What do sample co-op financial statements in NYC look like? Who’s responsible for analyzing and doing financial due diligence on your behalf? What can you learn about a building from just its financial statements?

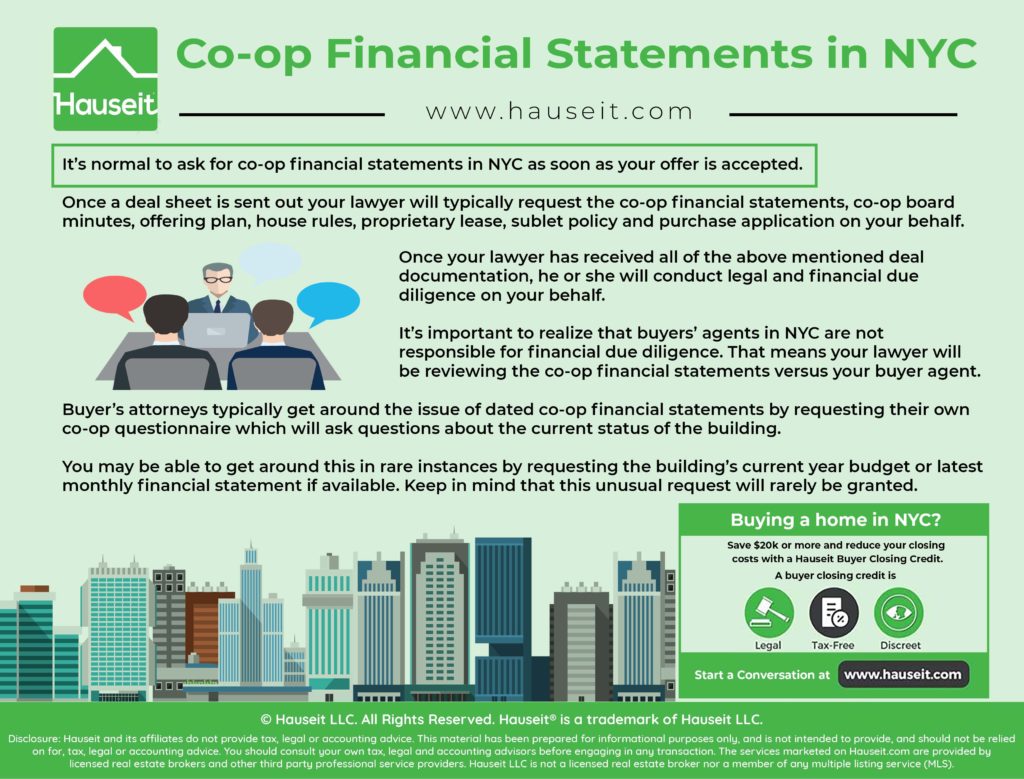

It’s normal to ask for co-op financial statements in NYC as soon as your offer is accepted.

Once a deal sheet is sent out your lawyer will typically request the co-op financial statements, co-op board minutes, offering plan, house rules, proprietary lease, sublet policy and purchase application on your behalf.

It may be possible to get a copy of the co-op financial statements before submitting an offer if your buyer agent makes the listing agent understand that you are a serious, pre-approved or all cash buyer who has been looking for quite some time.

Once your lawyer has received all of the above mentioned deal documentation, he or she will conduct legal and financial due diligence on your behalf.

It’s important to realize that buyers’ agents in NYC are not responsible for financial due diligence.

That means your lawyer will be reviewing the co-op financial statements versus your buyer agent. You are free to peruse them yourself, but just know that if you have a good attorney, he or she will already be thoroughly combing through them!

Please note that you will normally only be provided annual financial statements, meaning that there will always be a lag and you will never be able to see the current financial status of the building as of today.

Buyer’s attorneys typically get around the issue of dated co-op financial statements by requesting their own co-op questionnaire which will ask questions about the current status of the building.

You may be able to get around this in rare instances by requesting the building’s current year budget or latest monthly financial statement if available. Keep in mind that this unusual request will rarely be granted. You may not even want to ask for this information as you may risk board rejection by appearing to be difficult.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Sample co-op financial statements for a building in Park Slope

FINANCIAL STATEMENTS December 31, 2016

[ADDRESS] OWNERS CORPORATION | [ACCOUNTING FIRM] Certified Public Accountants

TABLE OF CONTENTS

Report Letter – page 3

Statement of Assets, Liabilities and Stockholders’ Equity – Income Tax Basis – page 5

Statement of Revenues and Expenses – Income Tax Basis – page 6

Notes to Financial Statements – page 7

To the Stockholders of [ADDRESS] OWNERS CORPORATION

Independent Auditor’s Report

We have audited the accompanying financial statements of [ADDRESS] OWNERS CORPORATION which comprise the statements of Assets, Liabilities and Stockholders’ Equity – Income Tax Basis as of December 31, 2016, and the related statements of Revenues and Expenses – Income Tax Basis for the years then ended, and the related notes to the financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with the basis of accounting the Company uses for income tax basis purposes. This includes determining that the income tax basis of accounting is an acceptable basis for the preparation of the financial statements in the circumstances. Management is also responsible for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of [ADDRESS] CORPORATION as of December 31, 2016, and the results of its operations for the year then ended, in accordance with the basis of accounting the Company uses for income tax purposes described in Note 2.

Other Matters

The Company has not presented the supplementary information about the estimates of future costs of major repairs and replacements that accounting principles generally accepted in the United States of America require to be presented to supplement the basic financial statements. Such information, although not a part of the basic financial statements, is required by the Financial Accounting Standards Board, who considers it to be an essential part of financial reporting for placing the basic financial statements in an appropriate operational, economic, or historical context. Our opinion on the basic financial statements is not affected by the missing information.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

ASSETS |

|

CURRENT ASSETS |

|

Cash |

$ 10,983 |

Escrow |

$ 14,796 |

TOTAL CURRENT ASSETS |

$ 25,779 |

FIXED ASSETS (NOTE 3) |

|

Land |

$ 32,000 |

Building and Improvements |

$ 246,059 |

$ 278,059 |

|

Less: Accumulated Depreciation |

$ (235,197) |

TOTAL FIXED ASSETS |

$ 42,862 |

Other Assets |

$ – |

TOTAL ASSETS |

$ 68,641 |

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

LIABILITIES |

|

Mortgage Payable (Note 4) |

$ 12,153 |

TOTAL LIABILITIES |

$ 12,153 |

STOCKHOLDERS’ EQUITY |

|

Common Stock, par value $1 654 shares issued & outstanding |

$ 654 |

Paid-in Capital |

$ 246,048 |

Accumulated Deficit – Prior Years |

$ (193,673) |

Accumulated Deficit – Current Year |

$ 3,459 |

Accumulated Deficit – End of Year |

$ (190,214) |

TOTAL STOCKHOLDERS’ EQUITY |

$ 56,488 |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ 68,641 |

REVENUE |

2016 |

2015 |

Maintenance Income |

$ 51,189 |

$ 51,840 |

Less: Contribution for Mortgage |

||

Amortization (Note 5) |

$ (8,425) |

$ (7,877) |

Sublet Fees |

$ 2,800 |

$ 3,000 |

Closing Costs |

$ – |

$ 2,912 |

Laundry Income |

$ 840 |

$ 840 |

Interest Income |

$ 300 |

$ 175 |

TOTAL REVENUE |

$ 46,704 |

$ 50,890 |

EXPENSES |

||

Interest |

$ 1,132 |

$ 1,680 |

Real Estate Tax |

$ 15,379 |

$ 14,089 |

Gas |

$ 3,962 |

$ 3,951 |

Electricity |

$ 1,325 |

$ 1,414 |

Water & Sewer |

$ – |

$ 8,039 |

Insurance |

$ 3,636 |

$ 4,156 |

Repairs & Maintenance |

$ 6,029 |

$ 2,293 |

Exterminator |

$ 310 |

$ 95 |

Supplies |

$ 165 |

$ 661 |

Professional Fees |

$ 2,600 |

$ 2,900 |

Janitor |

$ 3,900 |

$ 3,450 |

Franchise Taxes |

$ 851 |

$ 805 |

Permits & Licenses |

$ 38 |

$ 38 |

Bank Charges |

$ 240 |

$ 305 |

Miscellaneous |

$ 10 |

$ 60 |

TOTAL EXPENSES |

$ 39,577 |

$ 43,936 |

Excess of revenues over (expenses) |

||

before depreciation |

$ 7,127 |

$ 6,954 |

Less: Depreciation (Note 3) |

$ (3,668) |

$ (3,668) |

Excess of revenues over (expenses) |

||

(transferred to accumulated deficit) |

$ 3,459 |

$ 3,286 |

NOTES TO FINANCIAL STATEMENTS December 31, 2016

Note 1. The Corporation

[ADDRESS] CORPORATION (“The Corporation”) was incorporated in New York in May, 1984. Operations commenced in July, 1985, when the property was converted to cooperative ownership. The Corporation qualifies as a cooperative housing corporation under Section 216 of the Internal Revenue Code. The Corporation’s shares have been issued representing 8 tenant shareholders’ units represented by 624 shares.

Note 2. Basis of Reporting

The accompanying financial statements have been prepared on the cash method of accounting used for federal income tax purposes. Consequently, certain revenues and expenses are recognized in the determination of income in different reporting periods than they would be if the financial statements were prepared in conformity with generally accepted accounting principles.

Note 3. Land, Building and Improvements

The building is being depreciated on the straight-line method over 27.5 years. Expenditures for major improvements and betterments to fixed assets are capitalized, and expenditures for repairs and maintenance are expensed as incurred.

The property was acquired in a tax free exchange in accordance with Section 351 of the Internal Revenue Code. Consequently, the Corporation’s tax basis in the property for income tax depreciation purposes is the sponsor’s basis, increased by the amount of gain recognized by the sponsor in the exchange.

Note 4. Mortgage Payable

The mortgage was refinanced in 2003. The prior mortgage with the New York Community Bank ($68,785 principal balance) was replaced by a new mortgage with the same bank in the amount of $80,000 on April 31, 2003. The new mortgage payable, secured by the land, buildings and improvements, is payable in equal monthly installments of $836.42, consisting of interest at the rate of 5.75 percent per annum, with the balance of the payment applied to the unpaid principal balance.

This amount does not include any monthly escrow due. The mortgage is for a term of fifteen years. Assuming that the Corporation has made all of the payments, the mortgage will be fully paid off on April 4, 2019.

Note 5. Maintenance Charges

Maintenance charges assessed to the tenant-shareholders are intended to cover operating expenses of the building, as well as amortization of the mortgage debt. Accordingly, the portion of maintenance used for amortization of the mortgage is added to the stockholders’ equity as additional paid-in-capital.

Note 6. Future Major Repairs and Replacements

The Corporation has not conducted a study to determine the remaining useful lives of the components of the common property and current estimates of the costs of major repairs and replacements that may be required in the future. When replacement funds are needed to meet future needs for major repairs and replacements, the Corporation may have the right to borrow, utilize available cash, increase maintenance charges, pass special assessments, or delay repairs and replacements until funds are available. The effect on future assessments has not been determined at this time.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

Some mystery items explained.

Building and Improvements either remains unchanged or goes up, year to year. Adds on costs of new things, not repairs, to prior year’s figure. Its cumulative.

Accumulated Depreciation is negative and magnitude goes up year to year. The sum of every fixed asset’s depreciation for the year. Every fixed asset has a useful life in years and its cost divided by its useful life in years give you its depreciation for the year.

Retained Earnings is the sum of profit/loss with prior year’s Retained Earnings.

Total Assets = Total Liabilities + Stockholder’s Equity.

Paid in Capital gets calculated after you have everything else.

Paid in Capital = Total Assets – (Total Liabilities + outstanding stock + Retained Earnings)

This is Grant Herbster CPA

any example of required disclose regarding NYC Local Law 97