order to pay off another debt. Depending on how desperate the seller is, he or she may try to list the property for $1m or less in order to raise cash quickly.

If this sale were to go through, it would reduce the value of all apartments in the building.

How quickly you can close on a new construction condo in NYC largely depends on what stage construction is when you sign a contract.

If construction is complete and there have already been other closings, you could conceivably close in as little as a few weeks if you’re paying cash. Since there is no board application or right of first refusal process for new developments, the closing can be faster than what you’d experience for an existing condo.

If you sign a purchase contract well before construction is complete (i.e. you are buying a pre-construction condo), you face the prospect of numerous construction related delays and possibly even a cancellation of your contract under certain circumstances.

Learn more about the special risks to buying a new construction condo in NYC by reading our white paper on buying new development condos in New York City.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Published: 9/11/18 | Last Updated: January 29th, 2020

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

Thank you for explaining to us that it is the role of a listing agent to be in charge of listing the seller’s property on the market and helping them find buyers who can consummate a deal while acting in the best interests of the seller. I will be moving to the other side of the country later this year, so I need to sell my current residence in Hudson Valley soon since no one will be occupying it anymore. I’ll keep this in mind and consider hiring a real estate listing agent to help me find a trustworthy buyer for my property soon.