A post-closing REBNY coop financial statement is a common requirement for co-op board applications in NYC.

The post-closing financial statement is your pre-closing financial statement with three changes: add your purchase price to real estate under assets, remove the contract deposit from assets, and add your loan balance to liabilities.

Turning your pre-closing REBNY financial statement into a post-closing statement should not result in any change to your total net worth.

If you make an adjustment for buyer closing costs, it would make your post-closing net worth marginally lower.

Co-ops have relatively low closing costs for buyers of 1% to 2%, so whether or not you factor them in has little impact.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Table of Contents:

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

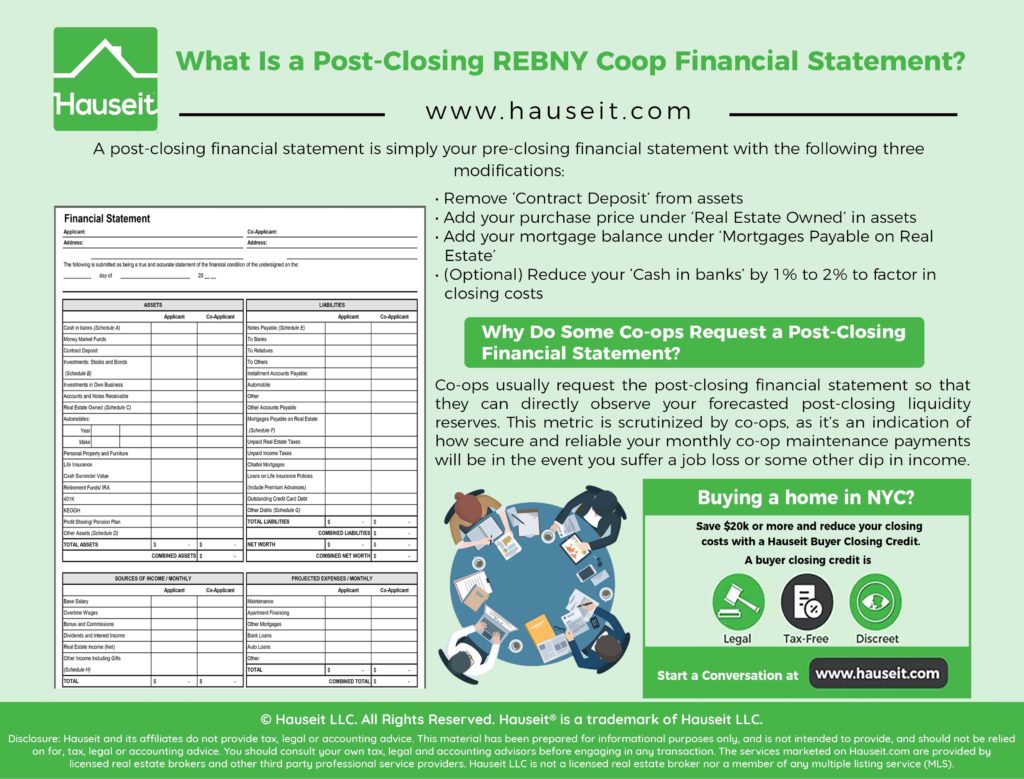

A post-closing financial statement is simply your pre-closing financial statement with the following three modifications:

-

Remove ‘Contract Deposit’ from assets

-

Add your purchase price under ‘Real Estate Owned’ in assets

-

Add your mortgage balance under ‘Mortgages Payable on Real Estate’

-

(Optional) Reduce your ‘Cash in banks’ by 1% to 2% to factor in closing costs

A post-closing financial statement may be required as part of your co-op board application.

While not all co-ops ask for this document, it’s a good idea to understand why they may ask for it.

Co-ops usually request the post-closing financial statement so that they can directly observe your forecasted post-closing liquidity reserves.

This metric is scrutinized by co-ops, as it’s an indication of how secure and reliable your monthly co-op maintenance payments will be in the event you suffer a job loss or some other dip in income.

It’s worth remembering that co-ops in NYC have relatively robust financial requirements for buyers which are almost always stricter than what lenders use to underwrite borrowers.

The point these requirements is to ensure financial stability and resilience amongst the co-op shareholder base.

Co-ops want to be absolutely sure that a buyer will always pay his or her monthly maintenance bill. If a unit owner refuses to pay, this increases the burden on other shareholders who will have to make up the shortfall.

Aside from post-closing liquidity, the debt-to-income ratio (DTI) of buyers is another metric which is heavily scrutinized by most co-op buildings in NYC.

Bear in mind that some co-ops take a holistic approach to evaluating a candidate’s finances as opposed to maintaining specific requirements.

This means that the co-op factors in post-closing liquidity, DTI, the buyer’s job and the size of the down payment (or all cash), among other factors.