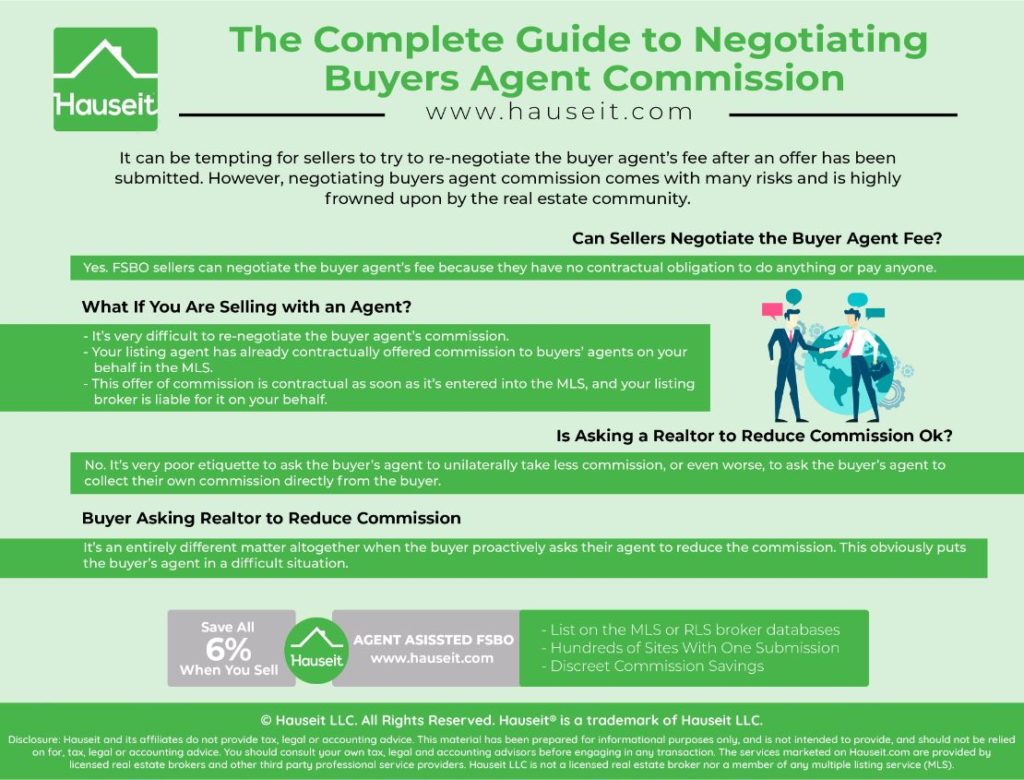

It can be tempting for sellers to try to re-negotiate the buyer agent’s fee after an offer has been submitted. However, negotiating buyers agent commission comes with many risks and is highly frowned upon by the real estate community. We’ll explain what you can and can’t do in this article.

Table of Contents: