Title insurance in Florida is paid by the seller in most Florida counties with the exception of Miami-Dade, Broward, Sarasota and Collier Counties where the buyer usually pays. Who pays for title insurance and title issuance costs is always negotiable regardless of the norms in the Florida county where the property is located.

In Florida counties where the seller pays for title insurance, the seller is typically also responsible for paying title issuance costs such as title, tax and lien searches as well as title-related closing fees.

In Miami-Dade and Broward counties where the buyer normally pays for title insurance, the seller usually covers the cost of title and municipal lien searches.

The party that pays for title insurance typically selects the title insurance company and the closing agent. The title insurance company, closing agent and escrow agent are often the same company in Florida.

If the buyer is financing, the separate title insurance policy for the lender is always paid by the buyer regardless of Florida county.

Who is responsible for paying specific closing costs, including title insurance, is outlined in the residential sale and purchase contract used for the transaction. In Florida, this is commonly the [“AS IS” Residential Contract for Sale and Purchase] template which is approved by the Florida Realtors and the Florida Bar.

Title insurance rates in Florida, both for the owner’s policy and lender’s policy, are regulated and set by Florida law. You can estimate the cost of title insurance in Florida with Hauseit’s Florida Title Insurance Calculator.

Thinking of buying or selling in Florida? Learn how to save with Hauseit.

Florida Title Insurance FAQ:

Is who pays for title insurance in Florida negotiable?

Buyer and seller are free to negotiate who pays for title insurance regardless of which Florida county the property is located in and the associated norms.

If you think you have leverage to make your counterparty pay for title insurance (and title issuance fees), then you can certainly try to negotiate.

That being said, don’t expect the seller to agree to a title insurance arrangement which is outside the norm if you’re a buyer interested in a hot property.

For example, in Miami-Dade and Broward counties where the buyer normally pays for title insurance, the seller usually covers the cost of title and municipal lien searches.

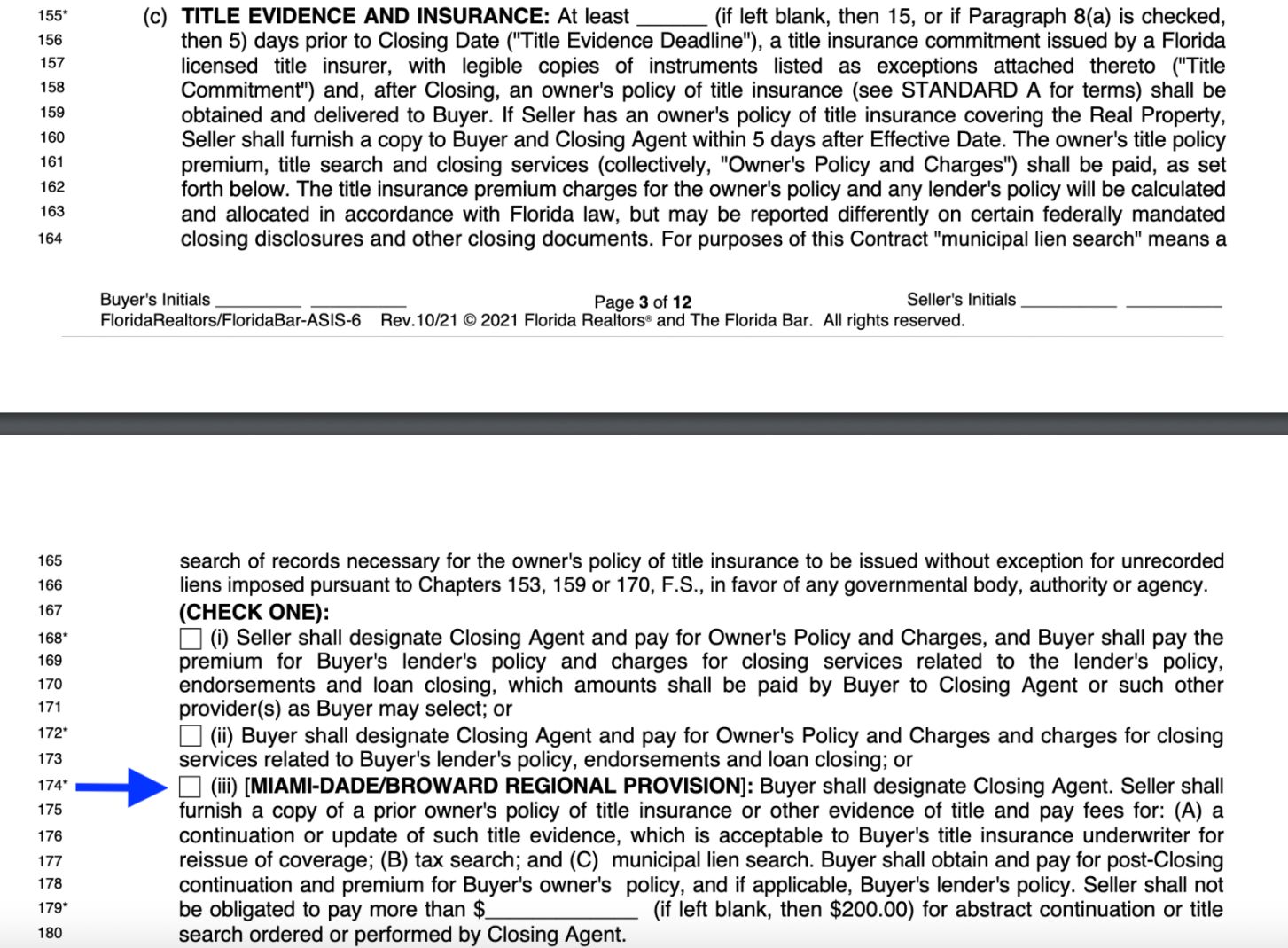

In fact, there is even a Miami-Dade checkbox in the title insurance section of the standard contract “AS IS” Residential Contract for Sale and Purchase to this effect:

Don’t expect a seller in Miami-Dade who has lots of interest or multiple offers to agree to a proposed contract which doesn’t have this box checked.

How much is title insurance in Florida?

The cost of title insurance in Florida is around 0.5% of the purchase price. You can estimate the cost of title insurance in Florida with Hauseit’s Florida Title Insurance Calculator.

Title insurance rates are set by Florida law:

-

From $0 to $100,000 of liability written: 0.575%

-

From $100,000 to $1 million, add: 0.500%

-

Over $1 million and up to $5 million, add: 0.250%

-

Over $5 million and up to $10 million, add: 0.225%

-

Over $10 million, add: 0.200%