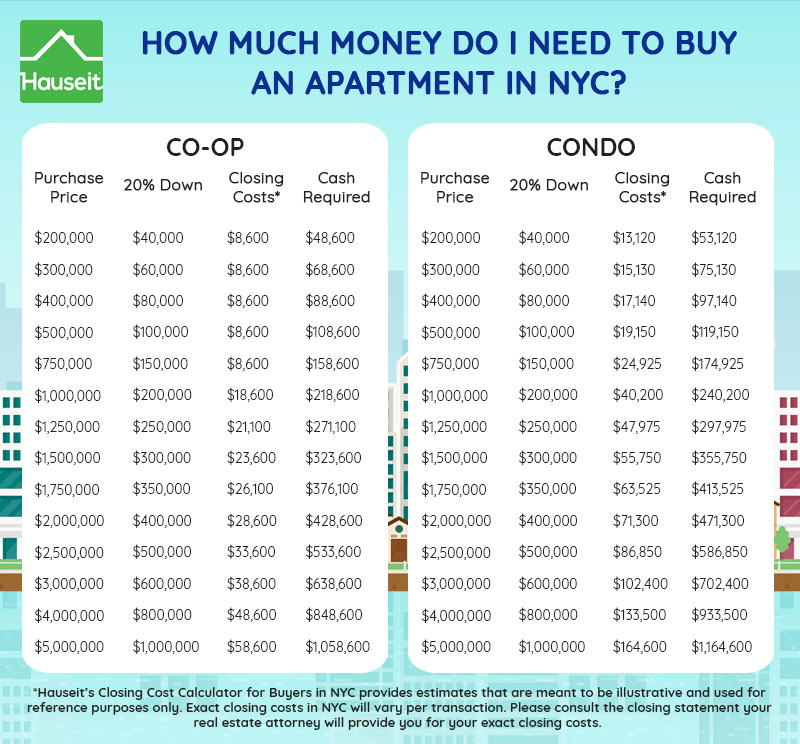

You need to have 22% to 26% of the purchase price saved for a condo and 21% to 22% of the purchase price saved for a co-op (assuming 20% down) to buy an apartment in NYC. These figures exclude mortgage lender reserve requirements, which are usually 6 months of housing payments.

How much money you need to buy an apartment in NYC depends on whether you’re buying a condo or co-op, the amount of your down payment and whether you’re financing the purchase.

Table of Contents:

The largest costs of buying an apartment in NYC are your buyer closing costs and your down payment.

Since the down payment goes towards your home equity, it’s not really an expense but rather just a cash flow consideration.

The true ‘costs’ of buying an apartment in NYC are simply your closing costs and the value of your time and emotional energy invested in the search process.

Buyer closing costs are lower for co-op apartments compared to condo apartments, especially if you’re taking out a mortgage.

Co-op buyers pay fewer closing costs than condo buyers because many buyer closing costs apply only to ‘real property,’ and co-ops are not considered to be real property.

We explain how the ownership structure works for co-op apartments in this article.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The cost of buying an apartment in NYC is your down payment plus closing costs.

The total amount of money you need to buy an apartment in NYC is 21% to 22% of the purchase price for co-ops and 22% to 26% of the purchase price for condos, assuming 20% down.

It’s important to understand that the figures above do not include any post-closing liquidity requirements of your co-op building or mortgage lender.

Most co-ops in NYC require that applicants have at least one to two years’ worth of monthly mortgage and maintenance payments in liquid assets after closing.

This is stricter than lenders which usually look for 6 months of post-closing reserves.

Furthermore, your down payment isn’t technically an expense since it goes towards your home equity.

Therefore, a more accurate answer for the ‘cost’ of buying an apartment in NYC is simply your closing costs and the value of your time and emotional energy spent house hunting.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The average down payment for a co-op apartment in NYC is 20% of the purchase price.

Exact down payment and financial requirements vary by co-op building, however it’s rare to find a cooperative building in NYC which permits anything less than 20% down.

Buying a co-op in NYC actually requires you to have much more than just the down payment and closing costs available in liquid assets.

This is because most co-op buildings require you to have liquid asset reserves of at least one to two years of housing expenses after closing.

You may wish to consider obtaining a gift from a family member to fortify your overall finances if you are a bit short on assets.

Since not all co-op buildings permit gifting, your buyer’s agent can verify the co-op’s policy by checking with the listing agent and/or the transfer agent and the building’s managing agent.

Receiving a gift is as simple as preparing a gift letter and submitting this along with your co-op offer.

When it comes to submit the co-op board application, you will also include the gift letter as part of your supporting financial documentation.

It’s possible to put down as little as 10% on a condo apartment in NYC, although some condo buildings have minimum down payment restrictions. The specific down payment rules vary by condo building.

If a building has no minimum down payment requirement, you can put down as little as the bank and the seller are willing to allow.

Condos have higher buyer closing costs than co-ops, so part of the down payment savings you may achieve with a condo would go towards additional condo closing costs.

With that said, condos usually have lower seller closing costs than condos. This is because many co-op buildings in NYC charge sellers an additional closing cost called a flip tax.

It’s also important to understand that condo buildings still may have certain sublet restrictions and other house rules which have some resemblance to what you’d find with co-ops.

There is a huge variety in terms of management style and the general approach for running condo and co-op buildings in NYC. In other words, the simple classification of ‘condo’ or ‘co-op’ does not paint the whole picture.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

To determine whether you can purchase an apartment in NYC, visit Hauseit’s interactive Home Affordability Calculator.

The calculator allows you to compute your maximum purchase price based on factors such as income, estimated closing costs and the post-closing liquidity requirements for your bank and/or co-op building.

Buying vs. renting in NYC is a highly contentious topic.

However, most people agree that it’s far more enjoyable to own something and build equity with your mortgage payments versus paying rent and receiving no long-term benefits or possible upside in return.

Published: 9/14/18 | Last Updated: March 26th, 2020

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.