All properties in Los Angeles County are subject to the LA County transfer tax of 0.11%. The City of Los Angeles, Culver City, Pomona, Redondo Beach and Santa Monica levy a city transfer tax on top of the LA County transfer tax.

Click on the sections below to learn more about real estate transfer tax rates in these cities:

If your home is located within Los Angeles County but it’s not situated in the City of Los Angeles, Pomona, Redondo Beach or Santa Monica, the only transfer tax you’re responsible for is the Los Angeles County Transfer Tax of 0.11%.

Voters in the City of Los Angeles recently passed Measure ULA which dramatically increased the city transfer tax rates on homes above $5,000,000.

Similarly, voters in Santa Monica recently passed Measure GS which levies an additional transfer tax on sales of $8,000,000 or more. Measure ULA took effect on 4/1/23, and Measure GS took effect on 3/1/23.

Interestingly, these recent Mansion Tax initiatives are city specific and do not apply to all homes in Los Angeles County. If you’re selling a $7,000,000 home in the City of Beverly Hills, Measure ULA does not apply since your home is in a separately incorporated city and is therefore not part of the City of Los Angeles.

What this means is that some luxury homeowners in Los Angeles County are much luckier than others! While a $7,000,000 home in the City of Los Angeles incurs a city & county transfer tax bill of $319,200 (4.57%), the seller of a similarly priced home in the City of Beverly Hills pays just $7,700 (0.11%).

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How much are transfer taxes in the City of Los Angeles?

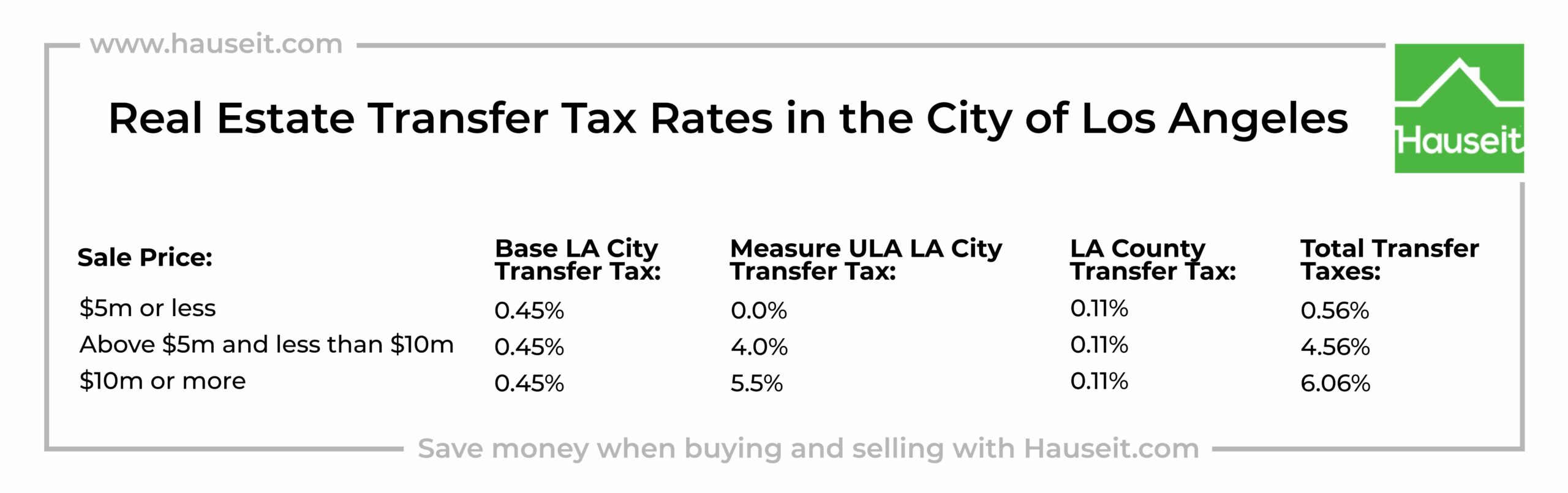

The City of Los Angeles levies a base real estate transfer tax of 0.45% on all properties. The combined city and county transfer tax rate is 0.56%.

Properties in the City of Los Angeles priced above $5,000,000 and less than $10,000,000 are subject to Measure ULA transfer tax of 4%, for a total of 4.45% in city transfer taxes. The combined city and county transfer tax rate is 4.56%.

Properties in the City of Los Angeles which sell for $10,000,000 or more are subject to Measure ULA transfer tax of 5.5%, for a total of 5.95% in city transfer taxes. The combined city and county transfer tax rate is 6.06%.

Real Estate Transfer Tax rates in the City of Los Angeles are as follows:

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How much are transfer taxes in Santa Monica?

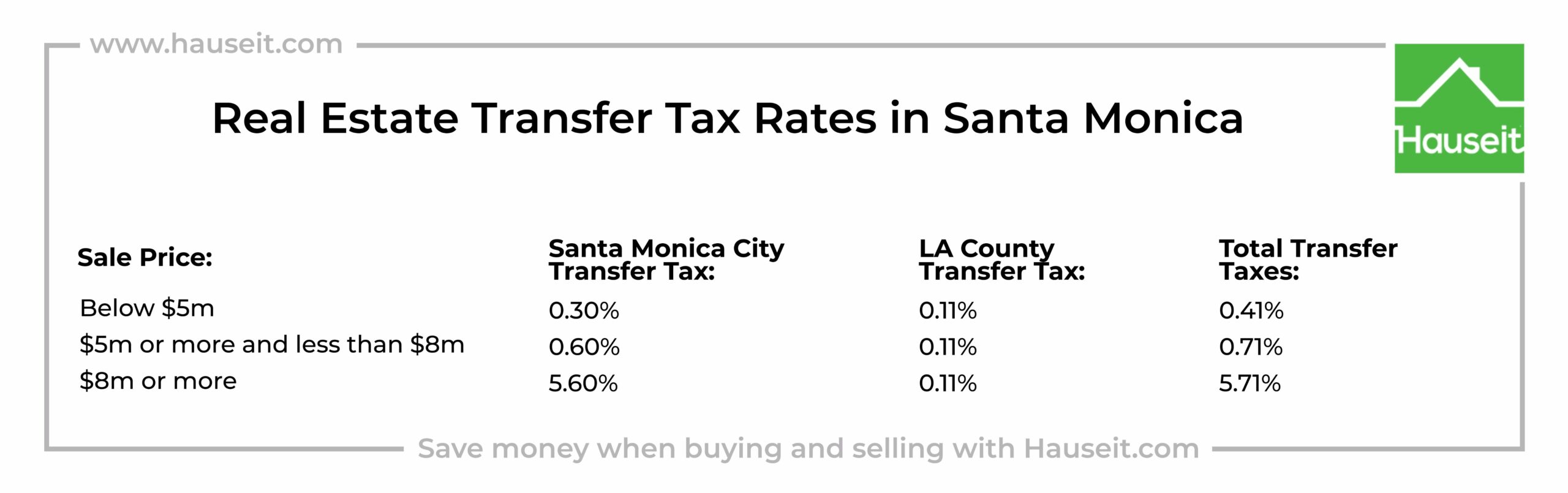

Santa Monica levies a city transfer tax of 0.3% to 5.6% based on the sale price.

City transfer tax rates in Santa Monica are as follows:

-

Under $5m: 0.3% of the sale price

-

$5m or more and less than $8m: 0.6% of the sale price

-

$8m or more: 5.6% of the sale price

The third tier of 5.6% was part of voter-approved Measure GS which took effect on March 1, 2023.

Combined city and county transfer tax rates in Santa Monica are as follows:

-

Under $5m: 0.3% city + 0.11% county = 0.41%

-

$5m or more and less than $8m: 0.6% city + 0.11% county = 0.71%

-

$8m or more: 5.6% city + 0.11% county = 5.71%

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How much are transfer taxes in Beverly Hills?

The City of Beverly Hills does not levy its own city transfer tax. Therefore, the only transfer tax payable on the sale of homes in Beverly Hills is the Los Angeles County Transfer Tax of 0.11%.

This is quite a competitive advantage for sellers of luxury homes in Beverly Hills above $5,000,000. As an example, let’s say you’re selling a $20,000,000 mansion in the Pacific Palisades.

Because the Palisades is part of the City of Los Angeles, you’re on the hook for city transfer taxes of $1,190,000 (5.95%) in addition to $22,000 (0.11%) in County transfer taxes, for a total transfer tax obligation of $1,212,000.

A similarly priced property in Beverly Hills, being a separately incorporated city within Los Angeles County, is not subject to the City of Los Angeles transfer tax. Therefore, the seller of a $20,000,000 home in Beverly Hills pays just $22,000 in total transfer taxes, saving $1,190,000 compared to the seller of a similarly priced home in the Pacific Palisades.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How much are transfer taxes in Culver City?

Culver City levies a marginal city transfer tax of 0.45% to 4% based on the sale price:

-

0.45% on amounts of $1,499,999 or less

-

1.5% on amounts from $1,500,000 to $2,999,999

-

3.0% on amounts from $3,000,000 to $9,999,999

-

4.0% on amounts of $10,000,000 and above

The calculation methodology for the Culver City transfer tax is as follows:

-

$1,499,999 or less: 0.45% x value

-

From $1,500,000 to $2,999,999: $6,750 + 1.5% x (value – $1,500,000)

-

From $3,000,000 to $9,999,999: $29,249.99 + 3% x (value – $3,000,000)

-

$10,000,000 and over: $239,249.96 + 4% x (value – $10,000,000)