The J-51 tax abatement is one of the most misunderstood tax abatements when it comes to buying an apartment. Not only is it more rare to find in condos and co-op apartments for sale, its very complexity tends to tie the tongues of listing agents trying to explain just exactly what the tax benefit is. We’ll explain everything you need to know about a building’s J-51 tax abatement and how to look it up on the NYC Department of Finance website in this article.

Table of Contents:

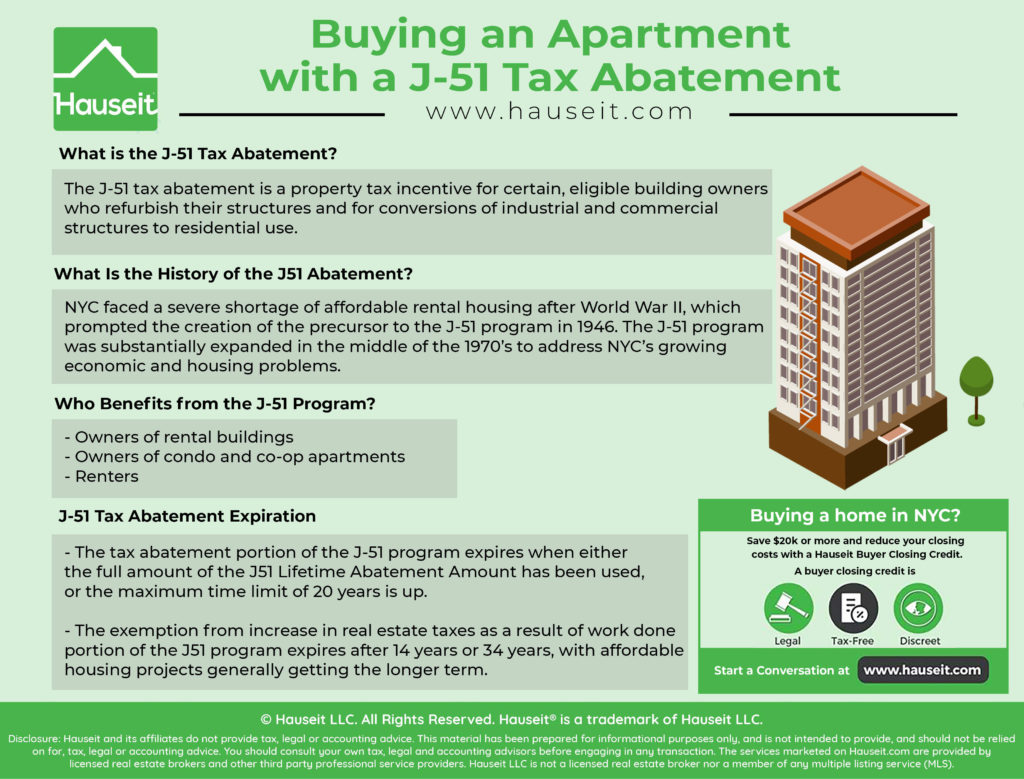

The J-51 tax abatement is a property tax incentive for certain, eligible building owners who refurbish their structures and for conversions of industrial and commercial structures to residential use.

The J51 abatement consists of both a tax exemption that freezes the assessed value at the level before construction began, as well as a tax abatement that decreases property taxes on a dollar for dollar basis.

According to the HPD, benefits granted under the J-51 tax abatement are as follows:

34-year (30-years full + 4-years phase out) or 14-year (10-years full + 4-years phase out) exemption from the increase in real estate taxes resulting from the work. Affordable housing projects generally get the 34-year exemption while other projects get the 14-year exemption;

Abatement of existing real estate taxes by up to 8 1/3% or 12 1/2% of the cost of the work each year for up to 20 years.

Privately-financed projects in Manhattan south of 110th Street and co-ops and condominiums generally receive some limited benefits.

So what this means is that your building will get a 34 year or 14 year exemption from increases in property taxes as a result of the upgrades done. Plus, you’ll get a dollar for dollar reduction (i.e. abatement) in your existing property taxes of up to 12.5% of the cost of the work per year, for up to 20 years.

Keep in mind that most buildings will not get full credit for the actual cost of the renovation work. The city uses a Certified Reasonable Cost (CRC) schedule to estimate the cost of the renovation, and buildings will get an abatement based on those estimates.

Furthermore, the actual abatement a building will get will typically be a fraction of the CRC. For example, you’ll often see abatements worth 50% or 90% of the CRC, but very rarely 100% unless it’s a landmark building. We’ll talk about this in more detail in the following sections.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

NYC faced a severe shortage of affordable rental housing after World War II, which prompted the New York State Legislature to enact section 5-c of the New York Tax Law in 1946 which provided tax benefits for owners who upgraded and made habitable vacant apartments in old law tenements, many of which did not even have modern indoor plumbing.

Section 5-h was added to the New York Tax Law in 1955, and this allowed New York City to pass Section J-41-2.4 of the city’s Administrative Code which provided tax benefits for the rehabilitation of existing, rundown buildings. J41 eventually grew to cover upgrades to existing multi-family properties, even if they were not deemed to be substandard. This expanded J-41 program was renamed to the J-51 tax abatement that we know in 1963.

The J-51 program was substantially expanded in the middle of the 1970’s to address NYC’s growing economic and housing problems. NYC faced significant losses in both businesses and residents since the early 1970s, and as a result many commercial and industrial buildings had become obsolete and vacant. Therefore, New York expanded the J-51 program in 1976 to cover the conversion of non-residential buildings into multi-family residential use.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Initially, most of the benefits went towards the owners of rental buildings, as the J-51 program was designed to encourage owners to upgrade rather than abandon many rundown buildings in the middle part of the 20th century.

However, beginning in the late 1970’s, we saw a wave of condo and co-op conversions in NYC which meant the buyers of the apartments received the benefits of the J-51 program.

Renters in buildings that are part of the J-51 program see benefits as well. According to the HPD:

All rental units become subject to rent stabilization or rent control for the duration of the benefits. In rental buildings, the landlord must also reduce the MCI rent increase allowed under rent stabilization as a result of the work, by a portion of the value of the tax abatement. The rent is temporarily reduced in the MCI proceeding or at a later date in a Tax Abatement Modification Proceeding. The rent is restored at the end of the tax abatement period.

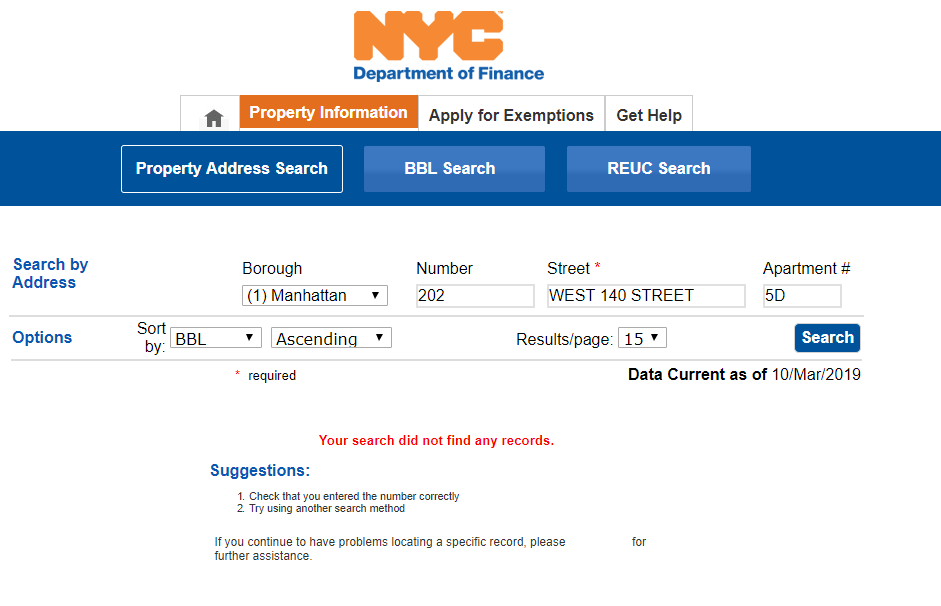

Let’s do an example. Let’s check out 202 West 140th Street, Apartment 5D, New York NY 10030. Start by accessing the NYC Department of Finance’s Property Tax Public Access Web Portal and use the property address search function as seen below (it’s the left most button).

Next, make sure you select the borough, in this case it’d be Manhattan, and enter the street number, street name and apartment number. Keep in mind that this system is pretty finicky as of this writing, and for the street name you’ll need to type in West 140 Street. Any other variation such as West 140th Street, W 140th St or even W 140 Street won’t work.

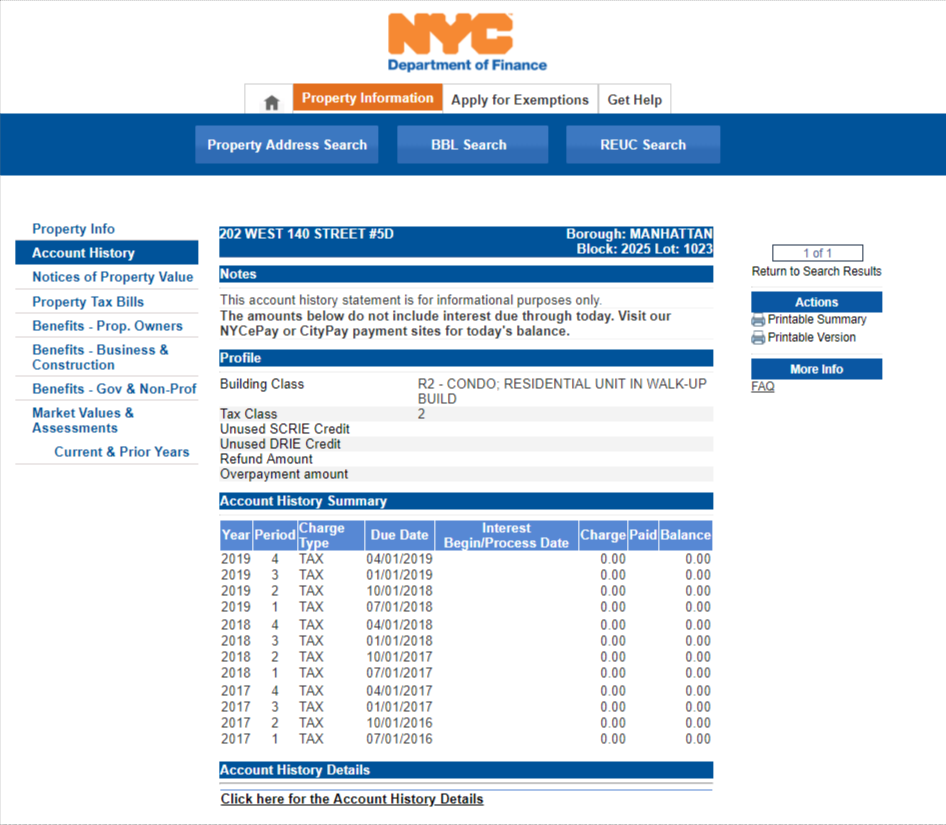

Once you hit search, you’ll be presented with a variety of information on the unit and building. You can click on Property Tax Bills to see actual property tax bills mailed to the owner, and you can click on Notices of Property Value to see the current assessed value as well as recent changes to the assessed value. Additionally, the Notice of Property Value will typically show the square footage of the unit, typically taken from the condo declaration or offering plan.

As you can see when you click Account History, this unit has not been paying any property taxes at all as of late due to the J-51 tax exemption and abatement in place.

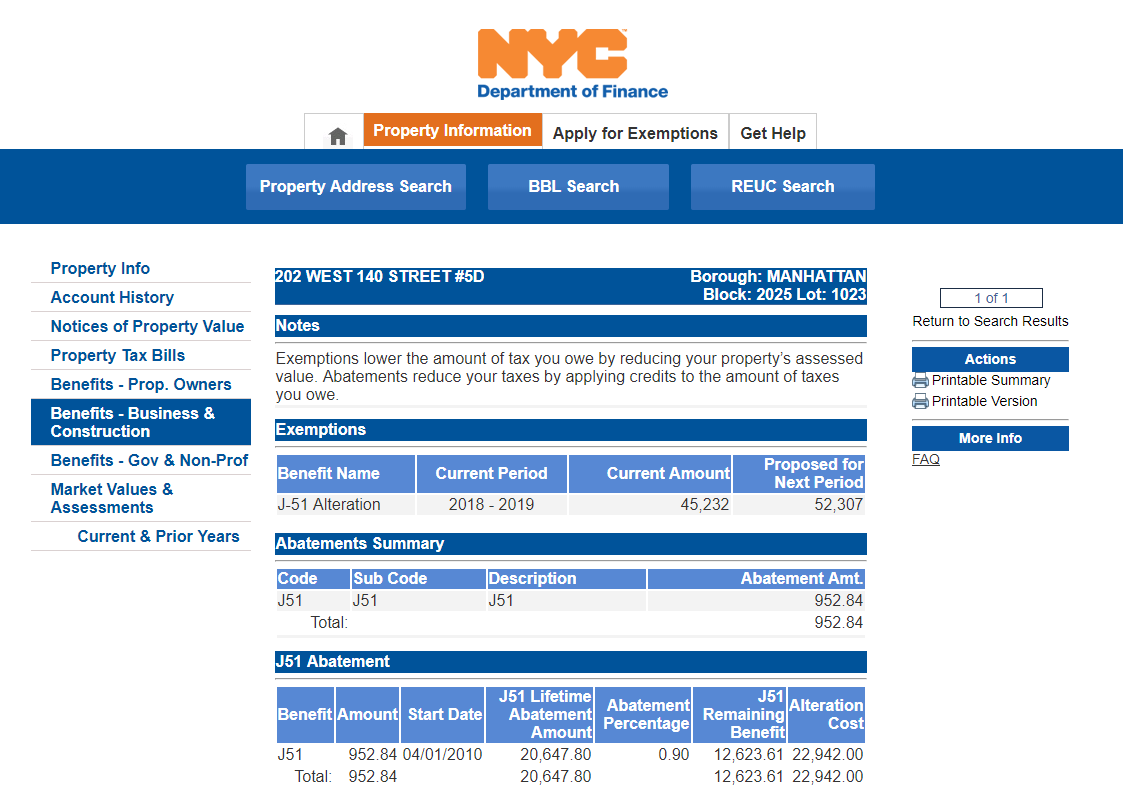

Next, let’s take a look at the specifics of the J-51 tax abatement in place for this unit. Click on the Benefits – Business and Construction tab and you’ll see the following pop up:

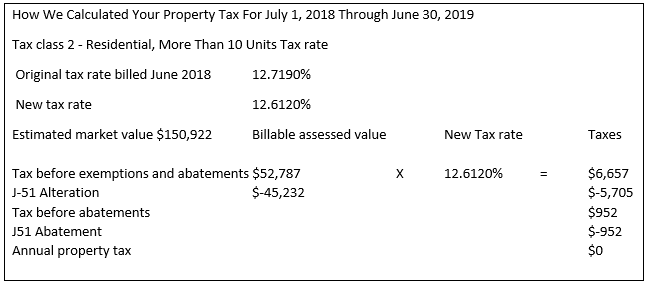

Now click back on the Property Tax Bills tab and open up the unit’s latest property tax bill (Q3: November 16, 2018 as of this writing) and you’ll see the following section on the second page. Compare the below with the above and notice how the numbers tie out.

Essentially, the assessed value of the unit has been reduced by $45,232 to bring the assessment back in line with what it was or should have been before the alterations or improvements were done. This substantially reduces the property taxes owed.

Furthermore, the property taxes due on the lower assessed value are reduced dollar for dollar by the abatement.

The Alteration Cost listed is actually the city’s estimate of the renovation costs, not the actual expenses paid by the owner. This Alteration Cost is known as the Certified Reasonable Cost (CRC), and the city establishes guidelines on reasonable cost for each type of work.

In this case, you see that the city has given this building credit for 90% of the CRC, and this figure is listed as the J51 Lifetime Abatement Amount.

In our example, you’ll notice that 8 1/3% of the $22,942 CRC figure equals $1,911.83 which is more than the $952 in property taxes owed. You can never have a negative property tax liability, so the maximum abatement in this case will equal the full amount of the property taxes owed, leaving the owner with $0 in property taxes to pay this year. The owner can push the unused abatement to following years, with a maximum limit of 20 years for the abatement period.

Notice that if you are able to take a 8 1/3% abatement every year, you’d hit 90% of the CRC figure in 10.8 years. This means that in most cases the full amount of the abatement will be used before the 20 year abatement period ends.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

The tax abatement portion of the J-51 program expires when either the full amount of the J51 Lifetime Abatement Amount has been used, or the maximum time limit of 20 years is up.

The exemption from increase in real estate taxes as a result of work done portion of the J51 program expires when after 14 years or 34 years. Affordable housing projects generally get the 34 year exemption period, while other projects typically get the 14 year exemption period. Keep in mind that the last 4 years for both are phase out periods, where assessed values gradually rise from the pre-construction assessed value to a post construction assessed value.

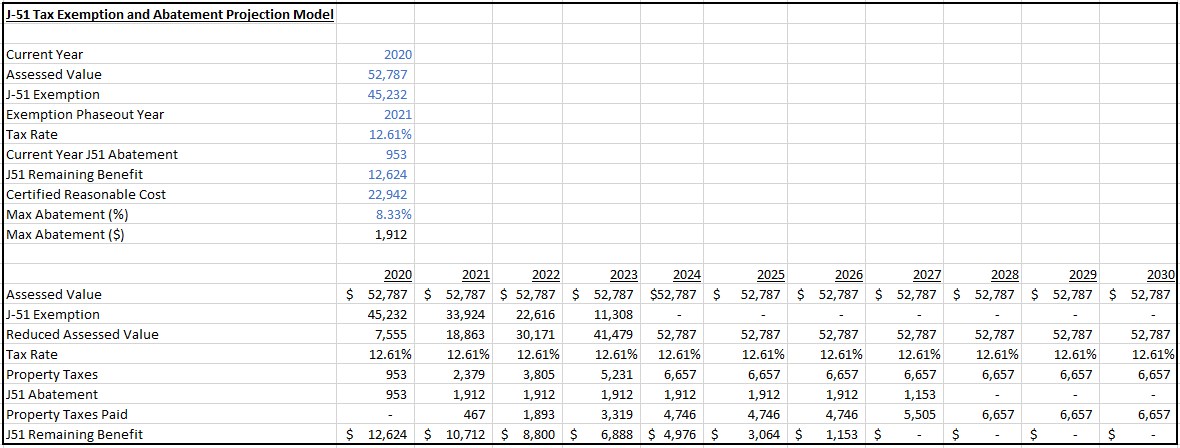

In our specific example, the start date is listed as 4/1/2010. This means that the property’s exemption from an increase in assessed values will last until 2024. Keep in mind however that this exemption will start phasing out in the last 4 years, starting in 2020.

Projecting the tax abatement benefits is more complicated, even though we know that the abatement will definitively expire after 20 years, or in 2030. However, since assessed values will start to rise as soon as 2020, the abatement will likely be used up well before 2030.

In our example, the tax before exemptions and abatements listed in the latest property tax bill is $6,657. This is a huge increase once the exemption goes away. Furthermore, there is only $12,623.61 left per the J51 Remaining Benefit figure listed. That is less than two years’ worth of property taxes, assuming the city doesn’t raise your assessment even further!

Remember however that the maximum abatement per year in this example is 8 1/3% of the CRC, or $1911.83. Assuming you are able to use the maximum amount per year, the abatement will be fully used up in 6.6 years.

We’ve modeled out the phase out of the J-51 exemption and abatement, plus what property taxes you’ll actually have to pay in our example. As you can see, the J-51 exemption is fully phased out by 2024, and the J-51 abatement is fully used up by 2028. Keep in mind that this model generously assumes that NYC won’t ever increase the headline assessed value of the property, which is a generous assumption indeed!

You can download our full J-51 Tax Abatement and Exemption Projection Model in Excel in the below link. You’ll also find a video below which explains how our J-51 model works and what all of the inputs and outputs mean. We hope you find our materials helpful. Please leave a comment below if you have any questions, or if you’ve simply enjoyed our work. Thank you!

Download Our J-51 Tax Abatement Model

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.