Meeting the Debt-to-Income (DTI) ratio requirement for a NYC co-op apartment can seem like a daunting task. While not all New York City co-op boards are equally strict or rigorous when it comes to buyer financial requirements, it can feel like a nightmare if you’re trying to buy into a co-op with a laser sharp focus on your DTI.

Many strict co-ops in NYC have a zero-tolerance policy for Debt-to-Income ratios above their guidelines. This means you’ll be rejected for having a DTI of just 25.15% or 25.4% if the building requires 25% or less.

Fortunately, there are a number of ways to structure your co-op offer in order to reduce your DTI and maximize the chances of board approval. These strategies include receiving a gift, raising your down payment, finding a lower interest rate or changing your loan product, receiving an income stipend or changing your purchase structure to a co-purchase or applying with a guarantor.

Table of Contents:

Receive a Gift

Most co-ops in NYC allow a prospective purchaser to receive a gift as a means of strengthening her or his financial profile to meet the Debt-to-Income and Post-Closing Liquidity requirements of the co-op.

Receiving gift money will directly increase your post-closing liquidity since you’ll have more liquid assets left over after factoring in your down payment and closing costs. A gift will indirectly reduce your Debt-to-Income Ratio by allowing you to increase your down payment, thereby reducing your monthly mortgage payment.

Submitting an offer on a co-op to show receipt of gifted funds is as simple as submitting a gift letter with your offer and updating your REBNY Financial Statement to reflect anticipated receipt of the gifted money. If you’ve already received the gift, you can include this as part of the proof of funds documentation submitted along with your offer.

Your buyer’s agent can help determine whether or not a co-op permits gifting by reaching out to the listing agent or the co-op’s managing agent on your behalf. If you plan on receiving a gift for more than 50% of the purchase price, this may be considered as ‘Parents Buying for Children’ as opposed to gifting. A co-op may permit gifting but prohibit parents buying for children, so it’s important for your buyer’s agent to clarify the specifics of the co-op’s gifting policy with building management.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Increase Your Down Payment

Increasing the size of your down payment is the most direct way to reduce your monthly mortgage payment and reduce your overall DTI. This strategy is challenging for many prospective home buyers since the vast majority of co-ops in NYC require a fairly high minimum percentage down of at least 20%.

Furthermore, you may only increase the size of your down payment if it does not adversely impact your post-closing liquidity. Most co-ops in NYC require applicants to have one to two years of monthly housing expenses in liquid assets post-closing, after the down payment and closing costs . If your monthly mortgage and maintenance payment is $6,000 and the building requires 2 years of post-closing liquidity, you’ll need at least $144,000 in post-closing liquidity.

Each co-op building has its own interpretation of what assets qualify as ‘liquid’ for the purposes of post-closing liquidity. While some buildings will count vested 401k balances towards this requirement, others will not. Furniture, art, cryptocurrency, cars and other real estate are essentially never counted towards post-closing liquidity.

Lower Your Interest Rate

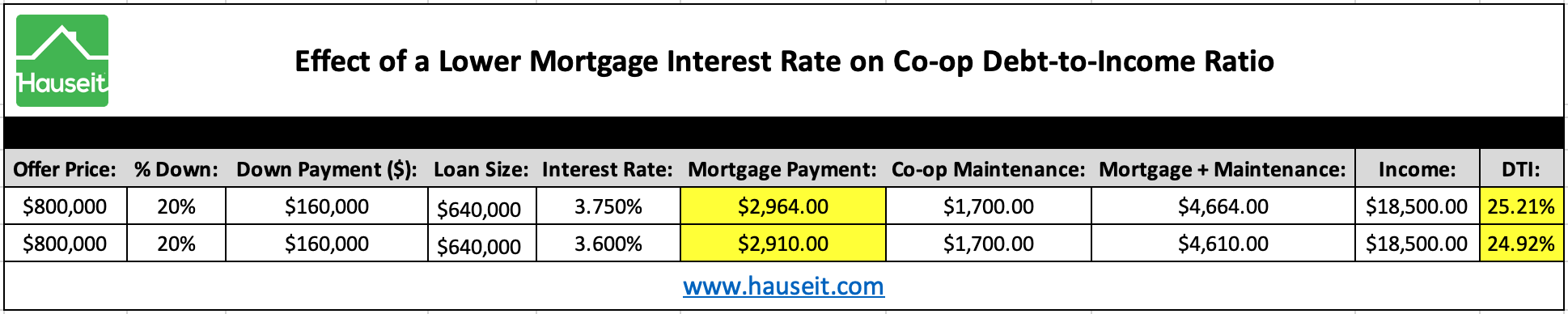

If your DTI is marginally higher than what a co-op requires, you may be able to lower your Debt-to-Income ratio simply by finding a lender who offers a more competitive interest rate. In the example below, reducing the interest rate from 3.75% to 3.60% has a large enough effect on the monthly mortgage payment to reduce the applicant’s DTI below the 25% threshold.

It’s important to keep in mind that your exact interest rate is not locked-in until you’ve signed a purchase contract and applied for financing. Therefore, some listing agents and sellers may still ask for additional concessions such as a higher down payment or a guarantor to mitigate the risk of your DTI exceeding 25% at the time the purchase application is submitted.

In rare instances, once you have an accepted offer the seller’s attorney may ask you to represent in the purchase contract that your Debt-to-Income Ratio is below the threshold mandated by the co-op. There are risks and implications for your contract deposit in agreeing to this language, so it’s best to consult with your real estate attorney.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Change Loan Products

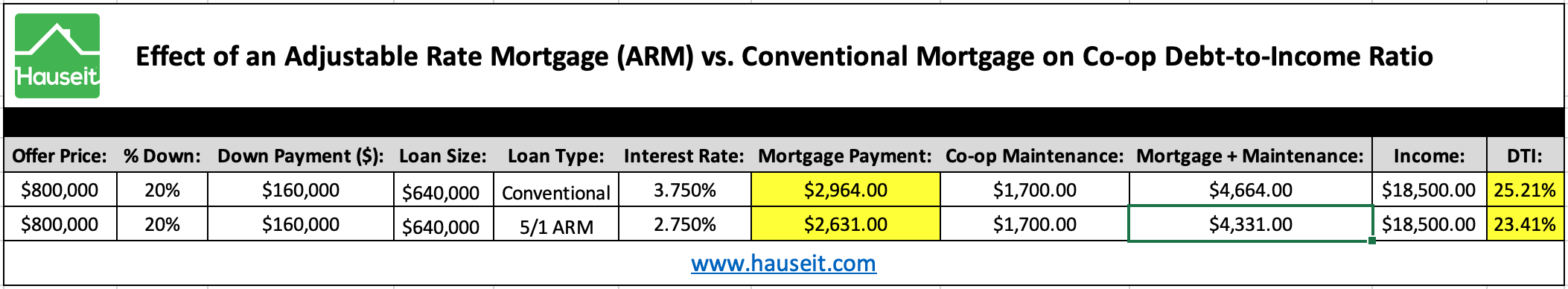

Switching from a 30-year fixed mortgage to a 7/1 Adjustable Rate Mortgage (ARM) or similar product with a lower interest rate will reduce your DTI by reducing your monthly mortgage payment. Here is an example of how a ARM will reduce an applicant’s DTI compared to a traditional, 30 year fixed mortgage:

The challenge with this approach is that many co-op buildings in NYC have outright prohibitions on adjustable rate mortgages. Here is an example of such a restriction from the purchase application of a co-op building in Lower Manhattan:

Other co-ops permit adjustable rate mortgages subject to your Debt-to-Income ratio passing a stress test based on the monthly mortgage payment using the highest possible interest rate under the terms of the loan. Because most ARMs have an extremely high interest rate cap of 6% or more, this would significantly increase the DTI of a prospective purchaser and negate any potential benefit of an initally lower interest rate.

Receive an Income Stipend

Another workaround for a high Debt-to-Income Ratio when buying a co-op in NYC is to receive a recurring monthly gift, also known as an income stipend. This is a less common method since the majority of co-ops will not consider such a stipend as part of the applicant’s income, and the ones that do will likely require the applicant to demonstrate a multi-month or multi-year history of having received this income stipend.

For the purposes of the initial offer and the board application, the individual providing you with the stipend will need to furnish a letter attesting to the permanent and recurring nature of the monthly income stipend. It’s also a good idea to highlight the income stipend funds on all monthly bank statements being submitted with the co-op board application.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Consider a Co-Purchase or Guarantor

Another way to reduce your Debt-to-Income Ratio when purchasing a co-op is to apply with a guarantor or to co-purchase the unit with a family member. Both options will allow you to leverage the income of the other applicant in order to meet the co-op’s Debt-to-Income ratio requirement.

Like with gifting, each co-op building has its own rules on co-purchasing and guarantors. Therefore, it’s important to strategize with your buyer’s agent on the proposed purchasing structure you envision before signing a purchase contract, and ideally before submitting an initial offer.

Posted: 01/03/2020

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.