Whether you’re buying or selling a co-op apartment in NYC, nobody wins when there’s a board rejection. The truth about co-ops in NYC is that board approval is almost entirely outside of your control. A co-op board can reject an applicant for any or no reason. To make matters worse, co-ops almost never share the reason(s) for a board rejection.

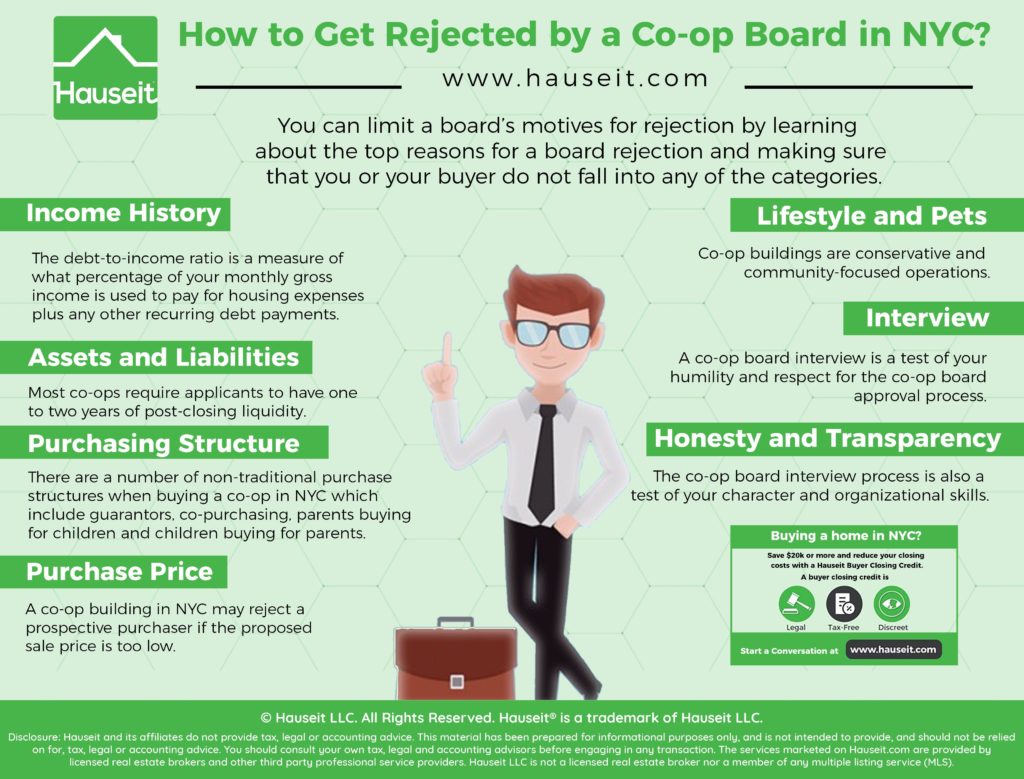

Unfortunately, you simply cannot remove all of the uncertainty surrounding co-op board approval in NYC. However, you can limit a board’s motives for rejection by learning about the the top reasons for a board rejection and making sure that you or your buyer do not fall into any of those categories.

Table of Contents:

Arguably the most rigid financial requirement for co-op applicants in NYC is the debt-to-income ratio (DTI) .

A typical co-op in NYC requires applicants to have a DTI of no more than 30%, and in some cases the maximum permitted ratio is 25%.

Some co-ops do not have a stated requirement, as they take a more holistic approach to a buyer’s financials.

The debt-to-income ratio is a measure of what percentage of your monthly gross income is used to pay for housing expenses (mortgage and co-op maintenance payments) plus any other recurring debt payments.

If you make $20,000 a month, have a mortgage payment of $5,000, co-op maintenance of $2,000 and a student loan payment of $1,000, your DTI is 40%.

We calculated this by summing up the monthly payments and dividing it by the monthly income figure of $20,000.

Truth be told, the subject of DTI can be more complicated than calculating a simple ratio.

Even if your DTI is within the requirements of the co-op, some boards may ask the following questions:

-

What is your DTI without bonus / overtime?

-

What is your average bonus / overtime over the past 2 years?

-

What is your DTI excluding non-wage income?

-

Were there any large variations in income over the past few years?

-

For how long have you held your current position?

In the event a large amount of your compensation comes in the form of bonus or overtime, co-ops will want to see a pattern of recurring bonuses and overtime. Often times the board will take a 2 year average, similar to what banks will do as part of the loan underwriting process.

If you’ve just started a high paying job this year after finishing school, you’d need to make sure that the co-op will use your income based on your employment letter instead of your YTD earnings.

Some co-ops only allow you to include wage income when calculating the debt-to-income ratio. This means that you’d have to exclude interest and dividend income, trust payments and any other recurring income stream.

These types of co-ops do not want ‘idle’ shareholders, even if they’re wealthy. This may be because the co-op thinks that people without stable, full-time employment may create more problems and/or spend more time hanging around the co-op compared to someone who is employed.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The primary purpose of a co-op reviewing your personal financial statement is to ensure that you have sufficient assets post-closing to help you withstand any dip in income while continuing to pay your monthly co-op maintenance bill.

Most co-ops require applicants to have one to two years of post-closing liquidity.

However, the calculation methodology for post-closing liquidity varies by co-op. This is because there are many interpretations of what assets qualify as being liquid.

If a co-op excludes IRAs and 401ks for the purposes of calculating post-closing liquidity, it means you’ll need to have one to two years’ worth of mortgage and maintenance payments in cash or cash equivalents: CDs, money market funds, etc.

Receiving a gift is the most common way for buyers with solid income to meet a building’s post-closing liquidity requirements if they’re short on assets themselves.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

There are a number of non-traditional purchase structures when buying a co-op in NYC which include guarantors, co-purchasing, parents buying for children and children buying for parents.

Each building has its own rules and procedures for these purchase structures.

Because policies vary by building, it’s essential that you or your buyer’s agent explicitly reconfirm the building’s policies which are applicable to your purchase structure.

To go a step further, it’s probably a good idea to have something in writing vs. simply taking the word of a listing agent who may not actually know the building’s policy.

A co-op building in NYC may reject a prospective purchaser if the proposed sale price is too low.

This is because existing co-op shareholders want to protect the value of their own apartments, and your low-priced sale would make it harder for future sellers in the building to obtain higher prices.

The fact that you may not be permitted to sell your own co-op in a down market (when you may need cash the most) because of the selfishness of your own neighbors is one of the main reasons why condos are better than co-ops (pricing aside).

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Co-op buildings are conservative and community-focused operations.

With that said, co-ops usually frown upon anything which is outside the status quo of a picture perfect, gainfully employed buyer who will be residing in the apartment on a full-time basis.

What do we mean by this?

If you are self-employed, work from home, go to school or plan on using the co-op as a second home (pied-a-terre), the co-op board may not be interested.

This is because all of these scenarios may suggest you’ll spend too much time in the apartment, make noise, hold parties and invite too many guests over, or never live in the apartment and possibly try to secretly sublet your unit without board approval.

In the abstract, it’s totally outrageous that a co-op has the ability to reject you based on a crude stereotype about how you may behave and use your apartment based on the nature of your employment.

However, co-ops are much less expensive than condos why is why most buyers are open to tolerating this type of behavior. It’s also important to note that the vast majority of co-ops are comprised of normal people with fair and practical boards.

A co-op’s pet policy is another serious consideration when thinking about board approval. Before submitting an offer on a co-op or accepting an offer from a buyer, you should have explicit confirmation of the pet policy and full information on the weight(s), breed(s), and type of pets in question.

The board interview is the final stage in the process of receiving co-op board approval in NYC.

An interview is nothing to worry about provided you are honest and concise with your answers, avoid asking questions and obviously avoid asking any arrogant or forward-looking questions such as:

-

When can I close?

-

When will you approve me?

-

Who do I talk to about my massive renovation project?

-

Can my parents come and live with me for 6 months?

-

Can I buy a pet parrot?

-

I think your building is poorly managed – can we paint the lobby?

-

Can I install an elevator in my apartment?

Some of the questions above are obviously exaggerated, but the meaning of them is very real: a co-op board interview is a test of your humility and respect for the co-op board approval process.

There is literally nothing which you need to ask immediately which cannot wait one to two weeks until you’ve closed on the apartment!

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The co-op board interview process is also a test of your character and organizational skills.

Most co-ops will immediately reject you if the feel that you’ve lied anywhere on the application or if you have not been transparent.

Therefore, a board is likely to reject you if you submit a confusing, incomplete or poorly organized board application.

While some merciful co-ops may give you a second chance to fix the application, it’s by no means guaranteed!

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.