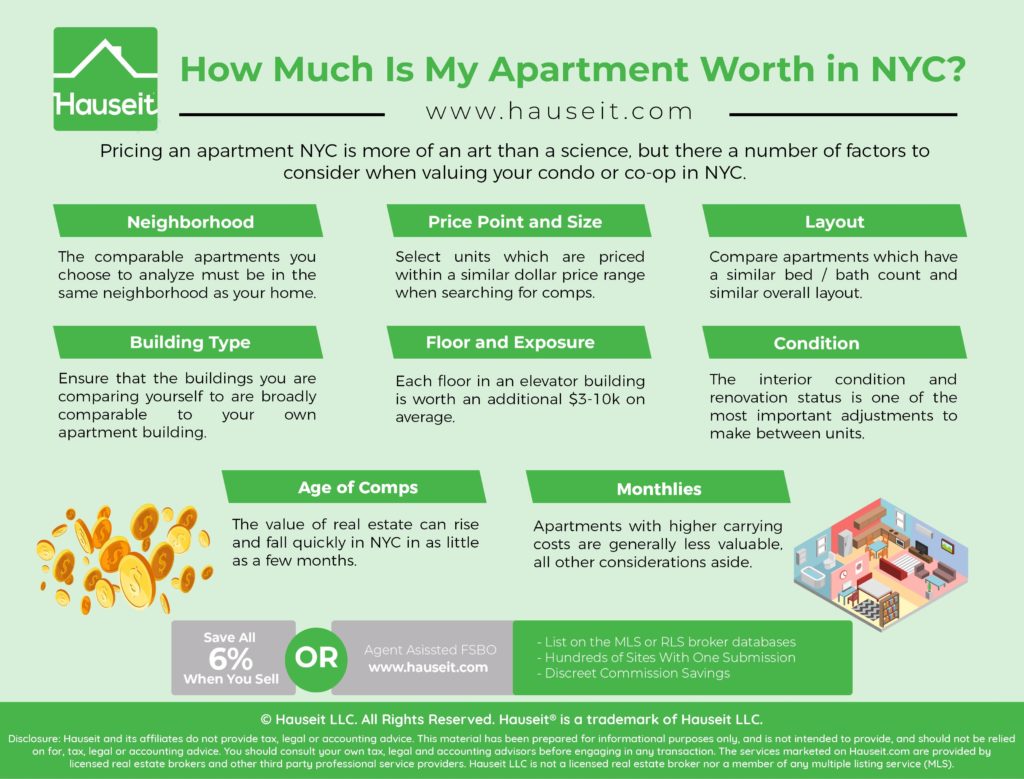

Pricing an apartment NYC is more of an art than a science, but there a number of factors to consider when valuing your condo or co-op in NYC. In this article, we explain all the variables you should consider when building a comp set and preparing a CMA (Comparative Market Analysis) for your NYC apartment.

Valuation Factors:

Location, location, location! Each neighborhood in NYC has its own pricing ecosystem which means that the comparable apartments you choose to analyze must be in the same neighborhood as your home.

When searching for comparable apartments, the first place to look is within your building. What has sold within the past 1-2 years?

Look in Your Building

If there are no recent active, in-contract or closed sales in your building, the next place to look is within a five-minute walking distance from your home.

In the instance that there are no suitable comps (comparable) close by, you can broaden your search to the rest of the neighborhood.

While comps in the same neighborhood usually don’t merit location adjustments, there are exceptions for wider neighborhoods such as Bedford-Stuyvesant and Crown Heights.

Because these neighborhoods extend very far East into Brooklyn, apartments on the western edges of either neighborhood will have higher valuations versus what you’d find in adjacent neighborhoods to the west: Clinton Hill, Prospect Heights, etc.

Another example of a neighborhood whose apartment values can vary geographically is the Lower East Side (LES).

The LES abuts Nolita to the West and extends all the way to the East River. Apartments in LES which are closer to Nolita / Little Italy are more valuable than units which are further east. If a neighborhood comp is significantly further east than your apartment, you could make an adjustment of 5-10% for location.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

When identifying comparable apartments, it’s a good idea to select units which are priced within a similar dollar price range.

For example, let’s say you are selling a 1br / 1bath condo in the East Village which is worth under $1,000,000. It would not be a good idea to compare the Price Per Square Foot (PPSF) of your condo to the PPSF for luxury new development condos whose prices start at $1,500,000 because the composition of the buyer base is not the same.

New Developments Have Unique Pricing

Continuing with the example above, you’ll want to compare your unit against PPSF of condos which are priced within the same approximate dollar pricing range as your apartment.

Since co-ops do not have official square footage figures listed in their Offering Plans, it’s even more important in the case of co-ops to compare apples for apples.

Preparing a Comparative Market Analysis (CMA) for a co-op in NYC is especially challenging since there are a number of interpretations for how to measure square footage.

Let’s say that you are selling a 1 br co-op in the West Village which is approximately 400 square feet, and your unit number is 3F. Apartment 2F, which is the same ‘line’ as your unit and therefore has the same size and layout, sold 6 months ago for $750,000. Prices have generally been rising ever since.

When searching for comparable co-op apartments in this scenario, you’d want to look for active, in-contract and sold co-ops that are priced between $700-900k.

Once you’ve assembled a list of comparable co-op units, a good way to compare size is to measure and sum the room dimensions on the floor plans.

If the size difference is ~ 50 square feet or more, a valuation adjustment for size may be warranted. For example, let’s say Comparable A which sold for $500k has a floor plan whose room dimensions sum up to 500 square feet. If Comparable B’s floor plan dimensions sums to 550 square feet, a potential adjustment would be $50,000 in favor of Comparable B.

It’s important to compare apartments which have a similar bed / bath count and similar overall layout.

For example, comparing a studio to a 1br would not be advisable even if they are the same approximate square footage since studios are less valuable.

Here are some examples where a ‘pricing adjustment’ must be made to comparably sized apartments to reflect the difference in layouts:

-

Alcove Studio vs. Studio

-

Studio vs. 1br

-

1br vs. 2br

-

1bed/1bath vs. 1bed/1.5bath

When making pricing adjustments for layout considerations, it’s important to consider ‘option value.’

Optionality is always valuable, whether it’s in real estate or any other walk of life. For example, if two apartments are the same size and price point, but one has 1 bath and the other has 1.5 baths, the latter unit is obviously worth more.

Similarly, if Comparable A and Comparable B are the same size but one has a private balcony, the unit with outdoor space is worth more.

Making valuation adjustments for layouts is obviously subjective, but it’s guided mostly by common sense and strategically considering the value of optionality.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

There are a number of different types of building classifications in NYC which include: pre-war vs. post-war, full-service, elevator vs. walk-up, boutique vs. large building and new developments.

When selecting comparable apartments, it’s important to ensure that the building types you chose are broadly comparable to your own apartment building.

Here are some examples of inappropriate comparisons:

-

Walk-up vs. Elevator Building – if your unit is a 3rd floor walk-up or higher, comparing it to a unit on the same floor in an elevator building would require a downward adjustment to the value of your unit.

-

Pre-war vs. Post-war – although there are exceptions, it’s generally inappropriate to compare the values of pre-war apartments vs. post-war or relatively new apartment buildings.

-

New Developments – new developments trade at a premium compared to existing stock units. Therefore, it’s never appropriate to compare the value of your apartment to the prices of new developments (even if they are in the same geographic area)

-

Full-Service Buildings – full-service buildings typically offer a 24 hour doorman as well as other communal amenities such as a gym, bike storage, garage parking, central laundry, a roof deck and/or other recreational areas. Because full-service buildings cater to a different buyer base vs. low-service buildings, apartment values general differ between the two types of buildings.

It would also be highly inappropriate to compare a condo to a co-op apartment since pricing between the two can vary by as much as 40%.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

For an elevator building, each floor is worth an additional $3-10k on average.

While the difference between floor 25 and 28 may only be worth ~$10k, the difference between floor 2 and floor 6 could be worth ~$30k or more.

In a walk-up building, apartment values generally decrease as you go above the 3rd floor.

Walk-Ups Are Less Valuable

This makes sense, as walk-up apartments higher than the 3rd floor have a smaller buyer base which usually does not include buyers who require accessibility.

If a higher floor walk-up apartment has a private roof deck, that may offset some or all of the downward floor adjustment.

While improved exposure and light is usually priced into the standard floor adjustments, an additional adjustment may be considered if a unit’s view is fully or partially obstructed or if a unit offers skyline views above a certain floor in a building.

For example, if an F line apartment on the 10th floor has unobstructed Hudson River views but the R line apartment on the same floor faces another building, the F line unit will be priced higher.

The interior condition and renovation status of apartments is one of the most important adjustments to make between units.

The most expensive renovations in NYC apartments are for the ‘wet areas’ of the unit, also known as the kitchen and bathrooms. A typical renovation per wet area in NYC can range from $20k to $50k, or $100-200 per square foot of the apartment size.

If Comparable A has a renovated kitchen and Comparable B is un-renovated, an appropriate condition adjustment would be $20-30k.

In the event the renovation is high end, a case could be made for a higher adjustment. If a unit has a renovated kitchen and bath, it is worth around ~$60k more than a comparable unit (all other factors constant).

The second most common condition adjustment is for floors. A typical hardwood floor in NYC costs anywhere from $2-6 per square foot for the materials and $2-4 per square foot for the installation. If a comparable apartment’s floor is in need of replacement, an adjustment should be made.

Adjustments for painting or other minor alterations is generally not required since the cost is relatively negligible compared to factors which are being analyzed: floor, major renovations, etc.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Apartments with higher carrying costs are generally less valuable, all other considerations aside.

If an apartment has a drastically higher or lower monthly maintenance or common charge bill, then a valuation adjustment should be made.

If an apartment has a large ongoing assessment, there is a possibility that the seller is willing to pay of the assessment in full.

If monthly maintenance and the building’s overall condition going forward is roughly comparable, you should not penalize the apartment’s valuation if the seller has agreed to pay the assessment and it’s perceived to be a one-off, non-recurring expense.

The value of real estate can rise and fall quickly in NYC in as little as a few months.

If you are analyzing closed comps which sold more than 3 months ago, it’s important you determine the direction of prices and make an appropriate adjustment to reflect the time which has elapsed since the apartment sold.

Furthermore, the price of an active listing does not automatically imply that the unit is worth its asking price.

If an apartment has spent more than 1-2 months on the market, it’s highly likely that the eventual sale price will be below the asking price. Therefore, it’s unreasonable to automatically assume that your apartment is worth as much as an apartment which has been stagnating on the market (possibly with an unrealistic asking price).

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Published: 6/18/18 | Last Updated: January 21st, 2020

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.