Co-op owners in NYC (also known as shareholders) typically receive an annual co-op tax deduction letter in the mail each year which specifies how much of a tax deduction each owner can take on their personal income tax returns. This letter is also referred to as a Form 1098.

The tax deduction amount is based on the amount of mortgage interest and real estate taxes paid by the co-op corporation each year. Calculate your annual co-op maintenance income tax deduction using Hauseit’s Interactive Co-op Tax Deduction Calculator.

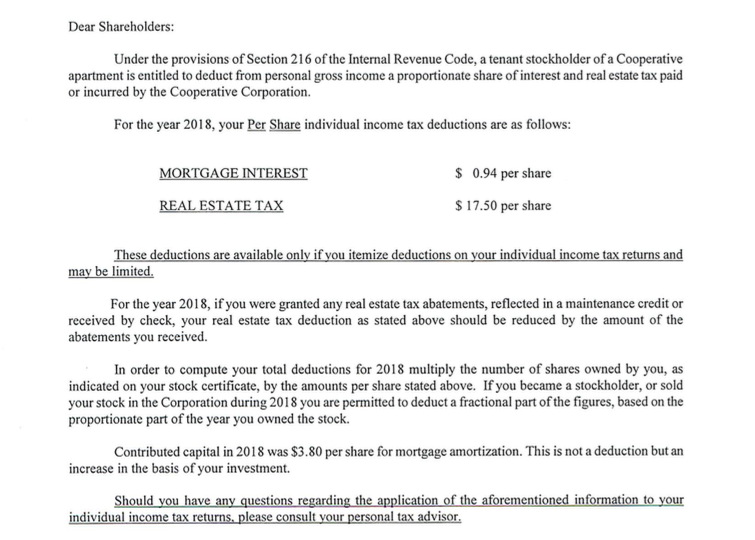

The Form 1098 specifies two dollar deduction amounts: one for mortgage interest and another for real estate tax. A co-op owner calculates her or his dollar deduction amount by adding these two figures and multiplying the result by the number co-op of shares owned.

Buyers, sellers and listing agents in NYC commonly refer to a co-op’s percentage of tax deduction for monthly maintenance (as opposed to the dollar deduction amount) in order to more easily compare this figure across different listings.

The percentage of tax deductibility of maintenance is calculated by dividing a co-op apartment’s annual tax deduction dollar amount by the annual sum of a co-op’s monthly maintenance payments.

Table of Contents:

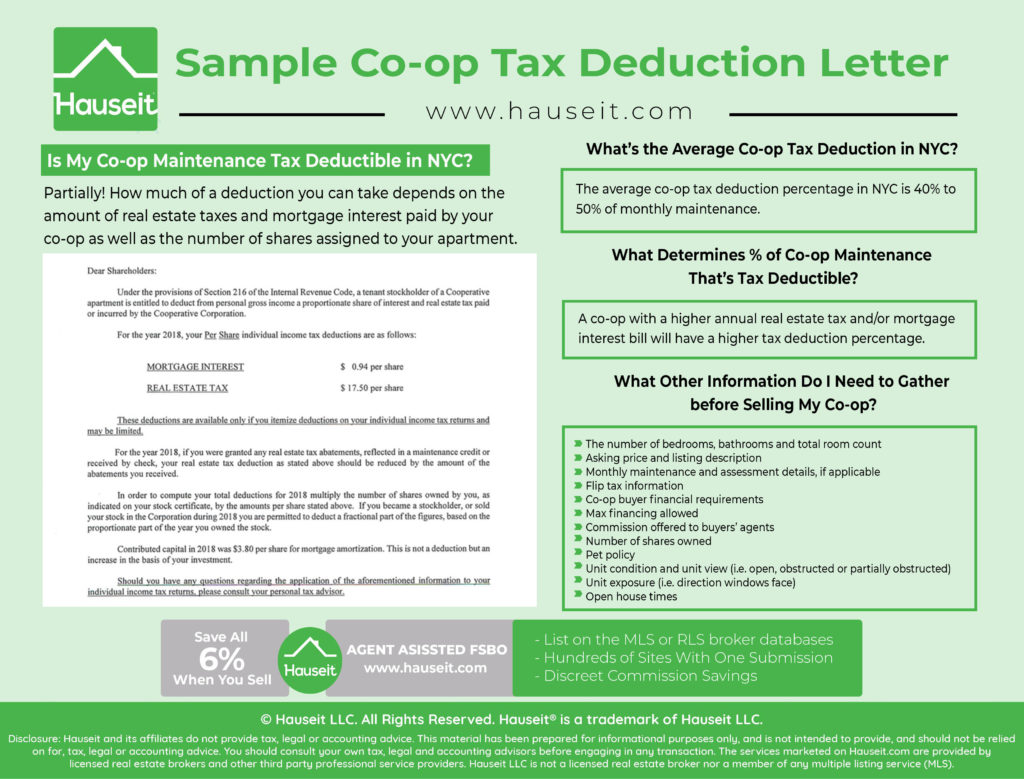

Partially! How much of a deduction you can take depends on the amount of real estate taxes and mortgage interest paid by your co-op as well as the number of shares assigned to your apartment.

As a co-op owner in NYC, you’ll receive a Form 1098 each year from the co-op’s accountant.

This letter will provide you with the real estate tax and mortgage interest deduction figures which will allow you to calculate your annual dollar tax deduction amount.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

What does a sample co-op tax deduction letter look like? Is it the same as the Form 1098 your co-op mails you for tax season?

Here is an example of an actual co-op tax deduction letter for a large co-op in Manhattan:

Here is another example of a co-op tax deduction letter for NYC:

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The percentage of tax deduction for co-op maintenance fees can be calculated in three simple steps:

Here’s an Example:

The average co-op tax deduction percentage in NYC is 40% to 50% of monthly maintenance. The specific tax deductibility percentage varies by co-op according to the amount of mortgage interest and real estate taxes paid by the co-op each year.

If two co-op buildings pay roughly the same amount of real estate taxes but one has a much larger mortgage with a higher interest rate, the annual tax deduction percentage will likely be higher for the co-op with the bigger mortgage.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

The percentage of co-op maintenance that’s tax deductible depends on how much in real estate taxes and mortgage interest is paid by a co-op building each year. Therefore, a co-op with a higher annual real estate tax and/or mortgage interest bill will have a higher tax deduction percentage.

When you’re listing your co-op apartment for sale, you’ll need to know key facts about your apartment such as the number of shares you own and what percent of your monthly maintenance is tax deductible.

Instead of guessing what percent of your maintenance is tax deductible or doing a complex calculation from the financial statements, simply retrieve the co-op tax deduction letter your co-op corporation mailed you.

This co-op tax deduction letter is formally known as IRS Form 1098 and tells you exactly what portion of the building’s real estate taxes and interest you paid as a shareholder.

As long as your co-op is compliant with Section 216 of the tax code and is primary engaged in being a housing cooperative versus other business activities, shareholders will be able to deduct their portion of the co-op corporation’s real estate taxes and interest!

Learn more about the differences between co-ops vs condos as well as condops in our blog!

After you’ve found your co-op tax deduction letter and figured out the percent of your maintenance that is tax deductible, you’ll need to procure a few other basic pieces of information to be able to list your apartment. These include:

-

The number of bedrooms, bathrooms and total room count

-

Asking price and listing description

-

Monthly maintenance

-

Assessment details, if applicable

-

Flip tax information

-

Co-op buyer financial requirements

-

Max financing allowed

-

Commission offered to buyers’ agents

-

Number of shares owned

-

Pet policy

-

Unit condition and unit view (i.e. open, obstructed or partially obstructed)

-

Unit exposure (i.e. direction windows face),

-

Open house times

In my opinion co-operative apartment shareholders are not property owners and are not treated as property owners pursuant to NY State tax law. Co-ops are treated as commercial entities, not private “homes.” Therefore the new Tax Bill just passed should allow shareholders to deduct their business expenses, that is, mortgage interest on the building, not end-loans and any costs that result from administering that business.

Hi Patricia, I think everyone is in agreement that co op apartments are definitely not considered to be real property. That’s why they aren’t paying property taxes directly like condo owners.

In fact, it’s the cooperative corporation that is the actual real estate owner here, of the entire building in fact. Therefore it’s the coop corporation that is paying NYC real estate taxes. The co op shareholders indirectly contribute to their share of the building’s taxes through their monthly maintenance fee. And as this article states, they get a Form 1098, aka co op tax deduction letter, by Jan 31st of each year to learn what exactly they paid in terms of property taxes etc. on behalf of the building.

By the way, since you asked about the new tax reform and law, Hauseit actually came out with an updated guide on NYC real estate taxes and taxes in general, updated for the Tax Cuts & Jobs Act of 2018. https://www.hauseit.com/nyc-real-estate-taxes/

Hi, I just purchased a co-op in NY and moving in starting this coming mid-December. Wondering how the new property tax law that starts in 2020 will effect co-op tax deductible? Any explanation or reply appreciated. Thank you – Shari

Confused as I prepare my own returns this year for the first time in decades. Not sure how to treat this deduction. I received a 1098 AND a co-op deduction letter from which I performed the above calculation. What do I do with the calculated deduction from the letter?