Coop apartment buyers who are financing their purchase will need to complete a UCC filing, more specifically a UCC Financing Statement.

We’ll explain in this article what a co op UCC Financing Statement is, what it looks like and why banks need one to fund your loan.

Table of Contents:

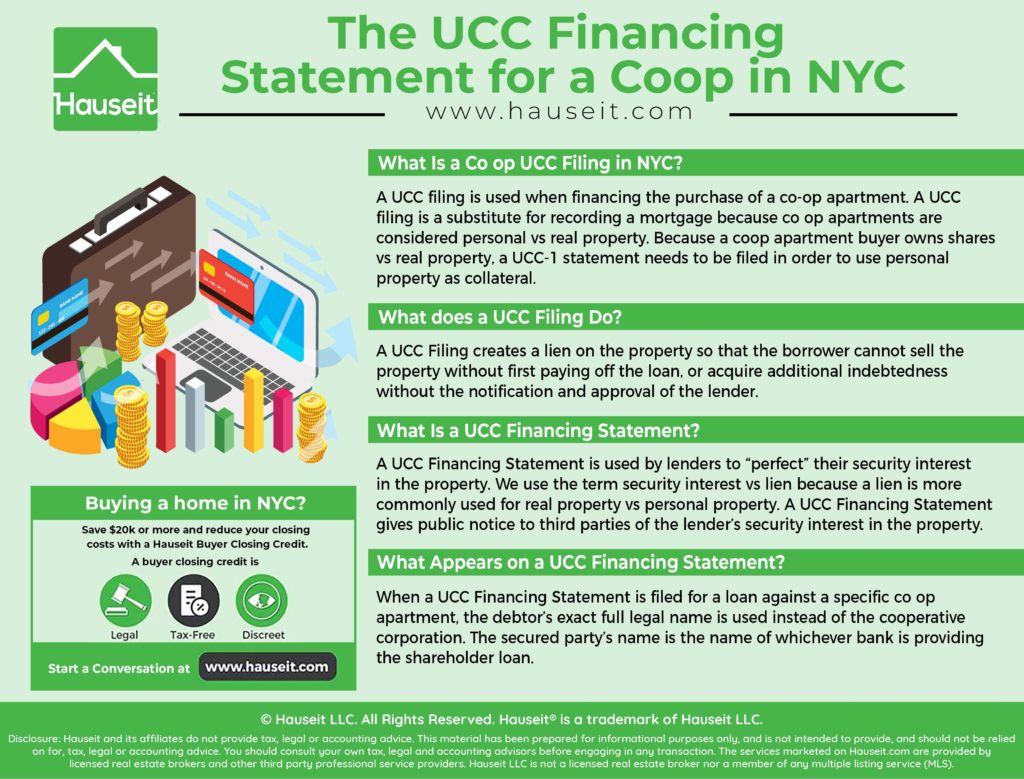

What Is a Co op UCC Filing in NYC?

A UCC filing is necessary if you are buying a coop in NYC. A UCC filing is a substitute for recording a mortgage because co op apartments are not considered to be real property, and mortgages are only applicable for real property. As a result, banks lending against co op shares need to rely on the Uniform Commercial Code (UCC).

Personal Property as Collateral

Under state Uniform Commercial Code laws and statutes, a UCC-1 statement is filed when personal property is used as collateral.

Personal property can include equipment, inventory, co op shares and other assets of a business.

A UCC Filing creates a lien on the property so that the borrower cannot sell the property without first paying off the loan, or acquire additional indebtedness without the notification and approval of the lender.

As a result, a UCC filing on a coop will allow the bank to extend a secured loan vs an unsecured loan.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

What Is a UCC Financing Statement?

A UCC Financing Statement is used by lenders to “perfect” their security interest in the property. We use the term security interest vs lien because a lien is more commonly used for real property vs personal property.

A UCC Financing Statement gives public notice to third parties of the lender’s security interest in the property.

If a lender does not “perfect” their interest in the property, the lender may have serious issues enforcing their claim to the collateral against third parties and other creditors who also claim a security interest in the collateral.

A UCC Financing Statement is a simple form that details the legal names of all parties, including the debtor and the lender. There will also be a section called “this Financing Statement covers the following collateral.” We’ve included sample language for a UCC Financing Statement for a co op corporation’s loan:

The assets and personal property, including fixtures, more particularly described on Schedule A attached hereto and made a part hereof, including those assets, personal property and fixtures which relate to the real property more particularly described in Exhibit A hereto and made a part hereof.

When a UCC Filing is made against a co op corporation, it is typically classified as a fixture filing even though the building may be secured against the loan (assuming the building does not have a land lease). In the section that asks for a description of real estate, our hypothetical coop corporation may write something like the following:

555 East 5th Avenue, New York, NY 10350 and as more particularly described on Exhibit A attached hereto and made a part hereof. Block 983 and Lot 74 of the Tax Map of New York County, New York.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

UCC Financing Statement for a Co op Apartment Loan

When a UCC Financing Statement is filed for a loan against a specific co op apartment, the debtor’s exact full legal name is used instead of the cooperative corporation. The secured party’s name is the name of whichever bank is providing the shareholder loan.

Here is sample language for the section called “This Financing Statement covers the following collateral.”

Shares as Collateral

Debtor’s interest in 150 shares of stock for apartment number 15B and the proprietary lease with NYC Cooperative Corporation and any replacement or additional stock and any lease amendments or replacement.

This cooperative property financing statement shall be effective until a termination statement is filed.

Full Address: 555 Fifth Avenue, Apartment 15B, New York, NY 10384

County: New York Block: 950 Lot: 5

Note that a UCC Financing Statement Cooperative Addendum is also typically filed. It is a one page form that accompanies a UCC Financing Statement and covers one or more cooperative interests. The form will detail the exact address and names of all parties. In the section called “Specify Other Unit Uses” you will write Cooperative Apartment.

An important note that is included with a UCC Financing Statement Cooperative Addendum is the following:

This Cooperative Addendum is for use when the collateral includes a Cooperative Interest. Only as to collateral which is a Cooperative Interest, but not as to other collateral, the initial Financing Statement to which this Cooperative Addendum relates shall be effective for 50 years from the date of filing the initial Financing Statement.

Sample NYC Coop UCC Financing Statement

We’ve included a sample Schedule A to a UCC-1 Financing Statement for a loan against a co op building. To be clear, this hypothetical UCC Financing Statement Schedule A is for a loan against a coop corporation, not for an individual co op apartment. This is essentially a loan agreement that goes in excruciating detail over everything which the debtor may have a security interest in.

Schedule A to UCC-1 Financing Statement

Debtor: NYC Cooperative Corporation

Secured Party: Big New York Bank Corporation

The types of property and interests covered by this UCC-1 Financing Statement including the following (any capitalized terms used in this schedule A and not defined herein shall have the meaning assigned to them in that certain Consolidation, Extension and Modification Agreement (CEMA loan) between Debtor and Secured Party (the “Mortgage”)):

All right, title and interest in and to the real property or properties described on Exhibit A hereto (collectively, the “Land”), being the same premises conveyed to Debtor by deed recorded in the Land Records on June 6, 1984 in Reel 1035 on Page 768.

All additional lands, estates and development rights hereafter acquired by Debtor for use in connection with the Land and the development of the Land and all additional lands and estates therein which may, from time to time, by supplemental mortgage or otherwise, be expressly made subject to the lien thereof (collectively, the “Additional Land”).

Any and all buildings, structures, fixtures, additions, enlargements, extensions, modifications, repairs, replacements and improvements now or hereafter located on the Land or any part thereof (collectively, the “Improvements”; the Land, the Additional Land and the Improvements hereinafter collectively referred to as the “Real Property”).

All easements, rights-of-way, strips and gores of land, streets, ways, alleys, passages, sewer rights, water, water courses, water rights and powers, oil, gas and mineral rights, air rights and development rights, zoning rights, tax credits or benefits and all estates, rights, titles, interests, privileges, liberties, tenements, hereditaments and appurtenances of any nature whatsoever in any way now or hereafter belonging, relating or pertaining to the Real Property or any part thereof and the reversion and reversions, remainder and remainders and all land lying in the bed of any street, road or avenue, opened or proposed, in front of or adjoining the Land or any party thereof to the center line thereof and all the estates, rights, titles, interests, dower and rights of dower, curtesy and rights of curtesy, property, possession, claim and demand whatsoever, both in law and in equity, of Debtor in, of and to the Real Property and every part and parcel thereof, with the appurtenances thereto.

All machinery, equipment, fixtures, appliances and other property of every kind and nature whatsoever owned by Debtor or in which Debtor has or shall have an interest (to the extent of such interest) now or hereafter located upon the Real Property or appurtenant thereto and usable in connection with the present or future operation and occupancy of the Real Property and all building equipment, materials and supplies of any nature whatsoever owned by Debtor or in which Debtor has or shall have an interest (to the extent of such interest) now or hereafter located upon the Real Property or appurtenant thereto or usable in connection with the present or future operation and occupancy of the Real Property, including but not limited to all heating, ventilating, air conditioning, plumbing, lighting, communications and elevator machinery, equipment and fixtures, and all plumbing and bathroom fixtures, refrigeration equipment, sprinkler systems, wash tubs, sinks, gas and electric fixtures, stoves, ranges, ovens, disposals, refrigerators, dishwashers, hood and fan combinations, carpeting, drapes, lobby furnishings, awnings, screens, window shades, refrigerators, kitchen cabinets, incinerators, kitchen equipment, laundry equipment (including, without limitation, washers and dryers), plants and shrubbery, pool furniture and equipment, exercise equipment and all other equipment and machinery, appliances, fittings and fixtures of every kind located in or used in the operation of the Real Property or any part thereof, together with any and all replacements thereof and additions thereto (hereinafter collectively referred to as the “Equipment”) and the right, title and interest of Debtor in and to any of the Equipment which may be subject to any security agreements (as defined in the Uniform Commercial Code of the State in which the Real Property is located (the “Uniform Commercial Code”)) superior, inferior or pari passu in lien to the lien of this UCC-1 Financing Statement. In connection with Equipment which is leased to Debtor or which is subject to a lien or security interest which is superior to the lien of this UCC-1 Financing Statement, this UCC-1 Financing Statement shall also cover all right, title and interest of Debtor in and to all deposits and the benefit of all payments now or hereafter made with respect to such Equipment.

All awards or payments, including interest thereon, which may heretofore and hereafter be made with respect to the Real Property or any part thereof, whether from the exercise of the right of eminent domain (including but not limited to any transfer made in lieu of or in anticipation of the exercise of said right), or for a change of grade or for any other injury to or decrease in the value of the Real Property.

All leases and subleases (including, without limitation, all guarantees thereof and security therefor, including, without limitation, all right, title and interest in and to any letters of credit now owned or hereafter acquired by, or delivered or required to be delivered to, Debtor by any tenant of the Real Property or additional security for the performance of such tenant’s obligations under its Lease or constituting “supporting obligations” for such leases and guarantees, as such term is defined in Article 9 of the Uniform Commercial Code, all letter of credit rights and any and all proceeds of such letters of credit or right to receive the proceeds of such letters of credit or to otherwise receive the benefit of any draw upon any such letter of credit, whether such right, tile and interest of Debtor is classified as a supporting obligation, letter of credit right, account, contract right, general intangible or instrument under applicable law, together with all proceeds thereof), and other agreements affecting the use, enjoyment and/or occupancy of the Real Property or any part thereof, now or hereafter entered into (including any use or occupancy arrangements created pursuant to Section 365(h) of Title 11 of the United States Code (the “Bankruptcy Code”) or otherwise in connection with the commencement or continuance of any bankruptcy, reorganization, arrangement, insolvency, dissolution, receivership or similar proceedings or any assignment for the benefit of creditors in respect of any tenant or occupant of any portion of the Real Property), together with any extension or renewal of the same (the “Leases”) and all income, rents, issues, profits, revenues and proceeds including, but not limited to, all oil and gas or other mineral royalties and bonuses from the Real Property (including any payments received pursuant to Section 502(b) of the Bankruptcy Coe or otherwise in connections with the commencement or continuance of any bankruptcy, reorganization, arrangement, insolvency, dissolution, receivership or similar proceedings or any assignment for the benefit of creditors in respect of any tenant or occupant of any portion of the Real Property and all claims as a creditor in connection with any of the foregoing) (the “Rents”) and all proceeds from the sale, cancellation, surrender or other disposition of the Leases and the right to receive and apply the Rents to the payment of the Indebtedness.

All proceeds of and any unearned premiums on any insurance policies covering the Real Property or any part thereof including, without limitation, the right to receive and apply the proceeds of any insurance, judgments or settlements made in lieu thereof, for damage to the Real Property or any part thereof.

All tax refunds, including interest thereon, tax credits and tax abatements and the right to receive or benefit from the same, which may be payable or available with respect to the Real Property.

The right, in the name and on behalf of Debtor, to appear in and defend any action or proceeding brought with respect to the Real Property or any part thereof and to commence any action or proceeding to protect the interest of Secured Party in the Real Property or any part thereof.

All accounts receivable, utility, or other deposits, intangibles, contract rights, interests, estates or other claims, both in law and in equity, which Debtor now has or may hereafter acquire in the Real Property or any part thereof, and all funds and deposit accounts and other accounts into which any funds of Debtor are now or hereafter deposited to be held by, on behalf of or for the benefit of Secured Party.

All rights which Debtor now has or may hereafter acquire to be indemnified and/or held harmless from any liability, loss, damage, cost or expense (including, without limitation, attorneys’ fees and disbursements) relating to the Real Property or any part thereof.

All plans and specifications, maps, surveys, studies, reports, contracts, subcontracts, service contracts, management contracts, franchise agreements and other agreements, franchises, trade names, trademarks, symbols, service marks, approvals, consents, permits, special permits, licenses and rights, whether governmental or otherwise, respecting the use, occupation, development, construction and/or operation of the Real Property or any part thereof or the activities conducted thereon or therein, or otherwise pertaining to the Real Property or any part thereof.

All agreements, contracts, certificates, instruments, franchises, permits, trademarks, licenses and other documents, now or hereafter entered into, and all rights therein and thereto, respecting or pertaining to the operation and management of the Real Property as a cooperative residential apartment building with ground floor retail stores and basement parking garage and the organization, operation and management of Debtor as a corporation, including, without limitation, cooperative offering plan, co-op bylaws and articles of incorporation of Debtor, Proprietary Leases and Commercial Leases, management agreement, shareholder agreements, subscription agreements, and any and all related documents (the “Cooperative Documents”), and all right, title and interest of Debtor therein and thereunder, including, without limitation, the right upon the occurrence of any Event of Default hereunder to receive and collect any sums payable to Debtor thereunder.

All proceeds, products, offspring, rents and profits from any of the foregoing, including without limitation, those from sale, exchange, transfer, collection, loss, damage, disposition, substitution or replacement of any of the foregoing, and all other, further or additional title, estates, interest or rights which may exist now or at any time be acquired by Debtor in or to any of the foregoing, including, without limitation, the Real Property, or any part thereof.

All of the property described in the foregoing paragraphs, shall be collectively referred to as the “Collateral.”

For avoidance of doubt it is expressly understood and agreed that any of the foregoing terms included in the description of Collateral shall refer to any definitions thereof in the applicable Uniform Commercial Code, as the same may be revised from time to time, it being the intention of the parties hereto that the description of Collateral set forth herein be construed to include the broadest possible range of property and assets and all tangible and intangible personal property and fixtures of the Debtor of every kind and description.

Exhibit A – Legal Description of the Premises

All that certain plot, piece or parcel of land, situate, lying and being in the borough of Manhattan, City, County and State of New York, bounded and described as follows:

Beginning at a point on the northerly side of East 90th Street, distant 100 feet east of the corner formed by the intersection of the northerly side of East 90th Street and the easterly side of Park Avenue;

Running thence northerly parallel with Park Avenue and part of the distant part of the distance through a party wall 100 feet to the center line of the block;

Thence easterly parallel with East 90th Street 300 feet;

Thence southerly again parallel with Park Avenue 100 feet to the norther side of East 90th Street;

Then westerly along the northerly side of East 90th street 300 feet to the point or place of beginning.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

What can be done if a shareholder does not abide by the process of securing a refinancing of their shares; they do not submit to managing agent an appraisal, they do not submit an updated personal financial statement and they consequently never received a recognition agreement approval from The Board. This process is proscribed within the proprietary lease as well as another building set of rules that states no financing can occur without those approvals and above 50% of the cooperative apartment value. What should the managing agent and Board do to remedy this situation?

The managing agent and Board should cancel the non approved mortgage, UCC, against the owner’s shares and ask the shareholder to go through the approved process and if approved and issued a recognition agreement, then make the shareholder and bank close again with a date post recognition agreement. But they can not treat one shareholder differently than outlined within the proprietary lease and additional building guidelines.