Seller closing costs in Westchester County are roughly 6.5% to 8%. However, you can pay as little as 1% to 2% in total closing costs by using a Hauseit Agent Assisted FSBO Listing.

The largest seller closing costs in Westchester include broker commissions, NYS Transfer Taxes, city transfer taxes in the case of Yonkers, Mt. Vernon and Peekskill as well as seller attorney fees.

Additional seller closing costs in Westchester include bank loan satisfaction fees if you have an outstanding mortgage, the property condition disclosure waiver fee if you’re selling a house as well as building fees if you’re selling a condo or co-op.

Seller closing costs in Westchester are considerably lower than in NYC. This is primarily because NYC charges an additional city transfer tax of 1% to 1.425% on top of NYS Transfer Taxes.

In addition, residential deals of $3m or more and commercial deals of $2m or more in NYC are required to pay a higher NYS Transfer Tax rate of 0.65% whereas the NYS Transfer Tax rate in Westchester is 0.4% across the board.

However, seller closing costs are comparable between NYC and Yonkers, Mt. Vernon and Peekskill because these three towns impose an additional city transfer tax similar to NYC.

Westchester Seller Closing Costs:

Broker commission

The traditional real estate commission rate in Westchester is 5% to 6% of the sale price. The total commission paid by the seller is typically split equally between the listing agent and the buyer’s agent.

If the total commission is 6%, the listing agent and the buyer’s agent both pocket 3%.

Most listing agreements stipulate a fixed total commission regardless of whether a buyer is represented. This means that the listing agent typically pockets the full 6% if there’s no buyer’s agent.

NYS Transfer Tax

The NYS Transfer Tax rate in Westchester is 0.4% of the sale price. The tax rate does not vary by sale price or property type (residential vs. commercial) as is the case with NYC Transfer Taxes.

When calculating the transfer tax, be sure to round up the sale price to the nearest $500.

For example, if the sale price is $875,501, round it up to $876,000 prior to multiplying by the tax rate. The transfer tax calculation in this example is as follows:

City Transfer Tax

Yonkers, Peekskill and Mt. Vernon charge sellers a city transfer tax on top of the NYS Transfer Tax.

Yonkers charges its own transfer tax of 1.5% on top of the standard 0.4% NYS Transfer Tax, for a total of 1.9% of the sale price.

Peekskill charges a city transfer tax of 1% in addition to the NYS Transfer Tax rate of 0.4%, for a total of 1.4% in seller transfer taxes.

Mt. Vernon levies a city transfer tax of 1% on consideration in excess of $100,000 in addition to the 0.4% NYS Transfer Tax on the entire purchase price. The combined city and state transfer tax rate in Mt. Vernon is approximately 1.4%.

The city transfer tax imposed by Yonkers, Peekskill and Mt. Vernon does not apply to co-ops.

If you are selling a co-op in Westchester, you’re only responsible for the NYS Transfer Tax.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Most real estate attorneys in Westchester operate on a flat fee basis which includes contract negotiation with the buyer’s lawyer and the closing.

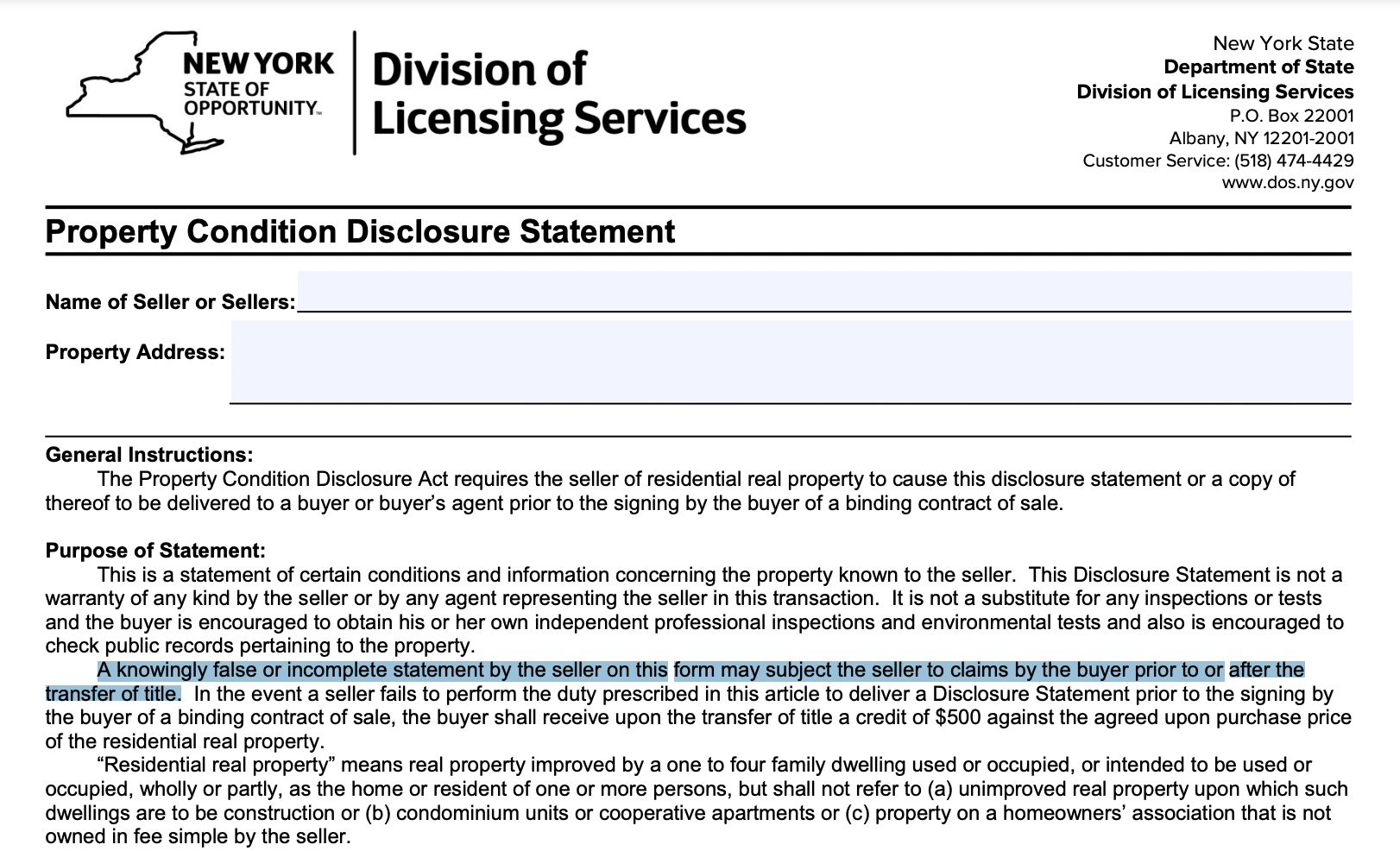

Property condition disclosure waiver fee

If you’re selling a house, you will need to fill out a Property Condition Disclosure Statement or credit the buyer $500 in lieu of completing this form.

Many sellers opt to pay the $500 penalty instead of filling out the form in order to reduce the risk of litigation.

Per the official disclosure form: “A knowingly false or incomplete statement by the seller on this form may subject the seller to claims by the buyer prior to or after the transfer of title.”

The Property Condition Disclosure Statement asks rather detailed questions, and most homeowners are not engineers or professional inspectors. Paying $500 is a small price to pay to mitigate the risk of costly litigation.

The Property Condition Disclosure Act became law in New York in 2002. It does not apply to condos and co-ops. Therefore, this form (and the associated $500 penalty for not completing it) is not applicable if you’re selling an apartment.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Building fees

If you’re selling a condo or co-op in Westchester, your building may charge a handful of closing related fees. These include:

-

Flip Tax: 1% to 3%, usually just for co-ops and varies by building

-

Move-out Fee: $1,000 or less

-

Move-out Deposit (refundable or non-refundable): varies

-

Closing Fee: around $500, payable to your building’s managing agent.