The REBNY Financial Statement provides sellers and listing agents with an overview of your financials. It’s typically required when submitting an offer on a co-op apartment in NYC in order to determine whether you meet the co-op’s financial requirements.

Click on the links below to download the latest Google Sheet, Excel and PDF templates of the REBNY Financial Statement.

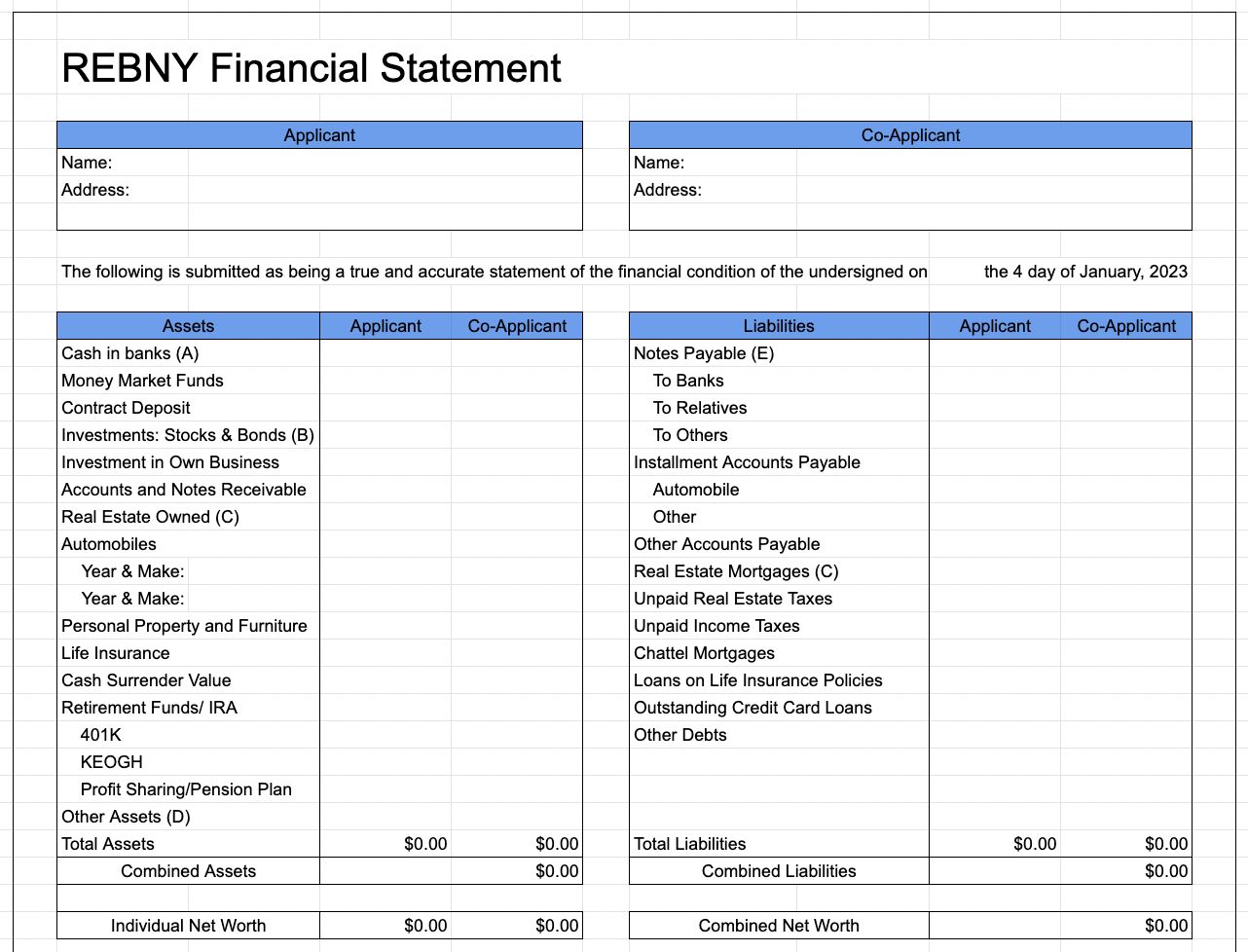

The REBNY Financial Statement contains two pages. The first page of the REBNY Financial Statement summarizes a buyer’s assets and liabilities:

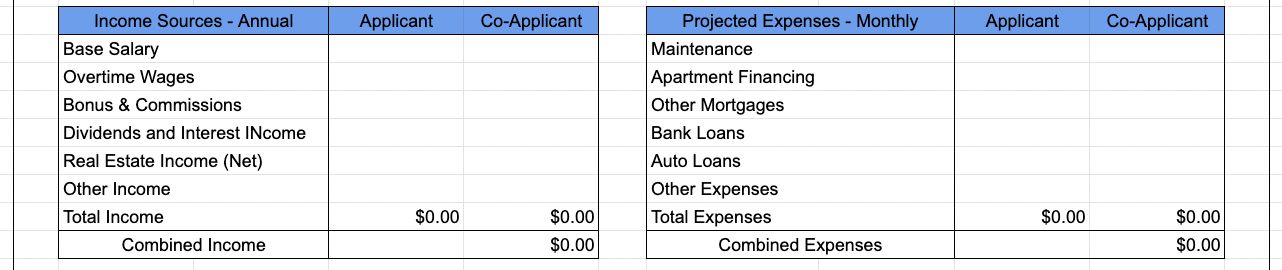

The first page of the REBNY Financial Statement also outlines the buyer’s projected expenses:

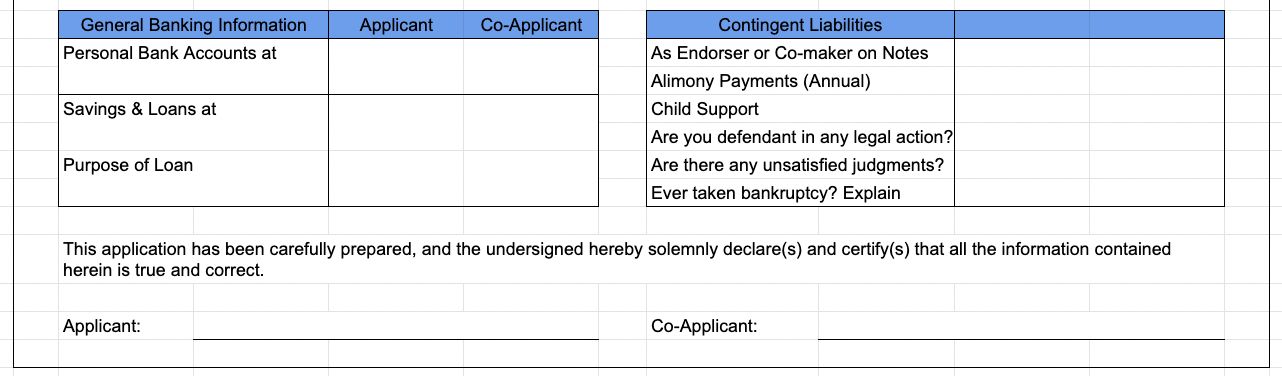

The first page of the REBNY Financial Statement also requests some miscellaneous financial information:

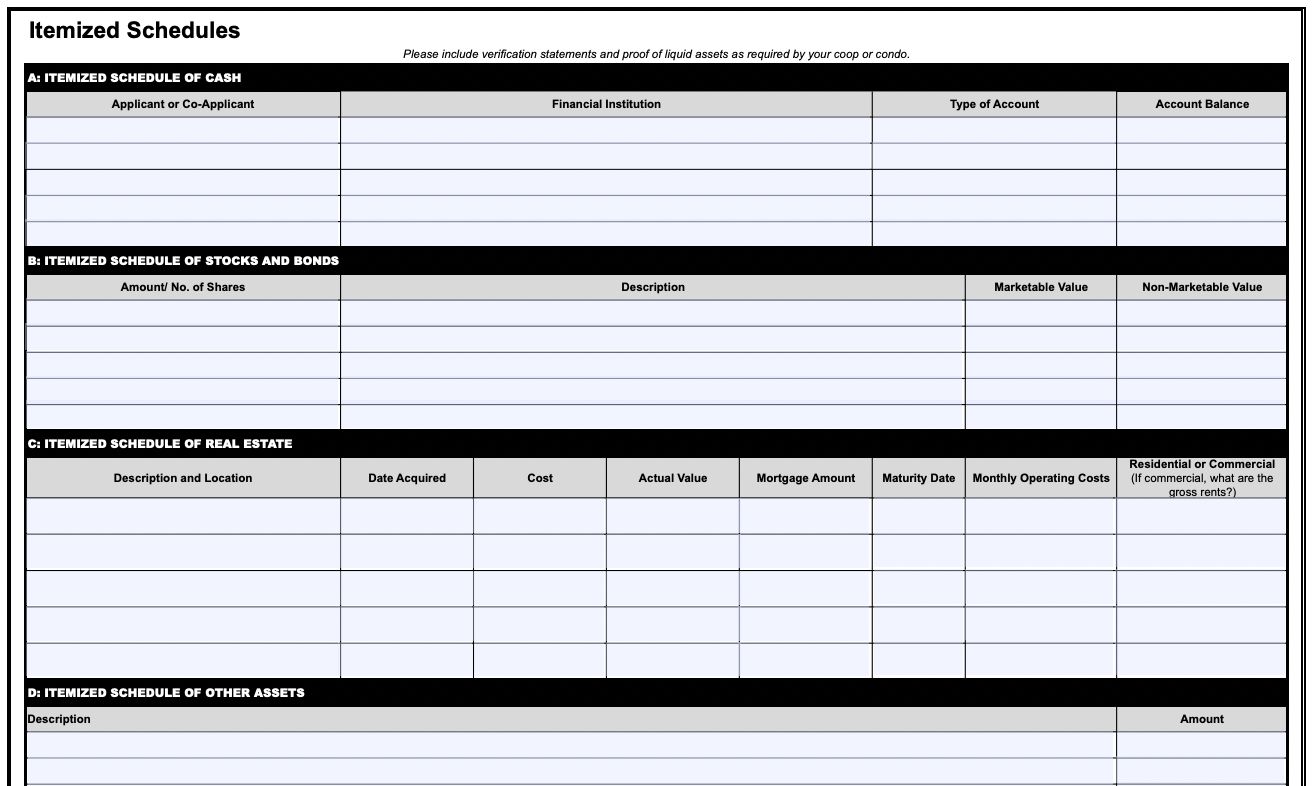

The second page of the REBNY Financial Statement contains an itemized list of assets:

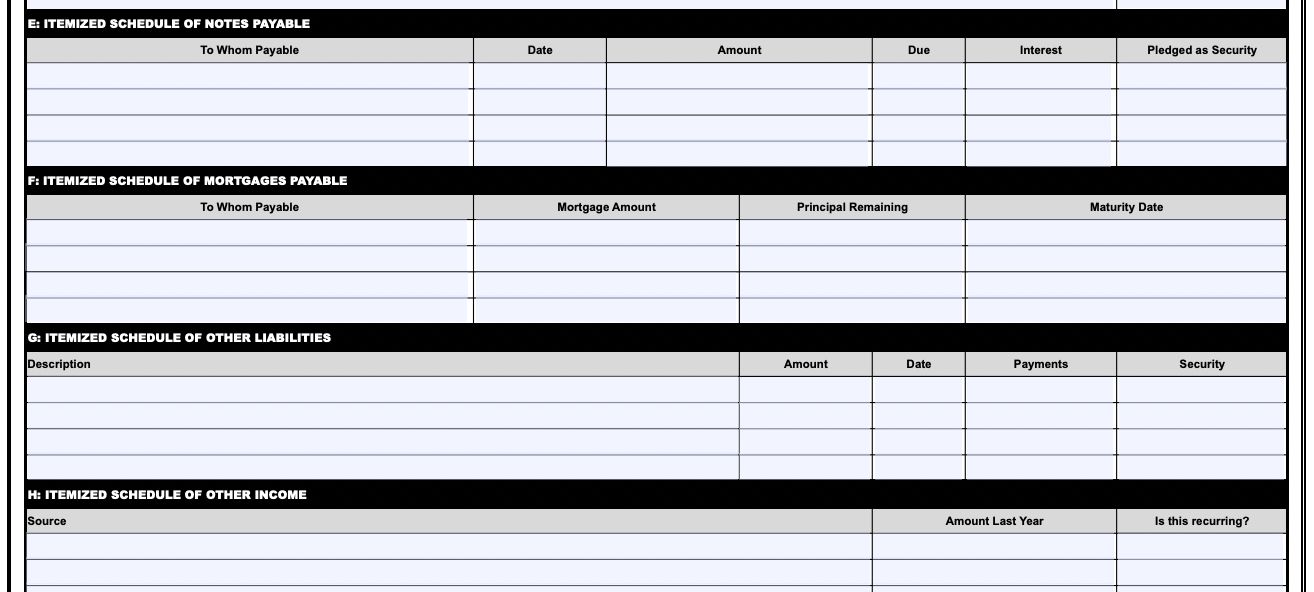

The second page of the REBNY Financial Statement also includes an itemized list of liabilities and other income:

Listing agents often require the submission of a REBNY Financial Statement for condos and townhouses too. However, it’s more common for a Submit Offer Form to be used in the case of condos and houses.

REBNY Financial Statement Frequently Asked Questions:

A REBNY Financial Statement is used by listing agents and sellers to evaluate and compare the financial strength of potential buyers. The statement itself is effectively a personal ‘balance sheet’ or statement of net worth along with a summary of monthly income and recurring expenses.

The REBNY statement asks a potential buyer to provide information about his or her assets (cash, stocks, property, etc.), liabilities (mortgages, student loans, etc.) as well as monthly income (salary, bonuses, dividends, etc.) and projected monthly expenses.

REBNY Financial Statements are most often used when dealing with the purchase and sale of co-op apartments because of the strict financial requirements imposed by NYC co-ops during the board application process.

Co-op board rejections happen frequently in NYC, and the last thing you want is for the rejection to possibly be a result of not meeting all of the board’s financial requirements. It’s therefore in your best interest as a buyer to complete the REBNY Financial Statement even if you feel that it’s somewhat invasive.

Working with an experienced buyer’s agent (who also offers you a buyer closing credit to save you money on the purchase) who can ascertain the nuances of each building can reduce your risk of a co-op board rejection.

In general, a REBNY Financial Statement is not required when submitting an offer for co-op sponsor units, condos and for new construction. Instead, you’ll be asked for your offer terms, a pre-approval letter, proof of funds and possibly a Submit Offer Form.

Here are the instructions for completing each section of the REBNY Financial Statement.

It’s a good idea to fill-out a REBNY Financial Statement, prepare your offer documentation, and select a real estate attorney towards the beginning of your search. Desirable properties sell quickly in NYC, so being prepared will ensure that you aren’t outmaneuvered by competing buyers.

Assets:

Under the assets section you will be asked to itemize and list all liquid and non-liquid assets for both yourself and any co-applicant (spouse, significant other, etc.).

The listing agent who reviews your REBNY Financial Statement will be looking to see if you have enough liquid assets to cover the following items:

Most co-ops have specific guidelines for the amount of post-closing liquidity a new shareholder (purchaser) should have after closing on the apartment.

If you are buying all cash, ‘post-closing liquidity’ simply means the amount of liquid assets you have available to cover the monthly co-op maintenance as well as any recurring monthly debt payments. If you are financing the unit, ‘post-closing liquidity’ means the amount of liquid assets you have to cover both the monthly mortgage and maintenance bills along with debt servicing payments.

Co-ops often look for anything between one to three years of post-closing liquidity. Some co-ops may take a more holistic approach to analyzing your financials instead of having a specific post-closing liquidity requirement. For example, a co-op may accept as little as 12 months of post-closing liquidity if you have a very low debt-to-income ratio or a guarantor. (more on this below).

Liabilities:

Under the liabilities section you will be asked to itemize any debt you currently hold including the following:

Liabilities consist of anything which appears on your credit report. If you pay off your credit card balances at the end of each month, there’s no need to list a balance for credit card debt.

The co-op board will run your credit as part of the board approval process to cross-check the liabilities listed on your REBNY Financial Statement.

Sources of Income / Monthly:

List all sources of income including base salary, bonuses, dividend income, real estate income and any other income (stipends, etc.). The income section of the REBNY financial is very important because it allows a listing agent to assess your monthly debt to income ratio.

If your income varies from year to year and/or your bonus or overtime income is unpredictable, it’s important for you to seek clarification from the co-op’s managing agent on how they will interpret your income. Some buildings may use a two year average when calculating your debt-to-income ratio, so this can impact whether or not a co-op board will approve you.

Here is the formula for debt-to-income ratio:

If you have other debt such as student loans, your debt-to-income ratio is calculated as follows:

In most cases, co-ops will require this ratio to be below 30% and often under 25%.

Projected Expenses / Monthly:

The projected expenses section of the REBNY Financial Statement is where you list your unit’s monthly co-op maintenance payment and mortgage amount based on your offer terms. You will also need to list any other recurring monthly expenses, such as car payments or student loan payments.

Because your projected monthly maintenance and co-op mortgage bill vary depending on which unit you are bidding on, you or your buyer’s agent will need to ensure that this section is updated for each apartment you submit an offer on.

The most efficient way to do this is to provide your buyer’s agent with a completed Excel version of your Financial Statement. For each offer you submit, your buyer’s broker can simply update this section and regenerate the statement for inclusion with your offer.

Itemized Schedules:

The Itemized Schedules section (page 2 of the REBNY Financial Statement) is where you list more specifics about the assets, liabilities and other income that you stated on the first page of the statement.

For example, in the event you own another property you’ll furnish details on its estimated fair value, outstanding loan balance, maturity date, monthly rental income and carrying costs.

Once you’ve completed the REBNY Financial Statement, sign and date the form.

The most important things to screen for as a seller when reviewing a buyer’s REBNY Financial Statement are the debt-to-income ratio, type and consistency of the income and the liquid net worth of the buyer.

Taking the time to thoroughly analyze your buyer’s financials will maximize the chance of board approval and ensure that you aren’t wasting your time by moving forward with a prospective purchaser.

Debt to Income Ratio: is the bidder’s ratio below 25% or 30% or in-line with the stated requirements of your co-op?

Income: what type of income does the buyer have? Is the income heavily weighted towards bonuses or some other form of unpredictable income? How stable is the income year over year?

Liquid Net Worth: does the buyer have enough liquid assets to pay for closing costs, the down payment and a provision for 1-2 years of post-closing liquidity?

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

Fantastic article, thank you for sharing both an Excel and PDF version of the REBNY Financial Statement with us. Very helpful to be able to find this when the listing agent told us to send him a REBNY Financial Statement. We had no idea at first what he was talking about but pretended to. A Google search later, voila and we are ready to submit an offer for our dream apartment in NYC!