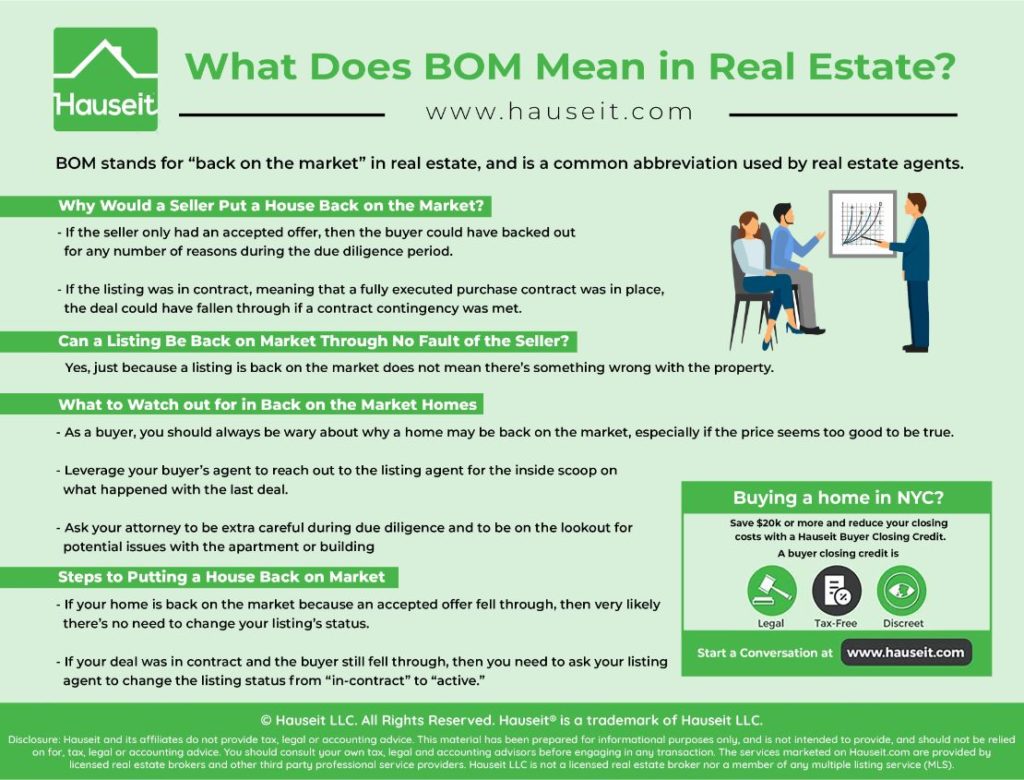

BOM stands for “back on the market” in real estate, and is a common abbreviation used by real estate agents. As the name suggests, a listing that is back on the market simply means that it is available again after a prior offer or contract fell through.

Table of Contents:

A seller typically puts a house back on the market because a previous deal with a buyer fell through, and the seller still wants to sell and is willing to look for another buyer.

The listing might have had an accepted offer or even a signed contract, but for some reason or another the buyer backed out.

If the seller only had an accepted offer, then the buyer could have backed out for any number of reasons during the due diligence period.

Perhaps the buyer’s attorney found something sketchy about the building while reviewing the board meeting minutes, the annual building financial statements or the condo or coop’s original offering plan.

If the listing was in contract, meaning that a fully executed purchase contract was in place, the deal could have fallen through if a contract contingency was met.

For example, perhaps the buyer had a mortgage contingency in the contract and was not able to get a mortgage commitment letter from a bank within the time limit, and decided to back out.

Or perhaps the appraisal came in low, and the buyer was protected by an appraisal contingency clause in the contract and decided to back out.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Yes, just because a listing is back on the market does not mean there’s something wrong with the property.

Most likely the reason that the property is back on the market is because the buyer decided to back out, perhaps because they got cold feet or they realized that they were not financially qualified (either generally speaking, or they didn’t meet a co-op’s financial requirements).

Sometimes, a buyer will back out of deal that’s in contract simply because the co-op board rejected them.

Or perhaps the buyer wasn’t able to get a loan, or couldn’t close with a loan because the buyer lost their job at the last minute. Things like this can happen through no fault of the seller.

As a buyer, you should always be wary about why a home may be back on the market, especially if the price seems too good to be true. Did the last buyer find something out about the property during the due diligence period that made the purchase untenable?

Leverage your buyer’s agent to reach out to the listing agent for the inside scoop on what happened with the last deal.

Many listing agents will be very upfront and honest about what happened, for example if the buyer was simply rejected by the co-op board.

It actually has nothing to try to to with “Bank Owned.” within the cut-off, use every available letter within the description allowed world of land listings, BOM is shorthand for “Back On Market.” It means someone was trying to sell their home, got a suggestion thereon and accepted it, and for whatever reason the one that was getting to buy the house backed out. Why would someone disclose BOM when it could mean that the inspection found something nasty? By their very nature, BOM homes have high DOM (Days On Market). the times in escrow still count against the CDOM.