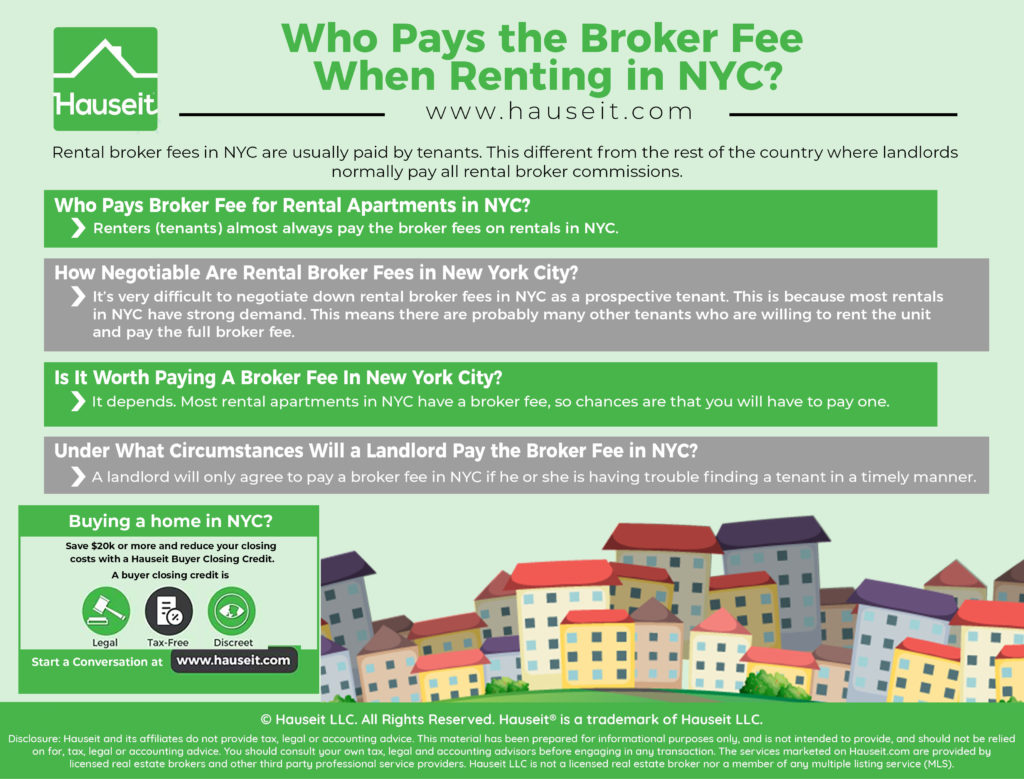

Rental broker fees in NYC are usually paid by tenants instead of landlords. This is the opposite of what happens in the rest of the country, whereby landlords normally pay rental broker commissions.

With that said, not all rentals in NYC have broker fees. An apartment can be ‘no fee’ if the landlord has agreed to pay the broker fee or if you’re renting a unit directly from the landlord and no broker is involved.

Table of Contents:

Renters (tenants) almost always pay the broker fees on rentals in NYC. The limited supply of housing in NYC and strong demand give the leverage to landlords when it comes to setting rent and determining who pays rental broker commissions.

In other parts of the country with weaker housing markets, it’s more common to see landlords pay broker fees as opposed to tenants.

With that said, it is possible to find rental apartments in NYC which are ‘no fee’ to the renter.

It’s more common to find ‘no fee’ units in neighborhoods of the city with large rental buildings and a ton of rental supply, such as the Financial District.

A greater supply of listings means that renters have more options, and this forces landlords to offer lower prices and cover broker fees in order to sweeten the deal for prospective tenants.

How Negotiable Are Rental Broker Fees in New York City?

Rental broker fees are usually more negotiable for landlords compared to tenants.

The specific rental broker fee, whether it’s 1 month rent or up to 15% of the annual rent, is usually negotiated between the landlord and the tenant before a unit is placed on the market.

Once the broker fee is set, it’s very difficult to negotiate it down as a prospective tenant.

This is because most rentals in NYC have strong demand, which means there are probably many other tenants who are willing to rent the unit and pay the full broker fee.

There is usually more room for negotiation on luxury rentals above ~$6,000/month, as these units usually have high 15% broker fees and take quite a while to find a tenant.

In some instances, the agent may be amenable to reducing the fee if it means renting the unit and receiving the broker fee sooner rather than later.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

It depends. Most rental apartments in NYC have a broker fee, so chances are that you will have to pay one. However, you can easily find a ‘no fee’ rental in NYC if you’re willing to be flexible on location and the specific apartments you consider.

You do not need to have a broker in order to rent an apartment in NYC, however many listings will have a listing agent who is charging a fee even if you don’t have your own rental agent.

It’s only worth paying a broker fee in NYC if you like an apartment and are unable to find an equally enticing, alternative rental which does not have a broker fee. There’s no doubt that broker fees are high in NYC, especially for sales.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

A landlord will only agree to pay a broker fee in NYC if he or she is having trouble finding a tenant in a timely manner. A savvy landlord will often conduct a rental pricing analysis and determine that making the apartment ‘no fee’ will decrease the vacancy period and save more money than the cost of covering the broker fee.

Here’s an example: let’s say you are in contract to purchase a condo in NYC.

You’ve bought the apartment as an investment property, and the unit will be vacant on the day you close since there is no tenant and you bought the property directly from the sponsor after it was renovated.

You realize that finding a tenant is an urgent priority, as it will cost you money each day that the unit is vacant. In reviewing the rental market, you see that the average comparable rental is asking $4,000 a month, and 50% of the units on the market are ‘no fee.’

As a savvy investor, you realize that most tenants will be thinking about the all-in cost per month factoring the broker fee (as opposed to just the monthly rent). You run a few quick calculations:

-

15% Broker Fee ($4,000/month rental) = $7,200

-

12% Broker Fee ($4,000/month rental) = $5,760

-

1 Month Fee ($4,000/month rental) = $4,000

The all-in monthly cost of the rental based on each broker fee is as follows:

-

15% Fee: $4,000 + ($7,200/12) = $4,600/month

-

12% Fee: $4,000 + ($5,760/12) = $4,480/month

-

1 Month: $4,000 + ($4,000/12) = $4,333/month

You determine that the average days on market for a rental is 60 days, meaning it will cost you $8,000 if the unit remains vacant for that period of time. Based on your analysis, you determine that asking $3,950 and listing the unit as ‘no fee’ will allow you to rent the unit in 2 weeks instead of 8 weeks, saving you $6,000.

Based on this analysis, you negotiate the broker fee down to 1 month and agree to pay it on behalf of the renter. Your strategy pays off, as the unit is rented within 10 days of being listed on the market. Despite paying the broker fee, you still save ~$2,000 due to the decreased vacancy period.

Published: 9/25/18 | Last Updated: January 30th, 2020

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.