Most articles on real estate investing for beginners will give you basic tips like getting pre-approved for a mortgage or other things you already know. We’ll take a contrarian approach in this article and talk about the pros and cons of real estate investing, and whether you should even be considering it given the alternatives. And if you are ready to be a property investor, we give you nuanced tips like how to cover your closing costs with a buyer closing credit and only working with an attorney who specializes in real estate transactions vs a generalist.

Table of Contents:

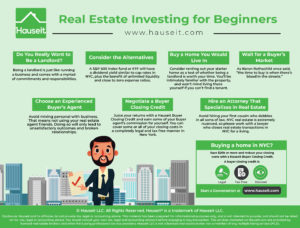

Before you invest in real estate, you must think carefully about whether you wish to be a landlord and deal with all the related commitments and responsibilities. Buying a property and renting it is not the same as just buying a stock, and sitting back and collecting the dividends. While you might get lucky with an easy tenant, you could just as easily have a nightmare tenant who never pays rent and is impossible to evict.

Furthermore, you’ll have to deal with a myriad of upkeep, maintenance and other property specific issues. Remember, having an investment property is just like owning a business and comes with all the responsibilities of running such a business. Do you really want to get involved, and more importantly, do you actually have time to devote to this?

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Consider the Alternatives

Carefully consider investment alternatives for your cash, especially if you plan on being a more passive investor. The opportunity costs may simply be too great. For example, dividend yields on broad equity indices are approximately the same as cap rates on most Manhattan rental properties.

However, buying a S&P 500 ETF comes with zero responsibilities and an effectively 0% expense ratio (i.e. IVV has an expense ratio of 0.04% and many ETFs are now offering 0% expense ratios). In contrast, buying a multi-family home in NYC means you’ll have no way to opt out of property taxes that increase virtually every year, and are typically at least 1% of the market value.

Furthermore, you can’t just sit on a multi-family investment. You’ll have to deal with city codes, regulations, maintenance, repairs and anything else that might happen from someone slipping on your sidewalk (better remember to shovel your sidewalk when it snows) to roof leaks and broken boilers.

The best piece of advice for a beginner real estate investor is to only buy a place that you yourself wouldn’t mind living in. That’s because if all else fails, you can move in and live there yourself!

Most beginners get their start in real estate investing by renting out their starter home once it’s time to upgrade to a bigger apartment. For example, once someone gets married and the bachelor’s pad no longer suits the growing family, many beginner investors will opt to rent it out vs selling it if they are fortunate enough to be able to buy a new apartment without having to sell the old one.

What’s great about this approach is that you’ll be intimately familiar with the property that you are renting out, considering that you yourself have lived there for a number of years. You’ll know every nook and cranny and will be able to explain to your tenant how to best make use of the apartment and how to maintain it.

For example, you’ll be able to explain to your tenant to be patient with the HVAC because it takes a few minutes for the air to warm up, or how to change the refrigerator’s water filter. All of these insights will not only make a happier tenant, but will cause less issues, stress and cost for you as a landlord.

Best of all, because it’s a place you wouldn’t mind living in yourself, you always have the option of moving back in. Whether it’s because the rental market is slow or because you’re simply ready to downsize once the kids are in college, it’s a familiar piece of property that works for you.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Wait for a Buyer’s Market

Real estate investing for beginners doesn’t need to be hard if you simply wait for large scale market disruptions, such as what we saw during the Great Financial Crisis of 2007-2008. As Baron Rothschild once said, “the time to buy is when there’s blood in the streets.”

While you may not need to wait until there’s an actual war that appears to be lost, you should perk up when there is widespread market panic. Why? Because it’s so much easier to not get ripped off as a novice investor when the whole market is for sale.

Think about it. During a normal market, or even a slow real estate market like the one in 2019, cap rates are under 3% in Manhattan and even many parts of Brooklyn. Listings are picked over by thousands of professional investors, both large and small. Do you really want to compete against the professionals and fight over the scraps at under 3% cap rates? If you do manage to score what seems to be a deal, there’s probably something horribly wrong with the property which is why you were able to get it in the first place!

However, if you wait patiently until there is large scale market disruption, such as what we saw in 2008 when prime location condos in Miami were selling for $200 price per square foot, it’s much easier to come in as a beginner real estate investor. In that type of situation, you have a large glut of properties for sale en masse, and as a result you won’t necessarily be forced to fight over the table scraps and leftovers.

So the best tip for real estate investing for beginners may well be to just be patient, and to wait for the right opportunity to pounce when there’s blood in the streets. When people are scared and no one wants to buy, and properties are selling for fire sale valuations once again, then it’s time for you to dip your toes.

Pro Tip: Interested in dipping your toes into the highly cyclical Miami real estate market? Start by checking out our predictions for the Miami real estate market. Then, once you’re ready to buy, study our in-depth guide on buying a condo in Miami.

It’s important to work with a veteran real estate agent who can guide you through the home purchase process, especially if you are a beginner when it comes to real estate investing. The last thing you’ll want is to work with a friend or acquaintance who is as green as you when it comes to real estate. Not only will that invariably lead to poor outcomes, it more often than not leads to broken friendships.

Even though buyers generally never have to sign any sort of Exclusive Right to Represent agreement, it’s important to stay loyal to one buyer’s agent. By working in good faith with only your buyer’s agent, he or she will be more incentivized to hustle and look for properties for you. In contrast, if your buyer’s agent knows you are floating around with multiple agents, he or she will not be motivated to scour the earth for you. Why bother when there’s a good chance you could find a property with another agent?

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

One of the best ways to juice your returns as a real estate investor is to sign up for a buyer closing credit, which essentially is a split of your buyer agent’s commission. Remember that the seller typically pays a commission of 6% of the purchase price which is split equally if the buyer has their own agent. This means your buyer’s agent stands to earn 3% of your purchase price on any transaction.

You can sign up to work with an experienced, traditional, local broker through Hauseit who has already agreed to give you back $20,000 to $40,000 of the buyer agent fee on the average NYC sale. This can be used to cover your closing costs or simply given back to you as a check post-closing.

Buyer closing credits are legal in 40 states including New York; moreover, buyer closing incentives are viewed as a concession on price vs income by the IRS.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Besides your buyer’s broker, the most important member of your team is your real estate attorney. Make sure you work with an attorney based in your city who specializes in real estate transactions. All too often we hear horror stories of buyers who unwittingly decided to take a referral from a friend or family member, and ended up working with a generalist lawyer who was a family friend. What invariably happens is that the generalist lawyer will be completely out of his or her depth, and will cause massive delays in the contract negotiation and due diligence process.

Real estate transactions can be quite complex especially in niche markets like New York City where contracts are lengthy, customized, and packed with contract riders. A generalist lawyer who doesn’t even live in the city will not be able to understand much of the language and standard practices when it comes to negotiating a purchase contract for a sale in the city. As a result, don’t hurt your family’s relationship with your family friend and hire a professional instead. Ask us for a referral if you don’t already have one. We’d be glad to introduce you to a few, highly experienced real estate attorneys whom we’ve worked with before!

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.