Making a winning lowball offer on a NYC apartment is a dream come true for any buyer. While it’s possible to submit a successful low ball offer in both a buyer’s or a seller’s market, it’s obviously much easier when market conditions favor buyers.

The first step in making a successful lowball offer is to try and step into the shoes of the seller you’re facing off against. Understanding a seller’s motives and trigger points will help you structure a low ball offer which minimizes the chances of insulting the seller and prematurely ending a negotiation.

Table of Contents:

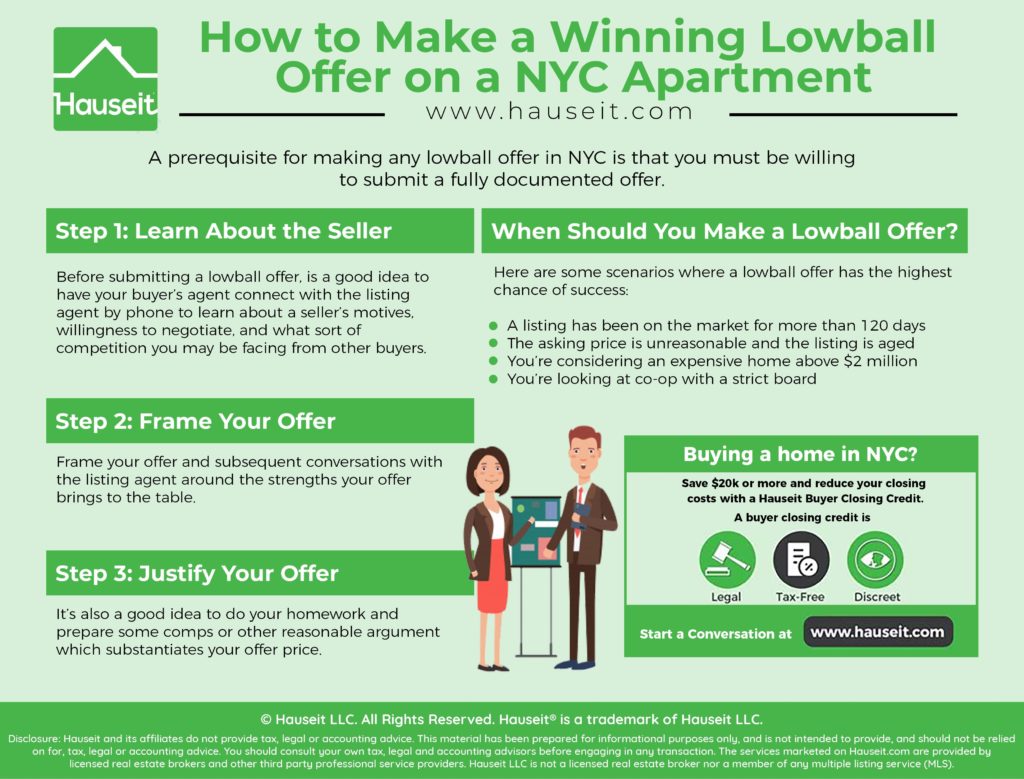

A prerequisite for making any lowball offer in NYC is that you must be a serious buyer who is prepared to submit a fully documented offer.

Regardless of whether you submit a lowball or a full ask offer, no seller will take you seriously if you simply send an aggressive one sentence email from your Yahoo or Gmail account with your offer price.

At a minimum, any serious offer must contain the following items:

-

Offer Price

-

Percentage Down

-

Contingencies – i.e. Mortgage Contingency

-

Pre Approval Letter (if financing)

If you’re submitting a lowball offer knowing that you have an uphill battle to persuade a seller, the truth is that your offer should be as comprehensive and fully documented as possible.

Submitting a comprehensive offer will make it look as serious as possible, and this will maximize the chances of a vulnerable seller negotiating with you as opposed to brushing you off.

Therefore, a lowball offer in NYC should ideally always contain all of the following items:

-

Offer Price

-

Percentage Down

-

Home Buying Contingencies, if any

-

Targeted Closing Date

-

Mortgage Pre-Approval Letter (if financing)

-

Proof of Funds (for at least 10% of the purchase price)

-

Real Estate Lawyer Contact Information

-

Submit Offer Form (if requested by the listing agent)

-

REBNY Financial Statement (necessary for co-ops, and usually condos too)

Step 1: Learn About the Seller

Before submitting a lowball offer, is a good idea to have your buyer’s agent connect with the listing agent by phone. If your buyer’s agent is experienced, this conversation can reveal a tremendous amount of information about a seller’s motives, willingness to negotiate, and what sort of competition you may be facing from other buyers.

Keep in mind that not all listing agents are willing to share information about their seller and the traction a listing is receiving. If you’re trying to submit an offer on a newer listing, you’ll have a much lower chance of receiving any valuable intel from the listing agent.

This means that even the most experienced buyer’s agent may not be able to glean much intel from the listing agent.

If the listing you’re targeting has been flailing on the market, chances are that the listing agent is as desperate to sell the property as the seller is. This means they’ll likely share plenty of information about the seller’s ‘bottom line’ with your buyer broker.

Let’s say that your interested in buying a co-op and the seller’s previous buyer was rejected by the co-op board. In a parallel example, let’s say that a seller is permanently moving to London in 3 months and they’re desperate to raise cash from the sale to fund a new home purchase in the UK.

In either scenario, it’s clear that the sellers will be more flexible on price if your offer is non-contingent, has a high percentage down, is all cash, and/or mentions an ASAP closing date. This is because all three of these elements suggest that you’re a lower risk buyer who offers a high likelihood of board approval and a swift closing.

Step 2: Frame Your Offer

Based on what you’ve learned about the seller, you can frame your offer and subsequent conversations with the listing agent around the strengths you bring to the table. For example, let’s say you have strong financials which will make for a smooth co-op board approval process.

In this case, you may want to compute and include your ultra-low debt-to-income ratio in the offer. You could even mention how many years of post-closing liquidity you have. If your offer is all-cash and/or non-contingent, you would want to continually emphasize this in all communications with the listing agent.

Step 3: Justify Your Offer

It’s also a good idea to do your homework and find some comps which substantiate your offer price. By definition, if you’re submitting a lowball offer it will be very difficult to find comps which justify your offer price. However, if you search long enough you’ll be able to find something which you can present to the seller and/or listing agent when asked.

Most buyers who submit lowball offers take a very combative ‘take it or leave it’ approach. This strategy has an ultra-low success rate, mostly because it’s incendiary and usually just enrages a seller to the point that they don’t want to speak to you.

Contrast that approach to submitting a fully-documented lowball offer which caters to a seller’s preferences and also includes at least some methodology and/or substantiation of your offer price and corresponding thought process. The latter approach will significantly increase your chances of a negotiation where a seller may ultimately concede and give you a good deal.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Submitting a lowball offer has to make sense in the context of the overall market and the sale trajectory of a specific listing. What we mean by this is that there are certainly instances where it makes the most sense to submit a lowball offer.

Here are some scenarios where a lowball offer has the highest chance of success:

-

A listing has been on the market for more than 120 days

-

The asking price is unreasonable and the listing is aged

-

You’re considering an expensive home above $2 million

-

You’re looking at co-op with a strict board

The most obvious place to search for motivated sellers is to look at listings which have been on the market for more than 4 months. On average, these sellers will be more open to a lowball offer compared to the seller of a listing which just hit the market.

It’s also a good idea to try and identify overpriced listings before a price reduction is made. This is because you’ll have the highest chance of negotiating a low price when there is less buyer traffic and no other offers to compete against, and traffic always goes up when there’s a price cut.

Luxury apartments, both condos and co-ops, usually have more flexibility on price as well since the asking prices are often stratospheric and unsubstantiated by comps in the first place. You may also be able to score a good deal on a co-op with strict financial requirements, as these buildings have a smaller buyer base and the sellers are usually more risk averse as a result.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Any lowball offer must still be reasonable and justifiable to some degree, otherwise you’re simply wasting your time. What we mean by this is that you simply cannot make up a number, throw it at a seller, and expect to stick.

For example, let’s say you decide to submit a $1.5 million offer on a $3 million apartment. The last time an apartment in that building sold for close to $1.5 million was 20 years ago.

Unless we’re in the depths of another 2008 style recession and you’ve caught a seller who is on the verge of bankruptcy, this offer will go nowhere.

A good rule of thumb is to look at a building’s sale history over the course of the past economic cycle. Your offer price must still be reflective of this cycle’s pricing for a seller to seriously consider it.

It’s also important to understand that a seller will only consider this reasoning if the market is trending down and the most recent sale comps from the past 6 months are therefore not necessarily a strong indication of fair value.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.