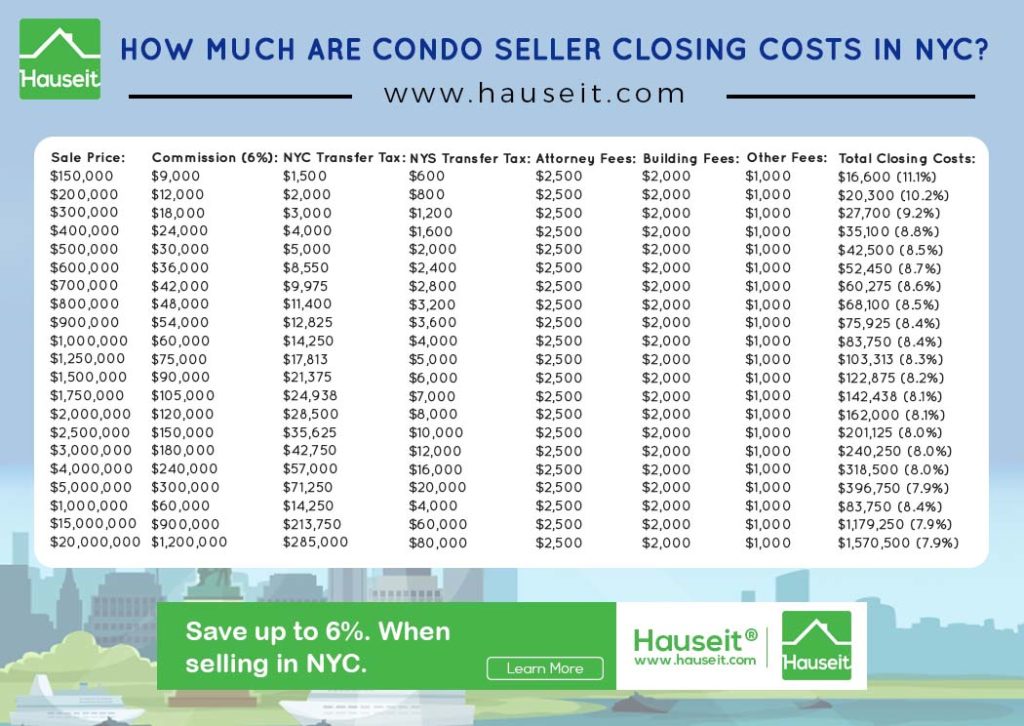

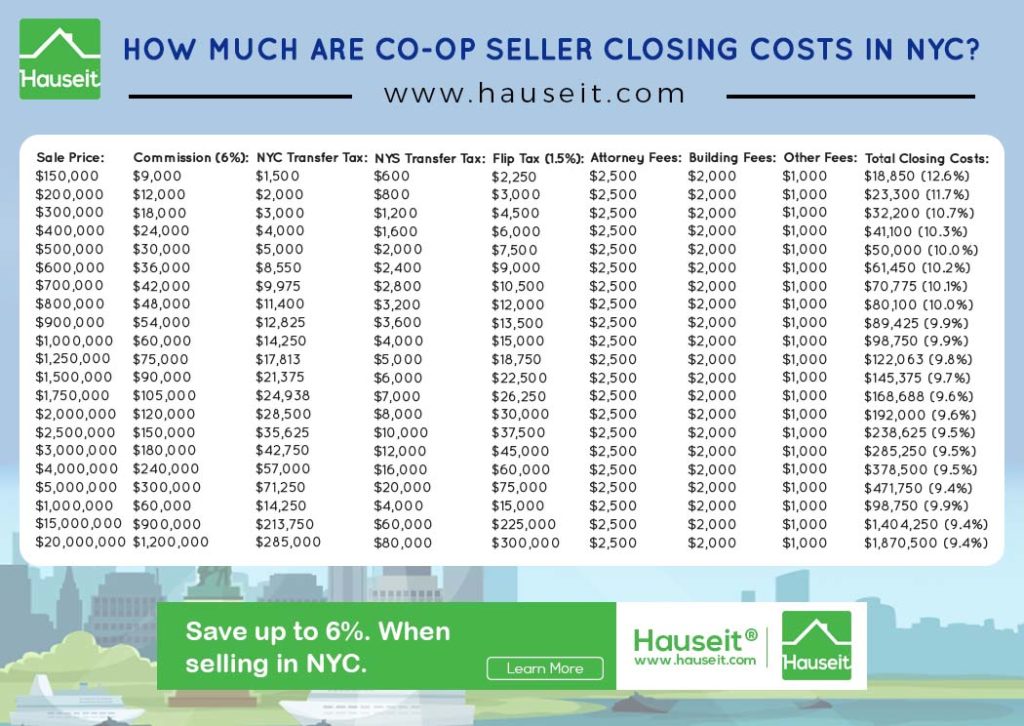

Seller closing costs in NYC are between 8% to 10% of the sale price. Seller closing costs are usually higher for co-ops than condos because most co-ops charge sellers a flip tax. Closing costs include a 6% broker fee, NYC Transfer Taxes of 1.4% to 2.075%, legal fees, a flip tax for co-ops, building fees and miscellaneous fees.

The traditional 6% real estate broker commission is the largest component of seller closing costs in New York City. The second largest closing cost is the combined NYC & NYS Transfer Tax which is 2.075% for sale prices of $3 million or more, 1.825% for sale prices above $500k and below $3 million, and 1.4% for sale prices of $500k or less.

Aside from broker fees and Transfer Taxes, seller closing costs also include real estate attorney fees ($2k to $3k), a bank loans satisfaction fee if there’s an outstanding mortgage, miscellaneous filing fees and move-out fees and deposits in the case of condos and co-ops.

Estimate your closing costs in NYC using Hauseit’s Interactive Closing Cost Calculator for Sellers.

Seller Closing Costs in NYC:

The largest closing cost for sellers is the traditional real estate agent commission of 5% to 6% of the sale price. Broker fees in NYC have remained sky high despite falling commissions nationwide and technological advances which have made it easier than ever to advertise a property and find a buyer.

One of the main reasons why commissions are high in NYC is because over 90% of deals are done with two agents: a listing agent represents the seller while a buyer’s broker represents the buyer.

A typical commission of 6% is intended to be split equally between both agents, meaning both earn 3%.

A typical seller in NYC signs an exclusive right to sell listing agreement which obligates them to pay a fixed commission amount at closing. If a buyer does not have an agent, the listing agent simply pockets the entire 6% and the seller’s total commission bill usually remains unchanged.

Most buyers in NYC have buyer agents because they’re aware that sellers are paying a commission anyway and neither the buyer nor the seller save money if the buyer is unrepresented. Many buyers also value the advice and strategic perspective that a dedicated buyer’s agent can offer. Furthermore, some buyers are not comfortable working directly with a listing agent under dual agency because of perceived conflicts of interest.

The fact that most buyers have agents further incentivizes sellers to offer high commissions to buyer agents. This creates a self-perpetuating flywheel whereby sellers are encouraged to offer high commissions and buyers are encouraged to seek the services of buyers agents.

Estimate your seller closing costs in NYC with Hauseit’s interactive closing cost calculator for sellers.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Most co-ops in NYC charge sellers a flip tax. The amount of the flip tax and how it’s calculated vary by co-op. As a general rule of thumb, an average flip tax in NYC is ~1.5% of the sale price.

A flip tax can either be a flat fee, a per-share amount, a percentage of the sale price, a percentage of profits or some combination of these methods.

The amount of the flip tax is usually listed in the co-op purchase application. If it’s not listed here, another good place to check is the house rules. As a last resort, you can ask your building’s managing agent to reconfirm the flip tax.

The NYC Transfer Tax is 1% for sale prices of $500k or less and 1.425% for anything above $500k. Higher rates apply for commercial properties and multifamily properties with 4-or-more units.

The NYC Transfer Tax is also known as the Real Property Transfer Tax (RPTT), and this is a separate tax payable in addition to New York State Transfer Taxes of 0.4% to 0.65%.

The combined NYC & NYS Transfer Tax rates range from 1.4% to 2.075%.

New York City Real Property Transfer Tax rates are as follows:

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The NYS Transfer Tax is between 0.4% and 0.65% of the sale price. The higher tax rate of 0.65% applies to residential sales of $3 million or more. It was enacted as part of 2019 changes to the New York Tax Law.

New York State Transfer Tax rates are as follows:

New York State levies an extra Transfer Tax on sales above $1m. This is commonly referred to as the Mansion Tax. Because the Mansion Tax is customarily paid by buyers, it’s not typically included when discussing seller Transfer Taxes in NYC even though it’s actually a Transfer Tax.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

A typical real estate attorney in NYC charges a flat fee of $2k to $3k for a sale or purchase transaction. The fee includes contract review/negotiation as well as the closing proceedings.

Who you select as your lawyer can make or break your sale in NYC.

A slow, combative or unresponsive lawyer may cause your buyer to walk away after you have an accepted offer.

Because hiring the right lawyer is so important, we encourage you to read our dedicated article on the questions to ask your real estate attorney in NYC. We also discuss the typical real estate attorney fees for NYC in this article.

Most co-ops and condos charge sellers a handful of miscellaneous fees when selling. These may include move-out deposits and fees as well as a fee payable to the managing agent for the closing proceedings.

These fees do not usually vary based on the sale price. Therefore, you’ll notice that seller closing costs as a percentage of the sale price are somewhat regressive since closing costs as a percentage of the sale price are higher for inexpensive properties.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Miscellaneous seller closing costs in NYC are generally less than $1,000. These fees may include a bank loan satisfaction fee if you’re paying off a mortgage as well as filing fees such as the Residential Deed Transfer Fee and ACRIS Filing Fees in the case of a condo or house.

For a co-op, you’ll need to pay a co-op attorney fee, a UCC-3 Termination Fee, a Non-Deed Transfer Fee as well as the Co-op Stock Transfer Tax.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.