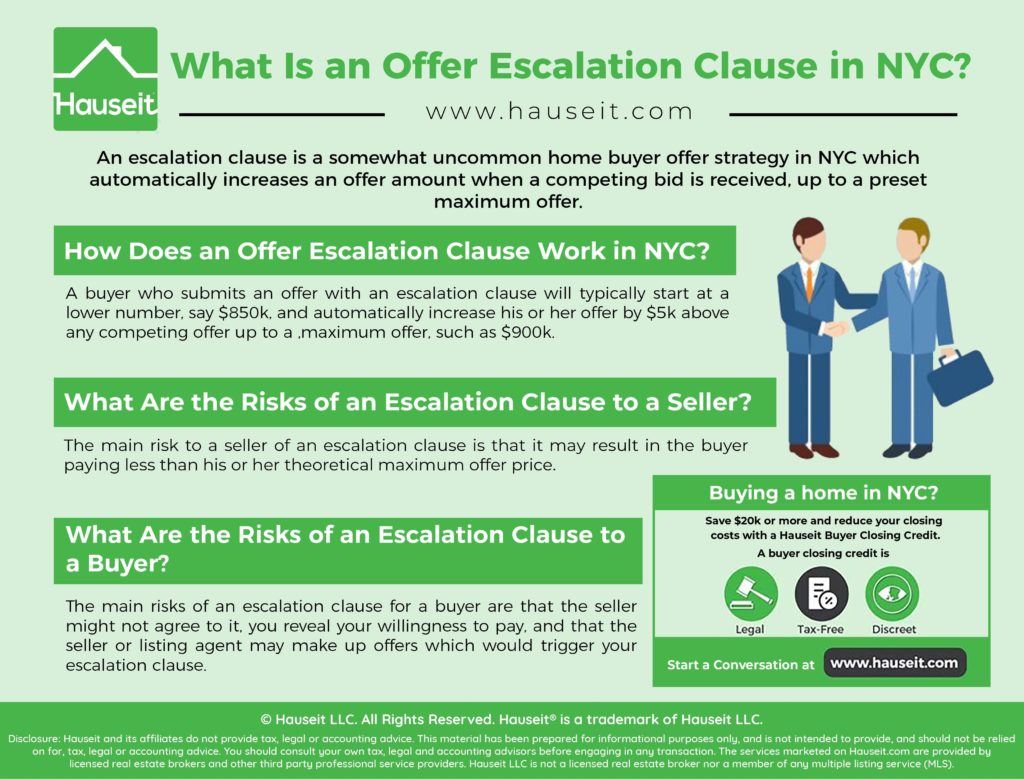

An escalation clause is a somewhat uncommon home buyer offer strategy in NYC in which a buyer automatically increases her or his offer amount when a competing bid is received, up to a preset maximum offer.

A buyer may consider using an escalation clause when he or she is bidding on a desirable property but does not want to engage in the typical back-and-forth negotiation which may happen in such a scenario.

Table of Contents:

A buyer who submits an offer with an escalation clause will typically start at a lower number, say $850k, and automatically increase his or her offer by $5k above any competing offer up to a maximum offer, such as $900k. An escalation clause is most commonly used in a highly competitive situation such as a bidding war or a best and final offer process.

Let’s say another buyer submits an offer of $855k. In this scenario, the escalation clause will automatically increase the original buyer’s offer to $5k above $855k, which is $860k. Assuming there are no more offers and the second bidder does not increase his or her offer, the original bidder with the escalation clause will purchase the apartment for $860k.

Using this same example, let’s say another bidder submits an offer at $900k.

Because the escalation clause is capped at $900k, this means that the original buyer’s offer will not automatically go higher than $900k.

An easy way to think about an escalation clause as a buyer is to know that regardless of what other offers come in, you’ll always have the highest offer price as long as the other offers received are at or below your escalation cap.

If you’re considering submitting an offer with an escalation clause, you’ll also need to define what documentation or other evidence constitutes ‘proof’ that a listing agent has received a higher offer.

Be prepared for possible push back from the listing agent, as most agents aren’t required to ever provide proof of competing offers so you know they’re not making them up.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Here is an example of an escalation clause being used when submitting an offer in NYC:

Escalation Clause Offer Email Language:

Submit Offer Form Escalation Clause Terms:

When drafting language for an escalation clause, it’s a good idea to consult your real estate lawyer and buyer’s agent. We explain the risks of an escalation clause to both the buyer and seller in the sections below.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The main risk to a seller of an escalation clause is that it may result in a buyer paying less than her or his theoretical maximum offer price.

For example, if a buyer’s initial offer is $1,500,000 but the escalation clause goes up to $1,600,000, the seller knows that the buyer is willing to pay $1,600,000.

Even if another offer comes in at $1,515,000 and the escalation clause triggers a $10,000 increase, the escalation clause buyer’s offer is still just $1,525,000.

This improved offer is still $75,000 below the maximum price the buyer is willing to pay.

An escalation clause can also hurt a seller by capping the degree to which a buyer increases his or her offer in a competitive situation. Whereas a buyer without an escalation clause may act impulsively and increase her or his offer excessively, a buyer with an escalation clause will only increase by the predetermined step-up amount included in the original offer.

An escalation clause also poses special risks to sellers of co-op apartments. This is because an escalation clause can divert attention away from a more financially qualified buyer whose offer is beaten by another buyer’s escalation clause.

This is an important consideration for co-ops due to the board approval aspect and associated financial requirements for prospective purchasers. The truth is that it’s often more prudent for a seller to go with a buyer who has a higher likelihood of co-op board approval, even if this buyer’s offer isn’t necessarily the highest.

In other words, a higher bid generated by an escalation cause may lead a seller down the path with a buyer who may not have the highest likelihood of being approved.

Using an offer escalation clause in NYC isn’t necessarily a good idea. There are several disadvantages to a buyer using an offer escalation clause in NYC:

-

An escalation clause could confuse a seller or agent who is unfamiliar with the concept of an escalation clause

-

A seller might not agree to an escalation clause

-

The buyer reveals her or his willingness to pay through the cap in the offer escalation language

-

A listing agent might ‘shop’ an escalation clause ceiling to induce higher offers

-

The seller or listing agent may fabricate higher offers in order to trigger the escalation clause

Some sellers won’t accept an escalation clause simply because they’re unfamiliar with it.

Even if a seller receives multiple offers, chances are that none of the other bidders have submitted an escalation clause. The fact that a buyer’s offer structure looks and feels different may sow distrust and ultimately put the buyer with an escalation clause at a disadvantage if the listing agent and seller haven’t encountered an escalation clause before.

If a listing is headed into a best and final offer process and the seller and listing agent are feeling confident, they may just demand that the buyer with the escalation clause submit her or his best number and drop the escalation clause language altogether.

If a seller rejects an escalation clause, the buyer will have already revealed how much she or he is willing to pay through the escalation clause cap. A shrewd listing agent or seller could simply ask this buyer to submit her or his highest offer right away (thereby discarding the step-up language in the escalation clause).

When a seller receives an escalation clause, it can also motivate them to go above and beyond to procure other offers which would trigger the buyer’s escalation clause.

A listing agent can also weaponize an escalation clause by leveraging the offer cap to induce a higher bid from another buyer.

The final risk of an escalation clause is that it may incentive a listing agent to stretch the truth, either by making up other offers or exaggerating how real they are or what these offer levels are.

Therefore, it’s very important to include language in your escalation clause which obligates the listing agent to provide proof of any other offers which trigger your escalation clause. It’s also important to clearly define what constitutes proof of a bona fide 3rd party offer.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.