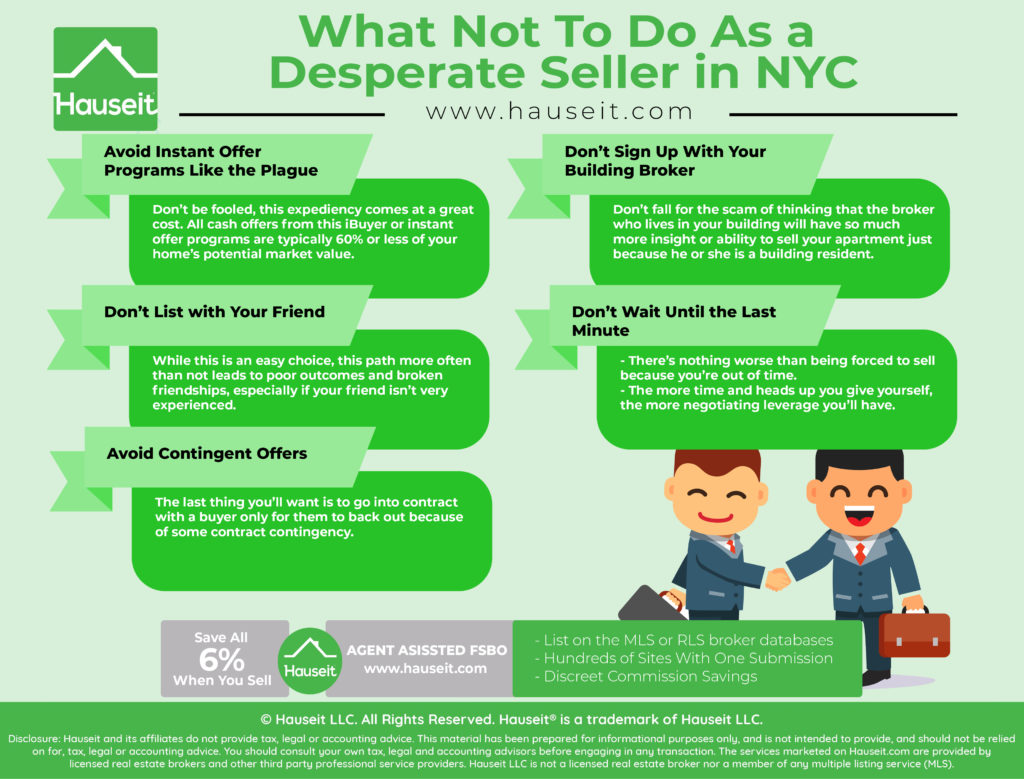

You need to move quickly as a desperate seller, but that doesn’t mean you should forgo some basic research about home selling alternatives. Don’t fall for instant offer programs or other vulture investor schemes, don’t just give your listing to the building broker and don’t call your friend to be your listing agent. Lastly, try to avoid contingent offers and make sure you get started as soon as possible!

Table of Contents: