What are the risks and benefits associated with an installment sale of real estate in NYC? What tax savings can you achieve with an installment sale of your property?

Table of Contents:

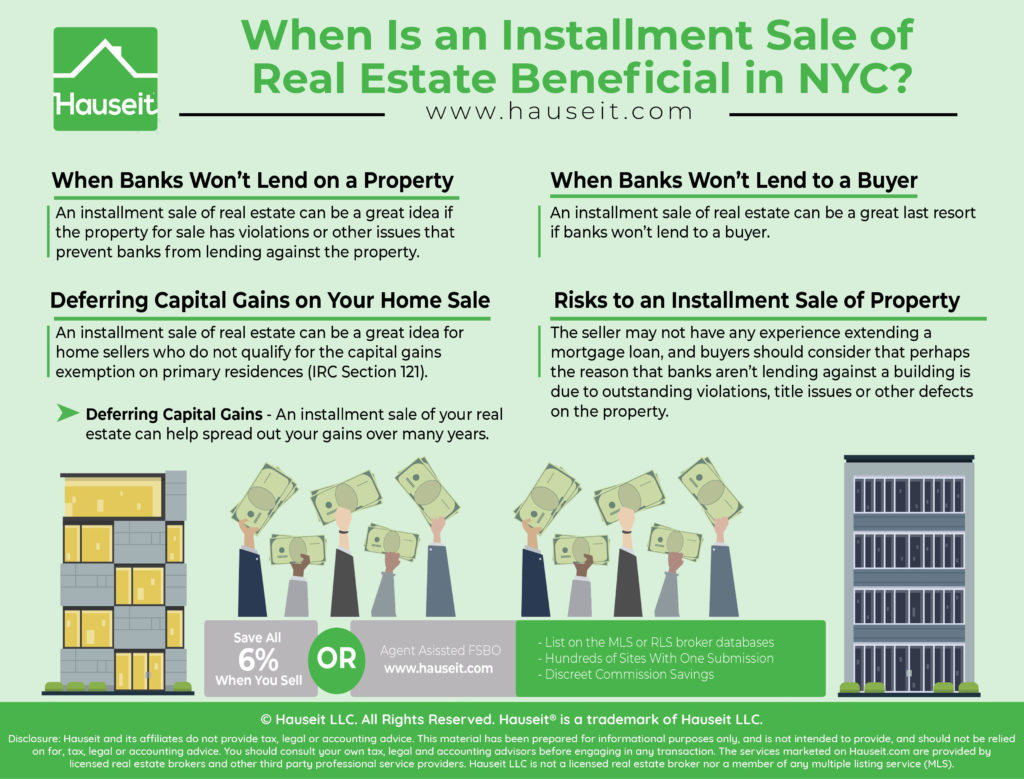

When Banks Won’t Lend on a Property

An installment sale of real estate can be a great idea if the property for sale has violations or other issues that prevent banks from lending against the property.

While violations or other unresolved issues on a property might turn away many buyers, there may be some buyers who are willing to take the risk and purchase the property anyway.

In this situation, the only issue becomes financing the purchase since traditional lenders are not an option.

When Alternative Financing Is Necessary

If both buyer and seller are aware of the reasons why banks won’t lend against the property and wish to proceed with a sale anyway, an installment sale of the real estate is a great way to effect the sale.

Essentially, the seller acts as the bank and provides seller financing to the buyer.

For example, let’s assume the sale price for a property is $6 million. The seller may ask for $2 million upfront as the down payment, and agree to lend the buyer $4 million for the balance of the purchase price.

Because the seller and the lender are the same entity, the seller doesn’t actually lend out any cash. However, the seller will have a mortgage on the property and can take back the property if the buyer defaults on the loan.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

When Banks Won’t Lend to a Buyer

An installment sale of real estate can be a great last resort if banks won’t lend to a buyer.

Bank lenders are much stricter after the Great Financial Crisis of 2007 and 2008, and gone are the days of NINJA (no income, no job, no assets) and no documentation loans.

Banks these days need to thoroughly analyze if a loan makes sense for a borrower before approving it.

That means following the Quality Mortgage process and verifying that the borrower can actually afford their mortgage payments, even far in the future.

In fact, banks now require borrowers to sign the loan application a second time at the closing.

As a result, many otherwise qualified borrowers may have difficulty receiving a mortgage from a traditional mortgage broker or bank these days. For example, a buyer may be self-employed with income that varies a bit more than your typical wage earner. Unfortunately for the self-employed, banks value steady W-2 wage income far more and this small business owner may not be able to get a loan.

This presents an opportunity for NYC home sellers to make a deal happen by becoming the lender themselves.

This is an especially attractive option if banks will otherwise lend against the property, meaning the asset is worthy collateral, but simply can’t get past regulatory hurdles on an otherwise well qualified buyer.

Since the seller has their own property as collateral, which one would assume they know quite well, it may make a lot of sense to effect an installment sale when banks won’t lend.

Deferring Capital Gains on Your Home Sale

An installment sale of real estate can be a great idea for home sellers who do not qualify for the capital gains exemption on primary residences (IRC Section 121).1

If for example you’ve missed the window to qualify for IRC Section 121 because you haven’t lived in the property for at least 2 out of the last 5 years, then you’ll face the full brunt of capital gains taxes on your personal residence.

Deferring Capital Gains

An installment sale of your real estate can help spread out your gains over many years.

In fact, no capital gains tax is due until principal of the loan is repaid.

Furthermore, by spreading out your gains over more than one year, you could potentially qualify for a lower tax bracket! There are many nuances on the tax treatment of installment sales of real estate which are beyond the scope of this article.

You can learn more about the tax treatment of real estate installment sales and loans on the IRS website regarding Publication 537.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Risks to an Installment Sale of Property

An installment sale of real estate involves additional risks for both the buyer and the seller.

If the primary reason for an installment sale of real estate is because banks won’t lend against the property, perhaps the buyer should re-consider buying the property if banks aren’t comfortable with the risks associated with the property.

Why Won’t Banks Lend?

Banks might not lend against a building because of outstanding violations, title issues or other defects on the property.

Perhaps the property won’t appraise close to the contract price so the buyer won’t be able to get enough financing to complete the purchase.

All of these are serious risks that the buyer needs to carefully consider before agreeing to an installment sale of real estate. At the very least, they are red flags that there is something atypical about the property that they are considering buying.

A seller needs to be wary about an installment sale of real estate as well, not only because the buyer truly might not be able to afford the property, but because the seller is inexperienced with making mortgage loans.

This may be the first time the seller goes through the mortgage loan process from the lender’s perspective, and the seller may not know a thing about the mortgage underwriting process or the mortgage loan process in NYC. As a result, the seller risks being too lenient on underwriting and approving an otherwise unqualified buyer.

Furthermore, a seller should consult an experienced real estate attorney for the mortgage and loan document. A seller should not try to save money and draft a mortgage note by themselves!

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.