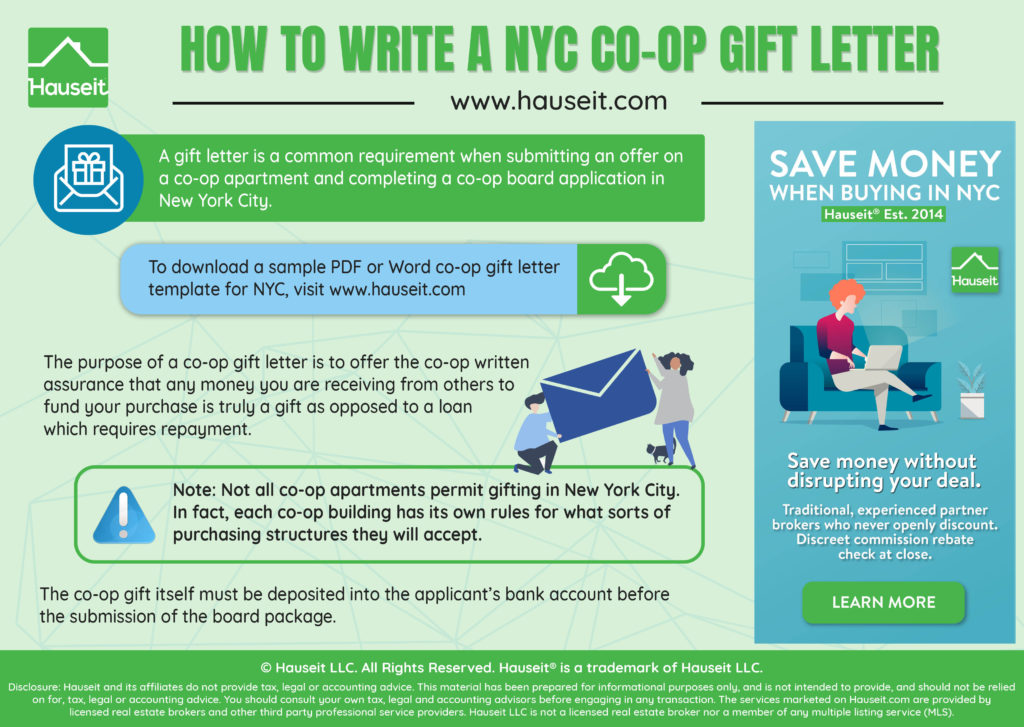

A gift letter is a common requirement when submitting an offer on a co-op apartment in NYC. Although not all listing agents will ask for a gift letter as part of your offer documentation, it’s always a good idea to prepare your coop gift letter in advance. This is because you will be required to submit the gift letter as part of your co-op board package once you have a signed purchase contract.

Table of Contents:

What is a Co-op Gift Letter?

Do All Co-op Apartments Permit Gifting in NYC?

What Is an Example Co-op Gift Letter for NYC?

When Must the Co-op Gift Be Deposited?

Co-op Gift Letter Template for NYC

Is There a Maximum Gift Amount for a Co-op in NYC?

Can a Gift Count Towards Co-op Post Closing Liquidity?

The purpose of a co-op gift letter is to offer the co-op written assurance that any money you are receiving from others to fund your purchase is truly a gift as opposed to a loan which requires repayment. Co-ops have strict financial requirements for apartment owners including a debt-to-income ratio of 25-30% on average.

This is much stricter than banks which typically lend up to a debt to income ratio of 43%. If a buyer were to receive a gift only for it to actually be a loan, it would mean that the buyer’s debt-to-income ratio would be understated.

This is exactly the opposite of what most co-ops are looking for: an applicant with strong financials who poses zero risk of non-payment of the monthly co-op maintenance fee that helps fund the building’s operations.

If a buyer’s gift is actually a loan in disguise, it also puts the building at risk of litigation and other recovery proceedings against the shareholder’s apartment by the lender (who was supposed to be a gifter).

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

No. Not all co-op apartment permit gifting in New York City. In fact, each co-op building has its own rules for what sorts of purchasing structures they will accept. These include gifting, co-purchasing, parents buying for children, children buying for parents, pied-a-terres and guarantors.

The easiest way to find out whether a co-op permits gifting is to ask the listing agent. However, you should be aware that not all listing agents are made equally. A novice listing agent may not actually have any idea what your question about gifting means, let alone what the answer is.

Working with a seasoned buyer’s agent can make the co-op rule discovery process much more efficient and accurate. This is because your buyer’s agent can also contact the co-op building’s managing agent directly to confirm whether or not gifting is permitted. If a co-op is self-managed, it means that the building does not have a managing agent.

In this case, your buyer’s agent (or the listing agent) would reconfirm the gifting policy directly with the board president (who is simply an apartment owner in the building).

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Below is an example of text from an actual co-op gift letter. In most cases, the co-op building will not have its own template. This means you can use your own language to draft the letter. The most important component of a gift letter is the component which states that there is no expected repayment.

The co-op gift itself must be deposited into the applicant’s bank account before the submission of the board package. This is because the co-op board will obviously want to confirm that the gift has actually been made.

As part of the Financial Statement and supporting documentation section of the purchase application, you’ll be asked to provide a few months of bank statements. It’s a good idea to highlight the line item which shows receipt of the gift money so that the co-op board members reviewing the application can easily identify the gift.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

To download an editable NYC co-op gift letter template in Word format, click here.

To download an editable NYC coop gift letter in PDF format, click here.

Although co-op buildings do not usually have a gift letter template, all lending institutions will have their own version they will ask you to use. You may request one by contacting your mortgage banker or mortgage broker.

For the purposes of the co-op board application, it’s usually okay for you to submit a copy of the same gift letter you are using as part of your mortgage process.

The answer to this question depends on the specific co-op building in question. Even if you are being gifted the entire purchase price, most co-ops will still require that the owner have sufficient income to meet the building’s debt-to-income ratio requirements.

Since there is no mortgage in an all-cash transaction, you’d need to have approximately 4x the monthly maintenance amount in order to have a 25% debt-to-income ratio.

If the co-op’s monthly maintenance is $1,500, this means you’d need to have monthly income of $6,000 even if you are receiving a gift for an all-cash transaction.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Yes. While most co-op gifts in NYC are used to fund a down payment, it’s not uncommon in NYC for a buyer of a co-op to receive a gift simply to fortify his or her post-closing liquidity. Post-closing liquidity is a measure of how much in liquid assets you have after closing on your purchase and factoring in closing costs. The specific rules for post-closing liquidity, including how much is required and what assets count as liquid, vary by co-op building.

If a co-op does not specify its post-closing liquidity rules, a conservative assumption is that you should have at least two years in monthly mortgage and maintenance payments in liquid assets.

If your financials are borderline for the co-op and you have the ability to request a gift from a family member, it’s certainly a good idea to take advantage of the gift. Fortifying your finances will increase your chances of being called for a board interview and ultimately receiving board approval.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

Awesome coop gift letter template and great read. One thing I would add, you can often avoid all of this nonsense by simply getting or giving a gift several months in advance of the purchase application.

The same goes for financing, most banks will only look for the last two months’ bank statements. If you got your gift half a year ago, no one will ask for the source of it, because it’ll be yours. No questions asked!