What is the definition of post-closing liquidity and why does it matter in NYC? If you are buying a co-op apartment in NYC, post-closing liquidity is one of the co-op financial requirements which the board will review as part of the co-op board application process.

Table of Contents:

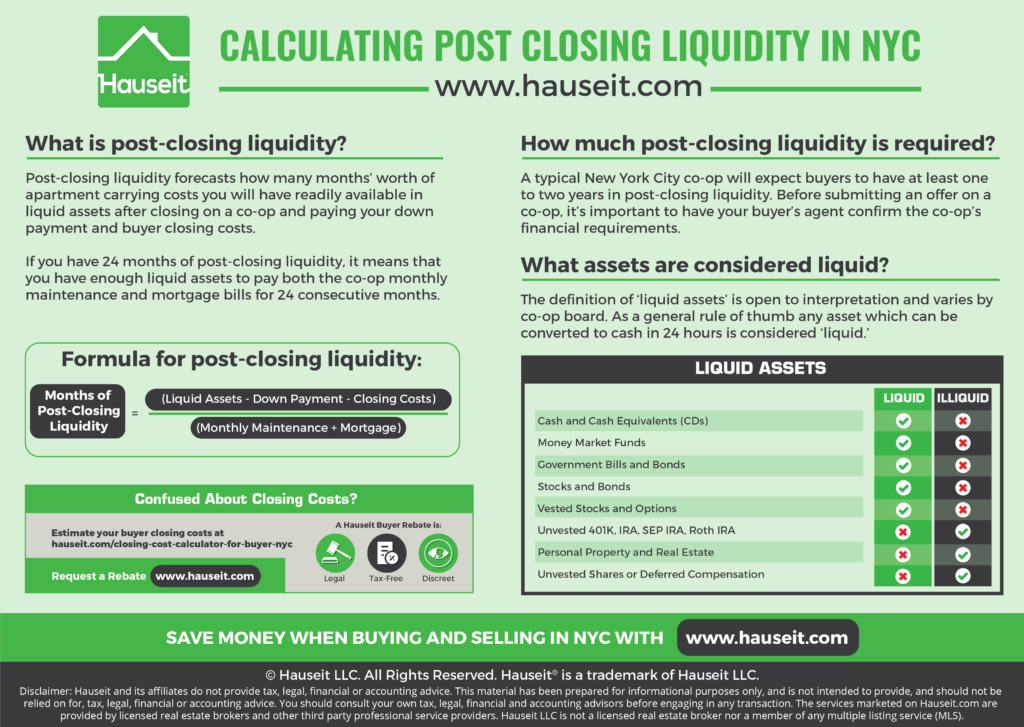

Post-closing liquidity is the amount of liquid funds a buyer will have once the down payment and buyer closing costs are paid at closing.

Post-closing (post close) liquidity forecasts how many months’ worth of apartment carrying costs you will have readily available in liquid assets after you close on your apartment.

Months or Years

Post-closing liquidity in NYC is typically quoted in months or years.

For example, if a buyer has 24 months of post-closing liquidity it means that he or she has enough liquid assets to pay the monthly co-op maintenance and mortgage bills for 24 consecutive months.

Listing agents in NYC also refer to post-closing liquidity in years. For example, “The buyer has 2.5 years of post-closing liquidity, not factoring in her vested 401K assets.”

It’s important to note that the definition of ‘liquid assets’ varies by co-op.

While some buildings may allow a buyer to include vested 401K or IRA assets, other buildings will only allow cash or cash equivalents to be counted towards post-closing liquidity.

The definition of post-closing liquidity can be obtained by reviewing the co-op purchase application instructions or asking the managing agent.

Here is an example of the post-closing liquidity requirements listed in a co-op purchase application:

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The formula for post-closing liquidity is as follows:

Here is an example of how post-closing liquidity is calculated:

Inputs:

Cash (Excluding Deposit): $75,000

Contract Deposit: $200,000

Money Market Funds: $100,000

Vested 401K: $50,000

Purchase Price: $1,000,000

Estimated Closing Costs: 2% ($20,000)

Co-op Monthly Maintenance: $1,250

Co-op Monthly Assessment: $200

Monthly Mortgage Payment: $4,000

Calculations:

Without 401K balance, post-closing liquidity is 28 months:

= ($75,000 + $100,000 – $20,000) / ($1,250 + $200 + $4,000)

= 28.44 months of post-closing liquidity

With 401k balance, post-closing liquidity is 38 months:

= ($75k + $100k + $50k – $20k) / ($1,250 + $200 + $4,000)

= 37.61 months of post-closing liquidity

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

A typical New York City co-op will expect buyers to have at least one to two years in post-closing liquidity.

Before submitting an offer on a co-op, it’s important to have your buyer’s agent confirm the co-op’s financial requirements.

If a building does not specify its post-closing liquidity requirements, a conservative rule of thumb is to have at least two years of post-closing liquidity.

Even if the managing agent won’t share the building’s financial requirements, your buyer’s agent may still be able to find out which types of assets the board will count as ‘liquid assets.’

The definition of ‘liquid assets’ is open to interpretation and varies by co-op board.

As a general rule of thumb any asset which can be converted to cash in 24 hours is considered ‘liquid.’

Liquid Assets:

Cash and Cash Equivalents (CDs)

Money Market Funds

Government Bills and Bonds

Stocks and Bonds

Vested Stocks and Options

Illiquid Assets:

Unvested 401K, IRA, SEP IRA, Roth IRA

Pension and Keogh Plans

Life Insurance

Personal Property and Real Estate

Unvested Shares or Deferred Compensation

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

Just read this entire article. Very informative and helpful for someone just starting out with the co op purchase process. My buyer’s agent couldn’t explain for the life of him what the definition of post closing liquidity is, and supposedly he’s a co op pro. So funny. Thank you for sharing this online with the rest of us.