No one knows when to buy a home just like no one can predict the movement of the stock market. With that said, the real estate market is slower moving and buyers can watch for signs like low interest rates, high average days on market, high housing supply and many local factors to help them gauge the optimal time to buy a home.

Table of Contents:

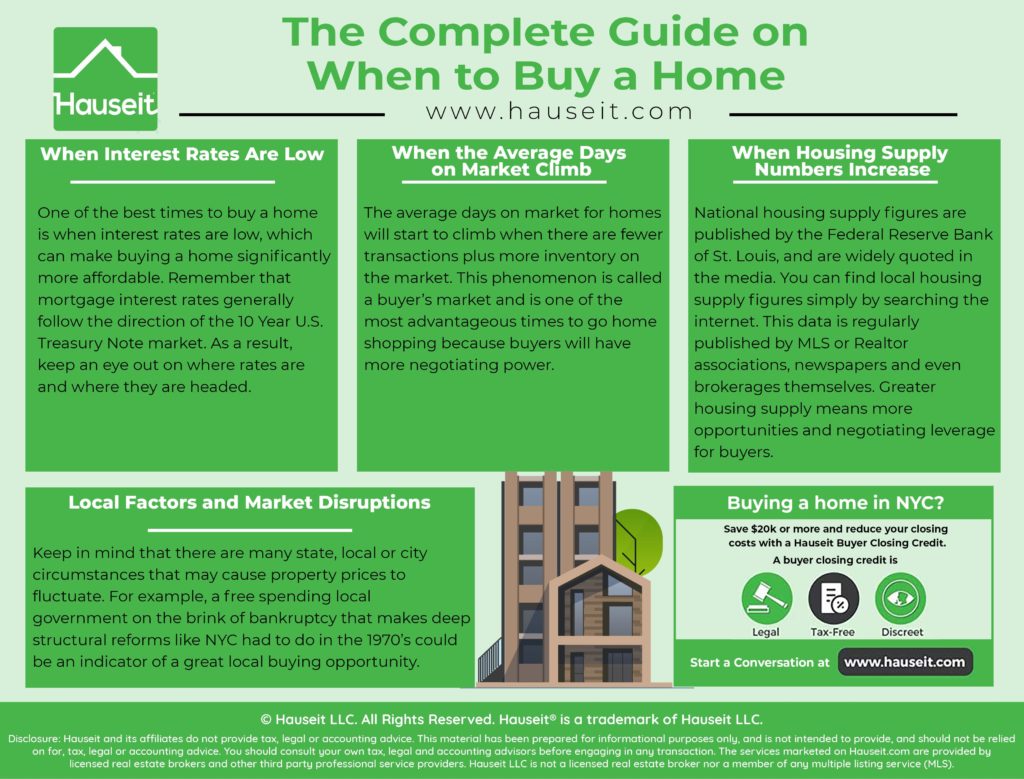

One of the best times to buy a home is when interest rates are low. Remember that mortgage interest rates generally follow the direction of the 10 Year U.S. Treasury Note market. As a result, keep an eye out on where rates are and where they are headed.

You can find out where on the run 10 Year U.S. Treasuries are trading by simply reading any newspaper or just turning on the television to a news channel.

The 10 Year Treasury Note is the most liquid U.S. Treasury Bill, Note or Bond and is therefore the most widely quoted as well.

Banks will typically base their 30 year fixed mortgage rates off of where the U.S. 10 Year Treasury Note is currently trading. Because Treasuries are considered to be risk free, and mortgage loans are not, mortgage rates will of course be higher than treasuries of an equivalent tenor.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Many news publications and even brokerages will publish periodic updates on the state of the real estate market in a particular market.

For example, if you are buying a home in NYC and simply Google this topic, you’ll find out that the average days on market to a signed contract is currently over 100 days in New York City.

That means it takes on average over 3 months for the average seller of a home in NYC to find a buyer and fully execute a purchase contract.

Pretty scary considering that NYC is typically considered to be the country’s hottest and most resilient real estate market.

This phenomenon is called a buyer’s market, and indicates a great time to be a buyer. A buyer’s market is characterized by fewer transactions but more inventory on the market.

As a result, sellers typically won’t receive multiple offers and have bidding wars that go above asking. In fact, the fewer transactions that do happen may often result from a single offer.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

National housing supply figures are published by the Federal Reserve Bank of St. Louis, and are widely quoted in the media. If you take a look at this FRED data, you’ll notice that the monthly supply of houses in the United States has increased as of late, though it is nowhere close to as high as the glut was during the Great Financial Crisis of 2007-2008.

Is this the beginning of another housing crisis? No one knows, but it’s clear from the figures that housing supply in the US has increased significantly as of late. This supports the conclusion that we are currently in a soft real estate market, otherwise known as a buyer’s market, as of this update in November 2019.

Keep in mind that there are many state, local or city circumstances that may cause property prices to fluctuate. For example, property prices may be in the gutter if the city or state is facing financial distress or even bankruptcy.

Case in point, NYC in the mid 1970’s was a complete mess. The city was facing both a crime and drug epidemic, and murders were at an all-time high. Furthermore, the city was facing imminent bankruptcy as a result of decades of public sector largess and overspending while large segments of the tax paying population migrated to the suburbs. City officials turned to the federal government, but then President Gerald Ford famously told the city to “drop dead.”

Without the possibility of a bailout by the federal government, NYC officials were forced to make tough choices and significant changes to how they fundamentally operated. This was a blessing for the city overall, and its real estate market in particular.

NYC in the 1970’s at this turning point would have been perhaps one of the most epically good times to start investing in real estate. Because of this turning point in local politics and spending habits, NYC would begin to improve, resulting in one of the greatest returns on investment in property of all time.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.