It’s common for both banks and buyer’s attorneys to request answers to their own survey questionnaire for cooperative purchases from a co op’s managing agent. However, managing agents charge dearly for the answers. The cost of each questionnaire can be up to $500 these days.

A Head Start on Due Diligence

A seasoned real estate attorney knows that managing agents can take their time in responding to a survey questionnaire for cooperative transactions, so they’ll typically send the attorney questionnaire as soon as they begin the due diligence process.

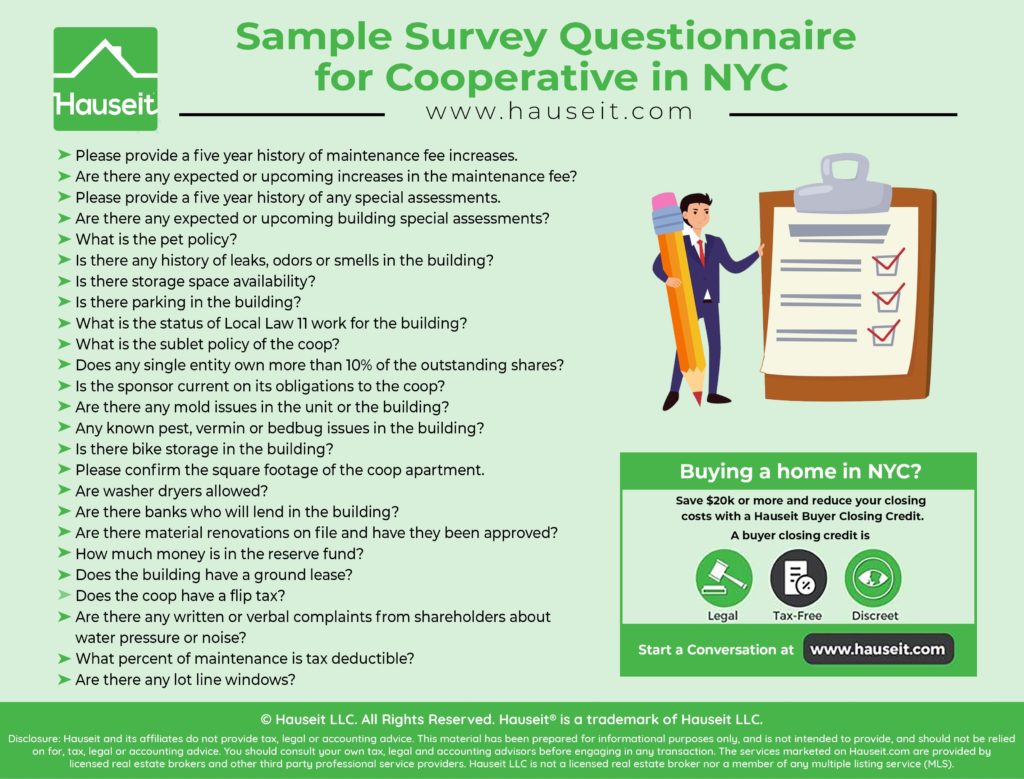

Please see below for a sample survey questionnaire for cooperative purchases in NYC.

Please note that the questions can vary depending on the attorney and the bank financing the deal.

Sample Survey Questionnaire for Cooperative in NYC

Please provide a five year history of maintenance fee increases.

Most real estate attorneys prefer consistency for this answer. For example, regular 3-5% increases in maintenance fees per year in line with inflation may be acceptable. However, it may be a red flag to see a 18% increase one year and a 2% increase the next year. This could mean that the co op board doesn’t have its house in order.

Are there any expected or upcoming increases in the maintenance fee?

This is a great question to ask the managing agent even though the co op board meeting minutes should reveal any discussion around this topic.

Please provide a five year history of any special assessments.

This is a great way to determine whether the building is using regular co op special assessments as a way to avoid raising maintenance charges.

Are there any expected or upcoming building special assessments?

Especially important to find out as you can potentially negotiate who pays an upcoming special assessment with the seller. You will also want to know if there are any especially large special assessments coming down the road which may affect the desirability of your purchase.

What is the pet policy?

A good real estate attorney will insist that the pet policy goes into the purchase contract if the client has pets. You do not want to buy an apartment only to find out that the building’s pet policy prohibits your pet Chihuahua from living there!

Is there any history of leaks, odors or smells in the building?

We’ve heard from various real estate attorneys in the city that a building’s managing agent is not legally responsible for their answers to a sample survey questionnaire for cooperative transactions in NYC such as this. However, it’s still a good idea to ask these questions and hope that the managing agent is truthful and does their job!

Is there storage space availability?

Sometimes a managing agent will just respond yes or no, which means your attorney will have to ask them to specify whether there is a wait-list, what the price is, and whether the storage units are individually deeded.

Is there parking in the building?

Some buildings may have a garage. There may be a wait-list. You’ll want to find out the price, and whether it’s open to the public or just residents. If it’s open to the public, you’ll want to check if there is a discount for residents of the building.

What is the status of Local Law 11 work for the building?

Was an inspection or work recently done? Is there any upcoming Local Law 11 inspection? If an inspection just happened, what was the result? If repairs are mandated, what is the estimated cost?

What is the sublet policy of the coop?

The co op sublet policy is extremely important to determine if you ever need or want to move to another apartment without having to sell. Sublet policies will vary by co op, but most cooperatives prefer primary residency and will restrict subletting in some form. Most coops will also charge fees to sublet.

Does any single entity own more than 10% of the outstanding shares?

Important for evaluating concentration risk. Banks will also use this figure as a threshold and require due diligence of the entity before approving a loan.

Is the sponsor current on its obligations to the coop?

If there are unsold shares or sponsor units remaining in the coop building, then you’ll want to make sure the sponsor is on good terms with the rest of the building and not in arrears on its maintenance.

Are there any mold issues in the unit or the building?

Most people are concerned with mold of the toxic variety, but even common mold can be dangerous to your health.

Any known pest, vermin or bedbug issues in the building?

You’ll want to know if other shareholders have complained about cockroaches and rats, or if the building has been treated recently for bedbugs.

Is there bike storage in the building?

Given the explosion in the number of bike paths in New York City over the past few years, bike storage is more important than ever for NYC coop residents. Or you can just use CitiBike!

Please confirm the square footage of the coop apartment.

A managing agent will never answer this question for the same reason that co op listing agents typically never advertise a square footage. That’s because there often isn’t a written record of a coop apartment’s square footage vs a condo. Sometimes, you may see square footage numbers listed in the original condo or co-op offering plan.

Are washer dryers allowed?

You should ask this question even if the apartment already has a washer and dryer. That’s because the coop house rules could have changed and the apartment is simply grandfathered in with the old rules. If that is the case, what happens if it breaks and needs to be replaced?

Are there banks who will lend in the building?

It’s a good idea to find out if any banks have already project approved the building. This will make the NYC mortgage process much easier for the buyer to work with one of these preferred lenders.

Are there material renovations on file and have they been approved?

If the unit has been renovated, you’ll want to make sure that the work was filed properly and approved by the building. That means the seller properly signed an alteration agreement and got the finished work approved by the building’s architect. You’ll want to be especially careful whenever you see a combination unit. You’ll also want to make sure that the work has been closed out fully and that there are no open permits. You can check this for yourself on the NYC Department of Buildings website. You can learn more on our list of useful real estate websites for NYC.

How much money is in the reserve fund?

What types of investments are the coop’s reserves held in? Scrutinize the coop building financial statements to see if the coop is actually borrowing money from the reserve fund without reducing the balance (i.e. “funds due to” or “funds due from”). Note that Restricted Balances are funds that are not readily available and therefore should not be used when determining the amount of reserves a building has.

Does the building have a ground lease?

What happens when a land lease expires in NYC? What are the terms for renewal and step ups in payments?

Does the coop have a flip tax?

How many transactions does the coop have on average per year? Is the coop flip tax a percentage of the sales price, a percent of profits or some fixed dollar amount?

Are there any written or verbal complaints from shareholders about water pressure or noise?

This is a great last attempt to fish for more color from the managing agent. The last thing you’ll want to do is to move into an apartment only to find out that you can’t sleep because of loud banging sounds from the water pipes at night. You’ll want to know if the previous owner has complained about loud noises day and night from the building’s gym downstairs.

What percent of maintenance is tax deductible?

Remember that a high percent of tax deductibility is not necessarily a good thing. Why would you want more of your monthly charges to be going to the government via taxes and the bank via the building’s underlying mortgage?

Are there any lot line windows?

The last thing you’ll want to do is to buy an apartment in NYC where the windows will be bricked up in a few years at your own expense. Worse still, some of your bedrooms will stop being a legal bedroom in NYC if they lose their source of air and light!

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

This is a co op questionnaire that we’re using, can also be used for a condo or condop. Every lawyer can have their own version, there is no standard when it comes to an attorney questionnaire.

COOP/CONDO/CONDOP QUESTIONNAIRE

Building Name:

Address:

Date:

Corporation/Condo Name: __________________________________

Corporation/Condo Address: ________________________________

Managing Agent: _________________________________________

Managing Agent Contact: __________________________________

Managing Contact Tel.: ____________________________________

Sponsor’s Corporate Name: _________________________________

Sponsor’s Contact:_________________________________________

Board President: __________________________________________

Broad President Contact: ____________________________________

Block: #_________

Lot: #___________

COOPERATIVE/CONDO UNIT INFORMATION

Unit no.: ________ No. owner occupied: _____

Unit’s % int.: ______ No.Investor/sublets: _______

Unit’s maintenance: $_________ No. Sponsor owned: _______

Total Units: __________

Total No. of Floors: _______

GENERAL PROJECT INFORMATION

Year built: _________________

New construction/renovation: _________________

Conversion? Yes __ No __ Eviction ____ or Non-Eviction ____ conversion

Permanent certificate of occupancy issued?

Can project be expanded?

Is this project subject to additional phasing and add-ons?

Building contains elevators: Yes __ No __

No. of elevators: ________

Shared Laundry Room:

Each has a washer/dryer:

Storage bins/rooms : Yes __ No __

If yes, how many? ______

Is there a waiting list :

Are pets allowed:

If yes, please provide a copy of any written policy.

Is smoking prohibited in the units?

Are there any recreational facilities or any common areas leased?

If yes, please explain:

Does any person or entity own 10% or more of the units?

If not the sponsor, name ______________________________________________________________

How many unit owners own more than 1 unit?: ____________________________________________

Is the building owned in fee simple or under a leasehold?: ____________________________________

Proprietary lease expires (if coop): ______________________________________________________

Is there a Flip Tax? _____________ What’s the percentage ________________________________

Are any units devoted to Commercial Space/Professional Space?

If Yes, what type (i.e. Garage Unit, Office Unit, Retail Units)? : _______________________

Are there parking spaces?

Assigned to the units or generally available _______________________

Are any units/apartments/rental spaces owned by the condo/coop?

Are there any special assessments in effect for the next 5 yrs?

Amount per share or total amount assessed __________________; amount still due _________

Schedule for payments __________________________________________________________

If yes, describe purpose: ___________________________________________________________

Number of owners over thirty (30) days delinquent in their assessments is: ______________

Total dollar amount outstanding is: $__________________

Number of Sponsor/Condo/Coop Association owned units delinquent on assessments: __________

Has the sponsor released voting control of the Board?

If condo, does the project’s legal documents include restrictions on a sale which would limit the free transferability of title or approval rights of the board? ( i.e. age restriction, right of first refusal, low to moderate income restrictions):

Is the Condo/Coop currently party to any litigation or public administrative action?

If yes, please explain and attach information.

Are there any mechanic’s liens filed against project/ building dept violations on the building or unit?

If yes, describe: _____________________________________________________________________

Does the Sponsor control the Board of Directors?

Is building/project insured?

Does the Owner’s association have a reserve fund separate from the operating account?

Amount in the reserve fund __________________

Have there been any short sale or foreclosure sales in the building?

Have there been any rodent/bed bugs issues? ___________________________________________

If so how was it handled or being handled?

Are there any restrictions on renting and selling the units?

Are there any law suits against the corporation or against any share holders in conjunction with their shares, if so what is the status?

What are the rules/ restrictions on renovations?

How often does the board meet? ______________________________________________________

Is there bike storage:

Is a washer/dryer permitted in the apartment?

Does the Board have a sublet policy/procedure?

Is there a written application for the sublet process?

Are there any fees or costs associated with sublet of an apartment?

Does the Corporation have any notice that there been any leaks into or out of the above unit to be purchased in the past year?

Total number of units more than 30 days delinquent on maintenances:

___________ Total $___________ amount due for more than 30 days: ________________.

Please identify which units are owned by the Sponsor _________________________________.

What capital improvements are being discussed and/or planned for the next 5 years and how are they being paid for?

When are the Corporation’s current year’s financial reports expected to be available? _____________.

What was the dollar amount for the current tax year attributed towards the real estate taxes and interest on the underlying mortgage allocated to the shares of the apartment that were deductible? ____________________

Does the Coop maintain an underlying mortgage?

If yes, what are the terms of the underlying loan (loan term, interest rate, prepayment penalties, etc.)?

UTILITIES

• Electric charges payable by: the unit owner __; or as part of common charges __

What is the name of the company providing electric service? ______________________________.

• Water/sewer service payable by: the unit owner __; or as part of common charges __

What is the name of the company providing water/sewer service? _________________________.

• Cable service payable by: the unit owner __; or as part of common charges __

What is the name of the company providing cable service? ______________________________.

• Heat payable by: the unit owner __; or as part of common charges __

How is the Unit being heated? _____________________________________________.

• Hot water payable by: the unit owner __; or as part of common charges __

How is the hot water being provided? ______________________________.

PLEASE PROVIDE THE FOLLOWING INFORMATION IF NOT YET PROVIDED:

– Last two (2) years most Recent Independent Certified Public Accountants Financial Report

– Transfer Sales History

– By-Laws

– Offering Plan

– Amendments to the offering plan