The Los Angeles Mansion Tax refers to additional transfer taxes levied on luxury home sales in Santa Monica, Culver City and the City of Los Angeles. Each city recently implemented higher transfer tax rates for luxury homes via voter-approved ballot initiatives.

All properties within Los Angeles County are subject to the LA County transfer tax of 0.11%, but only 5 out of 88 cities in Los Angeles County levy a city transfer tax: Santa Monica, Culver City, the City of Los Angeles, Pomona and Redondo Beach.

Recent ‘Mansion Tax’ initiatives in Los Angeles County include the following:

-

Measure ULA (City of Los Angeles): effective 4/1/23

-

Measure GS (Santa Monica): effective 3/1/23

-

Measure RE (Culver City): effective on 4/1/21

If your property is located within Los Angeles County but outside of the City of Los Angeles, Santa Monica and Culver City, the Mansion Tax does not apply since these measures are city-specific.

Click on the sections below to learn more about the Mansion Tax in each city:

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

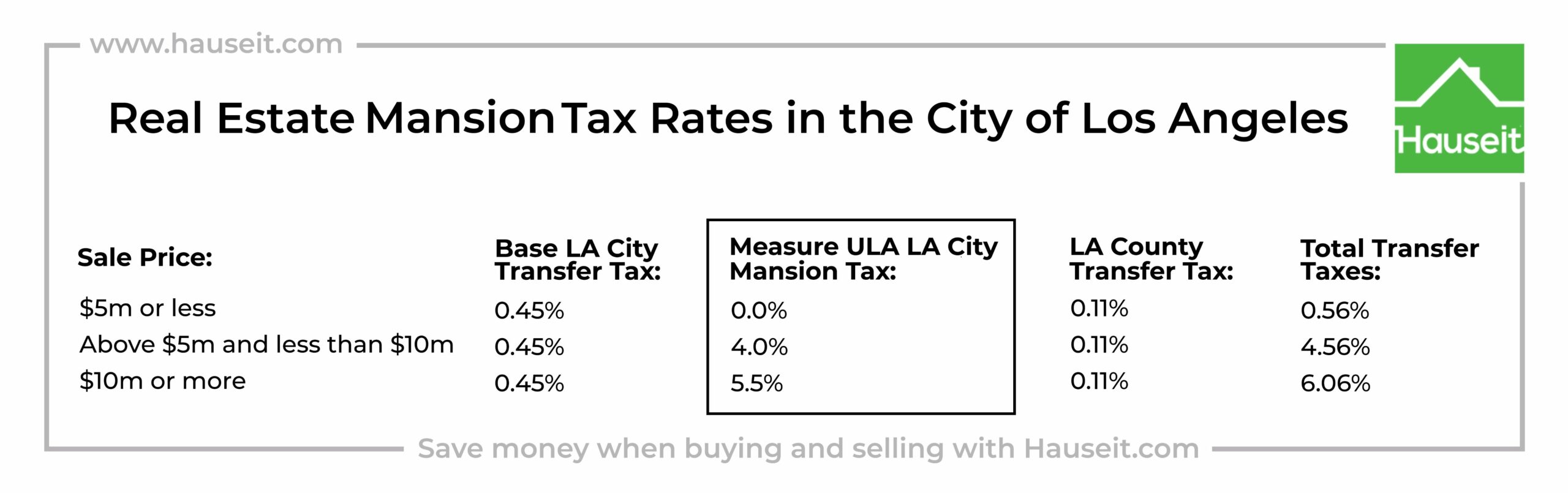

All properties which are located within the City of Los Angeles, including those affected by Measure ULA, are subject to a base city real estate transfer tax of 0.45% as well as the LA County transfer tax rate of 0.11%.

Combined city and county transfer tax rates in the City of Los Angeles are as follows:

-

$5m or less: 0.45% city + 0.11% county = 0.56%

-

Above $5m and less than $10m: 4% ULA + 0.45% city + 0.11% county = 4.56%

-

$10m or more: 5.5% ULA + 0.45% city + 0.11% county = 6.06%

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How much is the Mansion Tax in Santa Monica?

The Mansion Tax in Santa Monica is 5.6%, and it applies to sales of $8,000,000 or more. This tax bracket was part of voter-approved Measure GS which took effect on March 1, 2023.

Santa Monica has a total of three city transfer tax rates:

-

Under $5m: 0.3% of the sale price

-

$5m or more and less than $8m: 0.6% of the sale price

-

$8m or more: 5.6% of the sale price

Combined city and county transfer tax rates in Santa Monica are as follows:

-

Under $5m: 0.3% city + 0.11% county = 0.41%

-

$5m or more and less than $8m: 0.6% city + 0.11% county = 0.71%

-

$8m or more: 5.6% city + 0.11% county = 5.71%

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How much is the Mansion Tax in Culver City?

The Mansion Tax in Culver City consists of four marginal tax brackets which range from 0.45% to 4.0%. The highest rate of 4% applies to amounts of $10m and above.

Culver City transfer tax rates are as follows:

-

0.45% on amounts of $1,499,999 or less

-

1.5% on amounts from $1,500,000 to $2,999,999

-

3.0% on amounts from $3,000,000 to $9,999,999

-

4.0% on amounts of $10,000,000 and above

Culver City transfer taxes are calculated as follows:

-

$1,499,999 or less: 0.45% x value

-

From $1,500,000 to $2,999,999: $6,750 + 1.5% x (value – $1,500,000)

-

From $3,000,000 to $9,999,999: $29,249.99 + 3% x (value – $3,000,000)

-

$10,000,000 and over: $239,249.96 + 4% x (value – $10,000,000)

Properties in Culver City are also subject to the Los Angeles County transfer tax of 0.11%.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How much is the Mansion Tax in Beverly Hills?

There is no Mansion Tax payable on the sale of luxury homes within the City of Beverly Hills. While properties in Beverly Hills are subject to the LA County transfer tax of 0.11%, they are not subject to the Measure ULA Mansion Tax since it only applies to homes within the City of Los Angeles.

Beverly Hills is a separately incorporated city within the county of Los Angeles.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

This obligation is in addition to the base LA city real estate transfer tax of 0.45% as well as the LA County transfer tax rate of 0.11%.

Combined city and county transfer tax rates in the Hollywood Hills are as follows:

-

$5m or less: 0.56%

-

Above $5m and less than $10m: 4.56%

-

$10m or more: 6.06%

Note that the Mansion Tax is not applicable if your home happens to fall within the boundaries of West Hollywood, as it is a separately incorporated city within Los Angeles County.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How much is the Mansion Tax in Bel Air?

Bel Air and Holmby Hills are located within the City of Los Angeles, so homes in both neighborhoods are subject to the Measure ULA Mansion Tax of 4% for homes priced above $5,000,000 and less than $10,000,000 and 5.5% for sales of $10,000,000 or more.

This obligation is in addition to the base LA city real estate transfer tax of 0.45% as well as the LA County transfer tax rate of 0.11%.

Combined city and county transfer tax rates in Bel Air and Holmby Hills are as follows:

-

$5m or less: 0.56%

-

Above $5m and less than $10m: 4.56%

-

$10m or more: 6.06%

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How much is the Mansion Tax in the Pacific Palisades?

Pacific Palisades is located within the City of Los Angeles, so homes in the Palisades are subject to the Measure ULA Mansion Tax of 4% for homes priced above $5,000,000 and less than $10,000,000 and 5.5% for sales of $10,000,000 or more.

This obligation is in addition to the base LA city real estate transfer tax of 0.45% as well as the LA County transfer tax rate of 0.11%.

Combined city and county transfer tax rates in the Pacific Palisades are as follows:

-

$5m or less: 0.56%

-

Above $5m and less than $10m: 4.56%

-

$10m or more: 6.06%